In the late autumn of 2025, the global diagnostics industry stands at a precipice. Exact Sciences Corporation (NASDAQ: EXAS), the Madison-based architect of the non-invasive colorectal cancer screening market, has emerged as the singular focal point of a sector-wide reconfiguration. The catalyst for this inflection point is the revelation, surfacing on November 19, 2025, that Abbott Laboratories is in advanced negotiations to acquire Exact Sciences a transaction poised to reshape the hierarchy of medical technology.¹

This report offers an exhaustive, multi-dimensional analysis of Exact Sciences at this critical juncture. It is not merely a financial assessment; it is a comprehensive deconstruction of the company’s standing across geopolitical fault lines, macroeconomic shifts, legal battlefields, and the frontiers of genomic science. Our analysis reveals a company that has successfully navigated the treacherous transition from a single-product vendor to a diversified oncology platform, evidenced by its record Q3 2025 revenue of $851 million and a 20% year-over-year growth trajectory.³ Yet, this financial fortitude masks deepening vulnerabilities.

The erosion of its intellectual property moat, marked by the invalidation of key patents in its conflict with Geneoscopy, suggests that the era of uncontested market dominance for Cologuard is drawing to a close.⁵ Simultaneously, the broader geopolitical environment characterized by supply chain decoupling between the United States and China threatens the raw material inputs essential for high-throughput genomic testing.⁷

The potential acquisition by Abbott Laboratories is thus interpreted not as a simple exit, but as a strategic necessity: a flight to safety and scale in an era of “exponential risk”.⁸ By integrating Exact Sciences’ screening dominance with Abbott’s global infrastructure and balance sheet, the combined entity could bypass the structural limitations that currently constrain Exact Sciences’ international expansion and legal defenses. This document provides a definitive roadmap for stakeholders, dissecting the interplay between Federal Reserve policy, patent litigation, machine learning integration, and corporate culture to forecast the future of cancer diagnostics.

1. The Macroeconomic & Geopolitical Crucible

To understand the trajectory of Exact Sciences, one must first situate it within the broader macroeconomic and geopolitical currents of late 2025. The operational reality of a modern diagnostics company is no longer confined to the laboratory; it is inextricably linked to interest rate cycles, global trade lanes, and the strategic rivalry between great powers.

1.1 The Federal Reserve and the M&A Renaissance

The backdrop of the rumored Abbott-Exact deal is a shifting monetary landscape in the United States. Throughout 2023 and 2024, the Federal Reserve’s aggressive interest rate hikes created a “capital winter” for biotechnology and medtech growth stocks. High costs of capital compressed valuations, making debt-financed acquisitions prohibitively expensive and suppressing deal flow.⁹

However, September 2025 marked a decisive pivot. The Federal Reserve initiated its first rate cut since 2020, signaling a new cycle of monetary easing with a target rate projected to fall to ~3.4% by the end of 2026.¹⁰ This policy shift has had an immediate, galvanizing effect on corporate boardrooms. The reduction in the cost of borrowing acts as a lubricant for Mergers and Acquisitions (M&A), allowing cash-rich conglomerates like Abbott to leverage their balance sheets more effectively.

For Exact Sciences, this macroeconomic pivot created a window of opportunity. The company’s valuation, having been compressed by the previous high-rate environment, presented a “dislocated” asset trading below its intrinsic value relative to its future cash flows.¹¹ Analysts utilizing Discounted Cash Flow (DCF) models in late 2025 estimated Exact Sciences’ fair value at approximately $116 per share, significantly higher than its trading price prior to the acquisition rumors.¹¹ Abbott’s move is a textbook example of opportunistic consolidation: striking at the bottom of the valuation trough just as the macroeconomic headwinds turn into tailwinds.

1.2 Geostrategy: The China Supply Chain Vulnerability

While monetary policy dictates the timing of the deal, geopolitics dictates the risk profile of the underlying asset. The global pharmaceutical and diagnostics supply chain remains dangerously over-reliant on the People’s Republic of China. In 2025, geopolitical friction between Washington and Beijing has transitioned from trade spats to systemic decoupling, creating “exponential risk” for companies with complex supply chains.⁸

Exact Sciences is not immune to this exposure. Reports indicate that nearly a quarter of Active Pharmaceutical Ingredients (APIs) and a significant portion of Key Starting Materials (KSMs) the chemical precursors used in diagnostic reagents originate in China.⁷ While Exact Sciences does not manufacture pharmaceuticals, the molecular diagnostics industry relies on a steady stream of buffers, enzymes, and chemical stabilizers, many of which have upstream dependencies on Chinese chemical manufacturing bases.

The risk is not merely theoretical. The concept of “weaponized interdependence” suggests that in a scenario of heightened tension (e.g., a crisis in the Taiwan Strait), export controls could be used to choke off the supply of critical medical inputs.⁷ For a high-volume testing laboratory like Exact Sciences, which processes millions of Cologuard tests annually, a supply chain disruption of even a few weeks would be catastrophic to revenue and reputation. This geopolitical vulnerability adds a layer of strategic logic to the Abbott acquisition. Abbott, with its massive global footprint and diversified manufacturing base, possesses the logistical “muscle” to diversify supply chains more rapidly than a standalone diagnostics player.¹³ The integration of Exact Sciences into Abbott’s supply chain network would likely involve a “friend-shoring” initiative, shifting sourcing to politically stable jurisdictions like India or Mexico, thereby inoculating the Cologuard franchise against geostrategic shocks.

2. The Abbott Laboratories Acquisition Hypothesis

The rumors of November 19, 2025, did not emerge in a vacuum. They represent the culmination of strategic necessities for both Abbott Laboratories and Exact Sciences. This section analyzes the deal dynamics, valuation logic, and the strategic “fit” of the two entities.

2.1 The Strategic Imperative for Abbott

Abbott Laboratories is a titan of the medical device industry, with a market capitalization exceeding $218 billion and diverse leadership positions in cardiovascular devices, nutrition, and diabetes care.¹³ However, its diagnostics division has faced a unique challenge in the post-pandemic era: the “COVID cliff.” During the pandemic years, Abbott generated billions in windfall revenue from rapid COVID-19 testing. As the pandemic receded, this revenue stream evaporated, leaving a growth hole in the diagnostics division.¹⁵ Abbott needs a new growth engine a durable, high-margin franchise with a long runway. Exact Sciences fits this profile perfectly.

- Market Leadership: Cologuard is the undisputed standard of care for non-invasive CRC screening, a market with low penetration relative to the eligible population.¹⁶

- Recurring Revenue: Unlike capital equipment (e.g., MRI machines) which are one-time sales, screening tests are recurring. As the screening age lowers to 45 and the population ages, the volume of tests is structurally destined to rise.

- Pipeline Synergy: Abbott has no significant presence in the high-growth oncology screening market. Acquiring Exact Sciences provides immediate entry into CRC screening, multi-cancer early detection (MCED), and molecular residual disease (MRD) monitoring.¹⁷

2.2 Valuation and Financial Mechanics

The financial markets reacted euphorically to the rumor, driving EXAS stock up 24% to ~$86.² However, for a deal to close, the premium must be sufficient to satisfy Exact Sciences’ board while remaining accretive for Abbott shareholders. Analysts from William Blair and Canaccord Genuity have framed the valuation parameters:

- Takeout Multiple: A valuation of 6x to 7x forward sales is considered standard for high-growth MedTech assets.

- Implied Price: This multiple implies a deal price of $100+ per share, valuing Exact Sciences at over $20 billion.²

- Abbott’s Capacity: As of Q3 2025, Abbott held approximately $7.5 billion in cash and equivalents.¹⁵ While this is insufficient for an all-cash deal, Abbott’s pristine credit rating and the low-interest-rate environment allow it to easily finance the remainder through debt issuance, likely blended with stock.¹⁸

Table 1: Transaction Scenario Analysis

| Metric | Pre-Rumor Status | Acquisition Target Metrics | Strategic Implication |

| Stock Price | ~$69.00 | ~$105.00 | Requires ~50% premium to clear |

| Enterprise Value | ~$14 Billion | ~$22 Billion | Abbott absorbs debt & premium |

| Rev. Multiple | ~4.8x | ~6.5x | Aligns with high-growth peers |

| Synergies | N/A | “Sales Force, Int’l Dist.” | Cost synergies justify premium |

2.3 The Antitrust Shadow

Any deal of this magnitude attracts the scrutiny of the Federal Trade Commission (FTC). Under the Biden administration, the FTC challenged numerous healthcare mergers. However, the Abbott-Exact combination is largely a conglomerate merger rather than a horizontal one. Abbott does not currently have a competing stool-based DNA test. While they compete broadly in “diagnostics,” their product lines (rapid infectious disease tests vs. oncology screening) are complementary rather than overlapping.² This distinction is crucial and suggests that while the regulatory review will be rigorous, it is unlikely to be fatal.

3. Financial Performance: The Fortress Balance Sheet

To understand why Exact Sciences commands such a premium, one must look at its financial performance in late 2025. The Q3 2025 earnings report depicts a company that has successfully pivoted from “growth at all costs” to “profitable growth.”

3.1 Revenue Dynamics

In Q3 2025, Exact Sciences delivered record revenue of $851 million, a 20% increase year-over-year.³ This growth was not uniform; it was driven by specific, high-performing segments.

- Screening (Cologuard): Generated $666 million, up 22% YoY.³ This acceleration is attributed to the “care gap” programs, where health systems order tests in bulk for non-compliant patients to meet quality metrics.¹⁹

- Precision Oncology (Oncotype DX): Generated $184 million, up 13% YoY.³ While a mature product, Oncotype DX continues to grow through international expansion and increased adoption in node-positive breast cancer.

3.2 Profitability and Cash Flow

The most significant transformation has been in profitability. For years, critics pointed to Exact Sciences’ mounting losses. In Q3 2025, the company silenced these critics by delivering adjusted EBITDA of $135 million, a 37% increase YoY, expanding margins by 200 basis points to 16%.³ Crucially, the company generated $220 million in operating cash flow and $190 million in free cash flow (FCF) in the quarter.²⁰ This massive cash generation capability projected to reach nearly $1 billion annually within a few years changes the fundamental thesis of the stock. It proves that the business model acts as a flywheel: as testing volumes increase, the high fixed costs of the labs are covered, and incremental revenue flows directly to the bottom line.

3.3 The “Productivity Plan”

Management has been executing a multi-year “productivity plan” targeting $150 million in annualized savings by 2026.²² This involves automating laboratory workflows, optimizing supply chain logistics (crucial given the geopolitical risks discussed earlier), and streamlining General & Administrative (G&A) expenses. The success of this plan is evident in the divergence between revenue growth (20%) and operating expense growth (significantly lower), creating operating leverage.¹⁹

4. Product Innovation: The Technological Moat

Exact Sciences’ valuation is underpinned by a triad of technologies: Cologuard Plus, Cancerguard, and Oncodetect. Each addresses a specific phase of the cancer continuum: screening, multi-cancer detection, and recurrence monitoring.

4.1 Cologuard Plus: Redefining the Standard

The launch of Cologuard Plus in 2025 represents a critical defensive maneuver against emerging competition. FDA-approved in late 2025, this next-generation test was designed to address the “Achilles’ heel” of the original Cologuard: its false-positive rate.²³

Technical Comparison: Cologuard vs. Cologuard Plus

| Performance Metric | Original Cologuard (DeeP-C Study) | Cologuard Plus (BLUE-C Study) | Improvement Mechanism |

| CRC Sensitivity | 92% | 95% | Improved DNA Markers |

| AA Sensitivity | 42% | 43% | Enhanced Algorithm |

| Specificity | 87% | 94% | New Buffer Chemistry |

| False Positive Rate | ~13% | ~6% | 40% Reduction |

Source: ²⁴

The 40% reduction in false positives is the headline statistic. In a value-based healthcare system, false positives are expensive they trigger unnecessary, costly colonoscopies. By increasing specificity to 94%, Exact Sciences strengthens its economic argument to payers, ensuring that Cologuard Plus remains the preferred non-invasive option over cheaper Fecal Immunochemical Tests (FIT).²⁶

4.2 Cancerguard: The Multi-Omics Revolution

If Cologuard is the cash cow, Cancerguard is the moonshot. Currently an LDT, Cancerguard is a Multi-Cancer Early Detection (MCED) liquid biopsy. Unlike competitors that rely solely on methylation patterns (like Grail’s Galleri), Cancerguard employs a “multi-biomarker class” approach. It analyzes both DNA methylation and protein biomarkers.²⁷ This dual-modality approach is designed to increase sensitivity for early-stage cancers, particularly those that do not shed significant DNA but do overexpress certain proteins.

- Capabilities: Detects 50+ cancer types.

- Performance: In development studies, it detected 1 in 3 early-stage cancers and showed 97.4% specificity.²⁷

- Validation: The company is enrolling 25,000 patients in the “Falcon Registry” to generate the Real-World Evidence (RWE) necessary for future FDA approval.²⁷

4.3 Oncodetect: The Tumor-Informed Approach

Oncodetect targets the Molecular Residual Disease (MRD) market. It is a “tumor-informed” test, meaning the lab first sequences the patient’s removed tumor to identify a unique genetic fingerprint, then designs a custom blood test to track that fingerprint over time.²⁹ Data presented in 2025 showed Oncodetect achieved 91% sensitivity in surveillance monitoring, identifying recurrence months before imaging.³⁰ With Medicare coverage secured in mid-2025, Oncodetect is now directly competing with Natera’s Signatera. The strategic advantage for Exact Sciences lies in “ExactNexus,” its IT platform that integrates ordering into the Electronic Medical Record (EMR) systems of oncologists who already use Oncotype DX, creating a seamless user experience.³¹

5. The Patent Wars and Competitive Erosion

Despite its technological prowess, Exact Sciences is fighting a defensive war on the legal front. 2025 saw significant cracks emerge in the company’s intellectual property (IP) fortress, specifically in its battle with Geneoscopy.

5.1 The Geneoscopy Conflict

Geneoscopy, a St. Louis-based startup, developed “ColoSense,” a stool-based RNA test. Unlike Cologuard, which analyzes DNA, ColoSense focuses on RNA biomarkers, which Geneoscopy claims offer superior sensitivity for advanced adenomas.⁵ Exact Sciences sued Geneoscopy for infringing on patents related to sample collection and preservation methods (specifically the ‘781 and ‘746 patents).³² The core issue was the method of stabilizing stool samples to prevent degradation during shipping a critical component of any at-home test.

5.2 The PTAB Ruling: A Strategic Defeat

In July 2025, the Patent Trial and Appeal Board (PTAB) handed down a decisive ruling: it invalidated all 20 claims of Exact Sciences’ ‘781 patent.⁶ The Board found the claims to be “obvious” in light of prior art. This was a catastrophic legal outcome for Exact.

- Consequence: With the ‘781 patent invalidated and the ‘746 patent under similar review, Exact Sciences was forced to withdraw its preliminary injunction request in August 2025.⁵

- Market Impact: This cleared the path for Geneoscopy to launch ColoSense immediately. The new entrant now poses a direct threat to Cologuard’s monopoly, armed with a test that boasts high sensitivity and is now unencumbered by legal blockades.³⁴

5.3 The Freenome Pivot: “If You Can’t Beat Them…”

Perhaps anticipating the fragility of its stool-based dominance, Exact Sciences executed a remarkable strategic pivot in August 2025 by licensing Freenome’s blood-based CRC screening technology.³⁵ This deal is complex and revealing:

- The Deal: Exact Sciences gained exclusive rights to commercialize Freenome’s blood test in the United States.

- The Split: Freenome simultaneously partnered with Roche to commercialize the test outside the U.S..³⁶

- Strategic Implication: Exact Sciences effectively admitted that blood-based testing might eventually cannibalize stool-based testing. By licensing Freenome, they essentially bought an insurance policy. If the market shifts to blood, Exact captures that revenue through the Freenome license. If it stays with stool, Cologuard remains king. However, the split rights create a bizarre geopolitical map where Exact Sciences and Roche (a fierce competitor) are both tethered to the same underlying technology, partitioning the globe between them.

6. International Strategy: The Untapped Frontier

A recurring theme in analyst critiques of Exact Sciences is its over-reliance on the U.S. market. In Q3 2025, while Precision Oncology showed 19% international growth, the massive Screening division remains almost entirely domestic.⁴

6.1 The Cologuard Export Problem

Cologuard is not available outside the U.S..³⁷ This is due to fundamental differences in screening guidelines. The U.S. USPSTF recommends screening every 3 years, a cadence Cologuard is designed for. European guidelines typically favor biennial (every 2 years) FIT testing, which is significantly cheaper (often <$20 vs Cologuard’s ~$500). To succeed internationally, Exact Sciences must not only gain regulatory approval (CE Mark) but also fundamentally alter the health economic models of single-payer systems in the EU and Asia. They must prove that the higher cost of Cologuard is offset by the long-term savings of preventing cancer. This is a heavy lift that a standalone Exact Sciences has struggled with for a decade.

6.2 The Abbott Catalyst

This is where the Abbott acquisition becomes transformative. Abbott operates in over 160 countries with deep regulatory and reimbursement relationships in every major market.¹⁵

- Regulatory Arbitrage: Abbott’s teams are experts at navigating the EU’s new Medical Device Regulation (MDR), a hurdle that has slowed many smaller US firms.

- Distribution Power: Abbott can bundle Cologuard with its existing suite of diagnostic products, leveraging its massive sales force to push adoption in markets where Exact has zero footprint.

- Global Infrastructure: Abbott’s manufacturing capabilities could allow for the localization of Cologuard production (e.g., establishing labs in Europe or Asia), reducing the logistical costs and stability risks of shipping samples back to Madison, Wisconsin.

7. Company Culture and Organizational Health

Behind the financials and the patents lies the human element. Exact Sciences has grown from a scrappy underdog to a corporate behemoth, and this transition has strained its culture.

7.1 The “Kevin Conroy” Factor

CEO Kevin Conroy is widely regarded as the visionary who saved the company. His leadership style is intense, focused on “defying convention” and aggressive risk-taking.³⁸ However, “Founder-like” CEOs often struggle to manage the transition to a mature, bureaucratic organization.

7.2 Internal Friction

Glassdoor reviews and employee sentiment data from 2025 paint a picture of a “mission-driven” but “micromanaged” workforce.³⁹

- Pros: Employees are deeply motivated by the mission to eradicate cancer.

- Cons: There are consistent complaints about “nepotism,” a top-heavy management structure, and the cultural dilution resulting from rapid acquisitions (Thrive, PreventionGenetics).

The potential Abbott acquisition introduces a new variable: Cultural Integration Risk. Abbott is known for its disciplined, Six Sigma-driven operational culture. Merging Exact Sciences’ more fluid, risk-taking culture with Abbott’s rigid corporate machine could lead to a “culture clash.” Key talent particularly the scientists and engineers driving the Cancerguard innovation might exit if they feel stifled by Abbott’s bureaucracy, potentially destroying the value of the acquired pipeline.

8. AI and Data Governance

In the 21st century, a diagnostics company is also a data company. Exact Sciences processes petabytes of genomic data, making its IT infrastructure as critical as its wet labs.

8.1 AI Integration

Exact Sciences is aggressively integrating Artificial Intelligence (AI) into its workflow. The company is hiring AI engineers to build Generative AI models for “retrieval-augmented generation” (RAG).⁴¹ This suggests they are building internal “knowledge brains” AI systems that can query the company’s vast database of clinical trials and patient outcomes to generate insights for R&D and commercial strategy. Furthermore, the Cancerguard algorithm is a machine learning model trained on thousands of samples to distinguish the faint “whisper” of cancer DNA from the noisy background of normal cell-free DNA.⁴² The efficacy of this test depends entirely on the quality of the training data and the sophistication of the model.

8.2 Cybersecurity and Certification

With great data comes great responsibility. Exact Sciences manages Protected Health Information (PHI) for millions. The company has achieved ISO/IEC 27001:2022 certification for its Information Security Management Systems, a gold standard in the industry.⁴³ Additionally, its pharmacy subsidiary, ExactCare, has achieved HITRUST CSF certification, arguably the most rigorous security framework in healthcare.⁴⁴ These certifications are not just badges; they are operational necessities. In an era where healthcare ransomware attacks are rampant, Exact Sciences’ ability to demonstrate a “B” security rating (779/950) from UpGuard suggests a solid, albeit improvable, defensive posture.⁴⁵ The geopolitical risk of data theft by state actors (aiming to harvest US genomic data) adds a national security dimension to their cyber defense strategy.

9. Strategic Conclusions

As 2025 draws to a close, Exact Sciences is a company at the peak of its powers but aware of the gathering storm. It has conquered the U.S. CRC screening market, built a fortress balance sheet, and assembled a world-class pipeline. Yet, the invalidation of its patents and the rise of RNA and blood-based competitors signal that the “easy growth” is over.

The logic for the Abbott Laboratories acquisition is overwhelming.

- For Exact Sciences: It solves the international expansion puzzle, insulates the company from patent/legal shocks, and provides the capital resilience needed to commercialize Cancerguard.

- For Abbott: It fills the post-COVID revenue void with a high-growth, high-margin oncology franchise that complements its existing portfolio.

- For the Industry: It signals a consolidation wave where mid-cap innovators seek shelter within mega-cap conglomerates to weather the geopolitical and macroeconomic volatility of the late 2020s.

Outlook:

If the deal proceeds, we expect a rapid integration of sales forces in 2026, followed by an aggressive push of Cologuard into European markets leveraging Abbott’s regulatory rails. If the deal breaks, Exact Sciences faces a volatile 2026: fighting a price war with Geneoscopy’s ColoSense while burning cash to launch Cancerguard. In either scenario, the company remains the bellwether for the future of early cancer detection.

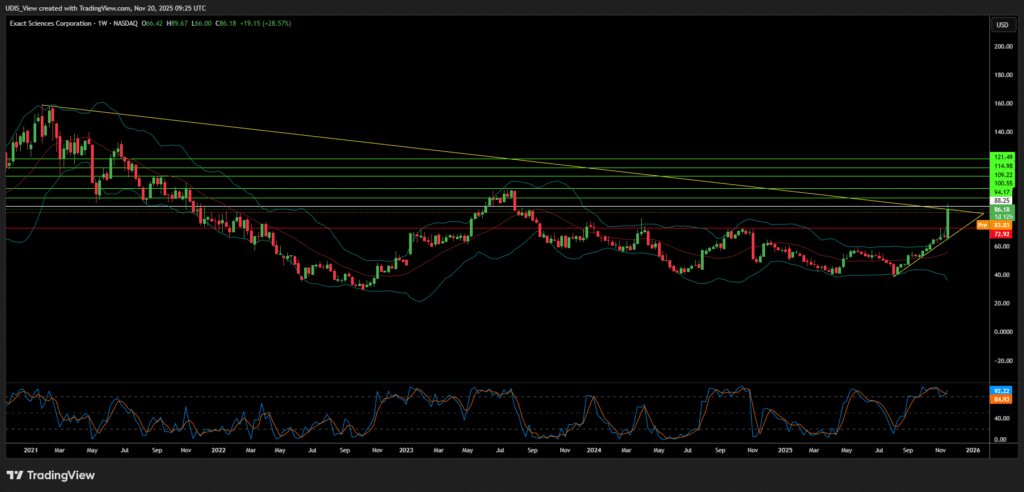

Exact Sciences Long (Buy)

Enter At: 88.25

T.P_1: 94.17

T.P_2: 100.55

T.P_3: 109.22

T.P_4: 114.98

T.P_5: 121.49

S.L: 72.92