I. The Platform Economy of Drug Discovery

A. Defining the TechBio Imperative

Recursion Pharmaceuticals (RXRX) operates fundamentally as a deep-technology platform, distinctly separate from a traditional biotech firm.1 This technological identity proves crucial for accurate financial valuation. The company’s integrated AI and automation platform targets disruption of the legacy pharmaceutical research and development (R&D) model.

The prevailing R&D structure is economically precarious and inefficient.2 Developing a single approved drug traditionally requires capital expenditures ranging from $2.4 billion to $3.2 billion.2 Furthermore, the average development cycle spans approximately 14 years from target identification to market launch.2

Recursion’s platform serves a strategic role, specifically engineered to compress this excessive cost and time curve.3 By accelerating time-to-market and lowering overall capital costs, the company acts as a vital macroeconomic catalyst for optimizing global health innovation efficiency. The potential for platform scalability, not just product success, drives its market perception.

B. The Strategic Valuation Premise

RXRX maintains a market valuation characterized by high risk, often described as an “all-or-nothing” proposition.1 This valuation reflects the enormous, anticipated asymmetric returns achievable by radically accelerating operational speed and scale. The market prioritizes the platform’s exponential potential over current financial performance.

Current negative financial reporting, such as the consensus Q3 2025 earnings per share (EPS) forecast of $-0.35, reflects planned, aggressive expenditure.4 This sustained capital outlay funds essential platform infrastructure, most notably the BioHive-2 supercomputer, and advances the clinical pipeline.5

Market dynamics currently value the platform’s demonstrated potential to drastically reduce future R&D costs.2 This prospective saving justifies the company’s current high capital intensity and differentiates its valuation metrics from those applied to traditional drug developers.1 Investors recognize the company as an infrastructure play, focused on reducing the industry’s $3.2 billion average development cost.

II. Technological Dominance: The High-Tech and Science Core

A. BioHive-2: Infrastructure as a Strategic Asset

Recursion establishes a powerful, proprietary technological moat through its BioHive-2 supercomputer.5 This dedicated, high-tech infrastructure leverages NVIDIA DGX H100 SuperPODs. Owning this computational asset places Recursion squarely at the forefront of computational life sciences.5

Control over this infrastructure allows the firm to generate proprietary data and execute rapid iteration cycles.5 This speed advantage proves difficult for competitors to replicate. This massive, dedicated computing power dictates the future scalability and maximum limits of scientific discovery velocity within the firm.

B. Scientific Differentiation: Foundation Models and Speed

Recursion forged a critical partnership with MIT and CSAIL to develop Boltz-2, a state-of-the-art, open-source biomolecular foundation model 5 This scientific advancement unifies two complex processes: the prediction of protein complex structures and the estimation of binding affinities.5

Boltz-2 approaches the chemical accuracy achieved by laborious physics-based Free Energy Perturbation (FEP) methods.5 Critically, the model delivers these complex results rapidly, often in about 20 seconds on a single A100 GPU.5 Proprietary hardware accelerators enhance these gains significantly. NVIDIA cuEquivariance kernels accelerate triangle operations up to 5x, while the NVIDIA Boltz-2 NIM microservice accelerates inference speed 2x to 3x.5 This profound acceleration directly compresses R&D timelines, leading to faster monetization.7

The decision to release Boltz-2 under an open-source MIT license serves a distinct geostrategy.5 This maneuver encourages broad scientific adoption, inadvertently driving industry standards toward Recursion’s data formats and underlying platform architecture. While the model is publicly accessible, the true competitive value resides in Recursion’s massive, high-quality, and proprietary biological data sets coupled with the unparalleled efficiency of the BioHive-2 infrastructure.5

BioHive-2 and NVIDIA Acceleration Metrics

| Technology Component | Strategic Advantage | Performance Metric |

| BioHive-2 Supercomputer | Proprietary computational scale | NVIDIA DGX H100 SuperPOD infrastructure 5 |

| Boltz-2 Foundation Model | Unified structure/affinity prediction | Approaches chemical accuracy of FEP methods 5 |

| cuEquivariance Kernels | Optimized triangle operations | Accelerates operations up to 5x 5 |

| NVIDIA NIM Microservice | Production inference acceleration | Accelerates protein prediction 2x–3x 5 |

C. Pipeline Validation: Platform Proof Points

Clinical progression provides tangible evidence of the AI platform’s predictive capabilities, systematically de-risking investor capital.6 Recent public data reported positive safety and preliminary efficacy for REC-617, an oral CDK7 inhibitor.6 Further, REC-994 met its primary endpoints in cerebral cavernous malformations.6

These clinical achievements confirm the platform’s core viability in hypothesis generation and compound selection. The selection of REC-3565 further highlights platform power. REC-3565 is designed as a potential best-in-class MALT1 inhibitor, specifically engineered to reduce the risk of hyperbilirubinemia, a common side effect of existing MALT1 inhibitors.6 This demonstrates the platform’s capacity to optimize compounds for improved clinical profiles early in the development lifecycle.

III. Reversing the R&D Curve: Macroeconomic and Economic Shift

A. Addressing Systemic Market Failure

The pharmaceutical industry faces significant systemic challenges: low productivity, extremely high capital costs, and the protracted 14-year R&D cycle.2 This high-cost, ROI-focused model inevitably limits innovation, often stifling investment in non-life-threatening or rare diseases.2 Recursion directly challenges this institutional inertia.

By reducing both R&D time and cost, 3, Recursion’s AI platform effectively lowers the requisite ROI threshold. This enables investment in therapeutic areas previously considered unprofitable.2 This macroeconomic shift is critical, leading to a projected expansion of total innovation flow in healthcare and potentially increasing drug accessibility globally.

B. Quantifying Operational Efficiency Gains

AI promises immediate, substantial reductions in critical operational expenditures. For instance, Generative AI is expected to yield a 62% reduction in clinical study design costs at peak adoption.8 These rapid gains in capital efficiency are essential for mitigating the operational losses reflected in current earnings forecasts.4

Economic evidence conclusively demonstrates that reducing time-to-market is highly monetizable.7 A significantly faster R&D cycle maximizes the period of patent life and subsequent revenue capture. This process directly enhances R&D innovation elasticity, encouraging further investment.7

The capability to accelerate drug development serves as a critical financial defense against policy risk. Government actions, such as the US Inflation Reduction Act (IRA), introduce uncertainty and can reduce anticipated long-term revenues.7 Economic models confirm that lower revenues lead to an R&D decline, with an innovation elasticity between 0.25 and 1.5.7 The acceleration provided by the Recursion platform mitigates this systemic risk. Speed allows drugs to reach the market rapidly, maximizing unprotected revenue time before policy-imposed price ceilings take effect.

Economic Imperative: AI Impact on R&D Cost and Time

| Metric | Traditional Baseline | AI Potential Impact | Source |

| Average Cost per Approved Drug | $2.4B – $3.2B | Significant capital efficiency gain | 2 |

| Development Cycle Length | 14 years | Acceleration of time-to-market | 2 |

| Clinical Trial Design Cost | Resource-Intensive | Up to 62% reduction (peak adoption) | 8 |

| Innovation Elasticity Response | 10% revenue drop 2.5%–15% R&D decline | Increased revenue window mitigates policy impact | 7 |

IV. Geopolitical and Strategic Risk Management

A. The Dual-Use Biosecurity Threat

Advanced AI capabilities for bespoke protein engineering introduce fundamental national security risks.9 The technology carries an inherent dual-use potential: applications can be curative or weaponizable. This dichotomy elevates the entire sector to the status of critical infrastructure.

Researchers previously identified an AI/biosecurity “zero-day” threat, demonstrating the creation of thousands of AI-engineered toxins that evaded existing detection methods.9 This vulnerability significantly heightens the sector’s strategic importance. Companies operating at Recursion’s scale must adopt extremely rigorous biosecurity protocols, moving them into the domain of geostrategic assets.

B. Cyber Posture as a Geostrategic Moat

Security governance represents a key strategic advantage in this field. The constant, rapid evolution of threats requires continuous vigilance, necessitating a security model analogous to a “Windows update model” for consistent patching and defense against biological threats.9

Recursion’s commitment to robust data governance protocols is therefore a strategic imperative.10 Operating explicitly as a “data controller” and adhering strictly to applicable national, provincial, and local laws implies adherence to high global standards such as GDPR or CCPA.10 This formal, rigorous compliance structure is critical for securing major partnerships with highly regulated global pharmaceutical firms, government entities, and allied military agencies.

In global competition, control over proprietary biological data sets is the essential fuel for BioHive-2, which is paramount.5 Given the “zero day” risks inherent in AI protein engineering 9, strategic partners prioritize platforms demonstrating superior data sovereignty and cyber integrity. Recursion’s formalized governance establishes its reliability in this sensitive geostrategic environment.

C. International Competition and Data Control

The global race for leadership in AI drug discovery is fundamentally geopolitical, involving sophisticated international competitors like Insilico Medicine.1 Maintaining technological superiority requires firm control over the foundational data. Recursion’s operational structure and compliance framework 10 enhance its standing as a trusted domestic and allied partner. This stability is crucial in the face of international strategic competition over bio-data and AI capability deployment.

V. Defending Innovation: Patent and IP Strategy

A. Aggressive Global IP Expansion

Recursion’s intellectual property (IP) strategy focuses strategically on protecting both the core platform technology and individual therapeutic compounds.11 This dual approach erects a substantial legal barrier to entry. In Q2 2024, the company recorded a sustained 1.99% growth in patent filings, confirming consistent investment in legal defense mechanisms.11

The company exhibits a strong focus on international IP protection.11 Approximately 75% of new Q2 2024 filings were routed through the World Intellectual Property Organization (WIPO).11 This high percentage signifies a deliberate intent to secure global market access and preemptively defend against potential infringement across crucial international commercial jurisdictions.

B. Strategic Patent Authority Selection

The heavy reliance on WIPO filings confirms a strategy aimed at global defense and maximizing future commercial reach.11 The global pharmaceutical commerce market necessitates this preemptive, broad-based defense strategy. Concurrently, 100% of Recursion’s patent grants are secured in the United States 11

This concentration ensures ironclad protection within the largest and most commercially valuable domestic market, prioritizing the defense of primary revenue streams. The pronounced focus on WIPO filings suggests Recursion prioritizes protecting its core technological processes the algorithms, screening methodologies, and AI architecture utilized by BioHive-2.5. Successfully protecting these elements legally shields the source of the speed and cost advantage, making their competitive moat exceptionally durable against attempted replication.

Q2 2024 Patent Activity and Global Strategy

| Metric | Q2 2024 Activity | Strategic Implication | Source |

| Filing Growth (QoQ) | 1.99% Increase | Sustained, targeted investment in IP | 11 |

| WIPO Filings % | 75% of new filings | Global market defense and commercial strategy | 11 |

| US Patent Grants % | 100% of grants | Prioritization of primary market defense | 11 |

VI. Financial Trajectory and Investor Outlook

A. Scaling the Integrated Model

Recursion Pharmaceuticals utilizes an integrated operational model that encompasses both the technology platform and clinical development.1 This vertical integration differentiates it from pure software players, demanding significantly higher initial capital investment.1 However, this strategy provides superior control over data quality, experimental validation, and iteration speed.

The ongoing operational losses, exemplified by the estimated Q3 2025 EPS consensus of $-0.35, align with the growth trajectory of scaling deep-technology platforms.4 Institutional investors must therefore track capital efficiency and pipeline velocity as core metrics, rather than focusing on near-term Generally Accepted Accounting Principles (GAAP) profitability.

B. Momentum Drivers: Clinical and Data Milestones

Near-term financial inflection points hinge entirely upon continued validation and clinical success.1 Recent advancements, including the Phase 1 dosing of REC-3565 and positive efficacy data for REC-617, offer crucial evidence.6 These developments validate the platform’s predictive accuracy and are essential for de-risking future funding rounds and maintaining investor confidence.

Successfully achieving clinical milestones converts the platform’s theoretical value into tangible therapeutic assets.6 This progression systematically shifts the financial narrative from being solely technology-focused toward emphasizing genuine market potential and monetization capacity. Given the high-risk “all-or-nothing” nature of the investment 1, Recursion must expertly manage its narrative around key financial dates. The Q3 2025 earnings report (estimated Nov 5, 2025) 4 holds significance not for its negative EPS, but for providing updated metrics on computational output, pipeline progress, and partnership depth, thereby sustaining the necessary technology valuation multiple.

C. Conclusion: Asserting Strategic Value

Recursion Pharmaceuticals has successfully leveraged massive high-tech infrastructure and profound scientific innovation to address a critical macroeconomic imperative: the unsustainable cost and duration of traditional drug development. The company’s strategic value proposition is robust and multi-layered.

This value is firmly underpinned by aggressive global IP protection 11, adherence to rigorous geostrategic biosecurity standards 9, and demonstrably accelerated scientific output through BioHive-2 and Boltz-2.5. Recursion represents a long-term strategic holding, dependent on its continued ability to translate computational speed and scale into positive clinical outcomes and monetize its foundational platform effectively through partnerships and drug launches. The firm remains a key player defining the future of AI-driven healthcare infrastructure.

References

- Recursion Is Betting Big On AI-Driven Drug Discovery – Finimize

- AI, NLP and the ROI of drug development – Blog

- AI Models and Drug Discovery Within Pharmaceutical Drug Market – PMC

- Recursion Pharmaceuticals, Inc. Class A Common Stock (RXRX) Earnings Report Date

- Recursion and NVIDIA Build the Most Powerful Supercomputer in Pharma

- Press Releases | Recursion Pharmaceuticals, Inc.

- Analysis Finds Meaningful Impact on Pharmaceutical Innovation From Reduced Revenues

- How pharma can benefit from using GenAI in drug discovery | EY – US

- AI can design toxic proteins. They’re escaping through biosecurity cracks.

- Privacy Notice – Recursion

- Recursion Pharmaceuticals sees highest patent filings and grants during June in Q2 2024

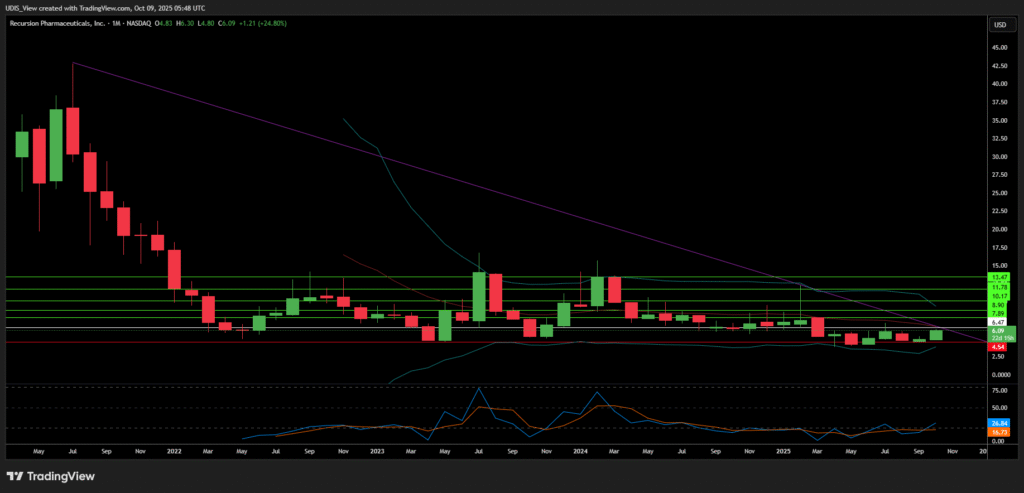

Recursion Pharmaceuticals Long (Buy)

Enter At: 6.47

T.P_1: 7.89

T.P_2: 8.90

T.P_3: 10.17

T.P_4: 11.78

T.P_5: 13.47

S.L: 4.54