The Asymmetry of Innovation

The biotechnology sector, historically characterized by a binary landscape of spectacular failure or revolutionary success, is currently witnessing the maturation of a third modality in genetic medicine. Moving beyond the established pillars of small molecules and biologics, and transcending the initial generation of gene replacement therapies, the industry is now grappling with the implications of “Silence and Replace” architectures.

At the forefront of this technological evolution stands Benitec Biopharma Inc. (NASDAQ: BNTC), a company that has recently transitioned from a speculative clinical-stage entity to a validated platform leader following the release of unprecedented clinical data in late 2025.[1] This report provides an exhaustive, multi-dimensional analysis of Benitec Biopharma, dissecting the convergence of its proprietary DNA-directed RNA interference (ddRNAi) technology, its strategic capitalization by institutional heavyweights, and the favorable geopolitical and macroeconomic currents propelling its ascent.

As of November 2025, Benitec has achieved a milestone that remains elusive for the vast majority of genetic medicine aspirants: a 100% clinical response rate in its Phase 1b/2a lead-in cohort for BB-301, its therapeutic candidate for Oculopharyngeal Muscular Dystrophy (OPMD).[3] This data point is not merely a statistical anomaly; it is the foundational proof-of-concept for a platform designed to address autosomal dominant disorder conditions where the presence of a toxic mutant protein renders traditional gene replacement ineffective.

By simultaneously silencing the pathogenic gene and expressing a functional replacement via a single vector administration, Benitec has unlocked a therapeutic pathway for diseases previously considered undruggable.[5]

The financial markets have begun to recognize this dislocation between current valuation and future potential. The company’s successful execution of a $100 million capital raise in November 2025, anchored by a $20 million direct investment from Suvretta Capital, has fundamentally de-risked the balance sheet.[7] This capital infusion, priced at a premium to historical trading ranges, signals a profound institutional conviction in the company’s trajectory. Furthermore, the regulatory environment has shifted in Benitec’s favor, with the U.S. Food and Drug Administration (FDA) granting Fast Track Designation to BB-301, accelerating the path to commercialization.[7]

However, to view Benitec solely through the lens of clinical data is to miss the broader strategic narrative. The company operates at the intersection of several global megatrends: the re-onshoring of critical biopharmaceutical supply chains, the rise of orphan drug economics as a defensive strategy against patent cliffs, and the increasing sophistication of computational biology in drug design. This report will explore these themes in granular detail, arguing that Benitec represents a unique asymmetric opportunity, a “pure play” on next-generation genetic engineering with a validated asset, a fortress balance sheet, and a clear regulatory runway.

The Biological Imperative: Oculopharyngeal Muscular Dystrophy (OPMD)

Pathophysiology and the “Toxic Gain of Function” Challenge

To understand the commercial and scientific magnitude of Benitec’s BB-301 program, one must first deeply appreciate the biological catastrophe that is Oculopharyngeal Muscular Dystrophy (OPMD). OPMD is an insidious, late-onset, autosomal dominant genetic disorder. Unlike recessive disorders, where a missing gene simply needs to be replaced, dominant disorders are characterized by a “toxic gain of function.”

In OPMD, the patient possesses one healthy allele and one mutant allele of the Poly(A)-Binding Protein Nuclear 1 (PABPN1) gene.[10] The mutation itself is a specific expansion of a GCN trinucleotide repeat within the PABPN1 gene. In healthy individuals, this region contains a stable number of repeats (typically 10). In OPMD patients, this expands to 11-18 repeats.[11] This seemingly minor genetic stutter has devastating downstream consequences.

It leads to the production of a mutant PABPN1 protein that carries an expanded polyalanine tract. This mutant protein is prone to misfolding and aggregation, forming insoluble intranuclear inclusions (INIs) within the muscle fibers.[10] These inclusions are cytotoxic. They sequester the functional PABPN1 protein, which is essential for mRNA processing and cell viability, along with other critical nuclear factors. Over decades, this gradual accumulation of toxic aggregates leads to the progressive death of muscle cells. The clinical manifestation typically begins in the fifth or sixth decade of life, presenting as ptosis (drooping eyelids) and, most critically, dysphagia (swallowing difficulties).[10]

The Clinical Reality: A Life-Threatening Progression

The dysphagia associated with OPMD is not merely a quality-of-life issue; it is a mortality driver. As the pharyngeal muscles weaken and atrophy, patients lose the ability to effectively propel food and liquid from the mouth to the esophagus. This results in “post-swallow residue accumulation,” where food remains trapped in the throat, and “aspiration,” where food or liquid enters the airway instead of the stomach.[4] The consequences are severe: chronic choking, profound malnutrition, social isolation due to the inability to eat in public, and recurrent aspiration pneumonia, which is a leading cause of death in this population.[12] The burden is universal among patients; the disease affects 97% of those with the mutation, making the addressable market highly predictable.[4]

The Limitations of the Current Standard of Care

Before the advent of BB-301, the therapeutic landscape for OPMD was bleak. There are no FDA-approved pharmacological treatments.[13] Management has been entirely palliative and surgical. The primary intervention is cricopharyngeal myotomy, a surgical procedure that involves cutting the upper esophageal sphincter to allow food to pass more easily by gravity.[14]

While myotomy can provide temporary symptom relief, it does not address the underlying muscle degeneration. It is a mechanical fix for a biological problem. The benefits typically wane over time as the pharyngeal muscles continue to weaken due to the persistent toxicity of the mutant PABPN1 protein. Furthermore, the surgery carries risks of infection, anesthesia complications, and worsening of gastroesophageal reflux. Benitec’s approach aims to render this surgical paradigm obsolete by arresting the disease process at the molecular level.[13]

Technological Architecture: The ddRNAi Platform

The “Silence and Replace” Mechanism

Benitec’s proprietary DNA-directed RNA interference (ddRNAi) platform represents a sophisticated evolution of gene therapy. Traditional gene therapy (gene replacement) is analogous to adding a bucket of water to a drying well; it supplements a deficiency. However, in dominant diseases like OPMD, the problem is not just a lack of water, but the presence of poison in the well. Adding fresh water (healthy protein) does not neutralize the poison (toxic protein).[15]

Benitec’s solution is the “Silence and Replace” architecture. This involves a single bifunctional construct that performs two distinct but synchronized operations within the target cell:

- Silence (The “Scrub”): The construct encodes DNA sequences that are transcribed into short hairpin RNAs (shRNAs) or microRNAs (miRNAs). These RNA molecules are engineered to specifically bind to the mRNA produced by the PABPN1 gene (both mutant and wild-type) and trigger the cell’s RNA-induced silencing complex (RISC) to degrade them. This effectively shuts down the production of the toxic mutant protein.[6]

- Replace (The “Refill”): On the same vector, Benitec includes a “codon-optimized” version of the healthy PABPN1 gene. Because the genetic code is degenerate (multiple codons can encode the same amino acid), Benitec can alter the DNA sequence of this replacement gene so that it produces the same functional protein but has a different underlying mRNA sequence. This alteration renders the replacement mRNA invisible to the shRNAs/miRNAs designed to silence the endogenous gene.[6]

This “hardened” replacement gene ensures that while the toxic mutant protein is eliminated, the cell continues to receive a steady supply of the essential wild-type protein. This restoration of physiological balance is the crux of the therapeutic hypothesis.[17]

The Vector: Adeno-Associated Virus Serotype 9 (AAV9)

The delivery vehicle for this sophisticated payload is the Adeno-Associated Virus Serotype 9 (AAV9). The choice of AAV9 is strategic and evidence-based. AAV9 has established itself as the “gold standard” for neuromuscular gene delivery due to its superior tropism for muscle tissue and its ability to transduce both dividing and non-dividing cells.[16]

Benitec utilizes a modified AAV9 capsid to maximize transduction efficiency in the pharyngeal muscles.[18] The non-integrating nature of AAV ensures that the risk of insertional mutagenesis (disrupting the host genome and causing cancer) is minimized, a critical safety consideration for regulatory bodies. The therapy is administered via a direct intramuscular injection, ensuring high local concentration of the vector in the tissues where it is most needed, the swallowing muscles, while minimizing systemic exposure.[13]

Preclinical Validation and Design Optimization

The journey to the clinic was paved with extensive preclinical validation. Benitec’s scientists utilized animal models, including mice and dogs, to optimize the construct. One critical challenge in RNAi therapeutics is “off-target effects,” silencing genes other than the intended target. Benitec mitigated this by utilizing microRNA (miRNA) backbones for their inhibitory RNAs, which are processed more naturally by the cell and tend to have higher specificity than first-generation shRNAs.[6]

Furthermore, the “Responder Analysis” developed during these stages has become a proprietary asset. By identifying the specific biomarkers and clinical endpoints that correlate with histological improvement in animal models, Benitec was able to design a Phase 1b/2a trial with a high probability of success, a foresight that has now paid dividends with the 100% response rate data.[2]

Clinical Evidence: The Phase 1b/2a Data Analysis

Trial Design and Execution

The BB-301 Phase 1b/2a clinical trial (NCT06185673) is an open-label, dose-escalation study designed to assess the safety and clinical efficacy of BB-301 in patients with OPMD. The trial is structured into cohorts, with patients receiving a single administration of the gene therapy followed by a rigorous monitoring period.[19]

The execution of this trial has been notably precise. The first subject was dosed in November 2023. Subsequent patients were dosed in a staggered fashion: the second in February 2024, the third in October 2024, the fourth in December 2024, the fifth in February 2025, and the sixth in April 2025.[21] This disciplined cadence allowed the Data Safety Monitoring Board (DSMB) to review safety data between dosing, ensuring patient safety was paramount. The DSMB’s recommendation to continue enrollment into Cohort 2 without modification is a significant regulatory green light.[22]

Efficacy Analysis: The 100% Responder Rate

The interim results released in November 2025 for Cohort 1 are the centerpiece of the current investment thesis. The data revealed that all six patients treated in this cohort met the formal statistical criteria for response, yielding a 100% response rate.[2]

Table 1: Detailed Clinical Response Metrics (Cohort 1)

| Clinical Metric | Outcome Description | Statistical Significance |

| Responder Rate | 6 of 6 patients (100%) met predefined criteria. | Yes (Met formal criteria) |

| Dysphagia Burden | Significant reduction in total dysphagic symptom burden. | Yes |

| Swallowing Efficiency | Decreased post-swallow residue accumulation. | Yes |

| Functional Speed | Shorter time required to consume fixed volumes of liquids. | Yes |

| Physiological Mechanics | Improved pharyngeal closure during swallowing. | Yes |

This unanimity of response is rare in early-stage trials, where dose-finding often leads to variable results. The fact that even the low-dose cohort achieved such robust efficacy suggests a potent biological effect.

Granular Patient Data: Subject 1 vs. Subject 2

A deeper dive into the individual patient data released in earlier updates provides nuance to these topline numbers. Subject 1 entered the trial with a more severe baseline condition, having been diagnosed 7 years prior, compared to Subject 2, who was 6 years post-diagnosis. Despite the higher disease burden, Subject 1 experienced significant clinical benefit.[24]

Subject 2’s data is particularly illuminating regarding the magnitude of improvement. At 180 days post-treatment, Subject 2 demonstrated:

- An 89% reduction in the Sydney Swallow Questionnaire (SSQ) Total Score compared to baseline.[24]

- An 84% reduction in the SSQ Sub-Score related to the “necessity of repeat swallows”.[24]

This specific metric, the need to swallow multiple times to clear a single mouthful, is a key driver of “eating fatigue” and malnutrition in OPMD patients. An 84% reduction essentially normalizes the eating experience for the patient. This is not just a statistical win; it is a transformative quality-of-life improvement.

Safety Profile

Safety is the primary hurdle for gene therapies, particularly regarding immunogenicity and liver toxicity. The Phase 1b/2a data reported a clean safety profile. There were no Severe Adverse Events (SAEs) observed in the treated subjects.[24] This “clean” safety profile is crucial because it reduces the likelihood of the FDA imposing “Clinical Holds,” which are common in gene therapy trials and can destroy shareholder value overnight.

Strategic Manufacturing & Supply Chain

The “Build vs. Buy” Decision

In the gene therapy space, manufacturing is often cited as “the process is the product.” The complexity of producing viral vectors like AAV9 at clinical and commercial scale is immense. Companies face a strategic choice: build internal manufacturing capabilities (CAPEX-heavy, slow) or partner with Contract Development and Manufacturing Organizations (CDMOs). Benitec has opted for a hybrid “smart outsourcing” model. Rather than sinking hundreds of millions into a facility before clinical validation, they have partnered with Lonza, a global leader in viral vector manufacturing.[25]

The Lonza Partnership

The agreement with Lonza provides Benitec with access to world-class infrastructure and expertise without the massive fixed costs. Lonza’s facilities in Houston, Texas, and Walkersville, Maryland, are at the cutting edge of AAV production.[26]

Table 2: Strategic Benefits of the Lonza Partnership

| Strategic Vector | Benefit to Benitec |

| Scalability | Lonza operates 2,000L bioreactors, ensuring seamless scaling from clinical to commercial batches.[26] |

| Regulatory Compliance | Lonza’s facilities are FDA/EMA GMP compliant, reducing the risk of Chemistry, Manufacturing, and Controls (CMC) rejections. |

| Cost Efficiency | Benitec converts fixed manufacturing costs into variable costs, preserving cash for R&D and clinical execution. |

| Supply Security | Lonza’s multiple sites provide redundancy, mitigating the risk of a single-point failure in the supply chain. |

The robust manufacturing process development work conducted under this partnership has allowed Benitec to maintain a consistent supply of BB-301 for its trials, a logistical feat that often trips up smaller biotechs.[27]

Supply Chain Resilience and Geopolitics

In an era of increasing geopolitical tension, particularly between the US and China, the security of the biopharmaceutical supply chain is paramount. The US government is actively scrutinizing reliance on Chinese CDMOs (e.g., the BIOSECURE Act debates). Benitec’s reliance on Lonza (Swiss-headquartered with a strong US presence) insulates it from these geopolitical risks.[25]

While Benitec acknowledges standard risks regarding global operations in its 10-K filings, identifying general risks in countries like China regarding IP[21], its physical supply chain for the critical drug substance is firmly rooted in the Western alliance sphere. This positioning makes Benitec a “safe harbor” investment for institutional capital mandated to avoid geopolitical supply chain exposure.

Financial Architecture & Capital Markets

The Capital Structure Transformation

November 2025 marked a watershed moment for Benitec’s balance sheet. The company executed a highly successful capital raise, generating approximately $100 million in gross proceeds.[8] This transaction was not a desperate dilution at a discount, but a strategic expansion of the shareholder base for $13.50 per share.[1]

To appreciate the magnitude of this success, one must compare it to the company’s financing in April 2024. At that time, Benitec raised $40 million at $4.80 per share.[28] The increase in offering price from $4.80 to $13.50 in just 18 months represents a near-tripling of the equity value assigned by institutional investors. This is the ultimate validation of the value creation milestones achieved by management (i.e., the positive clinical data).

The “Suvretta Thesis”

A critical component of the November 2025 financing was the $20 million direct investment by Suvretta Capital Management[7]. Suvretta is not a casual retail trader; they are a sophisticated, long-term healthcare specialist fund. Suvretta, through its Averill Master Fund entities, aggressively increased its position, now holding approximately 44% of the company’s outstanding shares.[38] This level of ownership effectively makes Benitec a “quasi-private” public company.

Why is Suvretta doubling down?

- Inside Information (Legal): With a representative (Kishan Mehta) on the Board of Directors[28], Suvretta has a deep understanding of the raw data, the FDA interactions, and the strategic roadmap.

- Control Premium: By holding a blocking stake, Suvretta can influence strategic outcomes, such as a sale of the company. They effectively control the “exit button.”

- De-risking: Suvretta likely views the 100% responder rate as the final de-risking event before a major value inflection point (Pivotal Trial start or M&A).

Burn Rate and Runway

As of September 30, 2025, Benitec reported $94.5 million in cash and cash equivalents.[8] The $100 million raise (net proceeds likely ~$92-95M) brings the pro-forma cash position to nearly $190 million.

The company’s burn rate has increased as clinical activities ramp up. R&D expenses for the year ended June 30, 2025, were $18.3 million, up from $15.6 million the prior year.[23] G&A expenses jumped to $23.4 million (from $7.0 million), though this was largely driven by $14.5 million in non-cash share-based compensation.[23] Excluding non-cash items, the operational cash burn is likely in the range of $30-$40 million per year. With ~$190 million in the bank, Benitec has a cash runway extending well into 2028 or 2029. This “fortress balance sheet” removes the need for dilutive financing for years, allowing the stock to trade on fundamentals rather than fear of the next secondary offering.

Intellectual Property & Legal Moats

The Patent Fortress

Intellectual Property (IP) is the bedrock of biotech valuation. Benitec’s IP portfolio is extensive and strategically layered. The company controls the fundamental “Silence and Replace” methodology, preventing competitors from using this specific dual-action mechanism[30].

Key Patent Families for OPMD:

- OPMD Family #1: Covers the BB-301 construct, the specific shRNA/shmiR sequences targeting PABPN1, and the replacement gene strategy.[30]

- OPMD Family #2: Covers additional target gene sequences and delivery methods.[31]

- Delivery Patents: Benitec holds patents on the specific AAV vector modifications and the proprietary injection device/technique used to deliver the drug to the pharyngeal muscles.[30]

Expiration and Exclusivity

Patents generally expire 20 years after their priority filing date. With priority dates for the OPMD families extending into the late 2010s and early 2020s[39], Benitec’s patent protection extends into the 2040s.

In addition to patents, Benitec benefits from regulatory exclusivity. Orphan Drug Designation (ODD) in the US provides 7 years of market exclusivity post-approval, while in the EU it provides 10 years.[4] This regulatory exclusivity runs concurrently with patents but provides a failsafe “floor” of protection even if patents were challenged.

Freedom to Operate

Benitec has actively managed its “freedom to operate” (FTO). The gene therapy space is litigious, but Benitec’s clear licensing of AAV9 technologies and its settlement of potential disputes early on have cleared the path. The absence of ongoing major IP litigation reported in the 10-K snippets suggests a clean IP landscape[30].

Geopolitical & Macro-Strategic Context

The Interest Rate Pivot

The macroeconomic environment in late 2025 is shifting in favor of biotechnology. After a period of high interest rates that crushed the valuations of long-duration assets (like pre-revenue biotechs), the market is anticipating a normalization of rates. As the cost of capital falls, the discount rate applied to Benitec’s future cash flows (expected in 2027/2028) decreases, mathematically increasing the Net Present Value (NPV) of the company’s shares.[32]

Biosecurity as National Defense

The US government’s focus on “biosecurity” has elevated the strategic importance of domestic biotechnology capabilities. The ability to precisely edit genetic expression (the core of Benitec’s platform) is considered a “dual-use” technology with national security implications. Benitec, as a US-headquartered company (Delaware Corp, CA HQ)[33], is positioned as a trusted domestic entity. This status may open doors to non-dilutive government funding (e.g., NIH grants, BARDA partnerships) or make the company a preferred partner for strategic national stockpiles, should the technology be adapted for other indications.

The China Factor

While Benitec lists “China” as a general risk factor regarding IP enforcement in its 10-K[21], the company’s strategic alignment is decidedly Western. This is a competitive advantage. Investors are increasingly wary of biotechs with heavy exposure to Chinese clinical trials or manufacturing due to the risk of sanctions or data integrity issues. Benitec’s “clean” Western supply chain and clinical footprint (US, Canada, France)[20] removes this geopolitical discount from the stock.

Market Landscape & Competitive Analysis

The Blue Ocean of OPMD

The competitive landscape for OPMD is remarkably sparse, creating a “Blue Ocean” opportunity for Benitec. Unlike Duchenne Muscular Dystrophy (DMD), which has dozens of competitors (Sarepta, Pfizer, Solid Bio, etc.), OPMD has been largely ignored by the industry giants.[13]

Table 3: Competitive Landscape Analysis

| Competitor Type | Examples | Mechanism | Benitec Advantage |

| Direct (Gene Tx) | None in the late stage | — | First-mover advantage; robust IP moat. |

| Surgical | Cricopharyngeal Myotomy | Mechanical cutting of muscle | BB-301 targets the root cause; surgery is palliative and temporary. |

| Pharmacological | None approved | — | BB-301 is potentially curative. |

| Research Stage | Academic research | “Myostatin inhibition, Stem cells” | Benitec is years ahead in clinical validation. |

As noted in industry reports, there are “no other clinical-stage programs for OPMD right now”.[13] This lack of competition means that upon approval, Benitec will not have to fight for market share. It will inherently command 100% of the pharmacological market share for OPMD.

Market Sizing and Pricing Power

While OPMD is a rare disease (1 in 100,000 general population), it has significant clusters. The largest cluster is in the French-Canadian population (and their descendants in New England/Louisiana), and among Bukhara Jews.[10] This clustering facilitates efficient patient finding and clinical trial recruitment.

The pricing power for a “one-and-done” curative therapy is immense. Analogues like Zolgensma (SMA), priced at $2.1 million, or Hemgenix (Hemophilia B) at $3.5 million, suggest that Benitec could price BB-301 in the $2-$3 million range. With an estimated addressable population of several thousand patients in the US and EU, the revenue potential is in the billions, dwarfing the current market cap.

Management, Governance & Culture

The “Analyst-CEO” Leadership

Dr. Jerel A. Banks, Benitec’s Executive Chairman and CEO, is a defining asset. His background is not just scientific (M.D., Ph.D. from Brown), but financial. He spent years as a biotechnology equity research analyst at funds like Apothecary Capital and Capital Research Company.[35] This “Analyst-CEO” persona explains the company’s disciplined capital markets strategy. Dr. Banks understands the “buy-side” mindset. He knows that institutional investors need clear catalysts, clean data, and sufficient cash runways. The timing of the November 2025 raise, immediately capitalizing on the positive data to secure the best possible terms, is a classic example of financial acumen that many scientist-CEOs lack.

A Board Built for Exit?

The composition of the Board of Directors hints at the company’s long-term strategy. The recent addition of Dr. Sharon Mates is particularly telling. Dr. Mates founded Intra-Cellular Therapies and guided it to a massive $14.6 billion acquisition by Johnson & Johnson in 2025.[22] Her presence on the board suggests that Benitec is preparing for “commercial scale” or, more likely, positioning itself as an attractive acquisition target for big pharma. The presence of Kishan Mehta from Suvretta Capital ensures that shareholder interests are ruthlessly prioritized.[28] This is not a “lifestyle board” for retired academics; it is a “deal board” focused on liquidity and value realization.

Culture of Innovation

Employee reviews characterize Benitec as having a “collaborative” culture that “fosters innovation”.[37] In the tight labor market of the Bay Area biotech hub, this positive internal culture is crucial for retaining the specialized talent needed to run complex AAV and RNAi programs. The mission-driven nature of curing a rare disease provides a strong cohesive force for the team.[2]

Conclusion: The “Silence and Replace” Revolution

Benitec Biopharma has successfully navigated the perilous “Valley of Death” that claims the vast majority of early-stage biotechnology companies. By delivering unequivocal clinical proof-of-concept, a 100% response rate in its lead program, the company has validated a technology platform that extends far beyond a single disease.

The Investment Thesis in Summary:

- Unmatched Clinical Efficacy: The 100% responder rate in OPMD is a “best-in-class” signal that de-risks the asset significantly.

- Platform Value: “Silence and Replace” is a platform, not a product. Success in OPMD validates the mechanism for other dominant genetic disorders, offering “option value” for future pipeline expansion.

- Asymmetric Financials: With ~$190M in cash and a market cap of ~$440M, the enterprise value (~$250M) assigns a fraction of the potential value to a late-stage, de-risked, orphan drug asset.

- Institutional Backstop: The massive ownership stake by Suvretta Capital provides a floor to the stock price and aligns management with a highly sophisticated exit-focused investor.

- Monopolistic Potential: With no direct competitors in the clinic, Benitec is poised to capture the entire OPMD value chain.

In the grand chessboard of genetic medicine, Benitec Biopharma has moved from a pawn to a rook, a piece with power, range, and strategic importance. As the company advances through the final stages of clinical development in 2026 and 2027, the “Silence and Replace” revolution appears not just possible, but inevitable. For investors and industry observers alike, Benitec represents the new vanguard of curative medicine.

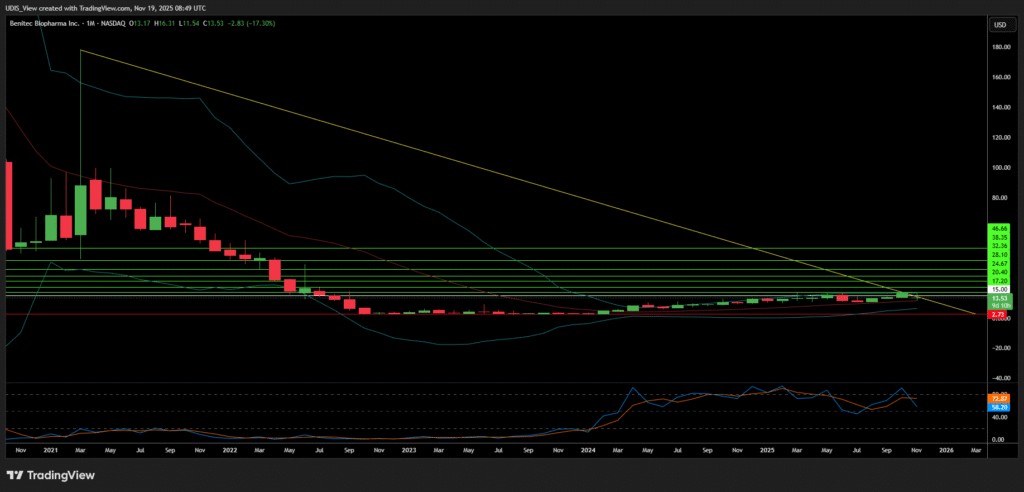

Benitec Biopharma Long (Buy)

Enter At: 15.00

T.P_1: 17.20

T.P_2: 20.40

T.P_3: 24.67

T.P_4: 28.10

T.P_5: 32.36

T.P_6: 38.35

T.P_7: 46.66

S.L: 2.73