Lumber prices remain structurally elevated following years of unprecedented volatility.1 Analysis confirms that this high-price environment is not transient. It represents a new baseline driven by entrenched geopolitical, industrial, and technological forces. Investors must understand these factors to forecast construction costs and evaluate supply chain risk accurately.

The Geopolitical Foundation of Volatility

Trade policy, particularly the use of Section 232 tariffs, has fundamentally reset the cost structure of North American lumber. This strategic maneuver establishes a durable floor for elevated prices.

Tariffs as a National Security Mandate (Geopolitics, Geostrategy)

The US administration has imposed substantial import taxes on wood products to shore up the domestic industry [Initial Query]. Softwood lumber imports face 10% tariffs, while kitchen cabinets and vanities incur 25% levies.3 These actions rely on Section 232 of the Trade Expansion Act.4 This statute permits the President to impose duties based on national security findings.4

The Department of Commerce determined that wood products support multiple critical infrastructure sectors.5 Lumber is essential for the power grid, transportation networks, and defense systems.5 This includes infrastructure, housing, and storage for personnel and materiel, and components for missile-defense systems.5 Framing the tariffs as a national security measure provides greater legal durability compared to reciprocal tariffs.6 This prevents hedging strategies dependent on a rapid legal reversal or trade deal reconciliation.

Foreign subsidies and unfair trade practices weaken the competitiveness of the US wood products industry.5 The official assessment concludes this erodes US industrial resilience and capacity. 5 Institutionalizing high duties forces suppliers and builders to plan for permanently higher input costs. This price floor is now structurally supported by US trade law.

Trade Realignment and Structural Deficits (Geostrategy, Economics)

US trade actions are actively restructuring global timber flows, exacerbating domestic supply constraints. Canada traditionally supplies about 12.0 billion board feet (BBF) to the US market annually.8 US domestic production capacity cannot quickly absorb this import volume.8 The industry requires an expansion of over 3.2 BBF of operable capacity just to fill the current Canadian shortfall.8

Canadian producers face escalating duties, with combined anti-dumping and countervailing duties reaching 35.2% in some categories.10 Canadian suppliers are responding by diversifying exports toward Asia and Europe.12 This strategic pivot reduces overall available North American supply.12 Simultaneously, global sanctions on Russian lumber exports tighten the overall global supply.14 Geopolitical events are therefore creating sustained upward pressure on global timber prices.13

Macroeconomic Pressure on the Cost Curve

Central bank policies and compounding financial risks significantly influence the realized cost of lumber in final construction prices. Lumber futures prices function as a leading indicator of broader construction activity 15

Interest Rates, Capital, and Housing Demand (Macroeconomics, Economics)

The demand for wood remains robust, with housing starts showing modest projected growth in 2025.15 However, this demand faces high-interest-rate headwinds. Rising interest rates inflate construction loan costs.17 Construction loans typically carry higher rates than conventional mortgages due to greater risk exposure 17

Higher capital costs directly undermine project viability modeling.18 Project feasibility relies heavily on the weighted average cost of capital (WACC).18 When rates increase, fewer early-stage projects secure favorable financing.18 This rate volatility extends project timelines and increases hedging costs for suppliers.18 Elevated mortgage rates further suppress homebuyer demand, compounding market challenges.17

Inflationary Compounding of Construction Costs (Economics)

Policy-driven commodity price increases have a disproportionate impact on consumer affordability. Tariffs alone are estimated to raise the price of an average new home by $7,500 to $22,000.19 CoreLogic projected these tariff adjustments would increase total construction costs by 4% to 6% within 12 months 19

Builders pass these costs, along with financing interest and profit margins, onto the final buyer.10 Builder profit accounted for 11.0% of the average new home price in 2024.21. Due to these markups, final home prices increase by nearly 15% above the direct material cost increase.10 Although the direct cost of softwood lumber is low (1.2% to 1.7% of the total home price) 22, the cumulative cost of tariffs and high capital rates applied across the entire construction base escalates the final price steeply.23

The combination of policy uncertainty and financing leverage leads directly to reduced housing affordability.19

Table 1: Economic Impact of Trade Policy on US Construction Costs

| Tariff Mechanism | Targeted Product | Effective Rate (Aug 2025) | Estimated Direct Cost Increase per New Home |

| Section 232/AD/CVD Duties | Canadian Softwood Lumber | Up to 35.2% 10 | $7,500 – $22,000+ 19 |

| Reciprocal Tariffs | Kitchen Cabinets/Vanities | 25% – 50% 24 | Significant supply chain cost 3 |

| Reciprocal Tariffs | Upholstered Wood Products | 25% – 30% 24 | Increased retail price volatility 25 |

Structural Supply Deficits: Industrial Resilience Crisis

The US capacity deficit remains the most critical long-term driver of elevated prices. Domestic production is severely constrained by labor and insufficient high-tech infrastructure.

Labor Shortages and Production Bottlenecks (Economics, Technology)

The US sawmill utilization rate remains inadequate, falling to 64.4% in the first quarter of 2025.2. Real output remains below 2018 levels despite expanded production capability.26 The critical restraint is not a lack of available timber stock but a lack of processing labor and capacity 8

The logging and forestry workforce is aging significantly; the national average age for logging contractors exceeds 57.28. One-third of logging business owners plan to retire or exit the business within five years.28 The industry struggles to attract younger talent, who favor higher wages in other trades or the burgeoning tech sector.28 These workforce shortages prevent existing mills from adding second or third shifts to increase utilization.8 This labor constraint ensures that the domestic supply response cannot materialize quickly enough to offset tariff impacts.9

The inability to hire makes expanding through new, highly automated facilities a mandatory requirement for increasing capacity.8 This high-capital requirement, driven by the need to mitigate labor risk, further contributes to the overall structural cost of lumber.

Climate Risk and Supply Interruption (Science, Geostrategy)

Climate change introduces acute, unpredictable supply risk to the North American timber market. Record wildfire seasons in Canada, notably in 2023, caused significant timber supply shocks.30 Companies like Canfor reported substantial revenue losses, partly due to wildfires.31

Wildfire events cause long-term harm through reductions in future harvest levels and diminished timber quality.31 Furthermore, these events cause logistical issues, creating immediate supply chain and transportation backlogs.31 As climate change increases the frequency of extreme events, this unpredictability contributes a permanent volatility factor to timber pricing.32

Table 2: North American Lumber Supply Chain Capacity Constraints

| Constraint Factor | Sector/Region Impact | Quantifiable Metric | Strategic Implication |

| Capacity Deficit | US Sawmill Production | US Shortfall: >3.2 BBF annually 8 | Cannot quickly replace Canadian imports 8 |

| Labor Shortage | Logging & Sawmills | Logging average age >57; 35% industry shrinkage 28 | Bottlenecks constrain utilization rates (74% in US South) 2 |

| Climate/Wildfire Risk | Canadian Timber Supply | Record wildfire seasons impacting future harvest levels 30 | Medium-term supply shock and fiber quality loss 31 |

| Geostrategy/Trade Shift | Canadian Exports | Diversification to Asia/EU due to tariffs 12 | Institutionalizes the US reliance deficit 8 |

Cyber-Physical Risk and Operational Integrity

Cybersecurity is an emerging, quantifiable risk factor in commodity pricing. The digitization of wood products processing has created new vulnerabilities in operational technology (OT).

Critical Infrastructure Vulnerability (Cyber, High-Tech)

The US government officially recognizes wood products as essential to national defense and economic stability.5 This designation increases the sector’s attractiveness as a target for sophisticated attacks.34 Logging operations, sawmills, and logistics platforms rely on integrated Industrial Control Systems (ICS).35 A breach anywhere in this complex industrial supply chain, from harvesting data systems to mill automation, can halt operations.37

Cyber risk is rising due to increased systemic reliance on software, cloud services, and automation platforms.34 Industrial organizations must adopt contemporary risk methodologies, including continuous assurance and real-time threat intelligence.34 Protecting these OT networks is deemed more critical than traditional IT security because ICS failures endanger human safety and essential public services.35

Ransomware as a Price Shock Accelerator (Cyber, Technology)

Ransomware attacks pose a direct threat to supply stability and price volatility. The manufacturing sector has incurred an estimated $17 billion in downtime since 2018 due to these attacks.38 Incidents often force sawmill or pulp mill shutdowns, sometimes due to “abundance of caution” regarding compromised control systems.39 A critical control system failure could halt production for weeks 40

Major construction materials companies have already faced significant disruptions, illustrating the sector’s vulnerability.41 The global financial impact from catastrophic OT cyber events could exceed $330 billion annually, with business interruption being the largest cost component. 42 This direct and indirect loss is often severely underestimated.42 To mitigate this risk, companies must invest heavily in OT security and compliance frameworks, such as ISA/IEC 62443.36. These mandatory expenses generate an irreducible “cyber risk premium” built into lumber pricing.

The Science of Wood: Innovation and Substitution

Technological innovation is creating new, high-value end-markets for wood fiber, supporting sustained demand resilience regardless of housing market cycles.

The Mass Timber Revolution (Science, High-Tech, Patent Analysis)

Mass timber products, particularly Cross-Laminated Timber (CLT), are revolutionizing construction. CLT is a sustainable material that substitutes high-embodied-energy products like steel and concrete.43 Its structural benefits include higher thermal resistance and faster construction due to prefabrication.43

The CLT market is experiencing explosive growth. Market analysts project a Compound Annual Growth Rate (CAGR) between 13.55% and 14.68% through 2034.45. Europe holds the largest global CLT market share at 45%, but North America accounts for 30% and is expanding rapidly.47 This growth is propelled by government policies and building code changes favoring green construction.44

Innovation and Patented Material Specialization (High-Tech, Patent Analysis)

Research and patent activity focus on enhancing wood products for specialized applications. Patents address the optimization of CLT panel structure, aiming to improve the stiffness-to-weight ratio.49 This design focus makes timber floor systems more competitive against conventional steel-concrete systems.49

Scientists are developing wood-based nanomaterials for high-tech uses, signaling a broader bioeconomy shift.50 Innovations include transparent wood substitutes for glass and biodegradable materials for electronics.50 This material science is enabling wood to displace fossil-based materials across diverse industrial sectors, including automotive and packaging.51 These high-value applications guarantee robust demand for high-quality wood fiber, maintaining a firm price floor.53

Digital technologies are also optimizing forest management itself. Drones and LiDAR (Light Detection and Ranging) provide precise, real-time data for resource assessment and inventory management.54 Furthermore, advanced logistics software is critical for optimizing wood flow and transportation to mills, potentially reducing delivered costs by up to 2.5%.56 These investments are necessary to mitigate chronic labor and logistics constraints.27

Table 3: Technological Drivers of Long-Term Wood Demand

| Technology Driver | Market Application | Growth Metric | Impact on Price/Demand |

| Mass Timber (CLT) | Multi-story commercial construction | 13.55%–14.68% CAGR (through 2034) 45 | Increases high-grade sawtimber demand; substitutes steel/concrete 43 |

| Precision Forestry | Forest assessment and logging | Drones/LiDAR for inventory optimization 54 | Mitigates labor risk; improves material utilization and supply certainty 28 |

| Materials Science | High-tech polymers/composites | Development of transparent wood, nanocellulose 50 | Creates new, high-value industrial markets for wood fiber 52 |

| Logistics Automation | Supply chain management | Advanced scheduling software; 2.5% reduction in delivered cost 56 | Reduces volatility caused by transportation bottlenecks 27 |

Financialization and Speculative Dynamics

The financial mechanisms surrounding lumber futures amplify price movements driven by policy and operational risks. Lumber futures contracts (LBS) trade on the CME, serving as the primary center for price discovery.59

Futures Market Volatility and Hedging (Economics, Financial Markets)

Lumber prices reached an all-time high of $1,711.20 per thousand board feet (MBF) in May 2021, demonstrating extreme volatility.1 Futures prices are sensitive to macroeconomic factors, including interest rates and housing starts, as well as policy factors like tariffs.60 This volatility creates substantial price risk for market participants, including sawmills, distributors, and home builders.62 Hedging instruments are essential for mitigating exposure to these sharp, sudden price shifts.62

Speculative Positioning and Market Amplification (Financial Markets)

Lumber, as a traded commodity, attracts significant speculative interest.61 Speculators, categorized in the Commitment of Traders (COT) report as Managed Money and Other Reportable, position themselves based on future price expectations.61 The use of unpredictable geopolitical policies, such as Section 232 tariffs, introduces supply shocks that generate high volatility.1

High volatility is intrinsically attractive to speculative capital. This non-commercial trading amplifies price momentum, often causing futures prices to temporarily detach from underlying physical market fundamentals.61 This dynamic accelerates the historical “boom and bust” cycles, making financial risk management increasingly critical for corporations exposed to the physical lumber market.62

Conclusion: Navigating the New Price Baseline

Lumber pricing has migrated from cyclical fluctuation to a structurally higher baseline. The convergence of macro-geopolitical mandates, chronic domestic supply deficits, and high-capital technological requirements dictates this new reality.

First, Geopolitical Permanence guarantees a durable cost floor. The use of national security law (Section 232) institutionalizes tariffs, eliminating hopes for a quick return to pre-tariff import prices.6

Second, Industrial Bottlenecks prevent an immediate domestic supply rebound. The crippling labor shortage – evidenced by the aging workforce and low sawmill utilization – forces expensive, long-term capital investment in automation.8 Climate change and cyber risk introduce additional, unavoidable supply volatility and cost premiums 31

Third, Technology-Driven Demand ensures long-term buoyancy. The exponential growth of mass timber (14%+ CAGR) and specialized bio-materials creates resilient, high-value demand that substitutes non-wood materials.45 This supports premium pricing for quality sawtimber.

Investors and corporate strategists must recognize that lumber price volatility remains high but oscillates around a significantly elevated mean. Future profitability depends on securing supply chain resilience through technology investment and sophisticated financial risk mitigation strategies.62 The era of cheap lumber is definitely over.

References

- Lumber – Price – Chart – Historical Data – News – Trading Economics

- Volatile Wood: Impact of Falling Lumber Prices | Chris Lehnes | Factoring Specialist

- Trump Goes After Imported Wood, Timber, Cabinets, and Upholstery With New Tariffs

- Section 232 Investigations – Bureau of Industry and Security

- Adjusting Imports of Timber, Lumber, and their Derivative Products into the United States

- How Court Rulings Could Affect Trump’s Aggressive Trade Policies

- U.S. Lumber Coalition Applauds President Trump’s Targeted Tariffs on Imports of Softwood Lumber Products into the United States – PR Newswire

- Does the US really need the Canadian wood products supply? – Fastmarkets

- Can the U.S. Lumber Industry Stand on Its Own? | NAHB

- Framing Lumber Prices – National Association of Home Builders | NAHB

- Canada drops 2 appeals of U.S. anti-dumping duties on softwood lumber – CTV News

- Canada’s Pivot: Indonesian Deal Could Unlock Timber Trade in SE Asia | Wood Central

- Trade wars and supply strains – navigating geopolitical headwinds in the timber market

- Global Softwood Lumber Trade Down in Early 2022 – ResourceWise

- Lumber Prices 2025: What They Reveal About Housing Starts and Interest Rates

- Timber prices set to rise with increased housing starts and investment: Timber outlook | 2025 preview – Fastmarkets,

- How do rising interest rates affect the construction industry? – Bridgit

- What Higher Interest Rates Mean for Construction Project Risk and Funding – CMiC

- Your New Home Just Got Pricier Thanks to Tariffs—Here’s the Eye-Opening Breakdown of Extra Costs

- Tariffs Could Mean Higher Prices for Your New Home—Here’s How – Investopedia

- Cost of Constructing a Home-2024 | NAHB

- Bearing Down on NAHB’s False Claims About Softwood Lumber Costs and Housing Prices. The National Association of Homebuilders

- NAHB’s top economist weighs tariffs, immigration, economics – National Mortgage News

- Trump sets 10% tariff on lumber imports, higher rates on wooden products – BNN Bloomberg

- Trump’s New Furniture Tariffs Are Lifting Some Stocks, Dragging Down Others

- U.S. Sawmill Production Capacity Constant in 2024 – Eye On Housing

- ICYMI: Timber prices went sky-high, but forestland owners won’t see a windfall

- Meeting America’s Forestry Workforce Needs – Forest Resources Association

- The Forest Industry Needs More Young Talent

- Three Lumber Traders Discuss Risks in the Market | Institutional Investor

- How can the forest sector respond to fires due to climate change?

- Climate change impacts on forestry – PNAS

- Timber Situation and 2025 Outlook | CAES Field Report – UGA

- Rising threats push industrial supply chains to adopt real-time monitoring and proactive cybersecurity practices

- What Is ICS (Industrial Control System) Security? – Fortinet

- Protecting pulp and paper mills from ransomware attacks – ABB

- Cyber insecurity: safeguarding the timber and wood products trade industry

- Ransomware Costs Manufacturing Sector $17bn in Downtime – Infosecurity Magazine

- 2025 OT Cyber Threat Report – Waterfall Security Solutions

- Defending pulp and paper mills from cyber threats | ABB

- Manufacturing Industry Faces Surge in Ransomware Attacks in 2024 | BlackFog

- Financial impact from severe OT events could top $300B | Cybersecurity Dive

- Structural Analysis and Design of Sustainable Cross-Laminated Timber Foundation Walls

- CLT & Mass Timber Popularity, Projects Take Off Across the Globe

- Cross Laminated Timber Market, Industry Size Forecast [Latest] – MarketsandMarkets

- Cross Laminated Timber (CLT) Market Size, Share, Growth Report

- Cross Laminated Timber Market Size, Growth and Forecast 2032 – Credence Research

- The cross-laminated timber market is forecast to more than triple by the end of the decade

- Cross-laminated timber structures having reduced inner-layer material and methods of optimization – Patsnap Eureka

- The Revolutionary Role of Wood in our Future – USDA

- Advances in Wood-Based Composites – PMC

- Wood-based alternatives to drive emission reductions and sustainable product innovation

- Emerging technologies open up a huge range of uses for wood – | European Forest Institute

- How Drones are Revolutionizing Forestry – Purdue Agriculture

- Seeing the Forest for the Trees: The Power of Drone LiDAR in Forestry Management

- Precision forestry: A revolution in the woods – McKinsey

- New research helps the forest industry integrate technology into business management

- Maximizing Timber Yields: Smart Logistics for Efficient Harvesting Operations

- Lumber Futures Price Today – Investing.com

- Volatility in Lumber Futures Markets – Impact Brief – Research – UGA CAES

- Why Do Lumber Prices Fluctuate?

- Hedging with Lumber futures – CME Group

- An introductory guide to random length lumber Futures and options – CME Group

- Commitment of Traders – CME Group

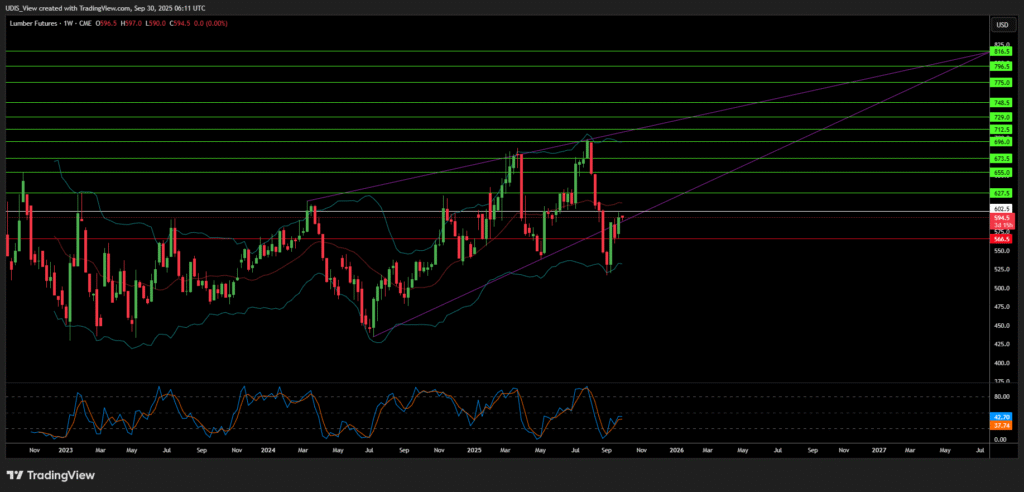

Lumber Long (Buy)

Enter At: 602.5

T.P_1: 627.5

T.P_2: 655.0

T.P_3: 673.5

T.P_4: 696.0

T.P_5: 712.5

T.P_6: 729.0

T.P_7: 748.5

T.P_8: 775.0

T.P_9: 796.5

T.P_10: 816.5

S.L: 566.5