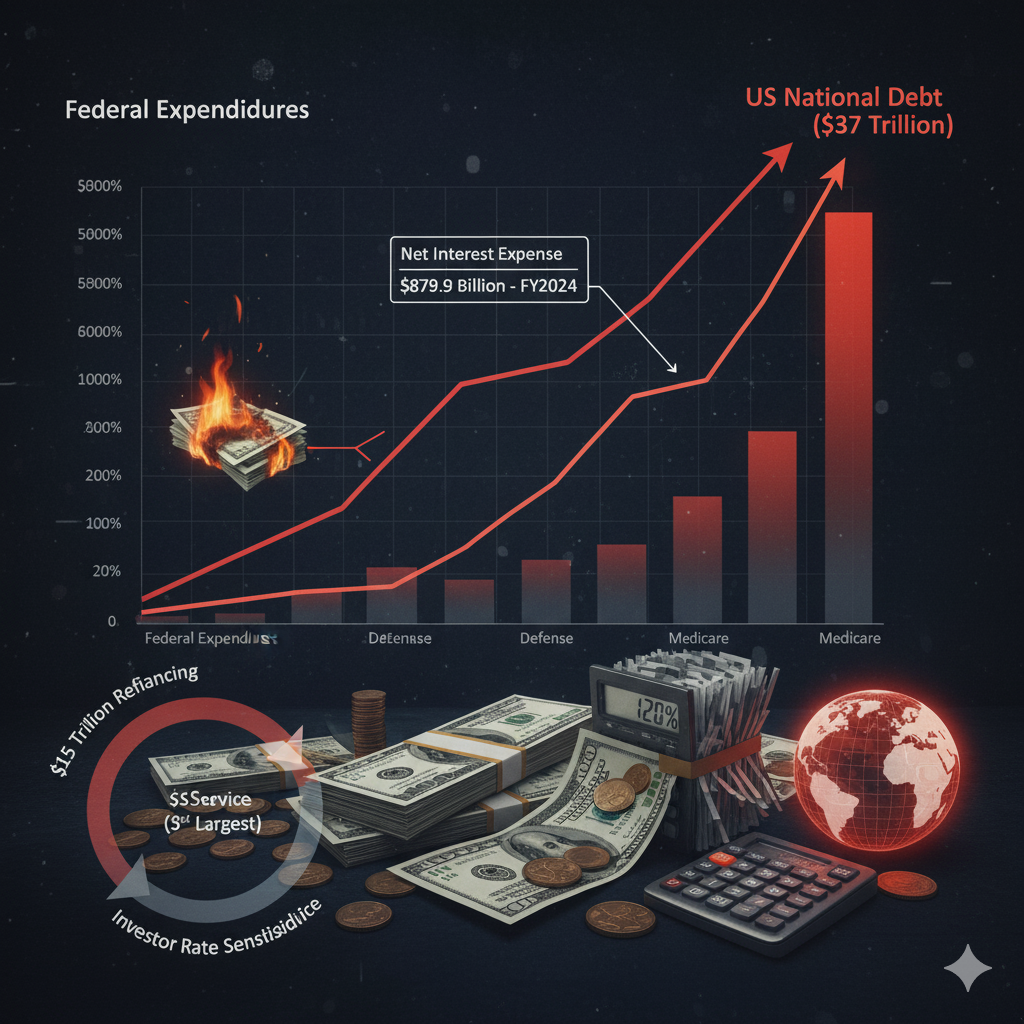

The U.S. national debt has crossed the historic $37 trillion threshold, representing a structural fiscalchallenge that extends far beyond domestic policy concerns. With the nation adding approximately$1 trillion to this debt every 100 days, the trajectory poses fundamental risks to both U.S. fiscalsolvency and global financial stability.

The Mathematics of Fiscal Stress

Chronic budget deficits represent the core driver of America’s debt acceleration. Structural spendingcommitments consistently outpace federal revenues, creating a persistent gap that has widenedsignificantly due to demographic pressures and policy responses to economic crises.

Net interest expense reached $879.9 billion in Fiscal Year 2024, making debt service the third-largestfederal expenditure – surpassing both national defense and Medicare spending. This represents acritical inflection point where debt service costs begin constraining other government priorities.

The debt-to-GDP ratio now approaches 120%, while approximately $15 trillion in Treasury bonds andshort-term debt requires refinancing by the end of 2025. This massive refinancing operation createsacute sensitivity to interest rate movements and investor confidence shifts.

Geopolitical Dimensions and Market Structure

Foreign ownership patterns of U.S. Treasury securities reveal important structural changes in globalfinance. China, historically the largest foreign holder of U.S. Treasuries, has systematically reduced its exposure amid broader geopolitical tensions. This trend forces greater reliance on domestic buyersand Federal Reserve intervention, potentially affecting Treasury yields and borrowing costs.

The shifting composition of Treasury holders creates both risks and opportunities. Reduced foreigndependency may insulate U.S. debt markets from geopolitical leverage, but it also concentratesrefinancing risk within domestic financial institutions and the Federal Reserve’s balance sheet.

Technology Sector Implications and Cybersecurity Costs

The intersection of debt policy with technology investment presents critical long-term considerations.Cybersecurity threats impose substantial and recurring costs on the U.S. economy, with estimatesranging from $57 billion to $109 billion annually as of recent assessments. Additionally, emergingdiscussions around state-backed digital currencies

could reshape how Treasury debt is financed andmanaged in future monetary systems.

High debt service costs risk crowding out essential research and development spending, particularlyin artificial intelligence, semiconductors, and other strategic technologies that underpin futureeconomic competitiveness.Federal R&D funding faces pressure from competing budgetary priorities,creating a potential feedback loop where reduced innovation investment weakens the revenue baseneeded to service existing debt.

Patent analysis and intellectual property protection become increasingly important as cyber thefttargets valuable proprietary data, , representing both current economic losses and future revenuestream risks.

Federal Reserve Policy Intersection

The Federal Reserve faces an increasingly complex mandate balancing inflation control with thegovernment’s financing needs.Current interest rates near 4.5% significantly impact the cost ofrefinancing existing debt, while monetary policy decisions must consider both economic growth andfiscal sustainability.

This dynamic creates tension between optimal monetary policy for price stability and thegovernment’s borrowing requirements, potentially constraining Fed independence in future policycycles.

Global Market Implications

U.S. Treasury securities serve as the global benchmark for risk-free assets, making America’s debtsustainability a systemic concern for international markets. Any erosion in fiscal credibility couldtrigger broader volatility in currency markets, emerging market debt, and global trade finance.

The dollar’s reserve currency status provides significant advantages in debt financing, but persistentdeficits and rising debt levels could gradually undermine this privilege, forcing higher risk premiumson U.S. borrowing.

Strategic Investment at Risk

Defense spending, infrastructure investment, and strategic technology development all compete withdebt service for federal budget allocation. As interest costs consume larger portions of federalrevenues, , the capacity to respond to national security challenges or invest in productivity-enhancinginfrastructure diminishes.

This creates potential national security implications where fiscal constraints limit policy flexibilityduring international crises or economic disruptions.

Market Outlook and Risk Assessment

The current trajectory suggests several key inflection points for financial markets:

- Treasury yield sensitivity to foreign buyer participation

- Federal Reserve balance sheet expansion requirements

- Crowding out effects on private investment

- Currency implications for trade and international reserves

Financial market participants should monitor Treasury auction results, foreign official institutionparticipation, and Federal Reserve policy communications for early indicators of stress in debtfinancing mechanisms.

Conclusion: Imperative for Structural Reform

The $37 trillion debt level represents more than a fiscal policy challenge – it constitutes a structuralthreat to long-term economic growth and global financial stability. With massive refinancingrequirements approaching and interest costs consuming increasing portions of federal revenues, policymakers face narrowing options for addressing the imbalance.

The intersection of fiscal policy, monetary policy, and geopolitical considerations requirescomprehensive reform approaches that extend beyond traditional budget reconciliation processes.Financial markets will likely remain sensitive to policy signals regarding long-term fiscal sustainabilityand structural spending reforms.

For investors and market participants, the debt trajectory represents both systemic risk and potentialopportunities in sectors positioned to benefit from eventual fiscal adjustment policies. The timelinefor addressing these structural imbalances may determine whether the adjustment occurs throughmanaged reform or market-imposed constraints.