Medtronic has entered 2026 with renewed momentum, combining solid fundamentals, breakthrough technologies, and expanding strategic tailwinds. The recent 23% share price gain reflects not euphoria, but a repricing toward its improving growth and risk profile [1] [2] [3] [4].

Earnings Momentum and Valuation

In fiscal Q2 2026, Medtronic delivered revenue of about $9 billion, up 6.6% year over year, with organic growth of 5.5%. Adjusted EPS rose roughly 8% to $1.36, beating both internal guidance and external expectations, which supported another guidance raise for FY26 revenue and earnings. Cardiovascular revenue grew 10.8% to about $3.4 billion, the strongest growth in over a decade outside the pandemic, signaling a durable acceleration rather than a one-off spike [2] [3] [1].

Geopolitics and Geostrategy

Geopolitics currently favors scaled innovators in essential healthcare over discretionary or cyclical sectors. Aging populations in the U.S., Europe, and key emerging markets ensure sustained demand for cardiovascular, neurological, and diabetes solutions, even as governments debate tariff regimes and industrial policy. Medtronic’s diversified manufacturing footprint and global supply network help mitigate tariff and trade frictions, reducing earnings volatility compared with more concentrated peers [5] [1] [2].

Industry Trends and Structural Demand

The medical-device industry benefits from long-term volume growth driven by chronic disease, minimally invasive procedures, and data-enabled care. Medtronic is positioned across multiple secular growth curves, including cardiac ablation, robotic surgery, neuromodulation, and diabetes technologies, which together support mid-single-digit organic growth with operating leverage. Importantly, penetration for robotic-assisted surgery remains below 5% of eligible procedures, leaving ample runway for new entrants and existing leaders [6] [7] [3] [1] [5].

Innovation Engine and PFA Advantage

Medtronic’s pulsed-field ablation platform is now a primary growth engine. After PulseSelect became the first FDA-cleared PFA system for atrial fibrillation in late 2023, the broader PFA portfolio drove a 71% revenue surge in Cardiac Ablation Solutions in Q2, including 128% growth in the U.S. PFA’s ability to ablate arrhythmogenic tissue with less collateral damage than thermal methods creates both clinical and economic advantages, reinforcing Medtronic’s competitive moat in electrophysiology [3] [1] [2].

Culture, Talent, and R&D Discipline

Medtronic’s culture blends mission-driven healthcare focus with disciplined engineering and regulatory execution. The company consistently allocates a high single-digit percentage of revenue to R&D, supporting hundreds of devices across cardiovascular, neuroscience, medical-surgical, and diabetes portfolios. This scale enables platform innovation—like PFA, renal denervation, and neuromodulation ecosystems—rather than isolated products, which deepens customer relationships and pricing power [1] [5] [3].

Business Model and Recurring Economics

The business model increasingly resembles a high-tech platform with recurring revenue. Large installed bases in cardiac rhythm management, spine, and surgical solutions drive durable demand for consumables, software updates, and service contracts, supporting cash generation even in slower procedure environments. Management’s willingness to rationalize lower-margin units, such as evaluating options for the diabetes care business, further enhances the margin and capital-allocation profile [4] [3] [1].

Leadership and Capital Allocation

Current leadership has shifted Medtronic from a “steady giant” to a more growth-focused operator. Recent quarters show a pattern: innovation-led revenue acceleration, EPS beats, and repeated guidance raises, coupled with sizable cash returns via dividends and buybacks. The board’s long record of dividend growth, alongside continued investment in R&D and targeted M&A, signals a balanced approach to rewarding shareholders while compounding intrinsic value [8] [3] [4] [1].

Macroeconomics, Rates, and Reimbursement

Higher-for-longer interest rates have pressured defensives with long-duration cash flows, but Medtronic’s improving growth and dividend yield offset part of that headwind. Healthcare utilization is normalizing after pandemic-era distortions, while payers increasingly favor interventions that reduce long-term hospitalizations and complications, such as PFA and renal denervation. Favorable CMS coverage decisions, including a broad national coverage determination for renal denervation, expand the addressable U.S. patient pool and support multi-year revenue visibility [5] [3] [4] [1].

Technology, Cyber, and Data

Medtronic is progressively embedding connectivity, software, and AI into devices and care pathways. Connected diabetes sensors, cardiac devices, and spinal platforms generate data that can support predictive analytics, remote monitoring, and outcome-based contracts with health systems. This shift raises cyber and privacy stakes, but Medtronic’s experience with regulated, life-critical systems provides a robust foundation for security-by-design and compliance frameworks [3] [1].

Scientific and High-Tech Positioning

The company operates at the intersection of bioengineering, materials science, and digital medicine. Its portfolio spans electrophysiology, neuromodulation, structural heart, renal denervation, and surgical robotics, each anchored in strong clinical evidence and long regulatory timelines that deter fast followers. This scientific intensity lengthens product cycles, supports premium pricing, and underpins durable competitive advantages relative to lower-tech device makers [1] [5] [3].

Robotics, Patents, and IP Leverage

Medtronic’s Hugo robotic-assisted surgery system is a central strategic bet. After meeting safety and effectiveness endpoints in urologic trials and achieving a 98.5% surgical success rate, the company submitted Hugo for FDA clearance in early 2025, aiming at prostate, kidney, and bladder procedures. Alongside a broad patent portfolio in robotics, navigation, and surgical tools, Hugo positions Medtronic to challenge Intuitive Surgical in an underpenetrated market with room for multiple large platforms [7] [9] [6].

Dividend Power and Total-Return Case

Medtronic has raised its dividend for 48 consecutive years and recently increased the quarterly payout to $0.71 per share, or $2.84 annually. At recent prices, that equates to a yield around the low-3% range, comfortably above the S&P 500 average, while keeping payout ratios compatible with ongoing R&D and capital investments. The stock holds Dividend Aristocrat and Dividend King status, making it attractive for income-focused investors seeking defensive growth plus rising cash flows [8] [4] [5].

Investment Verdict Heading Into 2026

Medtronic’s recent share-price strength reflects tangible improvements: accelerating cardiovascular growth, a differentiated PFA franchise, a credible entry into robotic surgery, and disciplined capital allocation. While execution risks remain in U.S. robotics, diabetes strategy, and pricing negotiations with payers, the risk-reward profile still looks favorable for long-term investors seeking a blend of yield, quality, and innovation-driven upside. For patient, income-oriented buyers, accumulating Medtronic on volatility ahead of key 2026 catalysts appear justified rather than late [9] [2] [8] [5] [3] [1].

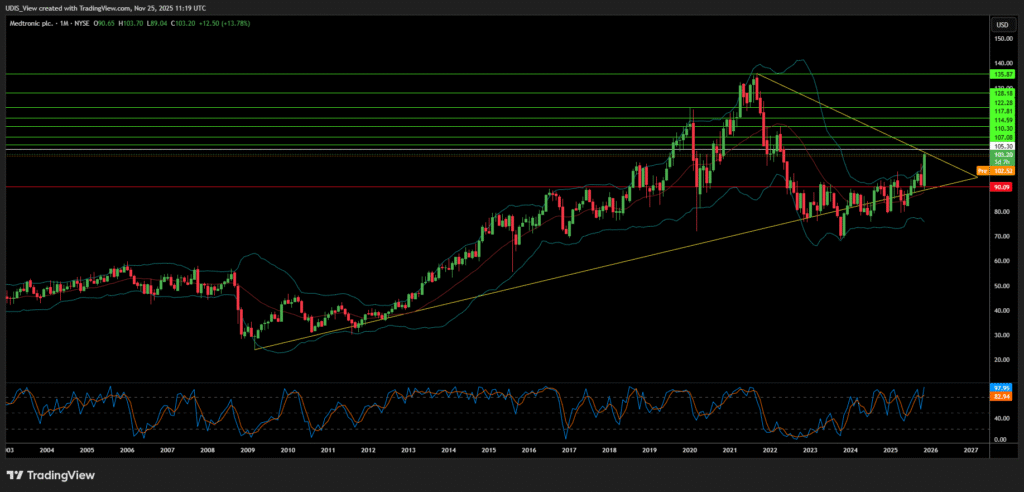

Medtronic Long (Buy)

Enter At: 105.30

T.P_1: 107.08

T.P_2: 110.30

T.P_3: 114.59

T.P_4: 117.81

T.P_5: 122.28

T.P_6: 128.18

T.P_7: 135.87

S.L: 90.09