Applied Digital Corporation has captured significant market attention, with its shares surging over 280% in the last year.1 This dramatic increase reflects a fundamental shift in its business model, moving away from its origins in cryptocurrency mining infrastructure toward the high-growth sector of high-performance computing (HPC) and artificial intelligence (AI). This strategic pivot, combined with a confluence of favorable macroeconomic, geostrategic, and technological factors, has redefined the company’s valuation narrative and positioned it as a key player in the accelerating AI infrastructure race.

A Strategic Pivot: From Crypto to AI Factories

Applied Digital, originally known as Applied Blockchain, Inc., made a deliberate change in its business model and identity in November 2022.2. The company transitioned from a focus on crypto mining hosting to building next-generation digital infrastructure for AI and HPC industries.1 This evolution is both strategic and necessary. While the company still provides infrastructure services to its legacy Data Center Hosting business, which primarily serves a single crypto-mining customer, the future revenue drivers are firmly in the HPC segment.4

The company’s new business segment, HPC Hosting, focuses on designing, constructing, and operating data centers specifically for high-power-density applications like AI.4 This segment, which currently has one major customer, is expected to generate revenue once the Polaris Forge 1 campus becomes operational.4 This pivot fundamentally de-risks the company by shifting from the volatile, singular demand of cryptocurrency to the stable, long-term contracts of the AI sector.5 The company reported fiscal 2025 revenue of $144.2 million, with the majority still coming from its Data Center Hosting segment, but the transition is well underway.4

The Global Infrastructure Imperative: Macroeconomic Catalysts

The explosive demand for AI computing is the primary macroeconomic force behind Applied Digital’s growth. The global AI market is projected to reach $500 billion by 2027, driven by increasing adoption across industries such as healthcare, finance, and manufacturing.4 The AI data center market is experiencing even more rapid growth, forecasted to expand from $17.54 billion in 2025 to approximately $165.73 billion by 2034, representing a robust CAGR of 28.34%.6

This growth is fueled by massive capital expenditure from “hyperscalers,” the world’s largest technology companies. Microsoft has committed an $80 billion investment for fiscal 2025 in AI-enabled data centers, while Google and Meta have committed tens of billions.7 These companies require a new class of digital infrastructure. AI queries demand 15 times the electricity of traditional queries, and modern server racks now exceed 50 kilowatts in power density.4 A critical market imbalance exists: less than 10% of current data centers can support this level of density, creating a significant growth opportunity for specialized providers like Applied Digital.4 The company is not just a beneficiary of this boom; its purpose-built infrastructure is a direct solution to an industry-wide power and density problem.

The following table provides a clear overview of the market opportunity and how it relates to Applied Digital’s current position.

| Metric | Value | Source |

| Global AI Market Size (2027 Projection) | $500 Billion | 4 |

| Global AI Data Center Market Size (2025) | $17.54 Billion | 6 |

| Global AI Data Center Market Size (2034) | $165.73 Billion | 6 |

| Projected CAGR (2025-2034) | 28.34% | 6 |

| Hyperscaler Capex (Microsoft, 2025) | $80 Billion | 7 |

| Hyperscaler Capex (Google, 2025) | $75 Billion | 7 |

| APLD Contracted Revenue (CoreWeave) | $11 Billion | 8 |

Geostrategic Positioning and Operational Advantage

Data centers have evolved from simple server rooms into strategic assets, equivalent to power plants or ports.9 Geopolitical competition over AI and its underlying infrastructure has intensified, with nations implementing policies to keep sensitive data within their borders.9 The United States government’s “Winning the Race: America’s AI Action Plan” includes policies designed to accelerate data center construction and streamline permitting.10 Applied Digital’s strategic location and operational model align directly with this geostrategic imperative.

Traditional data center hubs, such as Northern Virginia, are increasingly constrained by power availability and grid strain.11 Applied Digital’s choice to build its Polaris Forge campus in North Dakota is a deliberate and multi-faceted response to these challenges.13 The location provides a significant operational advantage: the naturally cold climate offers over 220 days of “free cooling” per year, a stark contrast to the 95 days in Texas or 174 days in Northern Virginia.12 This natural advantage enhances cooling efficiency and reduces energy costs and environmental impact, which helps the company achieve a low Power Usage Effectiveness (PUE) metric.8

The company’s approach to power delivery is a key differentiator. The Polaris Forge campus is situated near abundant, underutilized “stranded power” from renewable sources, particularly wind.12 Renewable generation has outpaced transmission capacity in many regions, creating an opportunity for data centers to access low-cost energy that others cannot.12 Applied Digital’s model of bringing the data center to the power source provides it with a cost-effective and sustainable energy supply.15 This win-win scenario also helps to stabilize the grid by utilizing otherwise curtailed power.12 The synergy between a geostrategically advantageous location and a proprietary, inside-out design creates a high barrier to entry for competitors.

| Location | Free Cooling Potential (Days/Year) | Grid Stability | Access to “Stranded Power” |

| North Dakota | 220+ | Exports 33% of generated power | Abundant stranded wind power |

| Texas | 95 | Least stable grid; 13% of US outages | Not a key strategy |

| Northern Virginia | 174 | Power constrained; uses more than it generates | Not a key strategy |

| Source | 12 | 12 | 12 |

The CoreWeave Catalyst and Competitive Landscape

The single most significant factor driving Applied Digital’s stock performance is its partnership with CoreWeave. Applied Digital finalized a new lease agreement with CoreWeave, an “AI Hyperscaler,” for an additional 150 MW at its Polaris Forge 1 Campus in North Dakota.16 This brought the total anticipated contracted lease revenue to approximately $11 billion over the 15-year term, with a total critical IT capacity of 400 MW.4

This long-term, high-value contract provides Applied Digital with a substantial backlog and unprecedented revenue visibility, which fundamentally de-risks its business model.5 The CoreWeave deal is a multi-phased project. The first 100 MW data center is scheduled to be operational in the fourth quarter of 2025, with a second 150 MW facility in mid-2026, and the third 150 MW facility in 2027.16 This phased buildout allows for a predictable ramp-up of revenue. The company has also completed diligence and onboarding with two additional North American hyperscalers, signaling its potential for further customer diversification 17

| Phase | Critical IT Load (MW) | Anticipated Contracted Revenue | Expected Operational Date |

| 1 | 100 | Part of $7B total 8 | Q4 2025 |

| 2 | 150 | Part of $7B total 8 | Mid-2026 |

| 3 | 150 | Part of $11B total 8 | 2027 |

| Total | 400 | ~$11 Billion | 4 |

The company’s competitive position is complex and warrants a nuanced analysis. Some competitor lists misleadingly group Applied Digital with unrelated business services companies.18 Its true competitors are a mix of:

- Hyperscale Cloud Providers: Giants like Microsoft, AWS, and Google, which build their own massive infrastructure.7

- GPU Cloud Specialists: Peers like CoreWeave, Crusoe Energy, and Lambda Labs, which also focus on specialized AI workloads.7

- Traditional Data Center Operators: Established players like Digital Realty and Equinix, which are retrofitting their existing, general-purpose infrastructure to handle AI demands.7

Applied Digital’s competitive advantage lies in its purpose-built design, which traditional operators cannot replicate with simple retrofitting.15 The CoreWeave partnership, while providing stability, highlights a key risk: single-customer concentration. However, management is actively working to mitigate this by engaging in discussions with other major players 5

Navigating Financial Performance and Contradictions

Applied Digital’s explosive stock performance, which has outperformed peers like Riot Platforms and Equinix, presents a paradox.4 The company is still grappling with significant financial challenges, including negative free cash flow and a substantial debt burden.1 Its fiscal 2026 loss estimates have widened, and it reported a loss of 80 cents per share in fiscal 2025.4. The company trades at a steep premium, with a forward 12-month Price-to-Sales (P/S) ratio of 14.46x, far exceeding the industry average of 3.58x.4

The seemingly high valuation is not a signal of overvaluation but rather a reflection of the market’s focus on future, not current, revenue. Traditional valuation metrics are ill-suited for a company in a high-growth, high-capital-expenditure transition phase.4 The $11 billion in contracted revenue from CoreWeave has yet to be recognized on the top line.5 At full buildout, analysts project the company could generate approximately $733 million annually from the CoreWeave contract alone, which would bring its forward valuation multiples to a more favorable level 5

The market’s bullish sentiment is further supported by institutional conviction. Institutional investors and hedge funds own 65.67% of the stock.21 Major firms like BlackRock and Vanguard have significant stakes, signaling a belief in the long-term growth story.22 This confidence exists despite notable insider selling, including a substantial sale by Chairman Wes Cummins.23 While insider selling can be a negative signal, it must be considered in context. Executives often sell shares for personal liquidity or diversification, and the fact that insiders still own a significant 6.5% of the company suggests continued alignment with shareholder interests.23 The conflicting signals highlight the competing narratives surrounding the company’s prospects.

| Metric | Applied Digital | FIN Industry | Finance Sector |

| Market Cap | $5.06B | $8.03B | $12.64B |

| Price / Sales | 35.10 | 6.89 | 30.70 |

| P/E Ratio | -17.75 | 17.29 | 244.65 |

| Net Income | -$231.07M | $313.53M | $1.01B |

| 1 Year Performance | 217.73% | 33.29% | 543.60% |

| Source | 19 | 19 | 19 |

Navigating the Digital Frontier: Cyber and IP

Data centers are increasingly complex and are prime targets for sophisticated cyber threats.24 These threats include ransomware, distributed denial-of-service (DDoS) attacks, and vulnerabilities within the supply chain.24 For a company entrusted with a client’s high-value AI workloads and sensitive data, security is a non-negotiable component of its value proposition.26

Applied Digital claims a comprehensive security approach, which includes robust site security, 24/7 physical monitoring, and multi-layered cybersecurity measures.26 The company’s protocols are not merely a cost center; they are a direct requirement from hyperscale clients and a key competitive differentiator.26 A single security breach could jeopardize a crucial long-term contract, underscoring the critical importance of operational excellence on the cyber front.

An examination of the company’s intellectual property reveals an interesting strategic choice. A search for patents reveals no significant patents assigned to “Applied Digital Corporation”.27 The patents found for “Applied Digital Research Corp.” are unrelated to the company’s core business, focusing on antenna systems.27 However, this absence of formal patents does not indicate a lack of competitive advantage. The company’s moat is built on “proprietary innovation,” including its “inside-out design philosophy,” advanced cooling solutions, and a model for leveraging “stranded power”.14 These elements are operational know-how and design-based advantages that the company protects as trade secrets.28 A trade secret strategy can be superior to a patent strategy, as it protects confidential information indefinitely without requiring public disclosure.28 This approach prevents competitors from replicating the company’s core operational efficiencies, solidifying its competitive position.

Conclusion: A Path Defined by Execution

Applied Digital’s explosive stock performance is a complex confluence of favorable macroeconomic, technological, and geostrategic factors. The company has successfully executed a strategic pivot from a volatile, legacy business to a high-growth sector with a massive, de-risking long-term contract.1 Its low-cost, purpose-built, and geostrategically sound infrastructure provides a significant operational advantage that competitors find difficult to replicate.12

The market’s current valuation of the company reflects a powerful bet on future cash flow rather than current financials.4 While the company’s narrative is not without risk, including single-customer concentration, high debt, and negative cash flow, the CoreWeave partnership and a multi-gigawatt pipeline of future capacity mitigate these concerns.4 The path forward for Applied Digital is no longer a question of if it can enter the AI market but how well it can execute on its planned buildouts and capture additional hyperscale demand.17 This shift in focus, from strategic pivot to operational delivery, will ultimately determine the company’s long-term success.

References

- Applied Digital (APLD): Assessing Valuation After ETF Launch and Shift to AI Data Centers – Simply Wall St News

- Applied Digital (APLD) Company Profile & Description – Stock Analysis

- Applied Blockchain, Inc. (APLD): history, ownership, mission, how it works & makes money – dcfmodeling.com

- Applied Digital Jumps 122% Year to Date: Buy, Sell or Hold the Stock? | Nasdaq

- Breakdown: Applied Digital’s $11 Billion HPC Hosting Deal With CoreWeave

- AI Data Centers Market Size to Hit USD 165.73 Billion by 2034 – Precedence Research

- What Companies Are Building AI-Ready Data Centers? – 174 Power Global

- Applied Digital (APLD) Shares Jump on New Multi-Billion Dollar CoreWeave Contract Expansion – MLQ.ai

- AI geopolitics and data centres in the age of technological rivalry

- Federal Government Engages on Data Center Policies | Thompson Coburn LLP

- US electric grids under pressure from energy-hungry data centers are changing strategy

- AI Factory: A Case Study For Total Cost Of Ownership WHITE PAPER – Applied Digital

- (VIDEO) Applied Digital Aligns Climate and Energy to Transform Data Centers – STAND

- Why Applied Digital Corporation (APLD) is Poised to Dominate the AI Infrastructure Space

- Applied Digital Corporation (APLD)

- Applied Digital Finalizes Additional 150MW Lease with CoreWeave in North Dakota

- Applied Digital Hits New 52-Week High: Here’s Why Analysts See More Upside In APLD Stock – Barchart.com

- www.marketbeat.com

- Applied Digital (APLD) Competitors and Alternatives 2025 – MarketBeat

- Digital Realty Launches Innovation Lab to Accelerate AI and Hybrid Cloud Implementation

- Scientech Research LLC Buys New Position in Applied Digital Corporation $APLD

- APLD 13F Hedge Fund & Institutional Ownership | HedgeFollow

- Have Applied Digital Insiders Been Selling Stock? – Moomoo

- Top Security Challenges Facing Data Centers in 2025 and Beyond – Guidepost Solutions

- Securing the Backbone of Artificial Intelligence: Protecting Data Centers: Cyber Threats

- Data Center Solutions – Applied Digital Corporation (APLD)

- Patents Assigned to APPLIED DIGITAL RESEARCH CORP. – Justia Patents Search

- What is Intellectual Property? – WIPO

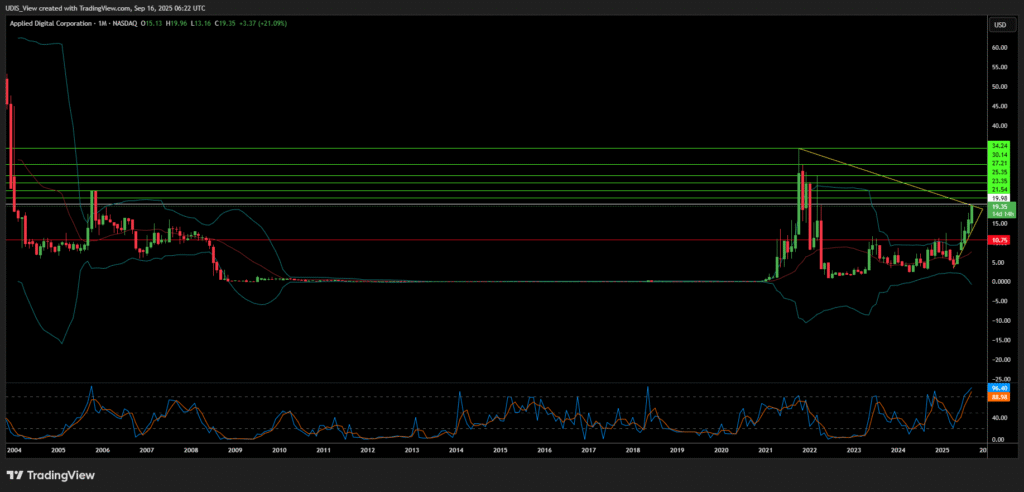

Applied Digital Long (Buy)

Enter At: 19.98

T.P_1: 21.54

T.P_2: 23.35

T.P_3: 25.35

T.P_4: 27.21

T.P_5: 30.14

T.P_6: 34.24

S.L: 10.75