International Business Machines (IBM) has solidified its position at the nexus of technology and geopolitics. The company leverages breakthroughs in quantum computing, cyber standardization, and vast intellectual property (IP) to drive financial growth. Recent strong earnings confirm that IBM is monetizing strategic imperatives, particularly the global urgency around quantum security. This report analyzes IBM’s increasing relevance across critical domains, validating its assertive strategic pivot.

Strategic Nexus: Geopolitics, Macroeconomics, and PQC Dominance

Geostrategy and the Quantum Imperative

Quantum technology has become a primary determinant of national power and economic competition.1 Geopolitical rivalry accelerates substantial government investment in quantum research and development.2 The US government recognized this necessity by mandating a timely transition to quantum-resistant cryptography.3 National Security Memorandum 10 (NSM-10) outlines initial required migration actions.4

This mandate directly translates geostrategic competition into a guaranteed procurement necessity.5 Adversaries pose an operational vulnerability to federal digital infrastructure today.5 The NSA’s CNSA 2.0 requires national security systems to adopt these new algorithms by the early 2030s.4 IBM’s central role in the NIST standardization process positions it as a critical national security technology partner.6 IBM effectively monetizes the US government’s urgent need to secure its infrastructure against state adversaries.4

Macroeconomic Tailwinds: The Q-Day Catalyst

The theoretical “Q-Day”, the moment quantum computers break current encryption functions, is a massive economic catalyst.7 The time to migrate legacy systems is finite, projected to be 5 to 10 years.8 Approximately $750 billion worth of Bitcoin currently sits in wallets vulnerable to quantum attacks.10 Financial institutions and critical infrastructure face immense economic exposure.9

Threat actors are already employing “harvest now, decrypt later” tactics.4 They steal encrypted data today, intending to decrypt it once quantum capabilities mature. This threat forces immediate migration for sensitive data with long lifecycles.9 This quantum risk compels highly regulated industries to overhaul their systems immediately 9. Risk mitigation spending in finance and defense is typically stable, even during periods of macroeconomic volatility. This external, compulsory driver creates a stable, high-margin revenue stream for IBM’s software and consulting segments.12

Patent Dominance and IP Moat

The Quantum IP Landscape

Intellectual property (IP) is crucial for securing a defensible market position in the quantum sector.13 Patents are vital for attracting investment and generating future licensing revenue.13 IBM secured 191 quantum technology patents granted in 2024 alone.13 This substantially leads its closest competitor, Google, which received 168 patents.13

IBM holds the definitive global lead in the quantum patent race overall.14 The company has filed over 2,500 quantum-related patents globally.14 Google trails with roughly 1,500 quantum patents filed.14 This patent concentration positions IBM to control the foundational technologies required for future quantum solutions.13 The resulting IP moat guarantees future monetization through licensing arrangements. As rivals scale, they will likely require access to IBM’s fundamental IP, creating a passive, high-margin revenue stream.13

Defense Through Continuous Innovation

IBM consistently leads US innovation, holding the most US patents for 28 consecutive years.15 This innovation leadership spans artificial intelligence (AI), cloud, quantum computing, and security IP.15 IBM’s strategy involves protecting the entire technology stack, from hardware to algorithms.15

Specialized hardware patents, including those for neuromorphic computing, accelerate AI-driven cybersecurity workloads.16 IBM’s strength lies in applying its IP across domains. Quantum-safe adoption requires integrating new PQC algorithms across a complex hybrid cloud infrastructure.17 IBM’s extensive IP in AI and cloud security supports this comprehensive implementation.16 The company provides cohesive, full-stack security solutions that specialized startups cannot easily replicate.17

Technology and Science: Achieving Utility at Scale

Scientific Breakthroughs: Qubit Entanglement

Creating genuine multipartite entanglement across a large number of qubits is a crucial step toward achieving error correction and fault tolerance.18 These complex Greenberger–Horne–Zeilinger (GHZ) states are susceptible to noise.18 IBM researchers successfully entangled 120 qubits, setting a new industry benchmark.20

The experiment achieved a GHZ “cat state” fidelity of 0.56(3) on the $ibm\_aachen$ processor.20 Researchers utilized adaptive compilation and temporary uncomputation to minimize noise.22 Temporary uncomputation momentarily disentangles resting qubits, maintaining system stability.22 This breakthrough confirms IBM’s sophisticated command over superconducting qubit control and circuit optimization.21 Demonstrating stability at 120 qubits validates the technical path toward engineering reliable logical qubits.19

High-Tech Hardware Roadmaps: Scaling Toward Fault Tolerance

IBM maintains a clear, aggressive hardware roadmap toward quantum advantage.19 In December 2023, IBM introduced Condor, a 1,121 superconducting qubit processor.24 Condor focused on optimizing manufacturing scale and chip yield.24 It features a 50% increase in qubit density over its predecessor, Osprey 24

IBM executes a two-pronged strategy: demonstrating physical scale (Condor) and refining logical qubit stability. The roadmap targets Starling, a fault-tolerant system, for deployment by 2029.19 Starling is designed to run 100 million quantum gates on 200 logical qubits.23 This defined roadmap provides crucial clarity for both investors and enterprise clients.26 The verifiable physical milestones and logical qubit goals significantly de-risk long-term investment.19

Quantum-Centric Supercomputing Integration

True quantum advantage requires integrated hybrid systems.27 IBM and AMD announced a collaboration to develop quantum-centric supercomputing architectures.27 This partnership combines IBM’s quantum lead with AMD’s expertise in High-Performance Computing (HPC) and AI accelerators.27 AMD currently powers the world’s two fastest exascale supercomputers.27

This strategy ensures IBM’s quantum solutions are deployable at exascale for massive government and defense clients.27 The hybrid approach links quantum access to existing, powerful classical infrastructure, accelerating commercialization.27 The partnership solves the critical integration challenge of managing quantum systems using classical resources.

IBM Quantum Milestones and Roadmap Projection

| Focus Area | Milestone/Processor | Date/Target | Strategic Significance |

| Hardware Scale | Condor (1,121 qubits) | Dec 2023 | Solves manufacturing scale and yield challenges 24 |

| Scientific Utility | 120-Qubit Entanglement (Cat State) | Early 2025 | Sets new benchmark for genuine multipartite entanglement, fidelity 0.56 21 |

| Fault Tolerance Goal | Starling (200 Logical Qubits) | 2029 (Target) | Delivers large-scale fault-tolerant system for quantum advantage 19 |

Cyber and Geopolitical Mandate: Standardization and Market Creation

The IBM-NIST Standard and Global Blueprint

The NIST publication of Post-Quantum Cryptography (PQC) standards in 2022 established the global blueprint for future security.6 IBM researchers led the development of two of the three primary standards selected.28 These standards include ML-KEM for key encapsulation and ML-DSA for digital signatures.30

Major technology firms such as Apple, Zoom, and Cloudflare are already implementing these IBM-derived standards.30 IBM transitions from simply a technology vendor to the mandatory security architect for global commerce.28 The company’s IP dominance effectively exports US-based cryptographic standards worldwide.9 This grants IBM an insurmountable first-mover advantage and inherent credibility when offering migration services.6

Government and Industry Migration Dynamics

The US government, through NSM-10 and CNSA 2.0, mandates compliance by the early 2030s.4 The UK advises full PQC adoption for high-risk systems by 2035.9 This regulatory complexity creates a massive, multi-year consulting mandate.9 Migration requires comprehensive vulnerability identification across thousands of custom enterprise applications.9

Over 4,000 corporate and government entities in critical infrastructure utilize IBM’s hybrid cloud platform.6 IBM can leverage these deep client relationships in finance and healthcare for PQC deployment.6 The PQC deadline ensures a sustained, multi-year revenue stream in IBM’s software and consulting segments.9 IBM is uniquely positioned as the IP originator to perform the comprehensive audit and remediation necessary for mission-critical workloads 17

PQC Standardization and Compliance Mandate

| PQC Algorithm/Mandate | IBM Role | Function | Market/Geopolitical Impact |

| ML-KEM (Kyber) | Lead Contributor | General Encryption/Key Exchange | Global blueprint for securing websites (TLS) 30 |

| ML-DSA (Dilithium) | Lead Contributor | Digital Signature Protocols | Secures digital identity and protocols 30 |

| NSM-10/CNSA 2.0 | Core Technology Provider | Mandatory Transition | US federal systems must migrate by the early 2030s 4 |

Economics and Financial Validation

Revenue vs. Hype: Commercial Quantum Reality

The quantum technology market shows high growth potential.31 Projections suggest the market could reach up to $72 billion by 2035.31 PQC standardization and services constitute a commercially mature vertical within this growth.32 IBM’s quantum division has already booked nearly $1 billion in cumulative revenue since 2017.33

This commercial milestone significantly exceeds competitors.33 This figure is over tenfold the cumulative revenue of specialized pure-play quantum startups.33 IonQ, for example, only targets $95 million in 2025 revenue.33 IBM demonstrates that quantum technology is an integrated, profitable part of its current business model, not merely an R&D cost center. 33 Immediate revenue from PQC consulting funds IBM’s ambitious long-term hardware roadmap internally.33 This offers a vital financial advantage over cash-burning competitors.

Q3 2025 Performance and Margin Expansion

IBM’s robust financial execution reinforces its strategic direction.35 IBM reported Q3 2025 revenue of $16.33 billion, surpassing expectations.36 Earnings per share (EPS) reached $2.65, substantially beating Wall Street forecasts.36 Revenue accelerated, growing 7% year-over-year.36

Adjusted EBITDA margins expanded by 290 basis points.36 The company generated a record $7.2 billion in year-to-date free cash flow.36 This margin expansion confirms the successful shift toward high-margin, sticky software and consulting services.12 Quantum assets, particularly PQC services, provide essential premium components driving this operational efficiency.37

Valuation and Future Projections

The market increasingly values IBM based on its strategic future potential in AI and quantum.37 Analyst projections suggest IBM’s forward P/E ratio may converge with peers like Nvidia and Microsoft by 2026.37 This trajectory implies a potential share price appreciation toward $338 to $362.37

IBM’s stock surged 8% immediately following the announcement of the AMD quantum partnership.26 This demonstrates high investor sensitivity to strategic quantum advancements.26 IBM offers a unique dual investment thesis: proven profitability today (Hybrid Cloud/AI) combined with validated, high-growth future optionality (Quantum IP and services). This combination significantly de-risks the quantum investment compared to pure-play competitors.

Quantum Commercialization and IP Leadership

| Metric | IBM (Cumulative) | IonQ (Target) | Google (R&D Focused) |

| Quantum Revenue (Since 2017) | ~$1 Billion | $95 Million (2025 Target) | Minimal Contribution |

| Global Quantum Patents (Filed) | $> 2,500$ | Not Listed | $\sim 1,500$ |

| 2024 Quantum Patents (Granted) | 191 (Global Leader) | $< 50$ | 168 |

Conclusions

IBM has successfully transitioned its quantum research into a strategically vital, financially validated business asset. The company’s leadership is secured not just by scientific milestones, but by geopolitical leverage. IBM established its expertise by defining the NIST post-quantum cryptography standards. This PQC mandate creates a high-margin market for services guaranteed by government deadlines and fear of “harvest now, decrypt later” attacks.

IBM possesses the largest quantum IP portfolio globally, providing a robust competitive moat and long-term licensing revenue potential. Furthermore, the company executes a clear hardware roadmap toward fault tolerance by 2029, validated by breakthroughs like 120-qubit entanglement. This technical progress, combined with the strategic AMD partnership, ensures practical quantum solutions are integrated at exascale. IBM is uniquely positioned to capitalize on the quantum revolution, driving sustained financial growth supported by strong operational efficiency and record cash flow.

References

- IBM Faces New Quantum Rival as China Fires Up 1000-Qubit Supercomputer – CXO TV

- China’s long view on quantum tech has the US and EU playing catch-up | Merics

- NIST Post-Quantum Cryptography Standardization and NSM 10

- Quantum-safe cryptography – IBM

- Why federal IT leaders must act now to deliver NIST’s post-quantum cryptography transition

- IBM-Developed Algorithms Announced as NIST’s First Published Post-Quantum Cryptography Standards

- Quantum Threat to Bitcoin: Market Panic Risk Before Actual Crypto Breakthrough – News and Statistics

- Bitcoin News Today: Bitcoin Faces Quantum Countdown: Immediate Measures Needed or Face Potential Extinction? – Bitget

- Secure the post-quantum future | IBM

- State of Crypto 2025: The year crypto went mainstream

- Accelerate hybrid cloud transformation through the IBM Cloud for Financial Service Validation Program

- IBM: Navigating the Hybrid Cloud, AI, and Quantum Frontier (October 2025) | User – Markets

- Top Quantum Computing Patents: Trends, Players, and Innovations in 2025

- Quantum Computing Patent Race: Who’s Filing the Most Quantum Patents? (Latest Data) | PatentPC

- IBM Tops U.S. Patent List for 28th Consecutive Year with Innovations in Artificial Intelligence, Hybrid Cloud, Quantum Computing, and Cyber-Security – Jan 12, 2021

- How IBM’s AI Hardware Patents Are Driving Tech Innovation – PatentPC

- How a post-quantum approach to cryptography can help protect mainframe data | IBM

- IBM’s Quantum ‘Cat’ Roars: 120-Qubit Breakthrough Pushes Bitcoin’s Encryption Risk Closer – Currently, from AT&T

- IBM Quantum Computing | Technology and roadmap

- Big cats: entanglement in 120 qubits and beyond – arXiv

- IBM’s Quantum ‘Cat’ Roars: 120-Qubit Breakthrough Pushes Bitcoin’s Encryption Risk Closer | Decrypt on Gate Square

- IBM’s Quantum ‘Cat’ Roars: 120-Qubit Breakthrough Pushes Bitcoin’s Encryption Risk Closer – Decrypt

- IBM outlines quantum computing roadmap through 2029, fault-tolerant systems

- The hardware and software for the era of quantum utility are here – IBM

- IBM Condor – Wikipedia

- IBM Stock Surges 8% As It Expands Quantum Computing Capabilities with AMD Chip

- IBM and AMD Join Forces to Build the Future of Computing

- CIOs must prepare their organizations today for quantum-safe cryptography

- Trusted AI helps enhance NATO’s critical multidomain decision making | IBM

- NIST’s post-quantum cryptography standards are here – IBM Research

- 2025 Quantum Computing Industry Report And Market Analysis: The Race To $170B By 2040 – Brian D. Colwell

- The Year of Quantum: From concept to reality in 2025 – McKinsey

- Trump’s Quantum Interest Shines Spotlight On IBM’s Revenue Lead – Benzinga

- IBM Has Earned $1 Billion From Quantum, CNBC Reports

- IBM (IBM) Is Up 8.8% after Q3 Earnings Beat and Breakthroughs in AI and Quantum Solutions

- Earnings call transcript: IBM beats Q3 2025 forecasts, stock rises

- More Great News for IBM Heading Into 2026. Is It a Buy Now? | The Motley Fool

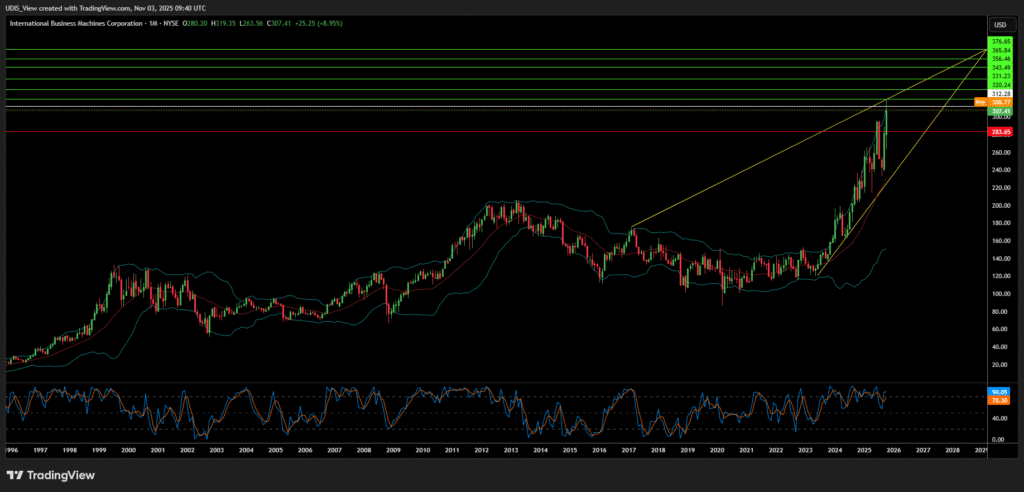

IBM Long (Buy)

Enter At: 312.28

T.P_1: 320.24

T.P_2: 331.23

T.P_3: 343.49

T.P_4: 356.46

T.P_5: 365.84

T.P_6 : 376.65

S.L: 283.65