Last week a U.S. court approved Wolfspeed’s Chapter 11 plan, wiping out about 70% of its $6.5 billion debt[1][2]. The restructuring also trims roughly 60% off interest obligations[1][2]. This massive debt reduction will free billions in cash flow for operations and new fabs. Creditors representing over 97% of Wolfspeed’s debt backed the plan[3], giving confidence the company will emerge from bankruptcy soon. In premarket trading the stock jumped nearly 60% on the news[1], reflecting investor relief that a financial overhang is finally cleared.

Wolfspeed leads the niche silicon carbide (SiC) chip market, a critical technology for EVs and high-voltage power systems[4][5]. SiC semiconductors switch at higher voltages and run hotter with greater efficiency than silicon, extending EV range and enabling faster charging[6][7]. Wolfspeed is unique in producing 200 mm (8-inch) SiC wafers in volume[8], a step-change that multiplies chips per wafer (and drives costs down). The company’s vertically integrated model—from crystal growing and substrates through devices and modules—gives it a full supply-chain advantage[9][10]. Industry studies show Wolfspeed among the top patent filers in SiC technology[10], underlining years of R&D and a strong intellectual property lead. In short, Wolfspeed’s SiC expertise and US-based fabs set it apart as vehicles, renewables and data centers rapidly electrify.

Global market forces now favor Wolfspeed’s silicon carbide focus. Electric vehicle sales topped 17 million units in 2024 (up >25% from 2023)[11], and projections call for 20–30% annual growth as EVs reach the mainstream. Each new EV typically uses more SiC power chips to improve efficiency. Similarly, expansion of solar, battery storage and fast-charging infrastructure is driving demand for SiC inverters and converters[4]. Even with broader economic uncertainty, companies like Onsemi report robust SiC chip orders thanks to EV growth in China and Europe[7]. These secular tailwinds mean Wolfspeed’s products have a growing addressable market.

Geopolitics and industrial policy are also at Wolfspeed’s back. The U.S. CHIPS Act has earmarked up to $750 million in incentives for Wolfspeed’s next-generation fabs[12] (with another ~$1 billion in related tax credits), underscoring government support for domestic SiC capacity. U.S. agencies now classify SiC as a “critical material” for clean energy and national security[13]. Wolfspeed emphasizes its fully U.S.-based supply chain to satisfy rising export controls and cybersecurity requirements[14]. By contrast, China is aggressively scaling its own SiC industry: a new Wuhan factory just began producing 360,000 six-inch SiC wafers per year (enough for 1.4 million EVs)[15]. Chinese firms have filed thousands of SiC patents in recent years[16], backed by state funding and mandates. In sum, Wolfspeed benefits from U.S. policy that favors domestic chipmakers, even as it braces for stiff competition from well-funded Chinese rivals.

Despite these positives, significant risks remain. Current Wolfspeed shareholders will be heavily diluted – retaining only about 3–5% of the restructured equity[2]. The company also faces execution challenges: ramping a novel 200 mm fab has proven difficult and past yield issues could recur. Global competitors (Infineon, STMicro, onsemi and others) and new entrants in China are rapidly expanding SiC capacity, which could pressure pricing and market share. Wolfspeed still operates at a loss, and its enterprise value remains high relative to current sales and earnings. These factors temper expectations.

In conclusion, Wolfspeed’s recent stock surge reflects a confluence of factors: a cleaner balance sheet, booming demand for energy-efficient chips and strong strategic support from U.S. policy [1][14]. Its technological leadership in SiC and deep patent portfolio [10] could translate these tailwinds into profit if the turnaround goes smoothly. But investors must weigh this bullish thesis against the heavy dilution and execution risks [2][15]. For now, Wolfspeed sits at a critical inflection point – a nascent recovery story driven by tech and macro trends, balanced by a high-risk restructuring.

Reference

[1] Wolfspeed’s shares surge as US bankruptcy court approves restructuring plan | Reuters

[2] [3] Wolfspeed Takes Proactive Step to Strengthen Financial Foundation Anticipating Scalable, Profitable Growth – Wolfspeed, Inc.

[4] [12] [13] Wolfspeed Announces $750M in Proposed Funding from U.S. CHIPS Act and Additional $750M From Investment Group Led by Apollo, Galvanizing Global Leadership in Delivering Next-Generation Silicon Carbide Technology | Wolfspeed

[5] [6] [14] Ramped + Ready: Silicon Carbide Supply Rises to Meet Innovation Demand | Wolfspeed

[7] Chipmaker Onsemi forecasts upbeat quarterly revenue on resilient demand from EV makers | Reuters

[8] [10] [16] US-China SiC semiconductor battle

[9] Wolfspeed, the vertically integrated SiC pioneer

[11] Trends in electric car markets – Global EV Outlook 2025 – Analysis – IEA

[15] China’s Largest SiC Wafer Factory Comes on Stream in Wuhan

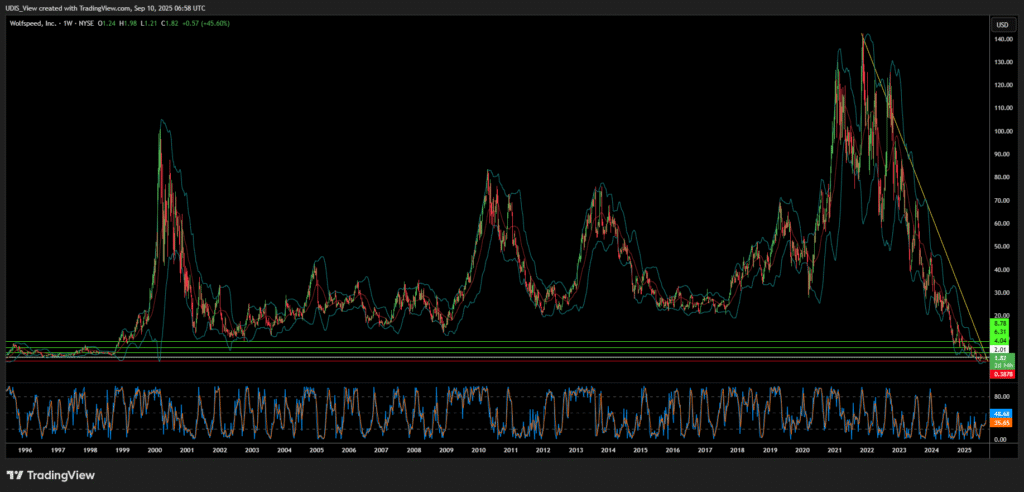

WolfSpeed Long (Buy)

Enter At: 2.01

T.P_1: 4.04

T.P_2: 6.31

T.P_3: 8.78

S.L: 0.39