AeroVironment (NASDAQ: AVAV) is experiencing unprecedented growth. A convergence of global conflicts, shifting military doctrine, and a strategic acquisition has propelled the company into a leadership position. Its rise is a direct reflection of a new era in defense, one defined by the primacy of small, intelligent, and cost-effective unmanned systems. The company is no longer a niche provider of drones; it is a critical enabler of modern, multi-domain warfare.

The Geopolitical Catalyst

The Russia-Ukraine conflict has functioned as a live-fire laboratory for defense innovation.1 It has demonstrated the strategic utility of low-cost, attritable unmanned systems. This asymmetric warfare model stands in stark contrast to traditional, asset-heavy military doctrines. Ukraine has emerged as a “Silicon Valley of defense,” where entrepreneurs rapidly develop effective, long-range drones.1 This real-world validation of new technologies provides a powerful case study for global defense ministries.

This institutional shift has a direct macroeconomic impact. Global defense stocks have flourished as nations seek to bolster their security and support allies.2 The U.S. defense budget has a proposed budget topping $842 billion for fiscal year 2024, with a $24.6 billion allocation for unmanned systems.2 The sector has outperformed the broader U.S. market by a significant margin.2 This trend signals a fundamental, institutional pivot in defense procurement toward adaptable and scalable systems.

The U.S. Department of Defense (DoD) has recognized the “urgent and enduring threat” posed by unmanned systems, which are changing the character of conflict.4 In response, the DoD has accelerated investments in counter-UAS capabilities.4 The

Replicator initiative, a senior-leader-led, DoD-wide effort, is designed to bypass traditional acquisition processes. This initiative aims to deliver thousands of “all-domain attritable autonomous systems” (ADA2) to warfighters at a scale previously unimaginable.6 The program’s focus on speed, scale, and cost directly aligns with AeroVironment’s core product portfolio. The company is a prime candidate to benefit from this institutional redirection of capital. Its strategic partnerships, such as the one with the Defense Innovation Unit (DIU) on Project Artemis, further solidify its alignment with these new geopolitical imperatives.10

The table below illustrates the precise alignment between U.S. military strategy and AeroVironment’s product development, demonstrating a clear causal relationship between high-level policy and the company’s market position.

| DoD Initiative / Doctrine | DoD Objective | AeroVironment Product / Strategy | Rationale / Impact |

| Replicator Initiative 6 | Accelerate fielding of thousands of low-cost, autonomous systems 7 | Red Dragon, P550, JUMP 20, Switchblade 3 | AVAV’s systems are purpose-built for mass production and rapid deployment, directly addressing the DoD’s need for scale.13 |

| Counter-UAS Strategy 4 | Defend against an “urgent and enduring threat” from drones 4 | BlueHalo Acquisition, P550 11 | The BlueHalo acquisition expands AVAV’s portfolio into critical Counter-UAS, cyber, and directed energy domains.15 |

| Tactical Relevance 12 | Provide reconnaissance and targeting capabilities at the battalion level 12 | P550 UAS for Long-Range Reconnaissance (LRR) program 11 | The P550’s MOSA design provides adaptability and ease of use, meeting the Army’s specific requirements.14 |

The Technology of Tomorrow, Today

Modern drones have evolved far beyond simple reconnaissance tools. They are intelligent, autonomous, and lethal. The integration of artificial intelligence (AI) and machine learning (ML) is the central driver of this evolution.17 AeroVironment’s P550 system, for instance, utilizes “proven AI and autonomy” for “smarter, safer operations” and provides “targeting and strike capabilities”.14 This is a strategic shift from manual operation to semi- and fully autonomous systems.18 This is not theoretical; the Ukrainian conflict has demonstrated that AI-enabled autonomous navigation can raise target engagement success rates from 10-20% to an impressive 70-80%.19 This efficiency is achieved by removing vulnerabilities to jamming and human error.19

Modern conflicts are “contested battlespaces” where GPS and communications are degraded.14 AeroVironment’s technologies are explicitly designed to counter these threats. The Red Dragon loitering munition is a prime example of this.13 It is engineered to operate in “GPS-denied and communications-degraded environments” and is resilient against “advanced electronic warfare (EW) threats”.10 This capability is a significant competitive differentiator. The company’s systems, like the Switchblade, also feature a “patented wave-off” and “recommit capability,” allowing operators to abort missions if a situation changes.21 This high-tech feature reduces collateral damage and provides unparalleled tactical flexibility.

AeroVironment has also adopted a Modular Open Systems Approach (MOSA) for its P550 UAS, a direct answer to the DoD’s call for accelerated innovation.12 This design allows warfighters to reconfigure the system with different payloads, radios, and power options in under five minutes without tools.14 This flexibility not only enhances battlefield adaptability but also reduces the cost and risk of keeping pace with technological advancements.14 This shift from a hardware-centric model to a software-defined, “family of platforms” is a central driver of the company’s growth.13 By creating a common software platform, such as the AVACORE™ shared software architecture for the Red Dragon, the company enables rapid development and adaptation of new variants, allowing for “evolutions at the speed of software and warfare”.13

Financial Strength & Strategic Acumen

AeroVironment finished fiscal year 2025 with a remarkable financial performance. The company reported record revenue of $820.6 million, marking a 14% year-over-year increase.23 A primary driver of this success was the Loitering Munition Systems (LMS) segment, which saw sales surge by over 83% to a record $352 million.23 This growth provides clear evidence of the market’s strong demand for AVAV’s core products. The company also reported record bookings of $1.2 billion and a funded backlog that nearly doubled from the prior fiscal year to $726.6 million.23 This robust backlog provides a clear indicator of sustained, future revenue.

The acquisition of BlueHalo in May 2025 was a transformative strategic move.23 The all-stock transaction had an enterprise value of approximately $4.1 billion, creating a more diversified defense leader with a highly complementary portfolio across air, land, sea, space, and cyber.15 On a pro forma basis, the combined company is expected to deliver more than $1.7 billion in revenue, with BlueHalo adding over $900 million in revenue for 2024 and a funded backlog of nearly $600 million.15 The acquisition is expected to be accretive to revenue, adjusted EBITDA, and non-GAAP EPS in the first full fiscal year.15

The company’s valuation presents an interesting dynamic. While its forward P/E ratio is high at 76.47, a significant premium over its industry average of 38.16, this is not necessarily a contradiction.27 This high valuation is a premium assigned by investors who are betting on the company’s future potential. The apparent contradiction between a “Strong Buy” consensus from some analysts and a “Sell” rating from others can be explained by a nuanced view of the financials.29 The negative short-term GAAP EPS figures and a 28.8% year-over-year decrease are largely influenced by one-time, non-cash charges, such as the UGV goodwill impairment of $18.4 million and accelerated intangible amortization.24 The underlying operational business remains robust, as evidenced by the record bookings and backlog, which are a direct measure of future revenue. The company is transitioning from a project-based model to one based on established programs of record, providing a more stable and predictable revenue stream.15

| Key Financial Metrics | Fiscal Year 2025 | Fiscal Year 2024 |

| Total Revenue | $820.6M 24 | $720M (estimated based on 14% YoY growth) 24 |

| Total Bookings | $1.2B 24 | N/A |

| Funded Backlog | $726.6M 24 | $400.2M 24 |

| Q4 YoY Revenue Growth | 40% 24 | N/A |

| LMS Sales Growth | >83% 23 | N/A |

The Transformative Power of the BlueHalo Acquisition

| Strategic Impact of BlueHalo Acquisition | Value & Rationale |

| New Segments Entered | Counter-UAS, Directed Energy, Cyber, Space 15 |

| Combined Pro Forma Revenue | >$1.7B 15 |

| BlueHalo 2024 Revenue | >$900M (estimated) 15 |

| BlueHalo Funded Backlog | ~$600M 15 |

A Moat of Innovation: Patent & Intellectual Property Analysis

AeroVironment’s competitive advantage is not a fleeting trend but the result of a long-standing, systematic commitment to innovation. The company has a storied history of groundbreaking achievements, from the human-powered Gossamer Condor and Albatross to the solar-powered Pathfinder and Helios prototypes.31 This legacy of “firsts” is the foundation for the company’s current work in high-altitude pseudo-satellites.11

The company’s intellectual property portfolio is a significant competitive moat.3 Specific patents cover unique and critical features, such as the loitering munition’s “wave-off feature” and “enhanced frequency hopping”.21 This “wave-off feature” is a notable strategic advantage, allowing operators to abort a mission mid-flight, a capability that distinguishes it from traditional munitions.22 This demonstrates that the company’s IP protects not just generic drone technology, but highly specialized, high-value capabilities. Other patents cover foundational technologies like amphibious UAVs and hydrogen storage, indicating a broad and diversified IP strategy.33

Innovation is a continuous process at AeroVironment. In fiscal 2022, the company invested $94.2 million in research and development.32 This consistent investment is critical for maintaining market leadership. The company’s innovation strategy extends beyond internal R&D. The acquisitions of Progeny Systems’ Intelligent Systems Group in 2021 and BlueHalo in 2025 are key components of a “buy-or-build” approach to technology.15 This hybrid model allows the company to both pioneer new areas and rapidly integrate best-in-class capabilities, creating a compounding advantage in a fast-moving industry.

Conclusions

AeroVironment is uniquely positioned to capitalize on a fundamental shift in military strategy. The company is a direct solution provider to a new, validated model of conflict that prioritizes low-cost, intelligent, and scalable unmanned systems. Its record financial performance in fiscal year 2025, driven by surging demand for its loitering munitions, provides clear evidence of this market alignment.

The strategic acquisition of BlueHalo fundamentally transforms the company, diversifying its portfolio across critical domains and creating a more stable, predictable revenue stream based on programs of record. While the company’s high valuation and temporary GAAP earnings weakness may cause some investor hesitation, a deeper analysis reveals a healthy underlying business. The high valuation is a justified premium on the company’s massive, near-term revenue potential from its record backlog and its long-term strategic advantages in AI, autonomy, and electronic warfare. The company’s deep innovation pipeline, protected by a valuable patent portfolio, ensures its competitive moat will endure for years to come.

References

- Ukraine becoming the ‘Silicon Valley’ of defense as startups develop long-range drones and missiles – PBS

- Defense stocks flourish after Russian invasion of Ukraine

- AeroVironment, Inc. (AVAV): PESTLE Analysis [Jan-2025 Updated] – dcfmodeling.com

- Department of Defense Counter Unmanned Aircraft Systems: Background and Issues for Congress

- DoD Announces Strategy for Countering Unmanned Systems > U.S. …

- The Replicator Initiative – Defense Innovation Unit

- Replicator Drone Initiative Earns Good Grades Two Years In – MeriTalk

- Implementing DoD Replicator Initiative at Speed and Scale – Defense Innovation Unit

- First Replicator Initiative Capability on Track for August, Officials Say – USNI News

- AV’s Cutting-Edge One-Way Attack UAS Secures DIU Backing Under Project Artemis

- News & Press Releases – Investor Relations | AeroVironment, Inc.

- U.S. Army taps AeroVironment, Edge for new recon drones

- AV Unleashes Red Dragon: A New Breed of Fully Autonomous Capable, GPS-Denied One-Way Attack Unmanned Aircraft Systems – AeroVironment, Inc.

- AV Delivers Initial P550 Autonomous Group 2 eVTOL Unmanned …

- AeroVironment to Acquire BlueHalo Establishing Next-Generation Defense Technology Company

- AeroVironment Delivers First P550 Autonomous eVTOL Systems to U.S. Army – Dronelife

- Send in the drones | Article | The United States Army

- Drone Autonomy & AI – Fly Eye

- Ukraine’s Future Vision and Current Capabilities for Waging AI-Enabled Autonomous Warfare – CSIS

- Red Dragon® – One Way Attack | Fully Autonomous Capable UAS | AV

- For more product information, visit avinc.com

- AeroVironment Switchblade – Wikipedia

- 2025 CORPORATE OVERVIEW – Investor Relations | AeroVironment, Inc.

- AeroVironment Announces Fiscal 2025 Fourth Quarter and Fiscal Year Results

- AeroVironment Announces Fiscal 2025 Fourth Quarter and Fiscal Year Results

- AeroVironment announced the all-stock acquisition of BlueHalo

- AeroVironment (AVAV) Dips More Than Broader Market: What You Should Know | Nasdaq

- AVAV 2025 Earnings & EPS History – Quarterly & Annual Growth Reports – FullRatio

- AeroVironment – AVAV – Stock Price Today – Zacks Investment Research

- AVAV Stock Price | Analyst Target 283.4 & Strong Buy Consensus – eToro

- AeroVironment – Wikipedia

- AeroVironment, Inc. (AVAV): VRIO Analysis – dcfmodeling.com

- Patents Assigned to AeroVironment – Justia

- AV News, Press Releases & Thought Leadership. – AeroVironment, Inc.

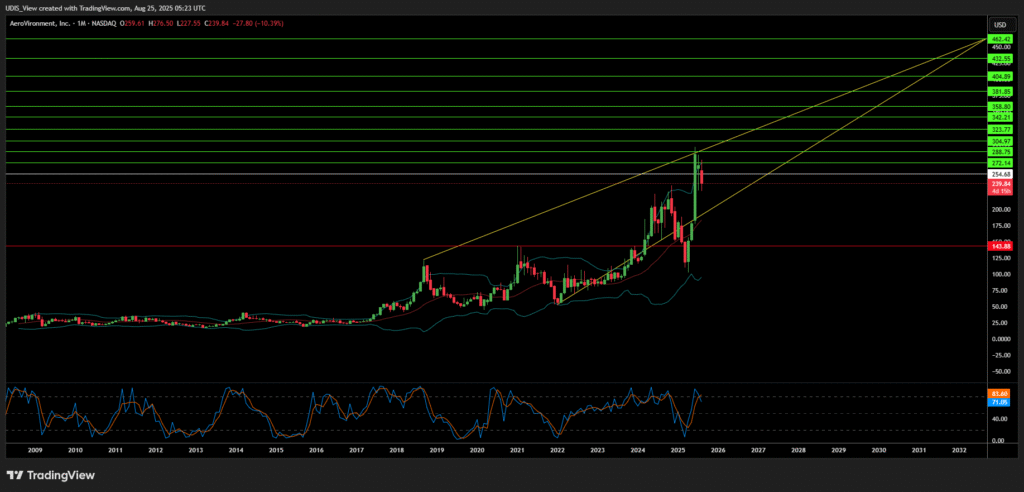

AeroVironment Long (Buy)

Enter At: 254.68

T.P_1: 272.14

T.P_2: 288.75

T.P_3: 304.97

T.P_4: 323.77

T.P_5: 342.21

T.P_6: 358.80

T.P_7: 381.85

T.P_8: 404.89

T.P_9: 432.55

T.P_10: 462.42

S.L: 143.88