D-Wave Quantum Inc. (QBTS) asserts itself as a frontrunner in commercial quantum computing.1 The company’s recent market surge stems from its unique strategic position, capitalizing on immediate utility rather than solely relying on future, fault-tolerant gate systems.2 This report analyzes D-Wave’s rapid market penetration across technology, finance, and geopolitics, providing an assertive assessment of its growth vectors.

Macroeconomic and Financial Imperatives

Economics and Market Validation

The quantum computing market demonstrates explosive, long-term growth potential.4 Analysts project the market will reach $20.20 billion by 2030, representing a compound annual growth rate (CAGR) of 41.8% from 2025.4. This expansion is driven by a critical need for enhanced computing systems leveraging advanced qubit modalities.4 The sector’s viability is translating directly into investor confidence.

D-Wave’s stock exhibits a strongly bullish trend.5 The share price trades robustly above its 5, 20, and 50-day exponential moving averages 5 Analysts assign the stock a consensus “Strong Buy” rating.6 This valuation persists despite the high costs associated with quantum system development.7 D-Wave demonstrated significant commercial traction, posting over 40% year-over-year revenue growth in a recent quarter.7 Crucially, bookings nearly doubled in that period, primarily attributed to demand for the commercially available Advantage2™ system 7

Macroeconomics and Institutional Funding

Major financial institutions now treat quantum computing as indispensable for national economic security.8 JPMorgan Chase launched a monumental $1.5 trillion initiative focused on financing critical industries.9 This strategic commitment targets “Frontier and Strategic Technologies”.9 The initiative explicitly includes investments in artificial intelligence, cybersecurity, and quantum computing.8

This massive injection of institutional capital validates the quantum sector beyond typical speculative venture funding.8 The categorization of quantum technology under “Security and Resiliency” elevates it to a mandatory defense and critical infrastructure asset class.9 This shift strategically positions D-Wave, whose Advantage2™ system holds “awardable” status on the U.S. Department of Defense’s Tradewinds buying platform.11 This national security mandate drives public sector procurement and defense spending.

D-Wave faces the challenge of reconciling strong revenue growth with wider-than-expected losses.7 However, investors currently value the company based on its rapid commercial adoption rate, evidenced by increasing bookings and analyst sentiment.6 D-Wave’s concentration on hybrid quantum solutions combining classical and quantum computing—provides a key revenue differentiator.2 This approach leverages the commercially mature annealing system to generate immediate value, funding the longer-term development of gate-model technologies and providing a viable pathway toward future profitability.12

Table 1: Global Quantum Market and Institutional Investment Benchmarks

| Metric | Value | Source/Implication |

| Global QC Market Forecast (2030) | $20.20 Billion | CAGR of 41.8% from 2025 4 |

| JPMC Strategic Investment Initiative | $1.5 Trillion | Includes financing for quantum computing as a critical security industry 8 |

| QBTS Analyst Consensus | Strong Buy | Suggests lower than normal risk perception and bullish trend 5 |

| Private Quantum Sector Funding (Cumulative 2024) | $15 Billion | Significant private investment surge, US leads global funding 13 |

Technology, Science, and High-Tech Validation

Technology and Competitive Architecture

D-Wave differentiates itself by pioneering quantum annealing, an architecture optimized specifically for complex optimization problems.7 Annealing systems bypass the significant classical overhead and strict error correction requirements endemic to gate-model approaches.3 This results in better scale and superior solution quality for specific commercial applications today.3

The Advantage2™ system remains the company’s commercially available engine for optimization.7 This system boasts over 4,400 qubits, increased coherence time, and enhanced energy scale.7 D-Wave remains the only company actively building both annealing and gate-model quantum computers, pursuing a hybrid strategy.12 This allows D-Wave to deliver immediate business value through annealing while positioning itself for the future of universal gate computing.2 Furthermore, the Leap™ cloud service grants real-time access to D-Wave’s systems, enabling rapid application development and deployment.1 Customers have submitted over 200 million problems to D-Wave’s systems globally.19

Science and Quantum Supremacy

D-Wave achieved a critical scientific milestone by demonstrating “beyond-classical computation” on a useful, real-world problem.18 The research, published in the peer-reviewed journal Science, detailed a complex magnetic materials simulation.20 The Advantage2™ prototype performed the simulation in minutes.21 This task would have demanded nearly one million years of computation and consumed more than the world’s annual electricity production on a classical supercomputer like Frontier 19

CEO Alan Baratz emphasized that this finding demonstrated the first true example of quantum supremacy on an important real-world problem.3 This contrasts sharply with previous supremacy claims based on contrived, non-utilitarian calculations.22 Although classical researchers, including those from the Flatiron Institute, disputed the claim’s full scope, D-Wave asserts its simulations covered a broader range of lattice geometries and conditions.23 The quantum computer indisputably excelled on the infinite-dimensional system within the study’s scope.23

The scientific validation of utility drives commercial adoption in high-tech manufacturing, where D-Wave already secures customers like Nikon.7 This breakthrough justifies the significant cost of the Advantage2™ system for enterprises.7 The cycle of scientific utility converting into enterprise confidence accelerates bookings and revenue growth.

High-Tech Optimization and Industrial Adoption

D-Wave’s annealing technology targets pervasive optimization challenges across multiple high-tech domains.7 These use cases span logistics, supply chains, manufacturing, and general operations management.7 Current customers include industrial giants such as GE, Vernova, and Ford.7

Ford Otosan provides a definitive example of immediate commercial value.25 The company integrated D-Wave’s hybrid quantum solver to optimize vehicle production sequencing.25 The resulting solution reduced scheduling times for 1,000-vehicle runs from 30 minutes to under five minutes.25 This successful deployment demonstrates production-grade return on investment (ROI) for commercial users today.

D-Wave aggressively benchmarks its annealing platform against competitive architectures.3 The company asserts clear, consistent wins for annealing in optimization scale, solution quality, and time to solution compared to approaches like QAOA (Quantum Approximate Optimization Algorithm) on gate-model systems.3 This empirical benchmarking signals the maturing competition and helps investors quantify the superior immediate commercial advantage offered by annealing for optimization tasks. D-Wave actively monetizes this application gap until gate-model systems achieve fault tolerance.

Table 3: Quantum Architecture Comparison for Optimization

| Architecture | Primary Strength | D-Wave Position | Commercial Readiness |

| Quantum Annealing (QA) | Combinatorial Optimization (Energy Minimization) | Advantage2™ (4,400+ qubits) 7 | High: Production-grade applications and revenue generation today 3 |

| Gate-Model (Circuit) | Universal Computation | Currently developing; secondary focus 12 | Lower: Limited scale/speed; needs prohibitive classical overhead for error correction 3 |

| Competitor Benchmarking | Optimization Quality (Size 320) | D-Wave: ~98% of optimal solution achieved 3 | IonQ (Size 10): ~80%; IBM (Size 6): ~75% 3 |

Geostrategic and Geopolitical Drivers

Geostrategy and Digital Sovereignty

Global trade increasingly fractures along geopolitical lines, prompting advanced economies to pursue “friend-shoring” strategies.26 Control over strategic technologies like quantum computing directly ties to national security and future competitiveness.27 D-Wave strategically positioned itself at the nexus of this techno-economic fragmentation in Europe.

D-Wave co-founded the Q-Alliance in Lombardy, Italy, alongside competitor IonQ.28 This landmark initiative aims to establish the world’s most powerful quantum hub.27 The alliance directly aligns with the Italian Government’s strategic framework for digital technologies.29 Its explicit mission involves accelerating scientific discovery and achieving digital sovereignty for Italy and the European Union.27

The Q-Alliance’s dual-vendor structure strategically hedges Italy’s technology bets.29 It ensures access to D-Wave’s commercially mature superconducting annealing technology and IonQ’s future-focused trapped-ion gate-model systems.29 Sovereign nations demand demonstrable, immediate quantum capability, moving beyond long-term research promises. D-Wave emphasizes its “production-grade annealing technology” as the crucial component fueling immediate application development within the alliance.12 This utility breakthrough accelerates D-Wave’s capture of key sovereign contracts based on current functionality.

Strategic European Footprint

D-Wave secured crucial strategic partnerships across the continent.17 The company extended its agreement with Aramco Europe’s Research Center in Delft, Netherlands.17 Their continued work focuses on managing computationally intensive seismic imaging and other complex geophysical optimization problems, demonstrating application to vital energy infrastructure.17

Furthermore, Swiss Quantum Technology SA (SQT) made a significant €10 million investment to deploy a D-Wave Advantage2 system.30 This deployment represents a direct commitment to installing production-ready hardware, significantly boosting Europe’s quantum capabilities beyond basic cloud access.30

Despite strong strategic positioning, D-Wave’s technology faces a unique geopolitical risk related to resource scarcity.31 Superconducting quantum hardware relies on helium-3 for necessary cooling.31 Helium-3 is extremely rare, sourced primarily from aging nuclear programs, making its supply volatile and subject to global geopolitical distribution risk.31 The successful long-term operation of D-Wave’s expanding hardware base requires securing strategic access to this limited resource.

Table 2: D-Wave’s Strategic and Sectoral Adoption Milestones

| Domain | Strategic Initiative | Key Result/Impact |

| Science Validation | Beyond-Classical Computation | Advantage2™ outperformed a supercomputer on useful materials simulation 19 |

| Geopolitics (EU) | Q-Alliance (Italy) | Dual-vendor hub co-founded to drive European digital sovereignty 27 |

| Pharmaceuticals | Japan Tobacco PoC | Quantum-AI workflow generated molecules with higher drug-likeness 25 |

| Manufacturing | Ford Otosan Deployment | Hybrid solver reduced production scheduling time from 30 minutes to under five 25 |

| Energy | Aramco Europe Extension | Optimizing complex geophysical seismic imaging problems 17 |

Sectoral Deep Dive: Pharmaceuticals and Cyber Strategy

The Pharmaceutical R&D Revolution

The pharmaceutical industry suffers from declining R&D productivity, complicated by high failure rates exceeding 90% for new drugs.33 Accurate molecular simulation is essential but remains computationally intense.34 Classical AI often struggles to accurately model the quantum-level interactions critical for drug development.34 This high failure rate represents the industry’s largest cost driver 34

D-Wave addresses this challenge by integrating annealing systems into computer-aided drug design.32 A proof-of-concept with Japan Tobacco (JT)’s pharmaceutical division aimed to accelerate generative design of small-molecule drug candidates.25 The project leveraged D-Wave’s quantum processing unit (QPU) within the training loop of large language models (LLMs).25 This quantum-assisted LLM training successfully generated molecules demonstrating higher quantitative estimates of drug-likeness and a broader range of valid structures than classical methods alone.25 Furthermore, companies like Menten AI use hybrid quantum applications to efficiently solve astronomical protein design problems, consistently finding superior solutions to classical solvers.33 D-Wave sells a solution that acts as risk mitigation in R&D, making its Leap™ cloud service an indispensable utility for unlocking billions in potential pharmaceutical profit.34

Cyber Strategy and PQC Migration Optimization

Quantum computing poses an existential threat to classical cryptography, raising the specter of “harvest now, decrypt later” attacks.36 The mandatory, multi-year transition to Post-Quantum Cryptography (PQC) presents a massive logistical challenge for governments and enterprises.37

While specialized analog quantum computers like annealers are generally deemed irrelevant for cracking major public-key encryption schemes (like Shor’s algorithm) 39, their capability to solve optimization problems poses a specific threat to algorithms such as stream ciphers.40 This dual nature mandates vigilance.

Critically, D-Wave’s core competency lies in solving complex combinatorial optimization problems by finding minimal energy states.42 PQC migration is fundamentally a complex logistical crisis.38 It involves optimizing dependency mapping, resource allocation, and ensuring crypto-agility across vast IT estates.37 D-Wave’s annealing system is uniquely positioned to optimize these PQC migration paths for large organizations. 37 D-Wave transitions from a peripheral hardware provider to a strategic cyber resilience partner, offering essential optimization services necessary for national security objectives, such as deploying NIST PQC standards 44

Patent Analysis and Competitive Landscape

Patent Analysis and IP Defensibility

Intellectual property (IP) represents a fundamental defensive moat in the quantum race.45 D-Wave maintains a concentrated portfolio of 208 active patent families, focused on core annealing and superconducting device technologies.45 This IP is highly targeted.45 Key grants include patents on systems for magnetic shielding, input/output systems for superconducting devices, and physical realizations of adiabatic quantum computers.46

Defensible IP, coupled with commercialization ability, will define the winners in this market.45 D-Wave explicitly recognizes the risk inherent in protecting its IP in financial filings, highlighting it as a core pillar of its valuation and defensibility.47 The focused IP creates a protective barrier around the specific niche of practical, large-scale optimization currently unavailable to gate-model competitors.15 Competitors attempting to develop similar superconducting annealing solutions face significant patent infringement risks, solidifying D-Wave’s first-mover advantage.

Competitive Dynamics

D-Wave aggressively defends its architectural choice, asserting that while gate-model systems could theoretically emulate annealing, the required classical overhead proves prohibitive in practice.3 This technological reality forms the basis of D-Wave’s long-term competitive advantage in the optimization vertical.3

The company claims significant commercial momentum, citing over 70 revenue-generating commercial customers.3 D-Wave consistently benchmarks annealing performance favorably against competitors’ gate-model approaches, claiming superior solution quality and speed for optimization tasks.3

The current trajectory suggests quantum computing will catalyze a regulatory restructuring, similar to the advent of cloud computing.11 Governments worldwide, already investing heavily, will intensify focus on quantum IP and data security.11 D-Wave’s established, defensive IP portfolio strategically positions the company to influence and benefit from future industry standards for hardware interoperability and security.

Conclusion and Forward Market Projections

D-Wave’s rapid market increase is a consequence of converging strategic factors, not isolated scientific events. These factors include demonstrable Scientific Utility (peer-reviewed superiority on real-world problems), deep Geostrategic Integration (anchoring European digital sovereignty initiatives), and robust Commercial Velocity (immediate, production-grade ROI in manufacturing and R&D).18

The hybrid architectural strategy effectively mitigates the technology risk associated with the maturation timeline of universal gate systems.2 D-Wave strategically utilizes its commercially mature annealing technology to generate revenue today, financing the necessary development of its gate-model roadmap.12

Investors must monitor several key risks. The company faces ongoing technical challenges from increasingly sophisticated classical algorithms, which actively attempt to match quantum performance in certain subsets of problems.23 The current high valuation necessitates consistent revenue growth and a credible path to profitability.2 Furthermore, the significant upfront cost of the Advantage2™ system remains a material barrier to entry for widespread commercial adoption.7 Achieving consistent financial maturity remains essential to fully justify D-Wave’s market capitalization.

References

- Quantum Computing Companies in 2025 (76 Major Players)

- D-Wave Quantum Stock’s Meteoric Rise Explained – Azat TV

- D-Wave Technology and the Competitive Landscape

- Quantum Computing Market Size, Share, Statistics, Growth, Industry Report 2030 – MarketsandMarkets

- JPMorgan Chase & Co. Vs. D-Wave Quantum, Inc. Sector Stock Comparison – Financhill

- D-Wave Quantum (QBTS) Stock Price & Overview

- D-Wave Quantum Valuation Tests Investor Patience After Early Hype | Investing.com

- These stocks are surging as JPMorgan follows Trump’s lead with investments in ‘critical’ industries | Morningstar

- JPMorganChase Launches $1.5 Trillion Security and Resiliency Initiative to Boost Critical Industries

- JPMorgan Chase launches $1.5 trillion plan to bolster US economic and national security

- Quantum Leap: D-Wave (QBTS) Stock Rockets on Commercial Breakthroughs and Technological Supremacy – FinancialContent

- D-Wave Quantum: The Birth of the World’s Most Powerful Quantum Hub – Green Stock News

- Benchmarking Quantum Technology Performance: Governments, Industry, Academia and their Role in Shaping our Technological Future

- Demystifying Quantum Computing Architectures: Gate-Based vs. Annealing

- D-Wave’s Approach to Quantum Computing

- Effectiveness of quantum annealing for continuous-variable optimization | Phys. Rev. A

- D-Wave Extends Agreement with Aramco Europe to Explore Quantum-Powered Optimization of Geophysical Problems

- D-Wave Demonstrates Quantum Supremacy on Real-World Problem in Peer-Reviewed Study

- Beyond Classical: D-Wave First to Demonstrate Quantum Supremacy on Useful, Real-World Problem

- Beyond Classical – D-Wave Quantum

- How much does a claim of ‘quantum supremacy’ matter? D-Wave is about to find out

- D-Wave Claims Quantum Supremacy: Experts Are Not Convinced – Dataconomy

- A quantum computing milestone is immediately challenged by a …

- D-Wave CEO Responds to Criticisms About Quantum Supremacy Claim

- D-Wave Advances Quantum Applications in Automotive Manufacturing and Drug Discovery

- Working Paper Series – Beyond borders: how geopolitics is reshaping trade – European Central Bank

- D-Wave Anchors Formation of Q-Alliance: Aiming to Make Lombardy… – Market Chameleon

- The Birth of the World’s Most Powerful Quantum Hub

- D-Wave, IonQ to Anchor “Q-Alliance” Quantum Hub in Lombardy, Italy

- Swiss Quantum Technology SA Achieves €10M Breakthrough With D-Wave Advantage2 Deployment

- National Quantum Strategy roadmap: Quantum computing – Innovation, Science and Economic Development Canada

- Japan Tobacco Inc. and D-Wave Announce Collaboration Aimed at Accelerating Innovative Drug Discovery with Quantum AI

- Quantum Computing in Life Sciences | D-Wave

- The quantum revolution in pharma: Faster, smarter, and more precise – McKinsey

- D-Wave and Japan Tobacco Validate Quantum and AI Workflow Towards Generative Drug Discovery

- Current Landscape of Post-Quantum Cryptography Migration – Encryption Consulting

- Managing the Migration to Post-Quantum-Cryptography – arXiv

- Timelines for migration to post-quantum cryptography – NCSC.GOV.UK

- Report on Post-Quantum Cryptography – NIST Technical Series Publications

- The possible impact of quantum annealing on cybersecurity – Biblioteka Nauki

- The Possible Impact of Quantum Annealing on Cybersecurity – Safety & Defense

- What is Quantum Annealing? – D-Wave Documentation

- Post-Quantum Cryptographic Migration Challenges for Embedded Devices – NXP Semiconductors

- Migration to Post-Quantum Cryptography – NCCoE

- PatentVest Releases First-Ever Quantum Computing Rankings – Stock Titan

- Patents Assigned to D-Wave Systems, Inc.

- D-Wave Launches New Go-To-Market Growth Strategy to Rapidly Accelerate Quantum Adoption

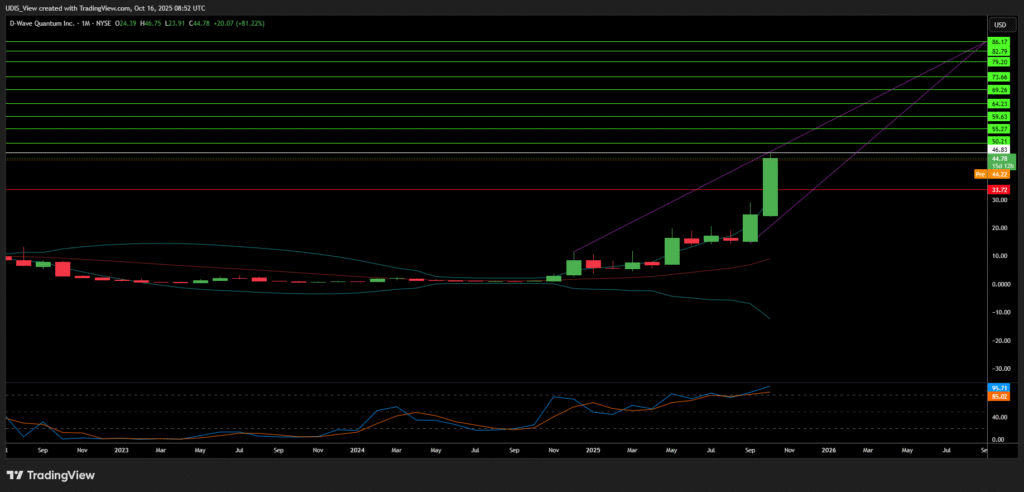

D – Wave Long (Buy)

Enter At: 46.83

T.P_1: 50.21

T.P_2: 55.27

T.P_3: 59.63

T.P_4: 64.23

T.P_5: 69.26

T.P_6: 73.66

T.P_7: 79.20

T.P_8: 82.79

T.P_9: 86.17

S.L: 33.72