The investment landscape has fundamentally transformed, presenting investors with a critical juncture. The ERShares Private-Public Crossover ETF (XOVR) is leading this evolution, pioneering a structure that blends public and private markets into a single, transparent vehicle. XOVR’s unique approach democratizes access to a class of high-growth, pre-IPO companies previously reserved for institutional players and accredited investors. The fund’s recent outperformance and rapid asset growth confirm a powerful market demand for this strategy, which identifies and invests in category-defining innovators with significant geopolitical and technological relevance.

A New Era of Investment: Blending Public and Private Markets

XOVR ETF represents a paradigm shift in financial products. It is the first ETF to offer retail investors direct access to private equity, bridging the $13 trillion public and private markets. The fund’s core mission is to level the playing field, providing retail investors with the same opportunities as institutional players. This innovative structure is built on a proprietary foundation developed over two decades by Dr. Joel Shulman, the CEO and CIO of ERShares. This methodology, the “Entrepreneur Factor,” powers the ER30TR Index, which forms the majority of XOVR’s portfolio.1

The Entrepreneurial Advantage

The fund’s strategy focuses on identifying entrepreneurial U.S. large-cap companies. The ER30TR Index, which accounts for over 85% of the fund’s weight, has a proven track record of finding transformative companies.1 Notably, the index was an early investor in all of the original “Magnificent 7” securities during their formative growth stages, including NVIDIA. This demonstrates the predictive power of the Entrepreneur Factor, which seeks to identify companies poised for unique cost efficiencies and demand explosions through disruptive innovation.2

A Strategic Pivot Drives Growth

The fund’s recent success is directly tied to a strategic pivot. Relaunched on August 29, 2024, with its new ticker symbol XOVR, the fund changed its implementation strategy.1 The previous fund, ENTR, was an actively managed ETF that held up to 93 equities and significantly underperformed the ER30TR Index since its inception in 2017.1. The new strategy, which concentrates the portfolio into the 30 companies of the ER30TR Index and adds select private equity holdings, is the direct cause of the fund’s dramatic turnaround.1 This strategic repositioning, not a random market trend, has attracted a flood of new capital, with the fund raking in more than $120 million in flows since the initial SpaceX investment. The fund’s AUM has since grown to over $481 million.3

The Bridge to Private Markets

The fund’s structure elegantly addresses the historical limitations of private equity. Historically, private companies are less liquid, less transparent, and require significant capital commitments from accredited investors. By blending a minority of private holdings into a majority public portfolio, XOVR provides investors with diversified, liquid access to high-growth private companies in a transparent vehicle. This structure allows for daily trading at the fund’s net asset value (NAV), with no minimum investment.1 The following table illustrates how the XOVR ETF bridges the gap between these two previously disconnected markets.

| Public Markets | Private Markets | The XOVR Thesis | |

| Liquidity | High | Low | Provides daily liquidity through a public ETF structure. |

| Transparency | High (Daily prices, public filings) | Low (Infrequent valuations) | Offers transparency with daily NAV calculations and portfolio disclosures. |

| Investor Access | Open to all | Restricted to accredited investors | Democratizes access for retail investors. |

| Valuation | Often based on short-term sentiment | Based on long-term growth and fundamentals | Combines public market volatility with private valuations based on long-term conviction. |

| Wealth Creation | A portion occurs post-IPO | Much of it occurs pre-IPO | Captures wealth creation at the critical pre-IPO stage. |

The Geostrategic Nexus: Why Space and Defense Matter

XOVR’s strategic value extends beyond a simple financial structure. Its recent investments in SpaceX and Anduril Industries signal a calculated bet on a new, privately driven defense industrial base. These companies operate at the convergence of technology, national security, and global strategy. They are not merely technology firms; they are critical players in a shifting geopolitical landscape.

Starlink: The Digital Lifeline of Modern Conflict

Starlink has evolved into an indispensable geostrategic asset. The war in Ukraine serves as the primary example of its dual-use nature, functioning as a critical communications backbone for the Ukrainian military where traditional infrastructure is destroyed 4 Ukrainian forces rely on Starlink for real-time intelligence gathering, drone operations, and battlefield coordination.5 This strategic utility has cemented SpaceX’s importance far beyond its commercial satellite internet business.4 The fund’s investment in SpaceX is not about “fleeting popularity,” but about a core holding that “redefines industries”.

However, this reliance on a private company carries significant risks. A global Starlink outage on September 15, 2025, underscored these vulnerabilities, temporarily disrupting Ukrainian military drone operations amid potential solar activity.4 The incident highlighted an over-reliance on a single provider for critical connectivity in a conflict zone.5 Furthermore, Elon Musk has faced criticism for personally imposing restrictions on the use of Starlink for offensive military operations, a move that blurs the lines between private corporate control and national military affairs.4 This dynamic reinforces the strategic complexity of XOVR’s conviction-based investment.

Anduril: The Arsenal of Tomorrow

Anduril Industries represents a foundational shift in defense technology. The company was founded to “radically transform the defense capabilities of the United States and its allies” by fusing artificial intelligence with advanced hardware.6 Anduril’s business model is a direct challenge to the traditional defense contracting industry. It privately funds its own research and development and operates with a “product-first” strategy, building viable technologies before the customer-specific requirements process begins.7 This approach contrasts sharply with the slow, process-driven structure of legacy contractors, enabling rapid product development and deployment at “machine speed”.8

The U.S. Army’s award of a $159 million contract to Anduril for the Soldier Borne Mission Command (SBMC) program validates this disruptive model.9 This contract is for a generational leap in capability, a night vision and mixed reality system that fuses battlefield data with AI to give soldiers “superhuman perception”.9 The SBMC system, built on Anduril’s Lattice platform, allows a single human operator to command and coordinate a range of autonomous assets.10 This contract signifies that the U.S. military is actively embracing agile, software-centric defense solutions.11 The fund’s investment in both SpaceX and Anduril is a clear and deliberate bet on the future of national security, where global power and economic value are tied to the privatization of strategic capabilities and the speed of innovation.

The Engine of Growth: Technological and Economic Forces

XOVR’s investment thesis rests on identifying companies with multifaceted moats – advantages in technology, economics, and intellectual property. The fund’s two largest private holdings, SpaceX and Anduril, exemplify this strategy.

High-Tech and Science Prowess

SpaceX’s technological leadership is founded on two core innovations: reusable rocketry and its LEO satellite constellation. The company has made the Falcon 9 booster recovery system exceptionally reliable, with an ambitious goal to fly a single booster up to 40 times.12 The Starship, once fully operational, would be the first “fully reusable orbital rocket,” drastically reducing launch costs.13 This reusability is the economic engine that makes the mass deployment of the Starlink constellation financially viable.14 Starlink’s architectural superiority stems from its low-Earth-orbit altitude of 550 kilometers, which provides significantly lower latency than traditional geostationary satellites.14 The constellation employs advanced features like autonomous collision avoidance and optical space lasers for truly global data transmission without reliance on local ground stations.14 SpaceX is also developing a direct-to-phone service, an innovation that could bypass regional telecom carriers and fundamentally reshape global connectivity.15 This capability challenges the existing telecom industry and could accelerate the adoption of next-generation applications worldwide 15

Anduril’s core technology is the Lattice AI platform. This is not a single product, but an “AI-powered, open operating system” that serves as the central nervous system for a family of autonomous defense systems.8 Lattice autonomously processes and fuses data from various sensors to provide a unified operational picture for human operators.10 It can dynamically react to real-time inputs and execute missions at machine speed, an essential capability in highly contested environments.10 The platform’s open architecture allows it to integrate with systems from different vendors, creating a scalable, interoperable ecosystem.16 Partnerships with tech giants like Oracle and Meta further demonstrate Anduril’s ambition to build a new standard for defense technology, moving beyond single-use products to a comprehensive, extensible platform.9

The Moat of Innovation: Patent and Intellectual Property Analysis

SpaceX has constructed a robust competitive moat through its intellectual property. The company holds a total of 202 patents globally, with 179 of them active.17 The United States is its primary R&D center and the location for the majority of its patent filings.17 These patents cover critical technologies, including satellite design, propulsion, and advanced antenna systems.18 This patent portfolio acts as a strategic asset that secures a competitive advantage and creates significant barriers for competitors who would attempt to replicate its satellite network and manufacturing scale.18 The strength of this portfolio is evident in public records: examiners at the USPTO have cited SpaceX’s patents to reject similar inventions from other companies, including Texas Instruments and Samsung 17

Anduril’s intellectual property strategy is similarly aggressive, though less transparent due to its private status. Its focus on privately funded R&D and a software-first approach suggests a strategy of building a proprietary IP ecosystem around the Lattice platform. This is further reinforced by its history of inorganic growth, acquiring seven companies over the past five years to integrate their autonomous weapons, command and control (C2), and surveillance technologies into its core software.7 This dual strategy of internal development and strategic acquisitions enables Anduril to create a defensible and continuously evolving IP moat.

Fund Performance and Market Dynamics: A Data-Driven Perspective

The fund’s financial performance and market reception provide a compelling validation of its strategic thesis. The fund’s growth is a direct consequence of its high-conviction investment strategy, not a coincidental market trend.

The Impact of Conviction: AUM Growth and Cash Inflows

The fund’s assets have grown dramatically, now standing at approximately $481.5 million.3 A significant portion of this growth, over $120 million, has arrived since the fund’s initial SpaceX investment was announced. This capital infusion is a clear market response to the fund’s ability to secure access to elite private companies. This growth demonstrates that investors are actively seeking exposure to high-growth private innovators and view XOVR as the optimal vehicle for this purpose.

Dispelling Misconceptions

ERShares has been transparent in its conviction and firm in its rebuttal of market speculation. The firm’s leadership has directly refuted claims that the fund would trade small portions of its private holdings to publish prices. Dr. Joel Shulman called such suggestions “misguided” and a reflection of a “superficial grasp of how private markets operate”. He states that ERShares builds positions in companies that “redefine industries,” not for fleeting popularity. The fund’s decision to increase its SpaceX position at $185 per share further affirmed this conviction-based approach, rejecting market speculation and demonstrating confidence in the company’s valuation.

Performance Metrics and Risk Profile

XOVR’s performance metrics validate its strategy. The fund has outperformed its benchmark and peers across multiple timeframes. Over the past year, its total return (NAV) was 33.46%, significantly surpassing the Morningstar US LM Brd Growth TR USD Index return of 26.48%.19 Its three-year annualized return of 28.11% also exceeds the index’s 26.36% and the Large Growth category average of 20.00%.19

While the fund’s performance is strong, it is important to acknowledge its risk profile. The fund is “non-diversified” and holds a high concentration of its assets in its top ten holdings, which account for over 50% of the portfolio.3 This concentration is a deliberate design choice, not a weakness. It is the very mechanism through which the fund generates outsized returns, allowing it to take high-conviction positions in companies it believes have the potential to drive multi-domain disruption and value creation.

The Outlook: A Vanguard for the Next Decade

XOVR is more than an investment vehicle. It is a vanguard for a new era of capital allocation, one that recognizes the diminishing line between public and private enterprise. The fund’s success is a direct result of its proprietary model, its strategic focus on geostrategically relevant companies like SpaceX and Anduril, and its unique ability to democratize access to pre-IPO opportunities.

The fund is not merely following innovation; it is positioning investors at its source. By leveraging the Entrepreneur Factor, XOVR aims to uncover the “next generation of disruptive companies,” those with the potential to become the next Magnificent 7. This focus on fundamental innovation, fortified by intellectual property and strategic importance, provides a compelling thesis for long-term value creation. XOVR’s model represents a fundamental shift in how investors can participate in the value creation that was once reserved for the privileged few.

References

- XOVR ETF – ERShares

- XOVR – ERShares

- Charles Schwab

- Starlink Outage Disrupts Ukraine’s War Efforts Amid Solar Flare Fears – WebProNews

- Starlink Global Outage Hits Ukraine Drones Amid Solar Storm – WebProNews

- Palmer Luckey – Anduril

- Anduril: A Persistent Product-First Strategy

- Anduril: Transforming US & allied military capabilities with advanced technology

- Anduril Awarded Contract to Redefine the Future of Mixed Reality

- Mission Autonomy | Anduril

- Army awards more than $350M in contracts for Soldier Borne …

- Starship Flight Secrets Revealed & Future of Starbase! – YouTube

- SpaceX Starship – Wikipedia

- How Does Starlink Work? – Clarus Networks

- Elon Musk announces Starlink breakthrough: Phones to connect directly to satellites in 2 years

- Lattice Partner Program – Anduril

- SpaceX Patents – Insights & Stats (Updated 2024)

- The Role of Patents in SpaceX’s Satellite Network Technology Success – PatentPC

- ERShares Private-Public Crossover ETF XOVR Performance – Morningstar

- ERShares Private-Public Crossover ETF XOVR Risk – Morningstar

- XOVR ERShares Private-Public Crossover ETF – ETF Database

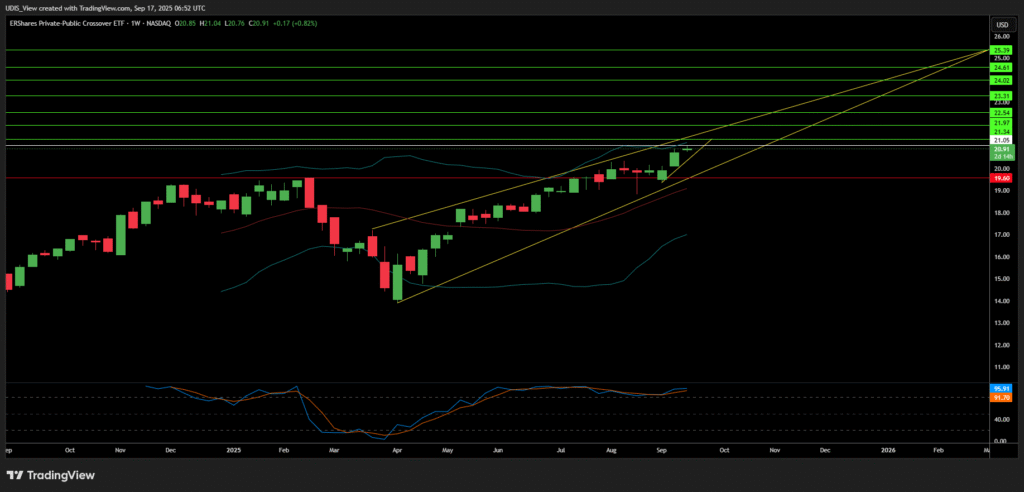

XOVR Long (Buy)

Enter At: 21.05

T.P_1: 21.34

T.P_2: 21.97

T.P_3: 22.54

T.P_4: 23.31

T.P_5: 24.02

T.P_6: 24.61

T.P_7: 25.39

S.L: 19.60