The Illusion of Strength: A Contradiction in Performance

The FTSE 100 has demonstrated unexpected strength in the current year, outperforming its American counterpart, the S&P 500. The UK’s benchmark index rose 10.9% year-to-date, surpassing the S&P 500’s 8.8% return.1 This performance marks a significant departure from historical trends. The index has delivered an annualized return of just 5.0% over the last decade, a figure well below the S&P 500’s 13.2% over the same period.2 This short-term gain masks deeper, long-term structural vulnerabilities.

The FTSE 100’s recent surge appears to be a temporary market rotation rather than a sign of fundamental health. Investors may be withdrawing capital from what they perceive as overvalued US technology stocks. They are shifting this capital toward more traditional sectors represented in the UK index.1 This temporary trend, while positive, distracts from the FTSE 100’s persistent underperformance over decades. The index’s core composition has not changed, suggesting its long-term growth prospects remain constrained without a shift in its underlying structure.2

Table 1: FTSE 100 vs. S&P 500 Performance Comparison

| Period | FTSE 100 Annualised Return | FTSE 100 Total Return | S&P 500 Annualised Return | S&P 500 Total Return |

| Last 1 Year | 10.4% 3 | 10.4% 3 | 10.1% 2 | 10.1% 2 |

| Last 5 Years | 14.1% 3 | 93.6% 3 | 16.7% 2 | 116.3% 2 |

| Last 10 Years | 5.0% 3 | 62.7% 3 | 13.2% 2 | 244.8% 2 |

| Last 20 Years | 5.2% 3 | 177.8% 3 | 11.0% 2 | 700.1% 2 |

Sources: Curvo.eu, The Motley Fool, IG.com

The Structural Deficit: FTSE 100’s Compositional Flaw

The FTSE 100 is a weak indicator of the UK’s economic health.4 The index’s movements are heavily influenced by global forces. This is due to its constituents being primarily large, internationally focused companies.4 Its composition is skewed toward traditional sectors. These include finance, energy, and mining.5 The index lacks significant exposure to the high-growth technology firms that have propelled other major indices 1

This imbalance represents a critical structural flaw. The five largest tech companies in the S&P 500 often possess a greater market value than the entire FTSE 100.5 This disparity has caused the UK index to miss the transformative growth of the digital economy.5 While the UK has a robust research and development ecosystem and ranks ninth in the European Patent Office’s 2024 Patent Index, it struggles to capitalise on its domestic innovation.6 Companies like chip designer ARM Holdings, based in Cambridge, choose to list overseas in the US to benefit from higher valuations.1 This creates a self-reinforcing cycle. Domestic innovation fuels foreign markets, leaving the FTSE 100 without the dynamism needed for long-term growth.

Table 2: Key Sectoral Weights

| Index | Primary Sectoral Weights | Key Omissions |

| FTSE 100 | Finance, Energy, Mining 5 | High-growth technology firms 5 |

| S&P 500 | Technology, Consumer Discretionary 1 | N/A |

Sources: IG.com, London Stock Exchange Group

Macroeconomic Pressures and Geopolitical Headwinds

The UK economy faces persistent macroeconomic challenges that create an unappealing backdrop for investors. Inflation rose to 3.8% in July, exceeding forecasts.8 This increases the likelihood that the Bank of England will hold interest rates steady, dampening economic activity.9 High government deficits also weigh on confidence. The UK’s budget deficit reached £20.7 billion in June, raising concerns about fiscal sustainability and potential tax increases.10 This is compounded by lingering uncertainty from the Labour government’s new policy plans.11

Policy uncertainty directly impacts investor confidence. Investors and businesses value a stable political environment for planning and growth.12 The prospect of a new tax regime, such as a windfall tax on energy companies, could create short-term market volatility and a cautious approach from investors.11 This domestic fragility is amplified by global geopolitical instability. Geopolitics is a top concern for UK institutional investors, with 61% reporting that it has shifted their risk appetite.13 Half of these investors are adopting a more defensive, risk-off stance, citing factors like the war in Ukraine and US policy uncertainty.13 These external threats force a recalibration of investment strategies. This reduces overall risk tolerance for UK assets despite the FTSE 100’s apparent stability in the face of these pressures.14

The Economic Calculus of Civil Unrest

The economic impact of civil unrest has become a quantifiable financial risk. Recent large-scale demonstrations in London and other UK cities, fueled by anti-immigration sentiment and far-right mobilisation, have led to violent clashes. These events translate directly into material damage and financial liability for businesses. More than a quarter of UK businesses were affected by civil unrest in 2024, reporting closed premises, damaged property, and stolen stock or equipment.15

This risk, classified as strikes, riots, and civil commotion (SRCC), ranks as a top 10 global business concern.16 Insurers have paid out an estimated $13 billion from just seven major global civil unrest incidents in recent years.16 In the UK, insured losses from riots following a stabbing incident in Southport were estimated at £250 million.15 The true cost is much higher, including uninsured losses and lost trade, which are “the tip of the iceberg”.15 These incidents force businesses to increase security and review their insurance coverage, adding to operational costs and reducing profitability.17 The underlying drivers of this unrest, such as inflation and social inequality, remain persistent.16 The rise of far-right movements and associated civil disorder is not a peripheral social issue but a direct, recurring threat to business continuity and asset valuation.

Table 3: Economic Impact of Civil Unrest on UK Businesses

| Impact Area | Reported Data | Source |

| Businesses Affected | Over a quarter (28%) of UK businesses in 2024 | 15 |

| Premises Closure | Nearly half (47%) of affected firms had to close | 15 |

| Property Damage | 44% of affected firms reported damaged premises | 15 |

| Insured Losses | Estimated £250 million from Southport riots alone | 15 |

| Primary Concern | Business leaders view civil unrest as a greater risk than terrorism | 15 |

Sources: Gallagher, Crawford & Co., Allianz

Future Outlook: Navigating a Volatile Landscape

The FTSE 100’s recent outperformance is not a long-term solution. It is a surface-level phenomenon that masks a deeper set of risks. The index is handicapped by a traditional sectoral composition that lacks exposure to high-growth technology. UK innovation often benefits overseas markets more than its own. This, combined with persistent domestic macroeconomic headwinds, creates a uniquely challenging environment. High inflation and significant government deficits create fiscal and monetary policy uncertainty that dampens investor confidence 9

Furthermore, the quantifiable economic risk of civil unrest poses a material threat to the operational stability of UK-based companies. The rise of political and social instability, exacerbated by the proliferation of far-right movements, necessitates a strategic response from corporations. Businesses must now account for political violence as a core component of their risk management plans.16 The index’s future depends on its ability to evolve beyond its traditional composition and mitigate the real, material costs of social and political instability. The FTSE 100’s long-term health is tied to its capacity to adapt to this new, volatile landscape.

References

- How much longer can the FTSE 100 keep outperforming the S&P 500? | The Motley Fool UK

- FTSE 100 vs S&P 500: historical performance from 2000 to 2025 – Curvo

- FTSE 100: historical performance from 2000 to 2025 – Curvo

- FTSE 100 Index – Wikipedia

- S&P 500 vs FTSE 100: why has the US index outperformed? – IG

- United Kingdom Patent Rankings 2024: Who Filed the Most? – Insights;Gate

- FTSE UK Index Series – LSEG

- FTSE 100 Opens Lower as UK Inflation Surprises; Pound Holds Steady – Advfn.com

- Late market roundup: FTSE 100 up despite UK inflation landing hot | AJ Bell

- FTSE 100 Closes Above 9,000 For First Time – IG UK

- Investment impact of Labour’s win | St. James’s Place

- What does a landslide Labour UK election win mean for the economy and markets?

- Government Deficits And Geopolitics Shift Risk Appetite For UK Investors

- FTSE 100 Morning Update: Japan Turmoil Hits Yen, US CPI Ahead – IG UK

- More than one in four UK businesses impacted by civil unrest last …

- Allianz Risk Barometer 2025 – Political risks | Allianz Commercial

- Over 1 in 4 UK businesses impacted by civil unrest in 2024: Gallagher – Reinsurance News,

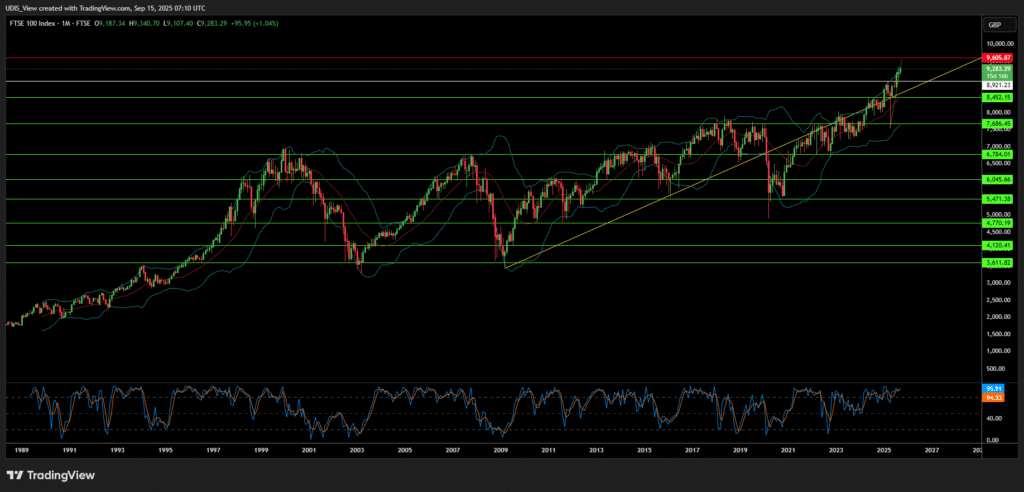

FTSE 100 Short (Sell)

Enter At: 8921.23

T.P_1: 8452.15

T.P_2: 7686.45

T.P_3: 6784.01

T.P_4: 6045.66

T.P_5: 5471.38

T.P_6: 4770.19

T.P_7: 4120.41

T.P_8: 3611.82

S.L: 9605.87