Navigating Opportunity and Risk

Applied Optoelectronics, Inc. (AAOI) is a small-cap optical networking company undergoing a significant strategic pivot.1 The company’s goal is to capitalize on the explosive demand for high-speed data transmission driven by artificial intelligence (AI) and 5G network expansion.2 Its core strategy involves leveraging a vertically integrated business model and proprietary laser technology to win high-margin business from key customers.1 The bull case for AAOI hinges on its successful re-engagement with a major hyperscale customer, a strategic shift to higher-margin products like 400G and 800G transceivers, and a bold supply chain realignment.2

The bear case, however, focuses on significant financial vulnerabilities.6 These include persistent net losses, a heavy debt load, and ongoing share dilution.7 The company also faces a history of customer concentration risk.1 External scrutiny exists regarding the feasibility of its planned manufacturing expansion in Taiwan.10 The company’s trajectory is not a simple linear path. It presents a high-stakes, high-risk, high-reward investment proposition. The analysis below synthesizes these complex dynamics to provide a comprehensive, data-driven perspective for the discerning financial reader.

Key Financial and Performance Indicators (FY 2024)

| Metric | Value | Commentary |

| Revenue | $368.23 million 8 | Grew 77.94% year-over-year.8 |

| Gross Profit | $106.35 million 8 | Represents a gross margin of 28.88%.8 |

| Net Income | -$155.72 million 7 | Consecutive years of net losses.6 |

| EPS (Basic) | -$3.19 8 | Diluted by increase in shares outstanding.2 |

| Total Debt | $211.22 million 2 | Carries a significant debt load relative to market cap. |

| Shares Outstanding | 49 million 8 | Increased from 25 million in prior years.2 |

| Market Capitalization | ~$1.73 billion 11 | Small-cap valuation with potential for significant volatility. |

The Macroeconomic Engine: Geopolitics and Unprecedented Demand

The AI and 5G Catalyst

The global demand for high-speed data is experiencing unprecedented growth.3 This surge is driven by the rise of advanced AI technologies, expanding cloud computing services, and the worldwide deployment of 5G networks.3 This environment creates a powerful tailwind for companies that provide the foundational infrastructure for data transmission, like Applied Optoelectronics 1

The optical transceiver market is a central beneficiary of this trend.12 The market was valued at USD 13.6 billion in 2024 and is projected to grow to USD 25 billion by 2029, a CAGR of 13%.3 Hyperscale data centers, in particular, are at the forefront of this growth.3 The data center segment represents AAOI’s largest and fastest-growing market.14 Industry forecasts project massive expansion, with one source estimating India’s data center capacity will rise from 1.3GW to over 5GW by 2030.15 This growth directly fuels demand for high-data-rate components, specifically 100G, 400G, and 800G transceivers 3

Geopolitical and Strategic Shifts

The optical components industry is not immune to global geopolitical pressures.16 The industry relies on strategic materials, including rare earths and critical metals, whose supply chains are concentrated in a few countries, primarily China.16 This reliance creates a vulnerability to supply chain disruptions and trade tensions. Recent geopolitical concerns and export controls have already driven up prices for key optical materials, with hafnium prices skyrocketing by over 150% since mid-2022.17 These challenges push companies toward “re-shoring” production, even if it comes at a higher cost.17

Applied Optoelectronics has a global manufacturing footprint with facilities in the United States, Taiwan, and China.1 This geographic distribution is a key strategic advantage but also a source of risk.1 The company’s decision to maintain its US and Taiwan facilities while intending to sell its Chinese assets is a direct response to this geopolitical landscape.19 This supply chain pivot is not a simple operational decision. It is a long-term geostrategic play designed to build resilience and secure a competitive advantage.5 By focusing on domestic and allied manufacturing, AAOI positions itself to benefit from potential government incentives, like the US CHIPS Act, and to secure higher-margin contracts from top-tier customers who prioritize supply chain security.5 This move sacrifices short-term cost advantages for long-term security and premium market access. It is a strategic effort to mitigate risks from tariffs and supply chain volatility.

The Business of Applied Optoelectronics

Who Are the Customers?

AAOI serves three primary end-markets: data centers, telecommunications, and cable television (CATV).1 The data center market has emerged as the company’s largest and fastest-growing segment.14 It accounted for 79.39% of AAOI’s revenue in 2024.14. The company’s customers include leading hyperscale data center operators like Amazon, Facebook, and Microsoft.6 A major development in the company’s growth narrative is the re-engagement of a key hyperscale customer.2 This relationship is significant as it resulted in the first volume shipment of a 400G datacenter transceiver.2 This development is particularly notable given the company’s history; in 2017, the loss of a major customer, believed to be Amazon, caused its stock to be “crushed.”.2 This renewed business signals a potential return to growth but also highlights the persistent risk of customer concentration.1 The company’s CATV business also generates substantial revenue.2 It experienced an “eightfold increase” year-over-year in Q2 2025.21

Market Position and Competition

The global optical components market is highly competitive and fragmented.22 While the provided data does not give a specific market share for AAOI, it does identify a formidable list of competitors.11 The main competitors include Coherent, Lumentum Holdings, Broadcom, Huawei, and ZTE Corporation.22 In Asia, these companies dominate the market.22 The Asia-Pacific region holds the largest share of the passive optical components market, driven by rapid urbanization and aggressive 5G deployment in countries like China and Japan.22

Applied Optoelectronics’ strategic plan is not to compete broadly on market share against these giants.21 Instead, it aims to “bite” into the market by focusing on high-margin, high-tech segments.2 Its strategy involves scaling up production of advanced 800G and 1.6T products.2 The company is also leveraging a key partnership with Lumentum for AI-driven 400G/800G transceivers.22 This move strengthens its position in high-capacity, passive optical component solutions for hyperscale data centers 22

Technological Advantage and Innovation

Vertical Integration as a Strategic Moat

Applied Optoelectronics employs a vertically integrated business model.1 This means the company designs, manufactures, and sells its products in-house.1 This approach contrasts with the “fabless” model used by many competitors.24 AAOI controls key steps in the production process, from semiconductor laser chip fabrication to final module assembly.4 This in-house manufacturing, particularly of critical laser components, is a key competitive advantage.4 It provides superior quality control, reduces production costs, and accelerates the time-to-market for new products.1

While vertical integration provides a strategic moat, it also presents a significant weakness.4 The model requires substantial capital investment in fabrication facilities.4 This financial strain contributes to the company’s persistent net losses and high debt levels.6 The company’s financial state, therefore, is a direct consequence of its strategic decision to build and maintain its own manufacturing capabilities.

The Technology Stack

AAOI’s technological advantage centers on its proprietary laser technology.1 The company manufactures advanced optical devices, including laser diodes, photodiodes, and transceivers, using specialized semiconductor technology.26 These components form the backbone of its high-speed optical transceivers for data centers and 5G networks.1 The company’s product portfolio includes high-performance QSFP-DD, QSFP, SFP, and OSFP modules supporting speeds of 100G, 400G, and beyond.28 The company is actively working on 800G and 1.6T products, with a major hyperscale customer having completed a factory audit for 800G production approval.2 This shows a direct alignment between R&D, customer needs, and production plans.

The company’s in-house semiconductor fabrication facility in Sugar Land, Texas, uses advanced Molecular Beam Epitaxy (MBE) and Metal Organic Chemical Vapor Deposition (MOCVD) techniques for laser production.4 This deep knowledge in laser diode design and high-volume semiconductor fabrication allows for the development of high-performance, power-efficient transceivers tailored to the high-data-rate needs of modern networks.4

Alternative Technologies on the Horizon

The market for optical components is dynamic and constantly evolving.12 While pluggable transceivers are currently the standard, emerging technologies like Co-packaged Optics (CPO) pose a significant long-term challenge.31 CPO integrates optical components directly with the switching ASIC, dramatically reducing the length of electrical connections.31 This leads to significantly lower power consumption, improved signal integrity, and higher throughput potential.31 This technology is gaining attention for high-performance computing, AI clusters, and hyperscale data centers, where traditional pluggable modules are beginning to reach their limits.31

This development represents a clear threat to AAOI’s core business model. However, AAOI is also positioned to benefit.2 The company’s deep expertise in laser diodes and optical components could allow it to pivot from a pluggable transceiver manufacturer to a key supplier of the optical engines required for CPO solutions.2 The company recognizes the advent of CPO as being “broadly expected to be highly beneficial for Applied Optoelectronics.”.2

The Foundation: Patents, Funding, and Financials

Intellectual Property and Legal Defense

A company’s intellectual property (IP) is a critical asset, especially in the high-tech sector.34 AAOI has invested significantly in developing its technology and building a substantial IP portfolio.35 This portfolio includes over 200 engineering patents, with 48 active patents in optical networking technology as of a 2022 analysis.36 The company’s IP is not merely a theoretical asset; it is an actively defended one.34

AAOI has initiated legal proceedings against competitors, including Cambridge Industries USA (CIG) and Eoptolink Technology USA, for patent infringement.34 The lawsuits assert that the competitors’ optical transceiver modules have unlawfully replicated AAOI’s patented technologies.34 These actions indicate the company’s belief in the value of its technology and its commitment to enforcing its IP rights.37 For investors, these lawsuits are a strong signal that AAOI views its patents as a defensible competitive moat.

Financial Health and Capacity

Applied Optoelectronics has consistently reported net losses despite impressive top-line revenue growth.7 The company’s financial performance shows a pattern of significant deficits.6 The Q2 2025 non-GAAP net loss was $10.9 million, though revenue more than doubled year-over-year to $103 million.21 This financial weakness raises concerns about long-term sustainability and the ability to fund R&D and expansion without seeking additional capital.6

The company has raised capital through at-the-market (ATM) equity offerings, which generated approximately $196 million in net proceeds.14 While this provides funding for capacity expansion, it also significantly dilutes existing shareholders.2 The company’s share count has grown from 25 million to 62 million in recent years.2 AAOI also carries a substantial debt load, totaling over $211 million.2 The company’s capacity includes a global workforce of 3,309 employees as of December 2024, an increase of 54% from the previous year.18 Its manufacturing facilities are located in Texas, China, and Taiwan.1

The company’s expansion plans in Taiwan are a key point of both optimism and contention.10 An SEC filing from September 2025 confirms AAOI signed a 15-year lease for a large facility in New Taipei City, with a two-month renovation period scheduled to begin in September 2025.39 The company aims to increase its production of 800G and 1.6T products.2 However, some external reports have expressed skepticism, claiming the Taiwan site is an “empty lot with unfinished construction” and labeling the 800G production story as an “optical illusion.”.10 This direct contradiction in the public narrative is a central risk factor for any investor.

Conclusion and Outlook

SWOT Analysis

| Strengths | Weaknesses |

| Vertically integrated business model 1 | Financial instability (net losses and debt) 7 |

| Proprietary laser technology 1 | Share dilution from equity offerings 2 |

| Re-engaged hyperscale customer 2 | Customer concentration risk 1 |

| Global manufacturing footprint in strategic locations 1 | Supply chain contradictions and scrutiny 10 |

| Active and well-defended patent portfolio 34 | Intense competition leading to pricing pressure 1 |

| Opportunities | Threats |

| Explosive growth in AI, 5G, and data centers 3 | Geopolitical and tariff risks affecting supply chains 16 |

| Strategic supply chain realignment to mitigate risk 5 | Rapid technological obsolescence (CPO) 31 |

| Potential for government incentives (CHIPS Act) 10 | Volatility of customer demand 35 |

| Niche dominance in high-speed, high-margin modules 2 | Short-seller scrutiny and market sentiment swings 10 |

Can AAOI Be a Major Player?

The analysis suggests Applied Optoelectronics is not destined to be a broad market leader on par with giants like Broadcom or Lumentum. However, it is a key, niche player in critical, high-growth market segments. Its vertical integration and proprietary technology give it a unique position to win high-value contracts from top-tier hyperscalers that require advanced, secure, and custom-engineered solutions.4 The company’s future as a “major player” hinges on its successful execution of a strategic pivot to high-margin 800G production, the smooth operationalization of its new Taiwan facility, and a financial turnaround to achieve consistent profitability.39

The Investment Thesis

Investing in Applied Optoelectronics is a high-stakes bet on the company’s ability to execute a complex strategic plan under intense scrutiny. The company is at a critical inflection point. The bull case rests on the company’s ability to successfully ramp 800G production and have the new Taiwan facility become fully operational.2 If the re-engaged hyperscaler customer contract delivers consistent, high-margin revenue, this could lead to a rapid financial turnaround and significant stock appreciation.2

The bear case, however, presents a significant counter-narrative.10 The manufacturing expansion could falter, customer concentration may prove to be an insurmountable risk, and financial vulnerabilities could lead to further share dilution or prevent future R&D.2 In this scenario, the stock’s recent run-up may indeed prove to be an “optical illusion”.10 The evidence supports both a compelling upside and a significant downside, positioning AAOI as a classic high-risk, high-reward investment.

Refferences

- Applied Optoelectronics, Inc. (AAOI) Business Profile

- Applied Optoelectronics AAOI introduction – Saul’s Investing

- Optical Transceiver Market Size, Share, Industry Report 2030 – MarketsandMarkets

- Applied Optoelectronics, Inc. (AAOI): history, ownership, mission, how it works & makes money – dcfmodeling.com

- Applied Optoelectronics (AAOI): Valuation Insights Following Launch of New AI-Driven Software Modules – Simply Wall St News

- Decoding Applied Optoelectronics Inc (AAOI): A Strategic SWOT Insight – GuruFocus

- Applied Optoelectronics Inc Financials – AAOI – Morningstar

- Applied Optoelectronics (AAOI) Financials – Income Statement – Stock Analysis

- Applied Optoelectronics | AAOI – Debt – Trading Economics

- Applied Optoelectronics (AAOI): An Optical Illusion Ready to Shatter | by BMF Reports

- Applied Optoelectronics 2025 Company Profile: Stock Performance & Earnings – PitchBook

- Optical Transceiver Market Size, Share, Analysis & Forecast – Verified Market Research

- Powering the US Data Center Boom: Why Forecasting Can Be So Tricky

- AAOI Primer – Pinegap – AI

- A Rs 5 lakh crore data centre play sparks a multibagger chase on D-Street. Where should investors look?

- DOSSIER Geopolitical Issues of Optics: A Strategic Industry – Eyes-Road

- Increasing Challenges for Sourcing Laser Optics Materials

- Applied Optoelectronics Inc Company Profile – Overview – GlobalData

- Applied Optoelectronics Vendor Summary Report – Cignal AI

- Applied Optoelectronics Inc Customers by Division and Industry – CSIMarket

- Applied Optoelectronics (AAOI) Earnings Call | The Motley Fool

- Passive Optical Components Market Size, Share, Growth Trends

- Fiber Optic Components Market Size, Share, Industry Trends, 2025

- Comparing The Costs Of In-House Vs. Outsourced Laser Cutting Services – Hflaser

- In-house production – Canon Global

- Applied Optoelectronics, Inc. AOI – Semiconductor Materials and Equipment

- Advanced Optical Components: TO, TOSA, ROSA, and BOSA – AOI

- Optical Transceivers: QSFP, OSFP, SFP & More – AOI – Applied Optoelectronics

- Datacenter Optical Solutions: A New Era of Networking – AOI – Applied Optoelectronics

- Lasers, Optical Transceivers & HFC Networks – AOI

- Co-Packaged Optics: Redefining Interconnects with Precision Testing – santec

- Co-packaged optics (CPO): status, challenges, and solutions – PMC – PubMed Central

- North America Co-Packaged Optics Market Size to Hit USD 385.12 Million by 2034

- AAOI Takes on CIG in Patent Infringement Lawsuit – Patexia

- Applied Optoelectronics Filed Patent Infringement Lawsuit Against CIG – Public now

- Applied Optoelectronics, Inc. (AAOI): VRIO Analysis [Jan-2025 Updated] – dcfmodeling.com

- Applied Optoelectronics Filed Patent Infringement Lawsuit Against Eoptolink Technology USA Inc.

- Applied Optoelectronics (AAOI) Number of Employees – Stock Analysis

- Applied Optoelectronics signs 15-year lease for New Taipei City facility

- Applied Optoelectronics, Inc. Common Stock (AAOI) SEC Filings – Nasdaq

- Applied Optoelectronics Reports Third Quarter 2024 Results

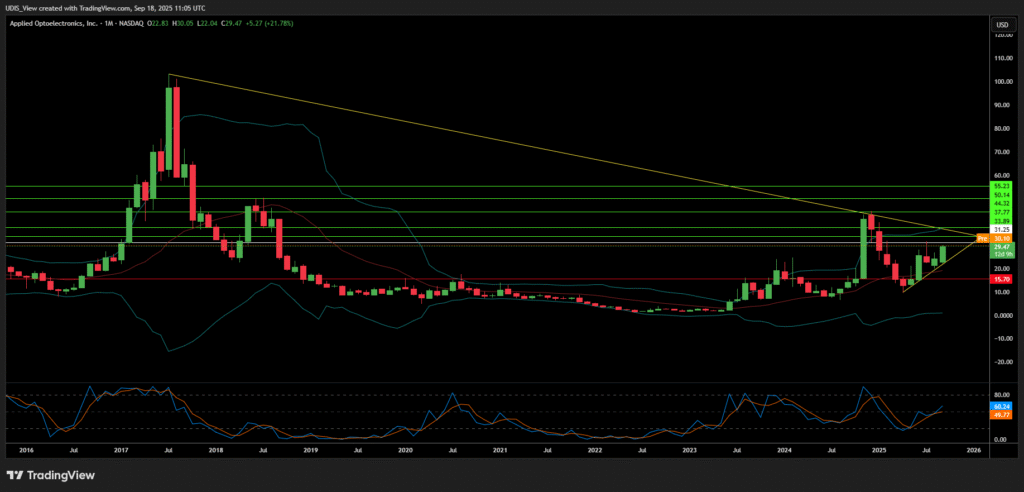

Applied Optoelectronics Long (Buy)

Enter At: 31.25

T.P_1: 33.89

T.P_2: 37.77

T.P_3: 44.32

T.P_4: 50.14

T.P_5: 55.23

S.L: 15.70