I. RISK ACCUMULATION AND THE VERTICAL INTEGRATION BET

Joby Aviation’s (JOBY) sustained market turbulence stems from structural, non-technical weaknesses. The company’s decline is not routine market fluctuation but a collision of an aggressive corporate strategy and severe external pressures. Joby pursues a high-spend, vertically integrated operator model aiming for total value chain control.1 This capital-intensive strategy faces crippling financial losses and demands constant refinancing.2

Structural threats challenge Joby from every operational axis. These threats include indefinite regulatory delays 4, significant legal exposure from critical intellectual property litigation 5, and punitive macroeconomic conditions.6 Technical milestones, such as preparation for Type Inspection Authorization (TIA) flight testing 7, have been achieved. However, the market correctly discounts this progress, projecting a significant downside in share price (approximately 30% on average).8

This analytical disconnect confirms investors rationally prioritize existential, non-technical risks. The high cash burn 2 and potential nine-figure legal liabilities 5 outweigh hardware readiness. These fundamental concerns validate the assessment that Joby’s current valuation remains highly inflated compared to its intrinsic, risk-adjusted value.3

II. MACROECONOMIC AND FINANCIAL VULNERABILITY

Joby’s strategic choice to control the entire value chain imposes a catastrophic financial burden. This high capital consumption is intensified by tightening global financial conditions.

A. The Cash-Intensive Model and Dilution Risk (Economics)

Joby’s “all-in” playbook requires aggressive spending to build a complete air taxi airline.1 This vertical integration strategy demands massive upfront capital expenditure (CapEx) for establishing dedicated manufacturing and testing facilities.9 The financial toll is evident in quarterly results. Joby reported a net loss of $324.67 million in the second quarter of 2025 alone.2

This high magnitude of loss confirms the unsustainability of pre-revenue capital commitments. The consistently severe cash burn dictates recurrent equity financing.3 This strategy perpetually exposes shareholders to profound dilution risk.3

The company currently reports substantial interest and investment income, reaching $9.85 million in Q2 2025.2 This income derives from Joby’s sizable existing cash reserves, estimated at $1.4 billion.10 This stream temporarily offsets total losses, but the protective buffer is superficial. As Joby continues to burn hundreds of millions per quarter 2, this cash shield will shrink rapidly. The market must look past this transient income source and assess the true severity of core operational negative economics.

Table 1: Key Financial Indicators (Q1 & Q2 2025)

| Period | Net Income (Millions USD) | EPS | Interest/Investment Income (Millions USD) |

| Jun 2025 (Q2) | -324.67 | -0.20 | 9.85 |

| Mar 2025 (Q1) | -82.41 | -0.20 | 9.90 |

B. Capital Cost in the High-Rate Era (Macroeconomics)

The prevailing “higher-for-longer” interest rate regime acts as a multiplier of financial risk. This environment severely penalizes capital-intensive, pre-revenue companies that depend on future funding.6 High inflation, signaled by rising Producer Price Index data 12, guarantees increased future costs for materials and manufacturing CapEx.

Joby is acutely sensitive to the cost of both debt and equity financing.6 The macro environment accelerates the financial consequences of Joby’s costly vertical integration strategy.1 High capital deployment in an expensive debt environment undermines long-term profitability forecasts.

III. REGULATORY AND GEOPOLITICAL FRICTION

Federal Aviation Administration (FAA) certification remains the primary rate-limiter for Joby. This critical regulatory dependency transforms technical progress into a geopolitical waiting game.

A. The FAA Certification Bottleneck (Geostrategy)

Joby’s Type Certification timeline is facing substantial and costly delays. The FAA requested additional safety documentation, introducing significant regulatory friction.4 This uncertainty has immediate operational consequences for investors. Analysts now suggest U.S. commercial deployment is “unlikely before 2027”.13

This delay dramatically extends the pre-revenue operational runway, increasing financial pressure and overall operational risk.4 Joby’s technical progression to Type Inspection Authorization (TIA) flight testing 7 is a clear engineering success, but it cannot overcome the reality of bureaucratic inertia. The protracted schedule undermines all immediate financial modeling for the business.

B. International Strategy as a Geopolitical Hedge

With U.S. operations pushed back, Joby relies increasingly on international validation to maintain momentum. The company is accelerating plans for a Dubai 2026 launch.13 Joby also established a joint venture with ANA Holdings to accelerate plans in Japan.4 The Dubai launch will be the first major test of its operational model and ability to scale internationally.13

This global strategic shift exposes Joby to diverse regulatory regimes. Crucially, this reverses the preferred certification sequence.14 Obtaining Type Certificate first in the U.S. simplifies global acceptance via Bilateral Agreements. Pursuing international certification ahead of FAA approval adds complexity and potential delays in establishing global operations.14

C. TSA Oversight and Operational Security (Geopolitics)

The introduction of novel air taxi services operating from urban skyports creates ambiguous security regulatory schemes.15 The Transportation Security Administration (TSA) is responsible for civil aviation security and may impose burdensome new requirements.15 Such mandates could significantly increase operating costs and reduce the convenience factor of the service. Regulatory uncertainty surrounding security directly affects long-term market acceptance and accessibility.

The FAA delay fundamentally undercuts the value of the Blade Air Mobility acquisition. Joby paid up to $125 million for Blade’s passenger business to accelerate its market entry and secure terminal access.16 The intent was a “fast-track to customers”.13 The FAA delay means the core S4 aircraft cannot utilize Blade’s network for years.13 This delay renders the nine-figure acquisition a long-term, non-performing asset, confirming poor capital efficiency due to external regulatory forces.13

IV. HIGH-TECH AND SCIENTIFIC HURDLES

The pursuit of superior performance in the Advanced Air Mobility sector imposes complex scientific and manufacturing trade-offs that Joby must manage.

A. Aerospace Battery Science: Density Constraints (Science)

eVTOL applications demand far greater power density than conventional electric ground vehicles.17 Pouch cells lead in energy density because their flexible design minimizes non-energy-storing casing volume.18 This technical advantage is crucial for achieving the necessary flight performance characteristics.

However, this optimal performance comes at the cost of robustness compared to cylindrical cells.18 Joby must navigate this fundamental scientific trade-off, demanding substantial, continuous investment in thermal runaway protection and advanced battery management system research and development. This scientific burden adds significantly to the firm’s cash burn.

B. The Vertical Integration Dilemma (High-Tech)

Joby’s “all-in” strategy aims to control all certification aspects under one roof.1 This approach reduces the logistical complexity and auditing risk associated with coordinating dozens of external suppliers for FAA compliance.14 Controlling the process de-risks the certification timeline from supplier issues.9

Conversely, this model dramatically magnifies execution risk. Joby must rapidly scale its internal manufacturing capacity and maintain stringent quality control across expanded facilities in Ohio and California.9 This centralization increases the immediate capital hurdle and creates long-term risk of internal manufacturing bottlenecks. If a competitor develops a revolutionary component, Joby’s massive investment in highly fixed, integrated capital faces rapid obsolescence. Re-tooling a self-built production line is exponentially more complex and expensive than adjusting external supplier contracts.1

C. Strategic Focus Diffusion (Technology)

Joby’s strategy involves purchasing technological capabilities outright—acquiring Xwing for autonomous flight systems and H2Fly for hybrid power applications.19 This approach secures intellectual property wholly within the company. However, it introduces significant integration risk.

Diverting core engineering focus from the S4’s immediate piloted certification to integrating complex, future-oriented systems (autonomy, hybrid power) potentially slow the critical Type Certification process.19 Furthermore, the stock price exhibits sensitivity to broader, non-specific tech sector retreats. Joby suffered valuation pullbacks correlated with general market skepticism regarding AI valuations.12 This response occurs because investors categorize Joby as an AI-driven growth stock due to its autonomous flight acquisitions 19, compounding company-specific regulatory fears with generic tech volatility.

V. INTELLECTUAL PROPERTY EXPOSURE

Legal jeopardy represents the most acute and quantifiable threat to Joby’s design integrity and financial reserves.

A. The Aerosonic Litigation Details (Patent Analysis)

Joby Aero, Inc. is currently facing a material legal challenge from Aerosonic LLC in the U.S. District Court.5 The complaint alleges Joby misappropriated trade secrets related to critical air data probes.5 Aerosonic claims Joby used confidential information, disclosed under a 2021 Mutual Nondisclosure Agreement (MNDA), to significantly accelerate its internal prototyping efforts.5 Joby allegedly attempted to purchase the IP rights but proceeded to develop the technology in-house when Aerosonic refused.5

B. Denial of Motion to Dismiss and Damages

In August 2025, the Court denied Joby’s Motion to Dismiss the First Amended Complaint.5 This ruling validates the strength of Aerosonic’s claims regarding plausible MNDA breach and trade secret misappropriation. Aerosonic asserts damages exceeding $100 million.5 This financial exposure rivals the company’s cash burn for an entire operational quarter.2

C. Production and Certification Threat

Air data probes are vital for measuring air pressure, angle of attack, and sideslip.5 These are foundational inputs for safe flight control systems. A finding of liability against Joby could result in a court-imposed injunction on production. Alternatively, it could mandate a costly redesign of the affected components, which would require extensive re-testing and FAA re-approvals.

This legal resolution would directly interfere with the TIA testing phase 7 and further paralyze the path to final Type Certification.4 The litigation fundamentally challenges the rationale of Joby’s vertical integration, which is meant to ensure control and speed.14 If the design integrity is compromised, the entire certification premise collapses, demanding massive financial and temporal expenditure.

VI. BUSINESS INFRASTRUCTURE AND CYBER RISK

Operational strategy reveals weaknesses in market capture and the need for rigorous cyber resilience across the decentralized Urban Air Mobility (UAM) ecosystem.

A. The Non-Exclusive Acquisition Flaw (Geostrategy/Economics)

The $125 million acquisition of Blade’s passenger business provided access to established terminals and loyal customers.16 However, the strategic value of this transaction is severely limited. Industry analysis confirms the deal grants Joby no exclusive rights to critical infrastructure like New York heliports or unique real estate.13 Blade’s infrastructure consists of easily replicable, low-cost portable lounges.13

This means the significant capital expenditure failed to establish a sustainable competitive moat. The deal functions more as a marketing narrative than as a defensible strategic asset. The capital spent sits idle, contributing to the overall cash burn.2 This confirms a profound disconnect between aggressive commercial spending and the slow reality of aviation regulatory compliance.13

B. Revenue Visibility Challenges

Joby adjusted a key urban infrastructure partnership to focus narrowly on charging infrastructure, narrowing the scope of collaboration.4 This revised framework diminishes near-term revenue visibility, heightening investor caution.4 Sector experts widely acknowledge that scaling UAM commercially is proving “harder than originally expected”.13 This challenge further stresses the company’s lengthy pre-revenue period.

C. Cybersecurity Governance and Operational Risk (Cyber)

Joby maintains a formal cybersecurity risk management structure, overseen by its Audit Committee.15 This framework is managed by an experienced Head of Information Technology.15 However, the core cyber risk is inherent in the platform’s novelty.

Securing proprietary flight control systems and the newly decentralized skyport network against sophisticated threats is a massive operational hurdle. Given the FAA’s heightened safety scrutiny 4, demonstrating robust cyber resilience is mandatory for final regulatory approval and long-term service reliability.

VII. INVESTMENT OUTLOOK AND RISK-ADJUSTED VALUATION

The composite risk profile across regulatory, legal, and financial domains necessitates a highly discounted valuation for Joby Aviation.

A. Analyst Consensus vs. Reality

The speculative nature of pre-revenue growth stocks is reflected in the vast range of analyst forecasts.10 The average price target of $12.17 suggests a significant 30.18% downside from recent trading levels.8 Bearish forecasts project prices as low as $6.00 8, reflecting fundamental pessimism about the company’s timeline. Analysts do not project profitability for Joby until 2027 or 2028.10

Table 2: Analyst Price Targets and Market Disconnect

| Metric | Value (USD) | Implied Downside/Upside | Source Context |

| Last Closing Price | $17.43 | N/A | Current Market Valuation 8 |

| Average Price Target | $12.17 | -30.18% Downside | Consensus of 6 analysts 8 |

| Lowest Price Target | $6.00 | -65.58% Downside | Bearish long-term outlook 8 |

B. Final Risk Synthesis

Joby’s decline is anchored by three structural failures that severely constrain its financial runway. First, the protracted regulatory timeline until 2027 fundamentally undermines all commercial and financial modeling.13 Second, the material $100 million-plus legal exposure from the Aerosonic trade secret lawsuit threatens potential design halting and production injunctions.5 Third, punishing macroeconomic headwinds, characterized by high interest rates, directly penalize the costly vertical integration CapEx model.6

The market is correctly pricing the high probability that these deep, fundamental constraints will continue to delay revenue generation. Technical achievement, such as TIA progress 7, loses its catalytic power when confronted with non-technical, existential threats. IP liability and regulatory uncertainty override hardware readiness, forcing investors to apply a severe discount based on worst-case scenarios for time-to-market.

Table 3: Multi-Domain Risk Summary

| Domain | Primary Risk Factor | Core Evidence/Finding | Implication for Commercialization |

| Economics | Excessive Cash Burn | Q2 2025 Net Loss: -$324.67M.2 | Necessitates frequent, dilutive equity financing.3 |

| Macroeconomics | Cost of Capital | “Higher-for-longer” interest rates.6 | Penalizes high CapEx for manufacturing/testing.1 |

| Geostrategy | Regulatory Friction | FAA requests additional safety documentation.4 | Delays U.S. commercial deployment possibly beyond 2027.13 |

| Technology | Vertical Integration Cost | Massive CapEx for manufacturing expansion.9 | Increases rigidity and vulnerability to technical obsolescence. |

| Science | Battery Constraints | Energy density requires demanding pouch cells.18 | Increases R&D costs for safety and thermal management.17 |

| High-Tech | Focus Diffusion | Integration risk from Xwing/H2Fly acquisitions.19 | Stretches engineering resources away from core S4 certification. |

| Patent Analysis | Trade Secret Litigation | Aerosonic $100M+ IP lawsuit on air data probes.5 | Threatens critical component design, potentially halting production. |

| Geopolitics | Security Ambiguity | Uncertain TSA requirements for novel skyports.15 | Could erode convenience and raise operational costs significantly. |

| Cyber | Operational Security | Need to secure novel, proprietary, decentralized systems.15 | Adds complexity to FAA safety compliance and operational resilience. |

References

- Cash Burn vs. Cautious Capital: Which eVTOL Strategy Will Win – MarketBeat

- Joby Aviation Inc (JOBY) Stock Price & News – Google Finance

- Joby Aviation (JOBY) Is Down 10.8% After $514 Million Equity Raise …

- Joby Aviation Shares Fall 0.84% Amid Regulatory Delays and Partnership Changes

- 1 UNITED STATES DISTRICT COURT MIDDLE DISTRICT OF …

- Impact of higher interest rates on private equity | Wellington US Institutional

- Joby’s First Conforming Aircraft Heads to Final Assembly in Preparation for TIA Flight Testing

- What is the current Price Target and Forecast for Joby Aviation, Inc. (JOBY)

- Here’s Why Joby Aviation Stock Flew Higher in July – Nasdaq

- Joby stock price prediction 2025: Does Joby Aviation have a future? | Markets.com

- Eve Holding’s SWOT analysis: eVTOL pioneer’s stock faces turbulent skies – Investing.com

- Why Joby Aviation Stock Plummeted This Week – Nasdaq

- Joby buys Blade’s passenger arm in $125m bet on fast-track UAM …

- Joby vs. Archer: The $10 Billion eVTOL Battle – YouTube

- joby-20231231 – Investor Relations

- Joby Completes Acquisition of Blade’s Passenger Business

- Key considerations for cell selection in electric vertical take-off and landing vehicles: a perspective – EES Batteries (RSC Publishing) DOI:10.1039/D4EB00024B

- Pouch vs. Prismatic vs. Cylindrical? Your Lithium Battery Cell Guide

- Joby vs Archer : r/JobyAviation – Reddit

Joby vs Archer : r/JobyAviation – Reddit

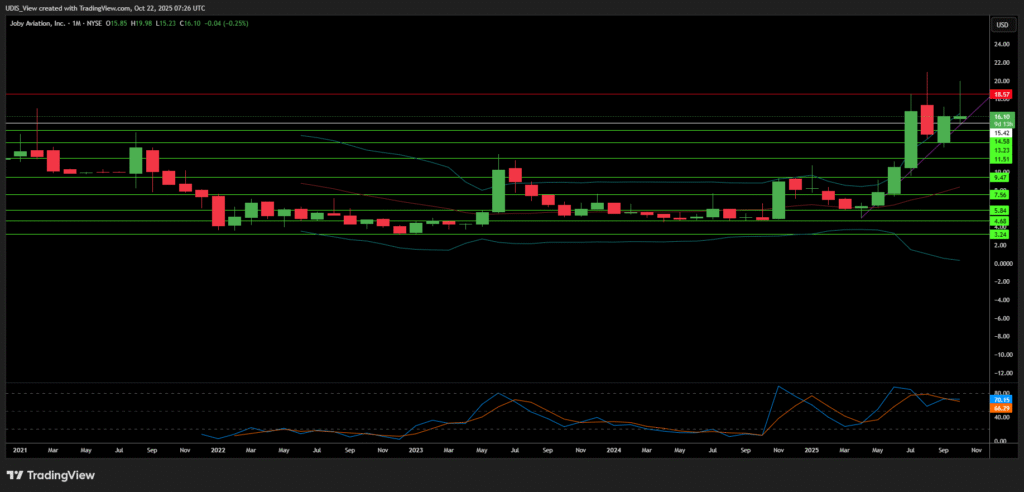

Joby Aviation Short (Sell)

Enter At: 15.42

T.P_1: 14.58

T.P_2: 13.23

T.P_3: 11.51

T.P_4: 9.47

T.P_5: 7.56

T.P_6: 5.84

T.P_7: 4.68

T.P_8: 3.24

S.L: 18.57