1. The Nexus of Defense, Demand, and Diligence

The recent massive surge in Nova Minerals Limited’s valuation reflects its successful transition into a critical strategic asset.1 Nova’s American Depositary Receipts (ADRs) experienced a dramatic increase, spiking over 100% and reaching a 52-week high of $66.10.1. This performance establishes the company as more than a standard explorer; it is now a foundational supplier for Western critical supply chains. The stock’s year-to-date gain exceeds 362%, driven by profound geopolitical shifts.2

The primary catalyst is the substantial $43.4 million funding award from the U.S. Department of War (DoW).3 This Defense Production Act (DPA) funding is earmarked for domestically producing military-grade antimony trisulfide in Alaska.3 Antimony is classified as a Tier 1 critical mineral, with the U.S. currently relying on 100% of its demand through imports.5 This DoW investment validates Nova’s immediate strategic relevance.

Nova offers a powerful dual-domain security proposition to investors.6 The company provides exposure to critical minerals necessary for national security (Antimony) alongside gold, a traditional hedge against macroeconomic instability.7 This combination significantly de-risks the company’s capital structure amidst escalating global uncertainty.8

The company is enhancing operational viability using cutting-edge processing technology. Nova is implementing X-Ray Transmission (XRT) ore sorting at its Estelle project.9 This advanced process drastically improves the recovered grade and operational efficiency, thereby lowering required capital and strengthening environmental compliance.10 Nova’s strategic positioning and technological diligence position it for sustained outperformance in a challenging global resource market.

2. Geopolitical and Geostrategic Imperatives

2.1. China’s Mineral Weaponization (Geopolitics)

China maintains overwhelming dominance across the global critical minerals sector.11 The nation processes more than 90% of the world’s rare earths and controls approximately 70% of global rare earth mining.11 Beijing recently heightened global tensions by announcing enhanced restrictions on exporting rare earths and related technologies.11 China cited national security concerns for these export restrictions, which also include antimony-related products.12

These actions immediately intensified the U.S.-China trade war.11 In response, the U.S. president announced retaliatory tariffs reaching 100% on specific Chinese imports.11 China views its control over these foundational materials as critical strategic leverage.12 Policymakers in Washington now prioritize reducing reliance on these foreign-controlled supply chains.

2.2. The Antimony Security Crisis (Geostrategy)

Antimony is essential for key defense applications and technological advancement.5 The metal is critical for munitions primers, armor hardening in tanks like the M1 Abrams, and specialized electronics such as infrared detectors.14 The U.S. military relies heavily on antimony for maintaining defense readiness.16 Critically, the U.S. sources 100% of its antimony demand from imports.5

Global supply concentration exacerbates this security risk.4 Russia and China currently control the vast majority of the world’s antimony market and all derivative products.4 A disruption in the antimony supply chain poses significant national security risks and industrial vulnerability for the U.S. defense industrial base.16 This acute dependence mandates robust, immediate government intervention to secure domestic supplies.

The significant DPA investment and the renaming of the DoD to the U.S. Department of War (DoW) underscore the severity of this threat. 17 This institutional shift demonstrates that resource insecurity is explicitly treated as a strategic vulnerability requiring wartime mobilization tactics.17 The scale of investment confirms this systemic, top-down approach. The DoW has already deployed $1.3 billion through the DPA since fiscal year 2025 to solidify resource independence.17 Nova benefits directly from this unprecedented strategic mobilization.

2.3. The Allied Response: US-Australia Partnership

The United States is accelerating efforts to diversify critical mineral sourcing through key alliances.17 Securing a non-Chinese critical minerals supply chain is a top agenda item for the high-level meeting between Australian Prime Minister Anthony Albanese and U.S. President Donald Trump, scheduled for October 20.1 Nova Minerals, an Australian company with U.S. assets, has been invited to brief the Australian Government ahead of this summit.2

This invitation signals Nova’s elevation from a mining explorer to an instrument of national geostrategy.2 The company is formally recognized as a crucial player in the Australia-U.S. mineral security alliance, linking strategic Alaskan resources to allied procurement efforts.1 This critical political capital substantially reduces the inherent risk associated with future permitting and large-scale project financing. The allied procurement strategy actively seeks to de-risk key suppliers like Nova.

3. Economics and the Antimony/Gold Value Proposition

3.1. The DPA Funding: Financial De-Risking (Economics)

The $43.4 million DoW contract validates Nova’s project quality and secures initial financing.3 This funding is allocated to creating a fully integrated U.S. antimony supply chain.4 The plan includes extraction, concentration of stibnite, and refining it into military-grade antimony trisulfide in Alaska.3

Receiving the DPA award confirms the Estelle Project’s antimony mineralization passed rigorous technical due diligence by the DoW.3 The funding guarantees crucial market access for the specialized military-specification product.19 This secured, non-dilutive government revenue stream transforms project risk into guaranteed defense revenue, essential for building the full mining and refining hub.3 Nova intends to initiate antimony production within 24 months.20

3.2. Explosive Price Dynamics (Economics)

The global antimony market is experiencing severe supply constraints and price volatility.21 China’s export restrictions, coupled with internal production declines due to environmental crackdowns, severely tightened supply.21 These constraints have caused historic price spikes. Antimony prices surged significantly, reaching US$51,500 per tonne in 2025.21

The geopolitical restriction of supply has artificially underwritten the economics of domestic projects.22 When critical commodity prices jump from typical levels, marginal projects become intensely profitable, effectively functioning as an artificial subsidy.21 China’s actions translate geopolitical risk directly into an immediate revenue opportunity. This guarantees exceptionally high margins for Nova, an early mover in non-Chinese antimony production.22 The global market constraint, driven by escalating defense and electronics demand, guarantees robust profitability.21 The U.S. market alone for antimony is projected to reach $106.57 million by 2032.19

3.3. Gold as a Capital Buffer (Macroeconomics)

Nova maintains significant gold exposure alongside its critical minerals assets.6 This dual-asset base provides a vital capital buffer, mitigating project financing risk.23 Gold prices have reached record highs, recently crossing $4,000 per ounce, having surged over 50% in 2025.7

The macroeconomic drivers for gold remain strong.25 The rally is fueled by persistent geopolitical tensions, economic uncertainty, and central banks actively de-risking reserves away from the U.S. dollar 8 Freezing Russian foreign holdings served as a trigger point for increased central bank buying, reinforcing a strong foundation beneath the market.24 Gold serves as a classic safe-haven asset, reflecting increasing global economic uncertainty and political instability. 8 Nova’s gold segment offers a strong hedge against inflation and currency risk.

The Estelle Gold Project’s long-term Net Present Value (NPV) is projected at approximately $1.5 billion based on current gold prices.6 The high-grade RPM deposit is central to the company’s fast-track strategy.23 It is projected to achieve a payback period of under one year, generating high-margin cash flow quickly.6 This immediate gold cash flow is essential for funding the strategic antimony segment. Defense projects face high initial costs and long permitting cycles.26 Leveraging the fast-payback gold operations limits the critical “valley of death” financing risk, making Nova exceptionally attractive to potential large-scale strategic partners.6

3.4. Financial Planning and Valuation

Nova is targeting a low-CAPEX starter mine strategy at the high-grade RPM deposit to rapidly achieve cash flow.23 The full-scale development of the broader Estelle Project is estimated to require A$200–300 million in additional capital.27 The gold revenue stream potentially allows Nova to self-fund this expansion, reducing the reliance on future equity dilution.27

The company exhibits robust fiscal management, with an enterprise value over $222 million and a conservative debt-equity ratio leverage of 1.1.19. Compared to peers with similar DoW validation, such as Perpetua Resources (market cap $\sim$A$2.4$ billion) and MP Materials (market cap A billion), Nova appears significantly undervalued.28 Nova receiving the same level of DoW validation suggests the market has not yet fully priced in the de-risked strategic value and scale potential of the Estelle Project, supporting significant latent upside potential.6

4. Technology, Science, and High-Tech Integration

4.1. Antimony in Advanced Technology (High-Tech/Science)

Antimony is not merely a military commodity; it is foundational to advanced civilian and defense technologies.5 Beyond traditional uses in alloying and flame retardants, antimony is crucial for semiconductors, specialized sensors, and diodes.5 It is a key material for infrared detectors and night vision goggles used in modern defense platforms.14 Military applications consume approximately 18% of the global antimony supply, a percentage likely to increase.15

Furthermore, antimony holds vast potential for future energy storage systems.30 It is a promising material for rechargeable Lithium-ion battery anodes due to its high volumetric capacity and good electronic conductivity.30 Antimony is also a primary ingredient in emerging grid-scale liquid metal batteries, highlighting its importance for energy resilience and the transition.31 The material’s role in semiconductors links the critical mineral crisis directly to the global technological competition for supremacy in AI and advanced defense systems.32 If the foundational material supply is compromised, the entire modernization effort is vulnerable.

4.2. Operational Advantage: XRT Ore Sorting (Technology/Process Innovation)

Nova is achieving superior operational metrics through the adoption of X-Ray Transmission (XRT) sensor-based ore sorting technology.9 This advanced process utilizes X-rays to penetrate rock particles and detect variations in density.34 Advanced algorithms analyze this density data to identify valuable minerals, which appear brighter, separating them from the darker waste rock.9 This is essentially automated geometallurgical characterization conducted in real-time.10

The successful implementation of XRT sorting on Estelle’s specific ore creates an internal, process-based competitive moat. Metallurgical testing demonstrated exceptional results, providing quantifiable grade enhancement.9 In a single pass, the technology achieved a 4.33x grade upgrade.9 This process successfully transformed material grading g/t Au into a high-grade g/t Au concentrate.9

This process innovation enables significant capital optimization. The technology recovered 48.8% of the gold while rejecting approximately 88.7% of the mass as waste in the initial pass.9 By concentrating the feed stream early, Nova can reduce the necessary size of downstream processing plants.35 This directly lowers the substantial capital expenditure required for full-scale development, thereby enhancing overall mine efficiency and economic benefits.10

4.3. Environmental and Efficiency Gains (ESG/Science)

The implementation of XRT sorting provides major environmental advantages crucial for navigating permitting in Alaska.27 The early rejection of waste material reduces processing demands significantly.10 Specifically, this technology enables potential water savings of 20–40% and reduces energy consumption by approximately 15–30%.10

Furthermore, the XRT process can decrease tailings volume by 25–60%, mitigating significant storage risks and environmental impacts such as acid rock drainage.10 This reduced environmental footprint is critical for obtaining necessary environmental approvals and operating licenses between 2025 and 2027.27. Lowering the environmental footprint is key leverage for navigating complex regulatory frameworks.27 Nova’s ability to efficiently navigate Alaska’s regulatory framework is a key factor in reducing project development risk for investors.27

5. Cyber Security and Supply Chain Resilience

5.1. The Critical Infrastructure Threat (Cyber)

The reliance on foreign sources for critical minerals like antimony represents a profound national security exposure.32 Supply chain disruption is increasingly viewed through the lens of hybrid warfare, encompassing cyber tactics.37 China, specifically, has been implicated in persistent, state-sponsored cyber attacks targeting U.S. critical infrastructure.38

Adversaries weaponize cyberspace to cause disruption and societal panic.38 If a foreign power controls the foundational materials (e.g., antimony for semiconductors) necessary for advanced military and cyber systems, it gains strategic leverage over system security and capability.13 Securing the antimony supply chain is a fundamental precondition for the U.S. to defend against sophisticated AI and cyber warfare threats.32

5.2. Institutional Support for Resiliency

The systemic threat posed by mineral dependency has mobilized major financial institutions alongside the government.39 JPMorganChase recently launched a massive $1.5 trillion, 10-year Security and Resiliency Initiative.40 This program is explicitly designed to boost sectors vital to U.S. national security.39

The initiative focuses on securing supply chains, advanced manufacturing, defense, and critical minerals.40 CEO Jamie Dimon stressed that the U.S. must “act now” to reduce reliance on foreign entities for essential products and minerals.39 This commitment includes up to $10 billion in direct equity and venture capital investments into select domestic companies.39 This profound financial backing signals deep systemic confidence in the market for secure, domestically sourced critical materials.

5.3. Alaskan Integration: The Secure Corridor

Nova’s strategy is dedicated to establishing a fully integrated domestic antimony supply chain, from mine to refined product.3 The aim is to create a state-of-the-art antimony mining and refining hub entirely within Alaska.3 This integrated “mine-to-market” deployment minimizes external geopolitical and cyber risks.3

Establishing domestic refining capabilities for military-grade antimony trisulfide bypasses the intermediate processing steps currently controlled by China and Russia.4 This strategic vertical integration directly enhances U.S. supply chain resilience against both geopolitical shocks and cyber infiltration targeting vulnerable overseas processing nodes.4 Nova secured the land use permit for its proposed refinery near Port MacKenzie, supporting this crucial integration strategy.20

6. Execution and Valuation Outlook

6.1. Project Roadmap and Milestones

Nova is accelerating its fast-track strategy to launch a Stand-Alone Antimony-Gold Starter Mine.23 Key technical and economic milestones are rapidly approaching.27 The company anticipates publishing its Maiden Antimony Resource Estimate during 2025.27 The definitive Pre-Feasibility Study (PFS), which includes engineering designs and preliminary economics, is scheduled for completion between 2025 and 2026.27

The current timeline targets the construction phase between 2026 and 2028, with initial production of both gold and antimony slated for 2027–2028.27 This disciplined execution plan aligns Nova’s operations directly with the strategic planning horizons of government and defense stakeholders.27 The company’s ability to meet these milestones will be heavily scrutinized by investors and government partners alike.

6.2. Permitting and Infrastructure

Nova’s efficient progress in securing regulatory approval is a critical factor in reducing investor risk.27 The company has already secured the necessary land use permit for its proposed antimony refinery near Port MacKenzie.20 This demonstrates the operational capability needed to navigate the complex Alaskan regulatory framework effectively.27

The full realization of the Estelle Project’s scale depends on significant external infrastructure development.42 The long-term scalability of the massive gold and critical minerals pipeline, which encompasses over 20 known prospects, hinges on the proposed West Susitna Access Road.23 This project, a proposed 100-mile industrial access route, is estimated to cost $450 million.42 The timeline for this critical infrastructure is tight: the Draft Environmental Assessment decision is expected in Winter 2025, with Phase 1 construction scheduled for Summer 2026.43 Successful execution of this road construction is the single largest external variable impacting Nova’s long-term valuation and capacity realization.43

6.3. Financing Strategy and Risk

The primary challenge for Nova remains raising the estimated A$200–300 million required for full-scale development of the Estelle Project.27 The company’s financing strategy mitigates this challenge through layered capital sources. It leverages the non-dilutive $43.4 million DPA funding specifically for the antimony segment.3 Simultaneously, the high-margin, fast-payback RPM gold starter mine is designed to generate internal cash flow, potentially self-funding future expansion and minimizing future equity dilution.6

Nova is currently engaging in discussions with major international mining companies.6 These strategic partnerships could provide the necessary large-scale capital and operational expertise.6 Securing a major partner would resolve the capital requirements while substantially reducing the risk of equity dilution, a key concern for investors.26

6.4. Valuation Relativity

Nova’s current valuation, with an enterprise value of $222 million, appears low relative to critical mineral peers that have received similar strategic validation. For instance, Perpetua Resources (market cap $\sim$A$2.4$ billion) and MP Materials (market cap A billion), both recipients of major DoW grants, maintain significantly higher market capitalizations.28

Nova is receiving equivalent DoW validation, and its target focus on the acutely strained antimony supply chain implies substantial latent upside potential.3 This disparity suggests the market has not fully accounted for the de-risked strategic value and scale of the Estelle Project, supporting significant latent upside potential.6 The company is poised for a significant re-rating as milestones are met.

7. Conclusion: Strategic Positioning for Outperformance

Nova Minerals has successfully leveraged escalating geopolitical tensions and resulting allied strategic investment to fundamentally re-rate its valuation. The company’s recent surge is firmly rooted in tangible, de-risked strategic value rather than mere speculation.1 Nova’s core value proposition is defined by its ability to address acute Western resource dependency.

The company offers a compelling multi-vector investment case.6 Nova secures dual exposure to recession-resistant gold and sovereign-critical antimony, providing both macro-hedging and national security upside.6 Furthermore, the application of XRT sorting technology ensures operational and environmental outperformance, making its gold and critical minerals production highly competitive and capital efficient.9

The future trajectory of Nova hinges on disciplined execution of its Antimony-Gold starter mine strategy and the successful advancement of the regional West Susitna infrastructure permitting.27 By delivering on its milestones and securing a major strategic partner, Nova Minerals is uniquely positioned to become a core, domestically secure component of the non-Chinese critical mineral ecosystem, delivering substantial value appreciation. Nova represents a direct and essential investment in Western supply chain resilience.

Strategic Applications of Antimony and U.S. Supply Vulnerability

| Application Category | Specific Defense Uses | U.S. Defense/Tech Importance | U.S. Import Dependency (Approx.) |

| Defense Munitions | Primer compounds, armor-piercing rounds | Essential for battlefield readiness | 100% (for demand) 5 |

| High-Tech Electronics | Infrared sensors, night vision goggles, and semiconductors | Crucial for modern targeting systems | High 5 |

| Safety and Logistics | Flame retardants for military equipment | Reduces fire spread by up to 60% | High 15 |

| Energy Storage | Lead-acid batteries, advanced flow batteries | Backup power and grid stability | 80%+ (on total supply) 31 |

Quantified Benefits of XRT Ore Sorting Technology at Estelle

| Metric | Input Feed Grade | Output Concentrate Grade |

| Grade Improvement Factor | N/A | 4.33x 9 |

| Gold Feed Grade | g/t Au 9 | g/t Au 9 |

| Mass Rejection (Waste) | N/A | 88.7% 9 |

| Energy Efficiency Gain | N/A | 15–30% Reduction 10 |

References

- Nova Minerals surges over 100% on US-Australia critical minerals engagement

- Nova Minerals Surges; Will Provide Minerals Briefing to Australian Government Ahead of Trump Meeting | Morningstar

- US Department of War Awards $43.4M to Alaska Range Resources to Secure Antimony Supply | Nova Minerals

- Department of War Awards $43.4 Million to Further On-Shore Antimony Trisulfide Production

- Primary and Secondary Production of Antimony – Quest Metals

- Nova Minerals Limited – ADS (NVA – $7.02 – Buy)

- Bullion experts warn that a gold rate correction may be near. Can central bank buying and inflation keep the bull run alive? – The Economic Times

- Gold hits new heights. An expert explains what is pushing up the price

- Gold Recovery Breakthrough: Nova Minerals’ RPM Process Success – Discovery Alert

- X-ray Transmissive Sorting in Mining: How It Works & Benefits – Discovery Alert

- Why has the US-China trade war restarted, and how have markets reacted?

- China steps up control of rare-earth exports, citing ‘national security’ concerns

- China’s Antimony Export Restrictions: The Impact on U.S. National Security – CSIS

- Antimony: A Critical Material You’ve Probably Never Heard Of

- Antimony: Critical Military Metal Development & Supply Chain – Discovery Alert

- Antimony: A Critical Metal for Defense and Industry, and Why New Age Metals’ Recent Staking Matters

- Critical Minerals Expected to Be High on the Agenda at Albanese-Trump White House Meeting – Small Caps

- Pentagon looking to buy $1 billion in critical minerals

- Nova Minerals Surge: Antimony Triumph – StocksToTrade

- Nova Minerals Secures Land Use Permit for Proposed Antimony Refinery Near Port MacKenzie – Quiver Quantitative

- Antimony Becomes One of 2025’s Hottest Strategic Metals

- Antimony arms race: US Government steps in – Special Feature – Mining.com.au

- Shaping the Future of Mining: Explore Strategy and Studies – Nova Minerals

- Here’s what gold crossing $4,000 is telling us about the U.S. economy – CBS News

- Bank of England warns of risk of AI market correction; gold hits new $4,000 an ounce record – as it happened

- Nova Minerals Engaged Ahead of High-Level Critical Minerals Talks with U.S. President Donald Trump – Stock Titan

- Nova Minerals’ Critical Minerals Project Attracts High-Level Diplomatic Attention

- Nova Powers Forward at Estelle with Strong Backing – Nova Minerals Limited (ASX: NVA)

- Nova Minerals Limited Launches 15,000m Drill Program at Estelle Project, Pursuing Gold and Antimony Resources – Quiver Quantitative

- Antimony (Sb)-Based Anodes for Lithium–Ion Batteries: Recent Advances – MDPI

- Antimony may be a renewable energy hero – St. Louis Group

- Antimony and National Security: A Critical Supply Chain Crisis – Small Cap Investor

- Nova Minerals Uses Sensor-Based Ore Sorting to Deliver Upgraded Gold Recoveries from RPM Deposit – Small Caps

- X-ray Transmissive Sorting in Mining: How It Works and Benefits

- Driving Sustainability Through Environmental Responsibility – Nova Minerals

- Improving Sustainability and Efficiency in Ore Sorting with Sensors – AZoMining

- Securing defense critical minerals: Challenges and U.S. strategic responses in an evolving geopolitical landscape

- Fortifying Critical Infrastructure: 5 Insights from U.S. Leaders on Securing Supply Chains

- JPMorgan Launches $1.5 Trillion Plan to Support Industries Deemed Critical to U.S. Interests – Investopedia

- JPMorganChase Launches $1.5 Trillion Security and Resiliency Initiative to Boost Critical Industries

- Expect Supply Chain Impacts from China’s Antimony Export Restrictions – Exiger

- The West Susitna Industrial Access Road Background

- Project Overview | West Susitna Access Road Project

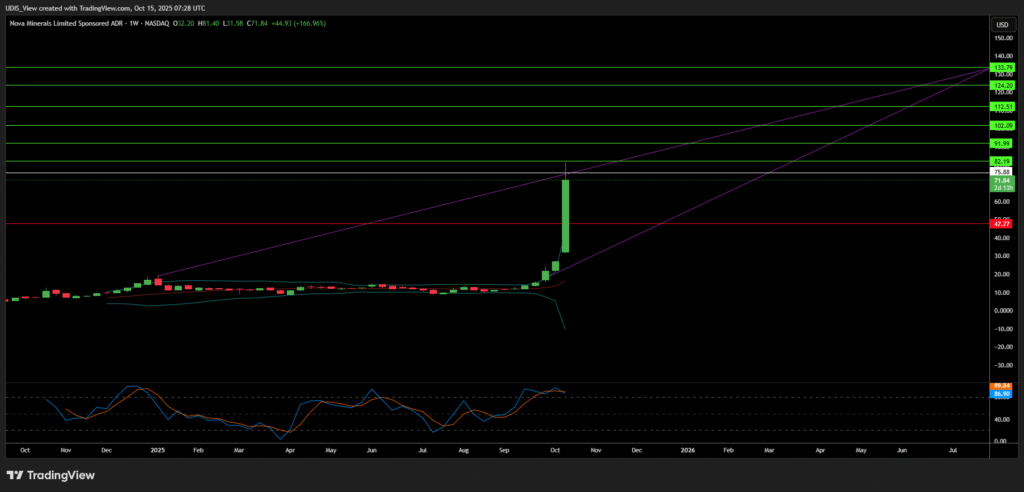

Nova Minerals Long (Buy)

Enter At: 75.88

T.P_1: 82.19

T.P_2: 91.99

T.P_3: 102.09

T.P_4: 112.51

T.P_5: 124.20

T.P_6: 133.79

S.L: 47.77