The AI Infrastructure Imperative

The exponential growth of Artificial Intelligence (AI) and High-Performance Computing (HPC) demands radical infrastructure change. Electrical interconnects cannot sustain this growth trajectory.1 They consume vast power and generate excessive heat, reaching physical limits.2 POET Technologies strategically counters this crisis with its proprietary Optical Interposer™ platform.2

This technology integrates electronic and photonic components at the wafer level.2 This design is essential for the next generation of AI clusters and hyperscale data centers. POET’s optical engines support massive data speeds, specifically 800G and 1.6T.2 These high capacities directly address escalating communication demands among GPU clusters.3

Market validation is evident through major industry partnerships. In May 2024, Foxconn Interconnect Technology selected POET’s optical engines for 800G and 1.6T transceiver modules.2 POET also launched 1.6T optical receivers with Semtech for AI networks.2 Furthermore, a recent $75 million private placement validates POET’s direction.4 This investment increases the cash reserves to over $150 million.4 POET now possesses the capital required to accelerate R&D and secure crucial supply chain components.4 POET is fundamentally transitioning to a necessary, scaled enabler for the multi-trillion-dollar AI ecosystem.

Technology, Science, and High-Tech: The Photonics Solution

POET’s competitive edge derives entirely from its proprietary wafer-scale integration platform. This platform radically changes how electronic chips and light sources communicate within a single package.2 The Optical Interposer platform addresses the severe bandwidth and distance restrictions of traditional electrical signaling.2 Electrical transmission suffers from resistive losses and parasitic capacitance.2

The Optical Interposer Advantage

Optical interconnects utilize light to transmit data, eliminating these electrical limitations.2 This approach delivers significantly higher throughput and drastically lower power consumption.5 Reduced power usage and minimal latency are critical features for training colossal AI models efficiently.5 Without new approaches, data center energy use could grow exponentially, consuming up to 8% of total U.S. power by the decade’s end.1 The Optical Interposer provides a scalable, sustainable path forward.1

Proprietary Process Science

The integrity of the Optical Interposer relies on advanced materials science and patented processes. POET holds granted patents covering the “Optical dielectric planar waveguide process”.6 This intellectual property secures the method for depositing silicon oxynitride film structures.6 These structures form the planar waveguides within the interposer.6

Crucially, the fabrication process employs a low thermal budget, operating below 400°C6. This low-temperature method minimizes the thermal mismatch risks inherent in integrating multiple materials.7 The process uses hydrogen-free precursors, yielding film structures that exhibit low stress levels, below 20 MPa.6 This patented science delivers low optical signal loss, measured at or less.6 The reliability enabled by these patented scientific parameters is critical for high-volume manufacturing.7

High-Tech Strategy: Asset-Light Scaling

The specialized scientific process enables a powerful high-tech business strategy. The low-thermal budget process is compatible with existing, standardized CMOS semiconductor foundry lines.6 This compatibility allows POET to scale manufacturing without building expensive, dedicated fabrication facilities.7

POET avoids massive capital expenditure (CapEx) by licensing its process to regional foundries or establishing joint ventures.7 This strategy validates the company’s flexible, asset-light manufacturing thesis.4 The core technical innovation of the low-temperature process directly unlocks faster, more economic market penetration, securing necessary scale without accruing significant debt.4 This approach transforms a technical challenge into a mandatory economic catalyst for POET’s growth.

Economics and Macro Drivers: The Photonics Investment Thesis

POET focuses on the fastest-growing segments of the semiconductor industry: Silicon Photonics and Co-Packaged Optics (CPO). Strong market forecasts and robust capital infusion underpin POET’s financial viability.4

Macroeconomic Market Expansion

The global Silicon Photonics Market shows substantial, sustained growth.8 This market, valued between billion and billion in 2025, projects to reach billion to billion by 2030.8 This impressive expansion corresponds to a Compound Annual Growth Rate (CAGR) between and .8 POET directly targets the optical transceiver segment, which held a revenue share in 2024.9

The ultra-high-speed segments offer the most aggressive growth. The 800 Gbps data rate is forecast to achieve a CAGR through 2030.9 The wider Co-Packaged Optics market, which closely aligns with POET’s vision, is projected to expand even faster.10 CPO market CAGRs range from a high of through 2030.10. The integration of optical engines is essential to capture this accelerating market demand.10

Corporate Financial Strength and Strategy

POET demonstrated significant investor confidence by securing a million non-brokered financing.4 This represents the largest single investment in the Corporation’s history.4 Following this investment, POET commands over a million in cash with no significant debt obligations.4

The capital deployment plan is aggressive and highly targeted. Proceeds will accelerate R&D, expand operations, and fund corporate development.4 CEO Dr. Suresh Venkatesan explicitly stated funds are earmarked for “investments and targeted acquisitions” in the light source business.4 This strategy aims to secure a technological lead in components for chip-to-chip connectivity and ultra-high-speed transceivers.4 This action mitigates a critical supply chain dependency risk. By capturing revenue from laser sources, the fastest-growing optical component segment (CAGR) 10, POET maximizes its revenue concentration in high-value components.

Market Growth Forecast: Silicon Photonics & Co-Packaged Optics

| Market Segment | 2025 Value (USD Bn) | 2030 Value (USD Bn) | Projected CAGR (2025-2030) | Source Relevance |

| Silicon Photonics | 8 | |||

| Co-Packaged Optics (Global) | 10 | |||

| Fastest Growing Sub-Segment: 800 Gbps Data Rate | N/A | N/A | 9 | |

| Fastest Growing Component: Laser Sources | N/A | N/A | 10 |

Geostrategy and Geopolitics: A Critical National Asset

Advanced semiconductors, particularly integrated photonics, are now fundamental components of national power.3 The global race for technological supremacy centers on manufacturing the most advanced, energy-efficient chips.3 POET’s technology directly impacts digital sovereignty and economic resilience.12

Digital Sovereignty and Supply Chain Control

Governments increasingly emphasize the need to “onshore” critical chip production.3 This trend strengthens domestic supply chains and mitigates geopolitical risk associated with offshore manufacturing dependency. Photonic integration is key to achieving this digital sovereignty, offering reliable and advanced domestic solutions.13

POET’s low thermal budget process enables production on standardized lines, simplifying supply chain expansion across various geographies.6 This adaptability enhances strategic autonomy by diversifying manufacturing locations. Furthermore, the technology’s energy efficiency directly supports strategic goals.

AI Infrastructure and Energy Security

Data centers’ surging power demands pose a significant risk to national energy security and grid stability.1 The use of generative AI alone drastically increases electricity consumption.12 Photonic approaches mitigate this strategic energy risk.12

Optical interconnects and Co-packaged Optics (CPO) reduce data center power consumption by up to compared to traditional pluggable solutions.1 This efficiency aligns POET’s platform with mandatory governmental and ESG directives focused on green energy and resilient power grids.14 POET’s platform thus becomes a crucial component for any nation seeking both AI leadership and strategic energy resilience. Control over this underlying hardware is tantamount to control over future economic and military capabilities.3

Cyber and Network Security Benefits

Resilient data infrastructure is non-negotiable for distributed AI workloads and critical national systems.15 Optical infrastructure provides critical physical and cybersecurity advantages necessary for modern hyperscale environments 16

Resilience in Data Center Interconnects (DCI)

Optical Data Center Interconnect (DCI) solutions deliver highly secure, low-latency data transmission.5 This security is vital for synchronizing data and supporting scalable AI workloads across geographically dispersed GPU clusters.15 Optical fiber networks inherently possess greater resilience against electromagnetic interference and physical eavesdropping than copper solutions.16

Optical DCI networks integrate crucial redundancy features.17 Solutions include fiber path protection, which seamlessly switches data transmission to a standby fiber pair upon failure.17 Optical line monitoring also detects and precisely locates damaged or cut fibers.17 These capabilities ensure continuous, secure data synchronization, vital for real-time business continuity and disaster recovery in AI operations.15

Latency and AI Integrity

Optical interconnects provide ultra-low latency, a critical performance metric.5 Low latency is necessary for real-time analytics and high-availability systems.15 This robust infrastructure minimizes potential vulnerabilities and supports necessary monitoring efforts.18

Secure infrastructure must continuously monitor model behavior.18 Highly reliable, low-latency communication is essential for detecting subtle behavioral changes that could indicate compromised AI models during production inference.18 POET’s focus on reliable, high-speed DCI directly supports the stringent security and performance mandates of modern AI deployment.

Patent Analysis and Intellectual Property Moat

POET’s valuation is substantially bolstered by its granted patent portfolio, which protects its core manufacturing process.6 This IP establishes a high technical barrier in the rapidly evolving Co-Packaged Optics market.10

Protection of the Wafer-Level Process

Key patents, including numbers 12399321, 12007604, and 11156779, protect the “Optical dielectric planar waveguide process”.6 These patents specifically define the method for achieving high-quality integration.6 The IP covers the use of low thermal budget deposition and specific hydrogen-free precursors.6

This protection ensures that POET’s precise recipes for fabricating low-loss, low-stress silicon oxynitride films are proprietary.6 Protecting these manufacturing process parameters is essential for overcoming the potential “yield cliff” associated with scaling novel photonic solutions.7 Rivals cannot easily replicate the necessary high-yield, low-cost fabrication without infringing on this critical IP.7

Validation and IP Monetization

Commercial adoption validates the patented technology’s industrial viability.2 Partnerships with firms like Foxconn and Semtech confirm that the patented process yields commercially viable optical engines for 800G and 1.6T systems.2

The IP also fuels POET’s asset-light business model. The company can monetize its process patents via licensing agreements with regional foundries.7 This strategy accelerates market penetration, generates royalty revenue, and strategically externalizes the heavy CapEx burden typically required for scaling fabrication.4 Protecting the manufacturing know-how through process patents translates directly into defensive economics and financial flexibility.

Execution and Commercialization Risk

Despite undeniable technical necessity and market tailwinds, POET faces significant execution risks inherent to scaling novel deep-tech solutions.19 Investors must evaluate how POET mitigates these challenges.

The Challenge of Scaling Photonics

The critical challenge lies in perfecting the transition from developmental prototypes to high-volume, reproducible wafer fabrication.7 The semiconductor space notes high risks associated with scaling novel manufacturing processes, including the dreaded “yield cliff.”.19 Early wafer-level integration attempts often suffer from low usable die counts due to misalignment, particle contamination, or thermal mismatch.7

Scaling requires turning artisanal processes into highly reproducible foundry steps.7 Photonics components also necessitate long and expensive qualification, including specialized optical power burn-in and testing.7 Fast and reliable fiber-to-device alignment and highly accurate test data remain major challenges for silicon photonics customers.21

Mitigation through Capital and Strategy

POET’s strong balance sheet, with over $150 million in cash, is a primary risk mitigation factor.4 This capital ensures sustained funding for yield enhancement R&D and rigorous qualification procedures.4

The company’s strategic focus on targeted acquisitions in the light source business directly addresses a critical scaling vulnerability.4 Vertical integration secures the supply chain for a key component, mitigating external risk and accelerating revenue capture.4 By securing manufacturing scale through foundry partnerships via its asset-light model, POET bypasses the need for massive internal CapEx and accelerates its commercialization timetable.7 This structure minimizes financial exposure while maximizing market access.

POET Technical Competitive Advantages

| Feature | Electrical Interconnects (Current Limit) | POET Optical Interposer (Patented Solution) | Investment Implication |

| Power/Heat Profile | High consumption, massive heat generation 2 | Low consumption enables CPO ( power reduction) 1 | Mitigates unsustainable data center costs and strategic energy risk 12 |

| Data Rate Capability | Bandwidth limits reached, scaling difficult 1 | Supports 800G and 1.6T speeds 2 | Future-proofs architecture for the fastest-growing AI cluster market 9 |

| Manufacturing IP | Traditional high-temp, specialized processes | Proprietary low-thermal budget process () 6 | Enables asset-light scaling; reduces CapEx; secures high-yield competitive moat 7 |

| Latency | Medium, dependent on distance/material 5 | Ultra-low latency, maximum throughput 5 | Essential for real-time AI and high-availability DCI systems 15 |

Conclusion: Investment Verdict

POET Technologies is not merely a high-tech play; it represents a strategic necessity in global infrastructure development. The company’s Optical Interposer platform definitively resolves the fundamental power, heat, and bandwidth crisis confronting the AI revolution.1

POET has effectively leveraged scientific breakthroughs (low thermal budget waveguides) into critical strategic advantages (asset-light scaling and IP protection).6 With a million in capital and validated partnerships with market giants 2, POET is well-funded to accelerate deployment and secure the high-growth light source segment.4 POET’s technology addresses strategic mandates concerning energy security and digital sovereignty.14 The company provides the indispensable hardware layer required to enable the next era of high-speed, secure, and energy-efficient AI. POET remains assertively positioned for long-term growth within a rapidly expanding, strategically vital market.

References

- Can silicon photonics overcome scaling challenges for AI and data centers?

- Is Poet Technologies Stock a Buy?

- Why Semiconductors are at the Center of Technology and Geopolitics – Deep Tech

- POET Technologies Announces Closing of US$75 Million …

- 6 Key Benefits of Optical Interconnect Technology – STL Tech

- Patents Assigned to POET Technologies, Inc. – Justia Patents Search

- Poet Technologies ($POET): Let there be Light! (and Silicon) | by Startup Sapience

- Silicon Photonics Market Size, Share, Trends, and Growth Analysis 2032

- Silicon Photonics Market Size, Growth Drivers & Industry Analysis, 2030

- Co-packaged Optics Market Size, Growth, Share, Trends & Report Analysis 2030

- Co-Packaged Optics Market Size, Share & Growth Trends 2025-2032

- Using photons and electrons for higher data transmission rates and greater energy efficiency – VDE

- Illuminating the Future: Navigating the Integrated Photonics Industry and Supply Chain

- The new ESG paradigm: Energy, Security and Geostrategy in a changing world – Euronext

- Optical Data Center Interconnect | Nokia.com

- Data Center Security | Fiber Optic Infrastructure – Corning

- Optical Data Center Interconnect: Connecting Your Data Centers With Private DWDM Technology – WWT

- The AI Supply Chain Security Imperative: 6 Critical Controls Every Executive Must Implement Now

- POET Technologies Stock (POET) Opinions on $75 Million Private Placement

- The Challenges and Innovations in Silicon Wafer Processing

- Silicon Photonics – Challenges and Solutions for Wafer-Level Production Tests – FormFactor COMPASS

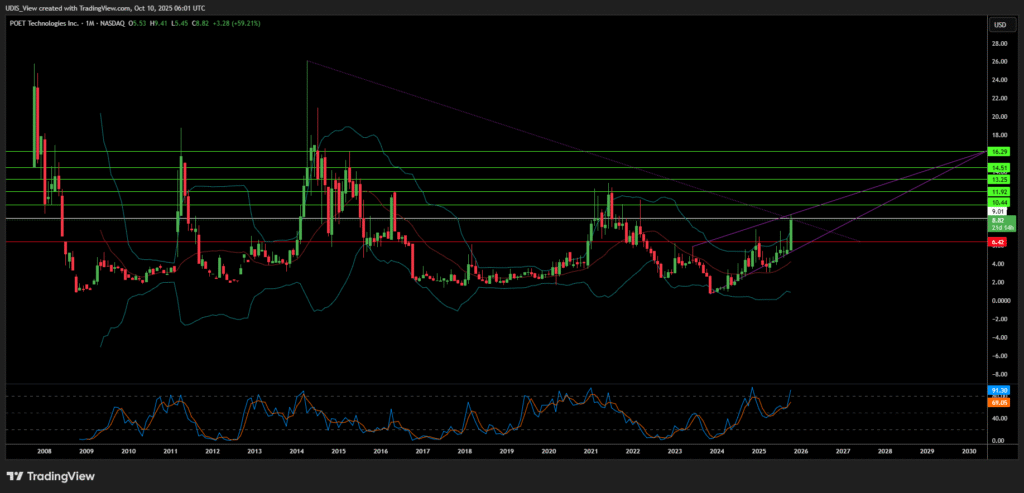

Poet Technologies Long (Buy)

Enter AT: 9.01

T.P_1: 10.44

T.P_2: 11.92

T.P_3: 13.25

T.P_4: 14.51

T.P_5: 16.29

S.L: 6.42