Navigating a Complex Landscape

Regeneron Pharmaceuticals occupies a unique position in the biotechnology sector.1 The company blends the financial stability of a major enterprise with the dynamic, high-risk, high-reward pipeline of a clinical-stage innovator.2 Recent performance clearly reflects this duality. Strong financial results are evident, even while the company navigates significant pipeline and regulatory hurdles.2

Regeneron’s success is propelled by two major forces. First, the enduring commercial strength of its collaboration-based products, particularly Dupixent, serves as a primary revenue engine.2 Second, its robust, internally driven R&D engine, a validated and unique approach exemplified by its proprietary VelociSuite technologies, continues to fuel innovation.5 The company faces concurrent challenges. The Eylea franchise is undergoing a critical, yet complex, market transition.7 Key pipeline assets have also encountered regulatory setbacks directly linked to third-party manufacturing issues.3 Broader industry risks, from geopolitical trade policies to widespread cybersecurity threats, also loom large.8

This report argues that Regeneron’s fundamental strengths – its technological foundation, diverse pipeline, and strategic legal defense – position it for sustained long-term growth. This is true despite near-term volatility stemming from operational and external risks. The company is successfully navigating the transition from a company reliant on one or two blockbusters to a diversified, multi-product biopharmaceutical powerhouse.2

The Financial Foundation: A Tale of Two Blockbusters

Regeneron’s financial health is a study in divergent trends. The company’s overall revenue growth is a product of its diverse portfolio. This portfolio includes the powerful, yet challenging, Eylea franchise and the thriving collaboration-based Dupixent. Understanding these individual dynamics is critical to assessing the company’s financial outlook.

A. Stronghold: Dupixent’s Enduring Growth

Dupixent, a blockbuster developed in collaboration with Sanofi, remains a primary revenue engine for the company.2 Global sales reached $4.34 billion in the second quarter of 2025, a 22% increase over the same period in 2024.2. This growth is not accidental. It is driven by strategic expansion into new indications. The FDA recently approved Dupixent for bullous pemphigoid and chronic spontaneous urticaria.2 Another key catalyst is the approval for Chronic Obstructive Pulmonary Disease (COPD) in Japan.11

The success of Dupixent validates a highly effective R&D and commercialization model. The partnership with Sanofi allows Regeneron to de-risk its pipeline while benefiting from a global commercial footprint.2 The expansion into new, multi-billion-dollar markets, such as COPD, shows a focus on maximizing value from a single asset. The strategy leverages one drug to capture market share in multiple therapeutic areas. This approach reduces the overall risk of the product portfolio while maximizing revenue. It contributes directly to Regeneron’s strong financial position and its ability to maintain a high R&D intensity.6 Furthermore, Dupixent’s patents do not expire until 2031.12 This provides a long runway for continued commercial growth without immediate generic competition.

B. Transition and Headwinds: Eylea’s Market Shift

The Eylea franchise presents a complex financial picture. Total U.S. sales declined 25% to $1.15 billion in the second quarter of 2025.2 This decline stems from a multifaceted strategy. It is due to a planned transition to the higher-dose Eylea HD, competitive pressures, and loss of market share to cheaper, compounded bevacizumab (Avastin).7 This trend is not a sign of failure but of a deliberate, strategic transition. The company is actively cannibalizing its legacy product. The impressive growth of Eylea HD, however, confirms the success of this shift. U.S. sales increased 29% to $393 million in Q2 2025.7. Eylea HD offers less frequent dosing, a critical defense against both biosimilars and the off-label, low-cost competition from Avastin.7 This is a forward-thinking move to protect the long-term value of the franchise.

The Eylea HD transition faces significant operational headwinds. Recent regulatory delays for the pre-filled syringe and monthly dosing are a major threat to this strategy.3 This delay is not due to the drug’s efficacy. Instead, it is linked to manufacturing issues at a third-party facility.3 This single operational bottleneck could slow the critical transition to Eylea HD. It could allow competitors to gain a foothold.3 The raw sales figures show a negative trend. A deeper analysis reveals that the decline is a consequence of a deliberate strategic transition. Eylea HD’s impressive sales growth confirms this internal shift. The delay of key Eylea HD enhancements due to a third-party issue links an established blockbuster to a new oncology drug. This highlights a critical, shared operational vulnerability.

Table 1: Financial Performance at a Glance (Q2 2025)

| Metric | Q2 2025 Value | Q2 2024 Value | Year-over-Year Change |

| Total Revenues | $3.68 billion | $3.55 billion | 4% 2 |

| GAAP EPS | $12.81 | $12.41 | 3% 2 |

| Non-GAAP EPS | $12.89 | $11.56 | 12% 2 |

| Dupixent Global Sales | $4.34 billion | $3.56 billion | 22% 2 |

| Eylea HD U.S. Sales | $393 million | $304 million | 29% 2 |

| Total Eylea U.S. Sales | $1.15 billion | $1.54 billion | -25% 2 |

The Pipeline as a Catalyst: Fueling Future Value

Regeneron’s extensive pipeline provides a path to sustained growth beyond its flagship products. The company’s strategic R&D investments are now yielding tangible results across multiple therapeutic areas. This diversification mitigates the risk associated with its existing portfolio.

A. Oncology Breakthroughs: The Significance of Lynozyfic

The FDA granted accelerated approval to Lynozyfic in July 2025.6 This drug is for relapsed or refractory multiple myeloma. It is Regeneron’s first FDA approval in blood cancer, validating its strategic focus on oncology.6 Lynozyfic is a BCMAxCD3 bispecific antibody, the third to market in its class.6 Its key differentiator is a response-adapted monthly dosing schedule. This provides a significant patient-centric advantage over competitors with fixed schedules.6

The drug demonstrated a 70% overall response rate (ORR) in a pivotal trial. This is competitive with J&J’s Tecvayli (68%) and superior to Pfizer’s Elrexfio (56%).15 This approval of Lynozyfic validates Regeneron’s “extreme” R&D intensity. The company invests nearly double the industry average, dedicating 36.1% of its revenue to R&D.6 The company’s strategy is not to be first to market. Its focus is on developing a superior, differentiated product. It achieves this by learning from its competitors. This patient-centric approach could translate into a powerful commercial advantage and rapid market penetration.6 The company used its R&D to solve a real-world problem – treatment burden. This is a problem that its competitors’ first-to-market products did not fully address.

B. The Regulatory Gauntlet: Odronextamab’s Setback

The FDA issued a second Complete Response Letter for odronextamab.3 The bispecific antibody is for follicular lymphoma. The rejection was not due to a lack of clinical efficacy or safety, which were strong.16 The setback was due to manufacturing issues at a third-party facility.3 The drug is already approved in Europe, further reinforcing that the issue is operational, not scientific.16

Regeneron’s CEO expressed confidence that the issues were procedural and could be resolved expeditiously.1 The odronextamab setback reveals a dual vulnerability. It highlights the outsized risk of relying on a single third-party manufacturer for critical processes. This is a supply chain and operational risk.1 It also shows the fragility of the approval process. The entire trajectory of a promising drug can be derailed by issues completely unrelated to its clinical merit.16 The repeated rejections for Odronextamab could seem like a major failure. A detailed analysis, however, differentiates the scientific success from the operational failure. The problem is procedural with a third-party, not a fundamental issue with the drug itself.

C. Emerging Opportunities: A Glimpse into the Future

The pipeline is a strategic asset that de-risks the company’s future beyond its two main blockbusters. The consistent flow of positive clinical data across multiple therapeutic areas demonstrates the productivity of Regeneron’s R&D engine.17 The company announced positive Phase 3 results for cemdisiran in generalized myasthenia gravis (gMG).10 Cemdisiran is an RNAi therapy with robust efficacy and a convenient quarterly subcutaneous administration.10 The company plans to submit a regulatory application in Q1 2026, positioning it as a potential “best-in-class” therapy.10

Other promising pipeline candidates include REGN5381 (a monoclonal antibody for chronic heart failure) and REGN7508 (a Factor XI antibody for thromboprophylaxis).20 Both are in large, multi-billion-dollar markets.22 The company’s pipeline is highly productive and multi-pronged. The success of one asset, like Lynozyfic, can offset the setback of another, like Odronextamab. This is a crucial aspect of Regeneron’s long-term resilience and a core reason why analysts maintain a positive outlook on the stock.

Table 2: Key Pipeline Catalysts

| Molecule Name | Therapeutic Area | Modality | Indication | Recent Update |

| Lynozyfic | Oncology | Bispecific Antibody | Multiple Myeloma | FDA accelerated approval in July 2025 6 |

| Odronextamab | Oncology | Bispecific Antibody | Follicular Lymphoma | FDA issued a second CRL in August 2025 3 |

| Cemdisiran | Immunology | RNAi | Myasthenia Gravis | Positive Phase 3 results in August 2025, regulatory submission planned Q1 2026 10 |

| REGN5381 | Cardiovascular | Monoclonal Antibody | Chronic Heart Failure | Phase 2, randomized, double-blind study began in January 2024 20 |

| REGN7508 | Hematology | Monoclonal Antibody | Thromboprophylaxis | Phase 3 study began in June 2025, currently recruiting 17 |

Strategic Moats: Technology, Patents, and Governance

Regeneron’s competitive advantage extends far beyond its current product portfolio. Its technological platforms and legal strategies form a robust defense. These elements create a durable barrier to entry that competitors cannot easily replicate. This provides a powerful foundation for long-term growth and market leadership.

A. VelociSuite: The Technological Moat

Regeneron’s drug discovery is powered by its proprietary VelociSuite technologies.5 VelocImmune, a core component, uses a genetically humanized mouse to produce optimized, fully human monoclonal antibodies.5 This overcomes a key limitation of traditional platforms, which can produce non-human antibodies that cause negative immune responses in patients 5 Veloci-Bi is another critical technology. It enables the generation of bispecific antibodies with favorable properties.5 Lynozyfic and Odronextamab are examples of this platform’s productivity. The company also uses advanced technologies like in silico predictive modeling and machine learning to accelerate discovery and development timelines and reduce costs.18

Regeneron’s VelociSuite is not just a collection of tools; it is a fundamental competitive advantage. It functions as a “moat” that protects the company. The successful development of bispecifics like Lynozyfic is a direct result of this platform.6 The legal victories over companies like Amgen, which leveraged their own technologies to create a rival product, demonstrate the power of this platform.24 The company’s legal victories provide a tangible example of how its technology, protected by intellectual property, creates market value.

B. Intellectual Property: A Robust Defensive Posture

Regeneron’s patent portfolio is a critical line of defense for its flagship products. The company successfully defended its Eylea patents in federal court against biosimilar challengers, securing a preliminary injunction against Samsung Bioepis.25 The court upheld its patents. It cited the likelihood of success and the threat of irreparable harm from biosimilar entry.25

The company also won a major antitrust lawsuit against Amgen. Amgen illegally leveraged a bundled rebate scheme to exclude Regeneron’s Praluent from the market.24 Regeneron’s legal strategy and robust IP portfolio are not mere administrative functions. They are critical components of the company’s geostrategy. The Amgen victory establishes a precedent that protects innovative companies from predatory practices. It ensures fair competition. The Eylea patent defense provides a crucial delay against biosimilars, buying time for the Eylea HD transition. These legal maneuvers protect the economic value of their scientific investments.24

C. Geopolitics and Supply Chain Resilience

Regeneron has a global manufacturing footprint with significant investments in both the U.S. (Rensselaer, NY) and Ireland.27 However, the company still relies on third-party manufacturers. The regulatory delays for odronextamab and Eylea HD are directly linked to issues at a third-party facility.3 The manufacturing delays highlight a critical supply chain and geostrategic vulnerability. While Regeneron is praised for its internal investments, its continued reliance on external partners for specific processes creates a single point of failure.

This risk is amplified by broader geopolitical trends. Proposed US tariffs of up to 200% on imported drugs could lead to price increases and supply shortages.8 A company’s internal manufacturing strategy must be viewed in the context of a fragile global supply chain. This supply chain is subject to political and operational risks. The Odronextamab delay is a micro-level symptom of a macro-level vulnerability.

D. Cybersecurity: Managing a Critical Business Risk

The biotechnology sector faces significant cybersecurity risks. These include supply chain attacks and cloud misconfigurations.29 A recent data breach at third-party vendor Cencora affected at least 27 pharmaceutical companies, including Regeneron.9 The breach compromised sensitive patient data, including health diagnoses and medications.9

The Cencora breach is a powerful, real-world case study. It shows how a cybersecurity failure at a single third-party vendor can create a systemic, industry-wide risk. This is a supply chain attack in the digital realm.29 For a company like Regeneron, a business built on trust and handling highly sensitive data, a breach of this nature is not just a financial or legal risk; it is an existential threat to its reputation and long-term viability.30 The mention of exposed DNA data and other sensitive information raises the stakes. It moves the conversation beyond a standard data breach to one of deep privacy and trust.

Conclusion: A Balanced Outlook for Investors

Regeneron’s core strengths remain its prolific R&D engine, its technological edge, and its robust intellectual property portfolio.5 The company has a powerful engine for creating value. Its ability to launch products like Lynozyfic validates this model.6 The near-term outlook is marked by operational headwinds. Specifically, third-party supply chain vulnerabilities have delayed key product enhancements and approvals.3 These issues, coupled with macro-level geopolitical and cybersecurity risks, present a complex risk profile for investors.8

While some analysts may view the near-term volatility as a reason for caution, the long-term investment thesis remains strong. The company’s pipeline and technological foundation provide a resilient path to sustained growth. Regeneron is successfully transitioning from a company reliant on one or two blockbusters to a diversified, multi-product biopharmaceutical powerhouse.2 The recent stock price increases and analyst upgrades reflect a growing confidence. They believe the company will overcome these challenges and continue to deliver on its innovative promise.

Table 3: Competitive Comparison: Bispecifics in Multiple Myeloma

| Product Name | Manufacturer | FDA Approval Date | Overall Response Rate (ORR) | Key Differentiator |

| Lynozyfic | Regeneron | July 2025 | 70% 6 | Response-adapted monthly dosing 6 |

| Tecvayli | Johnson & Johnson | October 2022 | 68% 15 | First to market 6 |

| Elrexfio | Pfizer | August 2023 | 56% 15 | Subcutaneous option 6 |

References

- Earnings call transcript: Regeneron Q2 2025 sees EPS surge, stock

- Regeneron Reports Second Quarter 2025 Financial and Operating Results

- Regeneron hit with second FDA rebuff on odronextamab – FirstWord Pharma

- Dupixent sales spur Sanofi growth, but profits fall short – Pharmaceutical Technology

- Technologies | Regeneron

- Why Regeneron’s Lynozyfic FDA approval validates its extreme R&D thesis

- Q2-2025 Ophthalmic Revenue Roundup for Regeneron, Amgen, AbbVie, Hoya, and Ocular Therapeutix | Market Scope

- Trump plans 200% tariff on imported drugs, raising risk of higher US prices and shortages

- Cencora Data Breach Exposed Patient Information from Multiple Drug Companies

- Regeneron Announces Positive Results from Phase 3 Trial in Generalized Myasthenia Gravis

- Regeneron Reports First Quarter 2025 Financial and Operating Results

- Drugs Losing Patent Exclusivity in 2025: What’s Next? – Pharma Now

- Lucentis vs. Avastin: A macular degeneration treatment controversy – All About Vision

- Lynozyfic™ (linvoseltamab-gcpt) Receives FDA Accelerated Approval for Treatment of Relapsed or Refractory Multiple Myeloma | Regeneron Pharmaceuticals Inc.

- With Lynozyfic Approval, Regeneron Takes On J&J’s Tecvayli and Talvey, and Pfizer’s Elrexfio in Bispecific Myeloma Space – Xtalks

- For a Second Time, FDA Denies Approval of Odronextamab in Lymphoma

- Investigational Pipeline and Medicines in Development – Regeneron

- Regeneron Pharmaceuticals, Inc. – Drug pipelines, Patents, Clinical trials – Patsnap Synapse

- Regeneron to Submit Application for Cemdisiran in Myasthenia Gravis Following Positive Phase 3 NIMBLE Data – NeurologyLive

- Agonist antibody to guanylate cyclase receptor NPR1 regulates vascular tone – PMC

- REGN5381 / Regeneron – LARVOL DELTA

- Venous thromboembolism | MedChemExpress (MCE) Life Science

- Regeneron Pharmaceuticals – Siddharth Shrimal

- Regeneron Prevails over Amgen in Antitrust PCSK9 Lawsuit Protecting Biotech Innovation and Patient Access to Life-Saving Treatments – GlobeNewswire

- Biopharmaceutical Patent Litigation: Regeneron’s Defense Against

- Regeneron defeats Amgen in PCSK9 case; 2 cell therapy biotechs cut staff

- Making Our Medicines – Regeneron

- Regeneron: Industrial Operations and Product Supply – Interactive Infographic

- 2025’s Top Biotech Cybersecurity Threats & Risk Reduction Strategies – Pennant Networks

- Biotech Cybersecurity Report 2025: Inside the Exposure of DNA and Health Records

- Cencora & The Lash Group Settle Data Breach Litigation for $40 Million

Cencora & The Lash Group Settle Data Breach Litigation for $40 Million

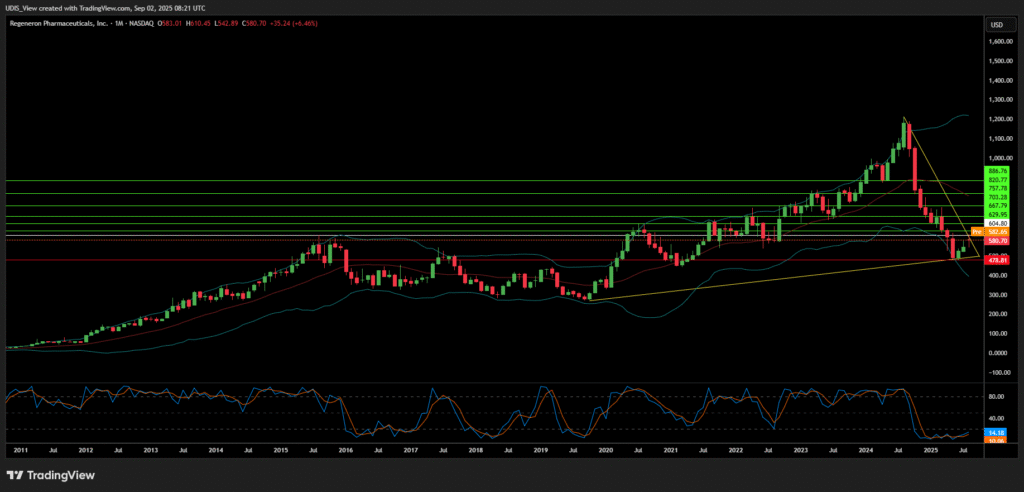

Regeneron Pharmaceuticals Long (Buy)

Enter At: 604.80

T.P_1: 629.95

T.P_2: 667.79

T.P_3: 703.28

T.P_4: 757.78

T.P_5: 820.77

T.P_6: 886.76

S.L: 478.81