Strategic Context: The Financialization of Geopolitical Risk

The VanEck Rare Earth/Strategic Metals ETF (REMX) increasingly operates as a direct proxy for global geopolitical risk. Investors recognize that Rare Earth Elements (REEs) are indispensable inputs for strategic sectors.1 These include renewable energy, advanced digital technologies, aerospace, and modern defense systems.1 Therefore, price movements in REEs reflect anticipated supply disruptions driven by state policy, not merely market demand cycles.2

National security imperatives fundamentally distort the REE market. US policy explicitly fuses security interests and geopolitical goals with efforts to secure domestic and international supply chains.3 This strategic imperative dictate high premiums for verifiable, secure, non-Chinese supply lines.4 Traditional free-market mechanisms alone cannot address this supply challenge.

The Refined Risk Premium

China’s market dominance defines the global REE landscape. While China accounts for approximately 69% of global REE mine production, its control over the processing stage is overwhelming.5 Chinese companies manage over 90% of the world’s processing capacity for rare earths.6 This discrepancy between mining and refining reveals a crucial vulnerability.

Control over complex, environmentally sensitive processing technologies constitutes the primary geopolitical choke point.4 Raw resource ownership is secondary to the capacity for separation, purification, and refining.7 Consequently, investors should view REMX performance as gaining primarily from successful diversification in processing capacity, not just mining exploration. These processing efforts face high technological hurdles and significant environmental permitting risks outside Asia.4

Table 1: Global Rare Earth Value Chain Concentration Metrics

| Value Chain Stage | China’s Approximate Global Share (%) | Source of Leverage |

| Mine Production (2024) | ~69% | Sets initial supply quota and pace 5 |

| Refining/Processing Capacity | >90% | The primary geopolitical choke point 6 |

| Permanent Magnet Manufacturing | ~92% (2019) | Controls high-value downstream products 8 |

Geopolitical Strategy: Weaponizing the Processing Chokehold

Beijing actively uses its near monopoly on processing as a strategic weapon, directly driving price volatility and supply fear. China’s new restrictions mandate strict licenses for exporting technologies used in REE mining, processing, and magnet manufacturing.6 This mechanism grants Beijing substantial leverage.

Export Controls: The New Economic Warfare

These restrictions enforce “long-arm jurisdiction” over global supply chains. Foreign firms must now obtain a license to supply rare earths produced in China or processed using Chinese technology outside China.6 This requirement allows Beijing to choke foreign manufacturing pipelines without imposing outright export bans on raw materials.6 The controls increase leverage in bilateral trade disputes and signal a stark warning to the West regarding China’s willingness to use trade heft to advance geopolitical goals.6

Targeting Critical Industrial Vulnerabilities

The restrictions target foundational high-tech industries. The global semiconductor supply chain now faces acute disruption.9 ASML Holding NV, the exclusive manufacturer of advanced chip-making machinery, anticipates weeks-long shipment delays.9 This is because chipmaking machines rely heavily on extremely precise lasers and magnets that utilize rare earths.9

US chip companies are scrambling to audit their products for Chinese REE content.9 They fear licensing requirements could abruptly halt production.9 These restrictions represent a strategic attack on the foundational technology driving the global Artificial Intelligence (AI) boom. The resulting REE price surges reflect this direct, targeted industrial risk.

Defense Primacy Under Threat

Dependence on a geopolitical rival for critical inputs threatens US military primacy.6 Rare earth magnets are crucial for modern defense platforms, generating electricity and driving servomotors for precision control.10 Neodymium-iron-boron (NdFeB) magnets replaced hydraulics in modern electric actuators, while Samarium-cobalt (SmCo) magnets operate in engine pumps and turbomachines.10

A single F-35 fighter jet requires over 900 pounds of REEs, including approximately 50 pounds of SmCo magnets.10 A Virginia-class submarine requires an estimated 9,200 pounds.10 Even guided artillery shells use miniature permanent magnets in their guidance fins.10 The sourcing risk is not theoretical; a Chinese-made SmCo alloy was discovered in an F-35 turbomachine pump, prompting immediate supply chain scrutiny.10

The Policy Signal as Price Driver

Neodymium oxide prices demonstrate extreme volatility linked to geopolitical events. Prices plummeted from $209.30 per kilogram in January 2023 to $113.20 per kilogram in January 2024.11 However, prices are projected to rise sharply to $150.10 per kilogram by October 2025, representing a significant recovery.11

This projected surge aligns directly with the imposition of new Chinese export controls enacted in 2025.6 The primary driver of recent price appreciation is not physical scarcity, but the immediate, quantifiable risk imposed by regulatory fiat. Investors now correctly view such regulatory announcements as the single most significant market-moving variable.

Macroeconomic Forces and Policy Responses

The sustained upward pressure on REE prices is reinforced by macroeconomic demand and aggressive Western policy mandates designed to counteract supply concentration.

The Green Tech Imperative: Exponential Demand

The electric vehicle (EV) sector is reshaping REE demand.12 EV motors are the fastest-growing source of rare earth demand, relying heavily on neodymium, dysprosium, and terbium.12 Demand tied specifically to EV motors reached 37 kilotons in 2024 and is projected to rise to 43 kilotons in 2025.12

The prevalence of Permanent Magnet Synchronous Motors (PMSMs) in EVs guarantees sustained demand for NdFeB magnets.12 This technological decision locks the global economy into persistent REE dependency. The sustained, high-speed demand growth exerts continuous upward pressure, especially on heavy rare earth prices like dysprosium.

Western Industrial Policy Mandates

The European Union (EU) and the United States (US) are implementing ambitious industrial policies to secure supply. The EU Critical Raw Materials (CRM) Act sets clear targets for 2030.1 These targets mandate that the EU must meet at least 10% of its annual consumption from domestic extraction and 40% from processing.1 Furthermore, no more than 65% of the EU’s annual consumption can come from a single third country.13

The US approach leverages government-backed financing and geopolitical priorities to secure supply domestically and internationally.3 For example, US Strategic Metals signed a Memorandum of Understanding with Pakistan, involving plans to invest nearly 500 million USD to develop mineral processing facilities.14 These commitments guarantee long-term demand for Non Chinese supply and establish a medium-term price floor for diversified supply chains.

Policy Ambition Versus Reality

Western policy sets aggressive diversification targets, such as the EU’s 40% processing goal by 2030.1 However, industry analysis suggests that the concentration of refined material suppliers will only decline marginally by 2035.15 Projections indicate the average market share of the top three suppliers will remain highly concentrated, effectively returning to 2020 levels.15

This lag between legislative ambition and physical project execution implies that global concentration risk will remain elevated for the foreseeable future. The persistence of high supply risk directly supports elevated REMX valuations over the next decade.

Technology and High-Tech Manufacturing Dependence

China’s leverage extends beyond raw material processing into high-tech manufacturing, creating a critical bottleneck in Western industrial output.

The Permanent Magnet Bottleneck

China dominates the final, high-value stage of the supply chain. In 2019, China accounted for 92% of the world’s production of rare-earth permanent magnets.8 China focuses on using its REEs to manufacture products with higher added value, such as electric motors.8

This concentration increases as the value chain moves downstream.16 Controlling the magnet manufacturing stage allows China to influence the global output of critical defense and civilian components.8 Diversification requires significant, rapid investment in domestic magnet manufacturing, presenting a substantial barrier to entry for Western firms.4

The Industrial Policy Deficit

The United States currently lags in the competition to secure REEs, being “out-invested, out-innovated, and out-educated. “.4 Relying solely on market-driven solutions is insufficient to correct the severe structural imbalance that developed over decades.4

The creation of secure supply chains requires politically challenging industrial policy. New refineries face inherent difficulties, including substantial local opposition due to environmental hazards and stress on local water resources.4 Investors must anticipate high capital expenditure and prolonged permitting timelines for non-Chinese processing facilities, which collectively contribute to globally higher REE prices.

The ‘Chokepoint’ Value Capture Strategy

China shifted strategically from exporting raw materials to manufacturing high-value-added downstream products.8 The 2025 export controls specifically target the technology used in magnet manufacturing.6 This is not merely resource protection; it is a mechanism to shield China’s competitive industrial advantage in high-tech component production, such as EV motors. By limiting the ability of Western firms to establish competing high-value downstream industries, China guarantees elevated REE prices and maintains control over critical technologies.

Intellectual Property and Future Innovation

The future of REE independence depends on technological advances in processing, recycling, and substitution. China’s strategy emphasizes volume, while the West seeks qualitative technological superiority.

Patent Volume Versus Quality Dichotomy

China leads overwhelmingly in the absolute number of rare earth patent filings, far surpassing the US and Japan.17 However, the overall strength or quality of Chinese patent portfolios, when measured by the Patent Asset Index, generally lags behind its two major competitors 17

China aims for patent volume to consolidate mastery over existing processing and production technologies. Conversely, the US and Japan tend to focus on qualitatively superior, high-impact patents. These likely target efficient process improvements, separation techniques, or the development of non-REE substitution materials. This qualitative edge could eventually erode China’s physical dominance.

IP Defense Strategy

China’s new export controls require licensing for technologies utilized outside its borders.6 This provision effectively extends China’s legal reach over intellectual property embedded within processing technology. Beijing leverages its physical processing monopoly (over 90%) to enforce compliance with its IP standards globally.6 This creates a significant regulatory and IP risk barrier, increasing the complexity and cost associated with foreign REE processing ventures.

Future competition will focus intensely on “circularity” and sustainability.1 The EU CRM Act requires mandatory information disclosure regarding recyclability and recycled content for permanent magnets.13 Patents related to advanced separation and recycling technologies, particularly those reducing reliance on heavy rare earths like dysprosium, will define the next phase of non-Chinese technological leadership.

Cyber and Supply Chain Resilience

The scarcity and concentrated sourcing of REEs intersect directly with national security supply chain risk management, adding another layer of cost and complexity.

Hardware Integrity and C-SCRM Risk

Cybersecurity Supply Chain Risk Management (C-SCRM) mandates mitigating risks throughout the entire lifecycle of Information Communications Technology (ICT) and Operational Technology (OT) products.18 These risks include inserting counterfeits, unauthorized production, tampering, and embedding malicious hardware.18

The highly concentrated sourcing of rare earth magnets means that component acquisition inherently carries high C-SCRM risk. The discovery of a Chinese-made SmCo alloy component within a US F-35 turbomachine pump illustrates this physical insertion risk.10 A hostile component in critical national infrastructure whether a defense platform or a power grid system creates a severe vulnerability.

The Dual-Use Component Threat Multiplier

REE magnets are essential for dual-use components serving both civilian high-tech manufacturing (e.g., ASML lithography machines) and advanced military systems (e.g., Tomahawk guidance).9 Concentrated sourcing of these physical, mission-critical components creates a magnified threat vector.

National security systems rely on audited hardware, requiring that REE magnets be certified as sourced and processed in trusted jurisdictions.18 If certification fails, the entire system, such as radar or targeting platforms, becomes a high-risk liability. Failure to secure REE supply chains represents not just an economic dependency but an active threat vector.18 The high cost of mandatory auditing and verification must be factored into the strategic valuation of non-Chinese REE producers.

Investment Outlook and Conclusions

The persistent rise in REE prices and the sustained interest in REMX reflect fundamental structural shifts driven by state action and exponential demand. The analysis confirms three interconnected drivers sustaining upward price pressure.

First, China’s political strategy converts its processing monopoly (over 90%) into geopolitical leverage via sophisticated export controls.6 Second, the exponential demand from the global energy transition guarantees a robust price floor, particularly for neodymium and dysprosium.12 Third, Western industrial policy, exemplified by the EU CRM Act and US strategic financing, guarantees long-term financing and demand for diversification projects.1

Investors should recognize that the extreme price volatility observed in Neodymium 11 reflects swinging confidence between China’s entrenched dominance and the political commitment of Western governments to diversification. Successful REE investments must prioritize companies focused on establishing verifiable, resilient supply chains, particularly in downstream processing and magnet manufacturing outside China.8

The necessary high capital expenditure, environmental permitting challenges 4, and mandatory auditing required to meet national security standards (C-SCRM) ensure that the cost of secure supply will remain high 18. Concentration risk will likely persist through 2035, given the slow pace of physical project completion compared to political mandates.15 Long-term investor gains depend on the persistent execution of US and EU diversification goals.

References

- Critical Raw Materials Act – Internal Market, Industry, Entrepreneurship and SMEs

- The Strategic Game of Rare Earths: Why China May Only Be in Favor of Temporary Export Restrictions – Resources for the Future

- Shovel-ready? Building US critical mineral resilience | White & Case LLP

- Critical Minerals, Rare Earth Elements, and the Challenges Ahead for the United States

- Rare Earth Elements: Understanding China’s Dominance in Global Supply Chains

- China’s new restrictions on rare earth exports send a stark warning to the West

- Rare earths by country: Production totals and known reserves – Quartz

- China has a monopoly on rare earth metals – Polytechnique Insights

- Chip supply chain braces for China’s rare earth curbs – Taipei Times

- 6 Military Uses of Rare Earth Elements in Defense Technology

- Neodymium Price Today – Historical Chart & Forecast – How to Buy – Strategic Metals Invest

- Why Rare Earths Are Critical to EV Motors – Elements by Visual Capitalist

- European Critical Raw Materials Act – Policies – IEA

- Pakistan, US advance rare earth minerals deal amid PTI’s ‘secret agreement’ warning

- Executive summary – Global Critical Minerals Outlook 2025 – Analysis – IEA

- Rare Earth Permanent Magnets – Department of Energy

- China Leads in Rare Earth Elements, Yet Portfolio Strength Lags

- Cybersecurity Supply Chain Risk Management | CSRC

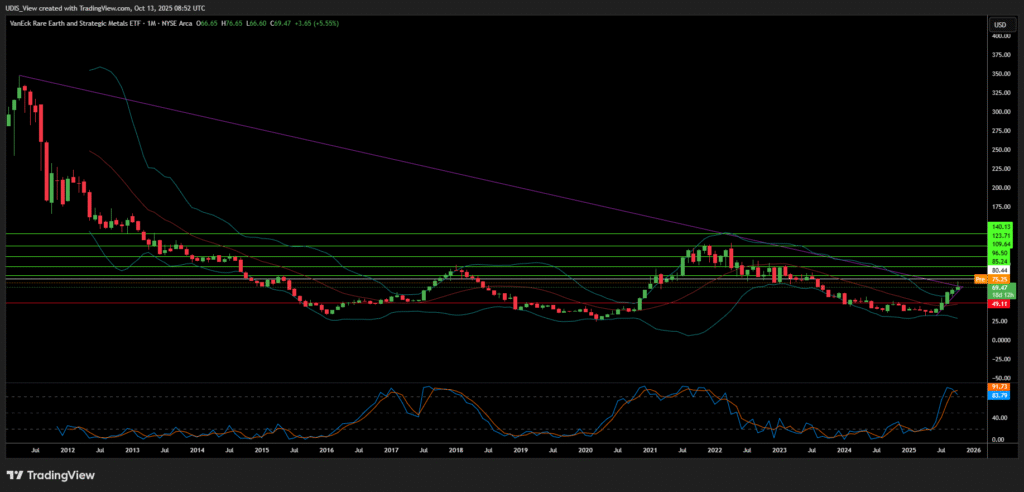

REMX Long (Buy)

Enter At: 80.44

T.P_1: 85.24

T.P_2: 96.50

T.P_3: 109.64

T.P_4: 123.71

T.P_5: 140.13

S.L: 49.11