The Fall from Grace: A Financial Post-Mortem

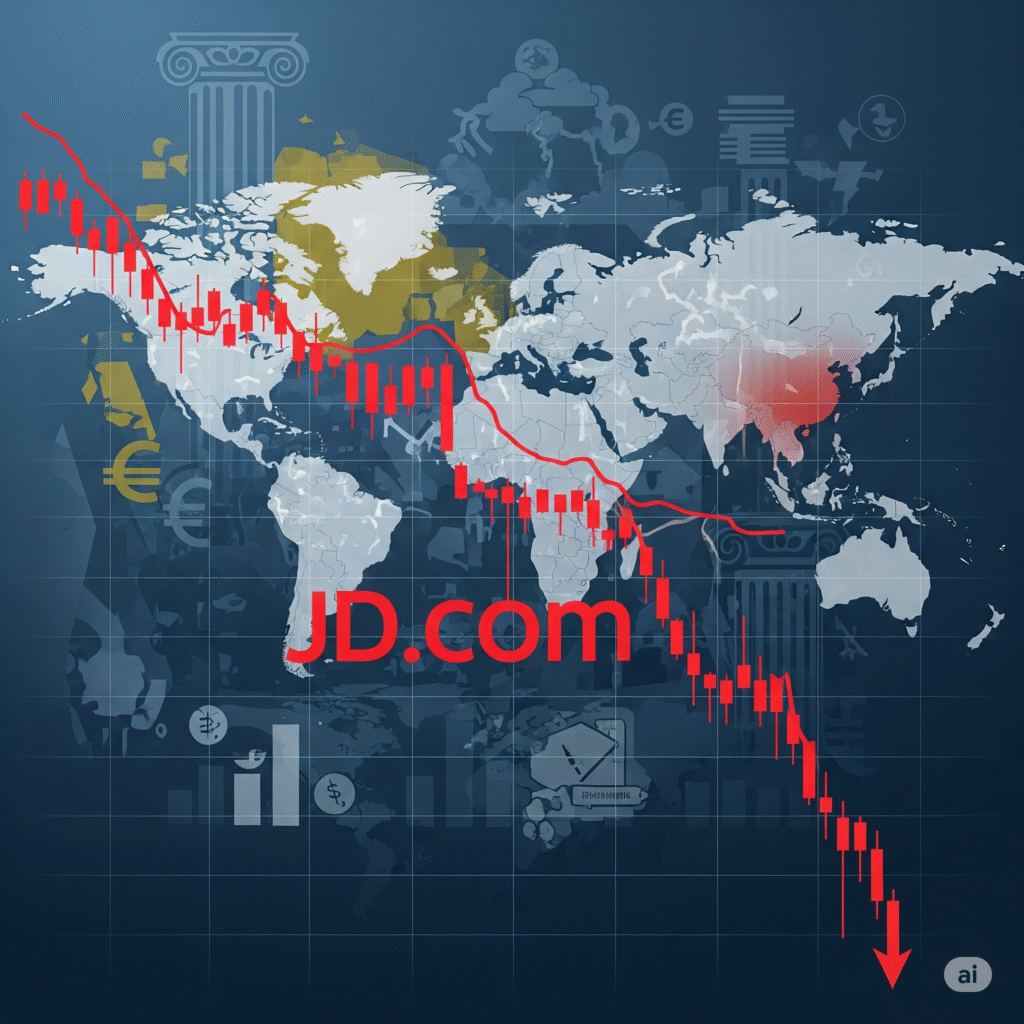

The Shockwave on Wall Street

Lululemon Athletica shares experienced a swift, steep decline. The stock plunged almost 18% in premarket trading on Friday, September 5, 2025, following a significant reduction in the company’s annual sales and profit outlook.1 This immediate market reaction was a direct repricing of the company’s valuation. The sell-off cut Lululemon’s market capitalization to $20.1 billion, leaving its shares down 54.9% for the year.2 The market responded aggressively to the revised guidance and growing strategic concerns.

By the Numbers: A Comprehensive Breakdown

A detailed look at the second-quarter results reveals the pressures behind the stock’s fall. The company reported a 7% year-over-year increase in net revenue, reaching $2.53 billion.1 However, this growth was not evenly distributed across its markets. Overall comparable sales grew by a mere 1%, primarily due to a substantial 3% decline in the Americas.1 This regional weakness stood in stark contrast to its international performance, where comparable sales surged by 15%.1

In response to this performance, management slashed its full-year revenue guidance. The new forecast is for revenue in the range of $10.85 billion to $11.0 billion, a significant drop from the prior guidance of $11.15 billion to $11.30 billion.1 The revised diluted earnings per share (EPS) outlook also fell. The company now expects EPS to be between $12.77 and $12.97, down from the previous range of $14.58 to $14.78.1 This marked the second guidance cut of the year, signaling a deeper, systemic issue.2

Analyst Consensus: The Shifting Narrative

The financial community reacted with a revised, more cautious outlook. Citigroup analyst Paul Lejuez quickly cut his price target on Lululemon Athletica to $190 from $220, while maintaining a “Neutral” rating.2 Lejuez’s report cited “broader athletic apparel industry headwinds,” “execution missteps,” and increased competitive pressures.2 The revised consensus among analysts also reflects a more skeptical view. The Street’s average target now sits at $235.78, well below previous expectations.2 The market’s loss of confidence in Lululemon’s ability to navigate current challenges directly explains the financial fallout.

Table 1: Lululemon Q2 2025 Financials & Guidance Revisions

| Category | Q2 2025 Results | Previous FY 2025 Guidance | New FY 2025 Guidance |

| Net Revenue | $2.53 billion (7% YoY growth) | $11.15B – $11.30B | $10.85B – $11.0B |

| Comparable Sales | 1% YoY growth | – | – |

| Americas Comp Sales | -3% YoY decline | – | – |

| International Comp Sales | 15% YoY growth | – | – |

| Gross Margin | 58.5% (down 110 bps) | – | – |

| Operating Margin | 20.7% (down 210 bps) | – | – |

| Diluted EPS | $3.10 | $14.58 – $14.78 | $12.77 – $12.97 |

Source: Lululemon Q2 2025 Earnings Report 1

The Geopolitical and Strategic Gauntlet

Navigating New Tariffs: A Direct Hit to the P&L

The Trump administration’s trade policy is a primary driver of Lululemon’s reduced outlook.2 Management specifically blamed the removal of the

de minimis exemption. This change, which became effective on August 29, 2025, ended duty-free treatment for shipments valued under $800.2 The policy now subjects all low-value imports to country-specific duties and taxes, along with increased customs inspections.6 This change fundamentally alters the cost structure for a company that relies heavily on its direct-to-consumer e-commerce model.7

A Supply Chain Under Fire

Geopolitical action has become a direct, quantifiable expense. Lululemon’s management quantified the impact. The company expects an incremental $240 million headwind on its gross profit in fiscal 2025.2 This headwind is projected to increase to $320 million on operating margin in fiscal 2026.2 This direct, monetary consequence highlights how global politics now directly impacts corporate profitability. Lululemon’s supply chain is particularly vulnerable. The company relies on Vietnam and mainland China for 40% of its manufacturing and 28% of its fabrics, respectively.2 This heavy reliance exposes it to the full force of protectionist trade policies.

The De Minimis Loophole Closes

Lululemon’s previous strategy leveraged the now closed de minimis loophole. The company fulfilled approximately two-thirds of its U.S. e-commerce orders from Canadian distribution centers.2 This allowed it to bypass duties and taxes on a large volume of low-value shipments.7 The removal of this exemption fundamentally changes the company’s supply chain economics. It now necessitates a complete review of its network to optimize inventory placement and distribution strategies.2 For financial analysts, this demonstrates that geopolitical risk is no longer a distant possibility. It is a line-item expense that must be factored into financial models.

A Shifting Macroeconomic Landscape

The Cautious American Consumer

Lululemon’s American business was hampered by a 3% comparable sales decline.1 Management attributed this to “continued softness” in the region.2 This weakness is understandable given the current macroeconomic backdrop. Persistent inflation is making American consumers more selective in their purchases.8 The PCE Price Index, for example, rose 2.6% year-over-year in July 2025.9 The Consumer Price Index (CPI) also increased 2.7% over the same period.10 The Federal Reserve’s decision to hold interest rates steady at 4.5% further constrains discretionary spending.11 Consumers are now “value conscious” and are seeking out lower-cost alternatives across various sectors.2

The Nuanced China Narrative

Lululemon’s international business remains strong, with a double-digit growth rate and a 25% increase in mainland China revenue.1 Despite this, management still flagged a potential “incremental weakening of the China consumer environment” as a risk to the stock.2 This seeming contradiction requires a closer look at China’s consumer trends. Overall, Chinese consumer spending has grown, rising 4.8% in the first seven months of 2025.12. However, mass-market goods and government initiatives largely drive this growth, not high-end luxury spending.13

The Rise of “Lying Flat” and Local Brands

The disconnect between overall Chinese growth and Lululemon’s cautious tone is explained by a profound shift in consumer behavior.14 Young Chinese consumers, particularly Gen Z, are increasingly embracing the “lying flat” counterculture. They are prioritizing personal well-being and experiences over conspicuous consumption.14 Furthermore, the “Guochao” phenomenon, which encourages consumers to favor local, culturally relevant brands, is gaining traction.14 A company can sometimes endure a difficult macroeconomic climate if its product is considered a “must-have.” However, management’s admission of a “stale” product line indicates that this is not the case for Lululemon.2 When consumers are forced to be more selective, they cut spending on items they perceive as “predictable.” Lululemon’s strategic missteps have amplified the effects of broader macroeconomic headwinds.

Internal and Competitive Failures

A Stale Product Assortment

Lululemon’s CEO, Calvin McDonald, directly addressed the company’s internal failures. He stated that the company had become “too predictable with our casual offerings” and had “missed opportunities to create new trends”.2 The company has allowed its product life cycles to run “too long,” particularly for its lounge and casual wear, which accounts for approximately 40% of sales.2 This strategic misstep has driven higher markdowns and has alienated American customers who were “not responding well to many of our new styles.”.2

The Threat from All Sides

Lululemon is no longer the undisputed leader in premium athleisure. The company faces “intense competition at both ends of its market”.2 At the high end, upstart brands like Alo Yoga and Vuori have captured significant market share.2 Alo Yoga appeals to consumers with its fashion-forward designs, while Vuori draws customers with its focus on sustainability and comfort.15 The company also faces pressure from “private-label dupes” that offer comparable fabric technology at significantly lower prices.2

The “Dupe Culture” Dilemma

The rise of “dupe culture” poses a direct challenge to Lululemon’s premium brand and pricing power.2 This trend is not confined to the U.S. and is also a significant factor in China. There, consumers are increasingly seeking out similar designs that offer “better value for money”.14 This phenomenon highlights the erosion of the company’s innovation moat. It forces Lululemon to compete on price rather than relying solely on its brand cachet.2 The core issue is not simply that competitors exist, but that they are successfully replicating Lululemon’s core value—technical fabric and design—at a lower price point. This commoditization effect explains why the company struggles to justify its premium prices in a cautious consumer environment.

The Duality of Technology and Intellectual Property

The Edge of Innovation: Science and High-Tech

Lululemon’s current issues do not stem from a failure of innovation. The company maintains an extensive intellectual property portfolio. It holds a total of 925 patents globally, with 717 of them currently active.16 These patents protect the company’s unique fabric blends, such as Luon and Nulu.17 The portfolio also extends into high-tech domains like smart clothing, health monitoring, and bioluminescent compositions.16 Furthermore, the company is actively investing in next-generation materials. It has partnered with biotechnology pioneer ZymoChem to develop bio-based nylon and with Samsara Eco to create enzymatically recycled materials 19

A Fortress of Patents

The company’s technology is a continuously evolving, legally protected core competency. Lululemon has filed the majority of its patents in the U.S. and Canada.16 The value of this portfolio is evident in the high citation counts of its top patents, such as US11045709B2, which has been cited 131 times.16 The company is actively and aggressively defending its intellectual property. The June 2025 lawsuit against Costco is a clear statement of this intent.20 The legal action directly addresses the “copycat culture” that threatens the brand’s identity and value proposition.20

The Legal Counter-Offensive

The lawsuit against Costco alleges design patent infringement, trade dress infringement, and trademark infringement.20 It focuses on iconic products like the SCUBA® hoodie and DEFINE® jacket.20 This legal offensive, while necessary, also underscores the extent to which Lululemon’s classic designs have been commoditized. A disconnect exists between the company’s internal innovation and its public perception. The company is actively developing bio-based fabrics and filing patents on advanced technologies, yet management admits that its product assortment is “predictable.”.2

The Cybersecurity Imperative

The company’s own earnings infographic lists “safeguard against security breaches” as a key business risk.21 While no specific data breach was reported, external data highlights the increasing threat of ransomware and phishing attacks targeting corporate employees.22 In an era of heightened geopolitical tension and increased e-commerce reliance, a robust cybersecurity posture is not a luxury. It is a fundamental necessity for protecting intellectual property, consumer data, and operational continuity.22 The company’s problem is not a lack of technology. It is a failure to commercialize and market its existing innovation in a timely or compelling way.

Outlook and Projections

The Path to Recovery: Product and Pricing

Lululemon’s management has outlined a plan to fix its product issues.2 They plan to introduce a more dynamic product mix and new styles. However, analyst Paul Lejuez warns that the effects of these changes will not be visible until fiscal 2026 at the earliest.2 To offset the new tariff costs, the company plans to implement “strategic price increases. “.2 This is a risky move in a market where consumers are already seeking out lower-cost alternatives.2 The company’s ability to hold the line on pricing without resorting to deep promotions will be a key factor over the next two quarters.2

A Revised Valuation: Balancing Risk and Resilience

The stock’s sharp drop and reset of expectations have brought its valuation more in line with its revised earnings projections.2 A patient investor may find value at this level, but the risks remain high until management can demonstrate a clear path forward.2 The company’s long-term strength lies in its intellectual property and innovative R&D. The short-term challenge is its ability to translate that innovation into timely, trend-setting products and to navigate a volatile global trade environment.

A Final Synthesis

Lululemon’s decline is a complex narrative of a company caught in a perfect storm of external geopolitical and macroeconomic forces. At the same time, it has made internal strategic missteps. The company’s strategic failures have amplified the effects of macroeconomic headwinds, turning a difficult market into a sales decline. The rise of competitors and “dupe culture” further erodes its market dominance. The company’s intellectual property and innovative R&D are strong, but the disconnect between this internal strength and its external market performance is its core problem. The path forward requires steady, decisive execution on product, pricing, and supply chain management.2

Table 2: Key Risks and Mitigation Strategies

| Risk Factor | Mitigation Strategy |

| U.S. Market Softness | Introduce a product assortment refresh to reaccelerate U.S. trends 2 |

| Geopolitical Tariffs | Implement strategic price increases to mitigate margin impact 2 |

| Stale Product Assortment | Develop and launch new styles, including Lounge Full and Big Cozy, in the second half of the year 2 |

| Competitive Pressure from “Dupes” | Pursue legal action against “copycat culture” and defend intellectual property through lawsuits 20 |

| Cybersecurity Threats | Invest in technology systems to safeguard against security breaches and protect intellectual property 21 |

Source: Lululemon Q2 2025 Earnings Infographic, CEO Statements, Legal Filings 2

References

- lululemon athletica inc. Announces Second Quarter Fiscal 2025 Results

- Lululemon Athletica Inc (LULU) Q2 2025 Earnings Call Highlights

- www.investing.com

- Presidential 2025 Tariff Actions: Timeline and Status | Congress.gov

- See where Trump’s tariffs are driving up prices on household items for now

- US tariff changes – suspension of de minimis exemptions | Tariffs, taxes and duties

- How the U.S. De Minimis Removal Affects Your Business | DHL Global

- US Consumer Spending Plans By Category, Q3 2025 – Forrester

- Personal Consumption Expenditures Price Index | U.S. Bureau of Economic Analysis (BEA)

- Consumer Price Index Summary – 2025 M07 Results – Bureau of Labor Statistics

- March 2025 Fed Meeting: Interest Rates Kept Steady, Slower Economic Growth Projected

- China consumer spending grows 4.8% in first seven months of 2025 – Fibre2Fashion

- Chinese Consumer Spend Rebounds: Q1–Q2 2025 – Gate Kaizen

- China’s Luxury Slowdown: What It Means for Global Brands | ISTITUTO MARANGONI

- DTCetc

- Lululemon Athletica Patents – Insights & Stats (Updated 2025)

- Who Makes the Lululemon Legging Fabric? How To Find It? | – Blue Associates Sportswear

- Our Fabric + Technology | lululemon EU

- lululemon Announces New Collaboration with ZymoChem to Advance and Scale Bio-Based Nylon

- Patenting for Inventors Ep.159: Lululemon Sues Costco – A Fashion

- q2-2025-earnings-infographic.pdf – lululemon

- Lululemon athletica Hostage Data: Ransomware and Protecting Your Digital Information

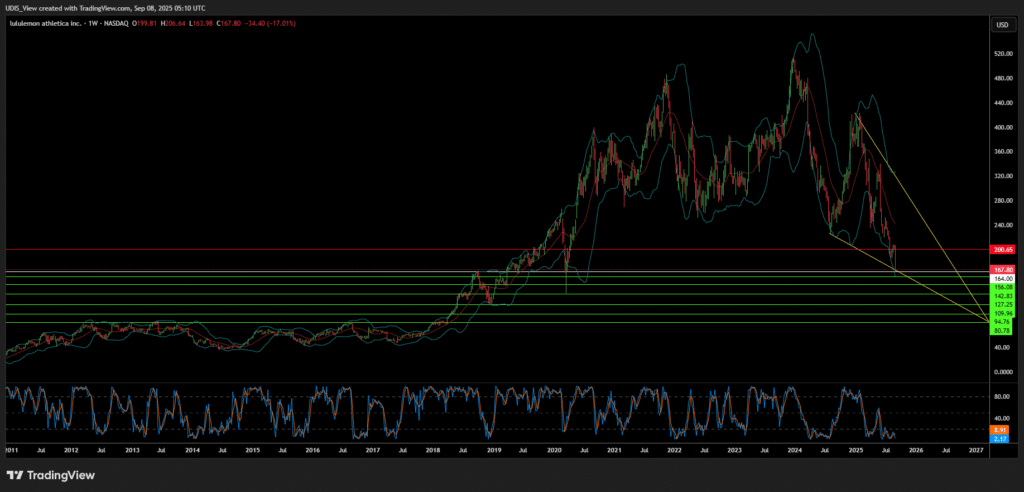

Lululemon Short (Sell)

Enter At: 164.00

T.P_1: 156.08

T.P_2: 142.83

T.P_3: 127.25

T.P_4: 109.96

T.P_5: 94.76

T.P_6: 80.78

S.L: 200.65