Iridium’s Strategic Ascent in Global Communications

Iridium Communications has firmly established itself as a pivotal global connectivity provider. Its distinctive Low-Earth Orbit (LEO) satellite constellation delivers unparalleled reach and robust resilience.1 This inherent strategic advantage propels its escalating significance across diverse operational sectors. The company’s recent growth derives from its indispensable role in national security, its advanced technological capabilities, and its formidable cybersecurity posture.2 Demand for reliable, global, non-terrestrial communication continues to intensify, positioning Iridium for sustained expansion.

The current success of Iridium represents a significant resurgence, building upon lessons from its predecessor. The original Iridium faced challenges, being characterized as “the right product at the wrong time” due to the rapid proliferation of cellular technology and high costs.4 However, the Iridium NEXT constellation marks a successful re-launch, demonstrating remarkable adaptability.5 This evolution indicates that present market conditions, defined by increasing requirements for global Internet of Things (IoT) solutions, remote operations, and critical government communications, now align precisely with Iridium’s unique capabilities.2 The company’s past experience served as a crucial learning curve, culminating in a more robust and strategically positioned offering today. Iridium’s trajectory is not merely a continuation but a deliberate, strategic re-emergence, capitalizing on a matured technological landscape and heightened geopolitical necessities.

The Foundation: Iridium’s Resilient LEO Network Architecture

Iridium’s operational backbone is its resilient LEO network. The Iridium NEXT constellation consists of 66 active satellites.5 These satellites orbit Earth across six distinct planes, with 11 spacecraft evenly distributed within each plane.5 This polar LEO configuration, maintained at an altitude of 780 kilometers, ensures comprehensive global coverage, reaching 100% of the planet.1

A defining feature of Iridium’s network is its cross-linked design. Each Iridium satellite establishes communication with up to four other satellites in orbit through Ka-band crosslinks.2 This unique architecture provides inherent redundancy and resilience. It facilitates automatic re-routing of communications in the event of disruptions, guaranteeing uninterrupted service.2 This design supports global voice and data services, accessible from any location on Earth.1

Iridium transmits signals to users via the L-band frequency.5 This frequency exhibits superior penetration capabilities, easily passing through clouds, forest canopies, and other environmental obstructions.5 This makes the network highly resilient to adverse weather conditions.2 Operating in LEO, Iridium offers low latency and high signal quality. Its proximity to Earth minimizes signal travel time, proving crucial for real-time applications.6

Comparing Iridium’s LEO system with Geostationary (GEO) satellites highlights distinct advantages. LEO satellites, like Iridium’s, provide significantly lower latency compared to GEO satellites.6 GEO satellites operate at a much higher altitude, approximately 36,000 kilometers above the Earth’s equator.6 This greater distance results in higher latency, which can severely impact time-sensitive applications.6 While GEO satellites offer wide, stable coverage with fewer units, LEO’s low latency and superior signal quality are paramount for contemporary demands.6 The strategic choice of a LEO architecture for Iridium is not merely a technical preference; it serves as a critical differentiator that directly enables its core value proposition for high-stakes, real-time operations, particularly within defense and intelligence sectors. The combination of low latency from its LEO positioning and its unique global coverage makes it exceptionally suited for applications where speed and reliability are non-negotiable, such as battlefield mapping, precise targeting, and real-time situational awareness.2 GEO’s inherent high latency renders it unsuitable for these critical, time-sensitive requirements.6

Table 1: Iridium NEXT Constellation Key Specifications

| Feature | Specification | Source |

| Number of Operational Satellites | 66 | 5 |

| Number of Orbital Planes | 6 | 5 |

| Satellites per Plane | 11 | 5 |

| Orbit Type | Low-Earth Orbit (LEO) | 5 |

| Altitude | 780 km | 5 |

| Inclination | 86.4° | 5 |

| Orbital Period | 101 minutes | 5 |

| Mission Life | 15 years to beyond 2030 | 5 |

| Risk Mitigation | 6 in-orbit spares + 6 hanger spares | 5 |

| Launch Vehicle | SpaceX Falcon-9 | 5 |

| Key Frequencies | L-band (user), Ka-band (crosslinks) | 5 |

Geopolitical and Geostrategic Imperatives: A Pillar of National Security

Iridium plays a critical role in global geopolitical and geostrategic landscapes. The United States government, specifically the Department of Defense (DoD) and the Space Force, relies extensively on Iridium for mission-critical connectivity.2 Iridium maintains a multi-year, fixed-price contract with the DoD, providing Enhanced Mobile Satellite Services (EMSS) with unlimited usage for an unlimited number of subscribers.2 This contract highlights Iridium’s indispensable status in national security operations.

The company enables a broad spectrum of secure, mission-critical applications. These include secure voice and data services, tactical group communications, and live video conferencing.2 Its capabilities extend to In-Transit Visibility (ITV) for personnel and equipment, battlefield mapping, precise targeting, and real-time situational awareness.2 These functionalities are vital for global command and control (C2) and remote surveillance operations.2

The strategic value of Iridium’s non-terrestrial, resilient communications is profound. Its LEO network operates independently of local terrestrial infrastructure, making it impervious to ground-based threats.2 This represents a crucial advantage in volatile global environments. Furthermore, the network’s cross-linked architecture provides additional layers of redundancy and resilience. This ensures service continuity even if individual satellites face disruption.2 This inherent resilience constitutes a key geostrategic asset, enabling operations where traditional networks are compromised or unavailable.

Iridium solutions also offer extensive interoperability and integration capabilities. They seamlessly integrate with existing radio or terrestrial platforms.2 This creates comprehensive communication networks for deployed teams, significantly enhancing interoperability across diverse military and intelligence operations.2 The DoD’s reliance on Iridium for “real-time tactical, mission-critical connectivity beyond the reach of terrestrial networks – anywhere on the planet” 2 underscores its role in enabling global power projection and rapid response. The fact that its services remain “unaffected by safety and security threats on the ground” 2 directly addresses vulnerabilities inherent in terrestrial networks within conflict zones or disaster areas. This positions Iridium as a fundamental component of modern military doctrine, not merely a service provider. Its technology functions as a strategic national asset, underpinning operational capabilities that directly influence geopolitical outcomes. Iridium’s growth is therefore intrinsically linked to global security demands and the persistent need for resilient, ubiquitous communication infrastructure in an increasingly contested world.

Table 2: Iridium’s Strategic Applications for Government & Defense

| Category | Applications | Iridium Advantage | Source |

| Location Services | In-Transit Visibility (ITV), Mission Command Collaboration, Battlefield Mapping Mission Tools, Precise Targeting and Navigation, GEOINT, Tactical PLI, Satellite Time & Location (A-PNT) | Secure Connections, Reliability, Redundancy, Interoperability, Comms-on-the-Move, Range of Solutions | 2 |

| Voice & Video Communications | NSA Type 1 Encrypted / Secure Voice, Radio Range Extensions (RRE) Voice, Secure Distributed Tactical Communications System (DTCS), Video Upload and Transfer, Video Conferencing, Senior Leader Communications | Secure Connections, Reliability, Redundancy, Interoperability, Comms-on-the-Move, Range of Solutions | 2 |

| Data Connectivity | “Push and Pull” Mission packages, Tactical Applications (WINTAK/ATAK), Sensor Imaging and Reporting, Remote Data Transfer, Unmanned Aviation Vehicles (UAV) and Unmanned Ground Vehicles (UGV) Command and Control (C2) | Secure Connections, Reliability, Redundancy, Interoperability, Comms-on-the-Move, Range of Solutions | 2 |

| Mission Critical | Real-time Situational Awareness, Comms-on-the-Move, Regional Theater Global C2, Remote Surveillance, Detection, and Alerting, Blue Force Tracking | Secure Connections, Reliability, Redundancy, Interoperability, Comms-on-the-Move, Range of Solutions | 2 |

Technological Leadership: Driving Innovation and Capability

Iridium demonstrates significant technological leadership through its advanced capabilities and strategic innovation. Iridium NEXT satellites host specialized payloads for government and scientific organizations.5 Prominent examples include Aireon’s Global ADS-B (Automatic Dependent Surveillance-Broadcast) receiver, which provides global, real-time aircraft surveillance and emergency location services.5 Additionally, Harris Corporation and exactEarth operate a global AIS (Automatic Identification System) payload, enabling comprehensive ship tracking and collision prevention.5 These hosted payloads deliver unprecedented geospatial and temporal coverage with low-latency data relay, showcasing Iridium’s ability to support high-value, specialized applications.5

The evolution of Iridium’s data rates and terminal solutions marks a significant advancement. While the original Iridium network offered very limited data rates, next-generation Iridium satellites provide improved capabilities.4 They support low data rates for handheld devices and up to 8 Mbps for fixed or transportable Ka-band terminals.4 This technological progression caters to a wider array of user requirements, from basic voice communication to more data-intensive applications.

Iridium maintains a clear strategic differentiation against emerging LEO competitors. Its unique cross-linked architecture ensures 100% global coverage and exceptional resilience.1 Unlike Starlink, which primarily relies on terrestrial receivers and operates in higher frequencies (Ka/Ku bands), Iridium’s L-band frequency offers superior weather resilience and direct connectivity to smaller, more mobile devices.2 Iridium deliberately focuses on critical, secure, and mobile communications, distinguishing its offerings from consumer broadband services.2 This strategic focus on specialized, high-value services, such as those for the DoD and global air/maritime surveillance, indicates that Iridium does not directly compete with mass-market broadband providers like Starlink.2 Instead, it serves a distinct, high-value, and often government or enterprise-focused segment. This strategic positioning minimizes direct competition and contributes to a stable, high-margin business model.

Iridium’s unique constellation architecture, cross-linked satellites, L-band resilience, and multi-layered security frameworks imply substantial proprietary technology.1 These technological differentiators are likely protected by patents, establishing a significant competitive advantage. The capacity to host payloads and provide secure government communications further points to specialized, protected intellectual property.2 Iridium’s technological leadership is therefore defined by its ability to provide highly reliable, secure, and specialized services to niche markets where traditional terrestrial or even other LEO broadband solutions prove insufficient. This strategic market alignment ensures a robust competitive moat.

Fortifying the Digital Frontier: Advanced Cybersecurity Measures

Satellite communication networks inherently face significant cybersecurity vulnerabilities. Due to their broadcast nature and extensive coverage, satellite signals are susceptible to jamming, spoofing, and eavesdropping by malicious actors.3 Furthermore, satellites operate under strict power, computational, and bandwidth limitations, which restrict the implementation of resource-intensive security measures.3 These constraints necessitate robust, lightweight security frameworks capable of countering sophisticated threats.3

Iridium addresses these challenges through a comprehensive, multi-layered security framework. This integrated approach combines physical-layer hardening, quantum-resilient encryption, and AI-driven analytics.3 It also incorporates a governance framework meticulously aligned with industry standards.3 This holistic strategy uniquely addresses prevention, defense, resilience, and collaboration across the SATCOM ecosystem.3 The framework prioritizes lightweight AI, quantum resilience, and cross-layer security, deemed critical for safeguarding next-generation SATCOMs against advanced cyber-attacks.3

Iridium places a strong emphasis on secure protocols for government communications. The company ensures that voice and data transmitted by U.S. government customers remain uncompromised.2 It employs FIPS-140-2 and ASC22FO encryption, along with NSA Type 1 Encrypted / Secure Voice capabilities.2 This commitment to high-level security protocols serves as a critical differentiator, particularly for its defense and intelligence clients.2

Iridium’s defense strategy includes a sophisticated tri-layer threat taxonomy for LEO constellations. This taxonomy links physical attacks (e.g., ASAT, directed-energy), communications attacks (e.g., jamming, spoofing), and service-availability attacks (e.g., DoS/DDoS) into a unified attack surface spanning space, ground, and user segments.3 Its five-domain defense stack further incorporates adaptive beamforming to harden physical links, machine learning and deep-learning intrusion detection, and a hybrid QKD–PQC scheme for post-quantum cryptographic agility.3 The stack also includes scalable multi-antenna hardware front-ends and integrated AOA–Doppler–NMA–SSSC processing to suppress spoofing.3 These elements collectively form an end-to-end protection blueprint for next-generation satellite networks.3

Iridium’s explicit, multi-layered, and government-certified security measures are not simply about compliance; they form a fundamental part of its value proposition, especially for its most lucrative government and defense clients.2 The significant investment in lightweight AI, quantum resilience, and cross-layer security demonstrates a proactive, forward-looking strategy.3 This robust security posture enables Iridium to secure high-value contracts and maintain client trust, directly contributing to its business growth. In an era of escalating cyber warfare and state-sponsored attacks, Iridium’s advanced cybersecurity is not merely a technical feature but a strategic asset that commands premium pricing and secures critical market segments. This transforms a potential vulnerability into a significant competitive advantage and a direct driver of economic expansion.

Table 3: Iridium’s Multi-Layered Cybersecurity Framework Components

| Layer/Component | Description | Source |

| Physical-layer Hardening | Measures to protect physical links, including adaptive beamforming. | 3 |

| Quantum-Resilient Encryption | Hybrid QKD–PQC scheme for post-quantum cryptographic agility. | 3 |

| AI-Driven Analytics | Machine learning and deep-learning intrusion detection systems. | 3 |

| Cross-Layer Security | Integrated approach across physical, communications, and service-availability layers. | 3 |

| Governance Framework | Aligned with standards, ensuring integrated workflow. | 3 |

| Specific Government Certifications | FIPS-140-2, ASC22FO encryption, NSA Type 1 Encrypted / Secure Voice. | 2 |

Economic and Market Dynamics: Sustaining Growth and Competitive Advantage

Iridium’s business model generates robust revenue streams from diverse sources. The company provides global voice and data services across the planet.1 A substantial portion of its revenue originates from its multi-year, fixed-price EMSS contract with the U.S. Department of Defense.2 Additionally, hosted payloads, such as Aireon’s ADS-B for aircraft surveillance and Harris/exactEarth’s AIS for ship tracking, represent diversified and high-value revenue streams.5

Iridium’s offerings present a compelling cost-effectiveness and value proposition. Hosted payloads, for instance, offer customers access to space at a fraction of the cost associated with a dedicated mission.5 This value proposition attracts critical government and scientific organizations. Iridium’s unique ability to provide global, resilient connectivity where terrestrial networks are absent or compromised creates significant value for remote operations, maritime, aviation, and defense sectors.1

The company’s market positioning and competitive advantage are distinct. Iridium differentiates itself by offering 100% global coverage and robust, secure, low-latency L-band communications.1 Unlike Starlink, which primarily targets consumer broadband, Iridium strategically focuses on mission-critical, high-value applications for government, maritime, aviation, and the Internet of Things (IoT).2 Its cross-linked network architecture provides a level of redundancy unmatched by other LEO constellations, ensuring superior reliability for critical operations.2

Iridium’s unique LEO constellation, cross-linked architecture, and advanced security protocols represent significant intellectual property.2 These patented or proprietary technologies establish a strong competitive moat. The capacity to integrate hosted payloads and offer NSA Type 1 encryption further solidifies its unique market position and technological advantage.2 While Starlink pursues a high-volume, potentially lower-margin consumer broadband model 4, Iridium’s emphasis on “mission-critical” 2, “secure” 2, and “cost-effective access to space” 5 for specialized, high-value applications suggests a high-margin niche strategy. The fixed-price DoD contract provides stable, predictable revenue.2 This approach minimizes direct competition with mass-market players and leverages Iridium’s unique technical advantages, contributing to robust economic performance. Iridium’s economic growth is therefore driven by a deliberate strategy to dominate high-value, specialized segments rather than general connectivity. This focus on unique capabilities and critical infrastructure services provides greater economic resilience and profitability, making it an attractive investment in the evolving SATCOM landscape.

Outlook: Iridium’s Trajectory in the Evolving Satellite Communications Landscape

Iridium is well-positioned for continued growth as global demand for resilient, non-terrestrial connectivity intensifies. Expansion into new Internet of Things (IoT) applications, remote asset monitoring, and deeper integration with defense and intelligence requirements will drive future revenue.2 The persistent need for secure, reliable communications in an increasingly interconnected and volatile world ensures Iridium’s enduring relevance and market expansion.

Strategic partnerships continue to bolster Iridium’s market position. Its collaboration with SpaceX for satellite launches exemplifies its ability to leverage industry leaders for critical infrastructure development.4 Future collaborations in areas such as direct-to-device connectivity or enhanced data services could unlock entirely new market segments. The valuable experience gained from the original Iridium’s initial challenges positions the current company to adapt and innovate effectively in a dynamic market.4

For investors and the broader telecommunications industry, Iridium represents a compelling proposition within the critical infrastructure sector. Its stable government contracts, unique technological advantages, and high-margin niche strategy offer a distinct investment profile compared to other satellite operators.2 The company’s ongoing innovation in cybersecurity and hosted payloads reinforces its long-term viability and leadership in specialized satellite communications.3 The trajectory of Iridium provides valuable insights into the broader satellite communications market. The original Iridium’s initial difficulties, attributed to being “the right product at the wrong time” 4, contrast sharply with its current success. This indicates that the market for highly specialized, mission-critical satellite communications has matured significantly. Iridium’s ability to secure long-term government contracts and host high-value payloads signals robust and growing demand for capabilities beyond basic broadband.2 This positions Iridium not merely as a company, but as an indicator of the viability and profitability of targeted, resilient SATCOM solutions within the space sector.

Conclusion

Iridium Communications has solidified its market position through a strategic confluence of technological superiority, geopolitical necessity, and astute economic positioning. Its resilient LEO network, characterized by cross-linked satellites and L-band frequency, provides unparalleled global coverage and low-latency, weather-resilient communication vital for real-time applications. This foundational architecture directly supports its indispensable role in national security, evidenced by its long-standing, high-value contracts with the U.S. Department of Defense.

The company’s growth is further propelled by its technological leadership, demonstrated through advanced hosted payloads and continuous evolution of data services. Its strategic differentiation from mass-market LEO providers, focusing instead on high-value, mission-critical applications, ensures a stable and profitable niche. Crucially, Iridium’s proactive and multi-layered cybersecurity framework, including quantum-resilient encryption and AI-driven analytics, transforms inherent satellite vulnerabilities into a core competitive advantage, securing sensitive government and enterprise communications.

Iridium’s current success represents a strategic resurgence, having leveraged past market lessons to align perfectly with today’s escalating demand for secure, ubiquitous, and resilient connectivity. This deliberate focus on specialized, high-margin services, underpinned by robust intellectual property and strategic partnerships, positions Iridium for sustained economic growth. The company stands as a compelling investment in critical infrastructure, serving as a bellwether for the maturity and profitability of targeted satellite communication solutions in an increasingly complex global landscape.

References

- Iridium Satellite Communications | Your World. Our Network

- U.S. Government Defense, Intelligence, & Security | Iridium

- Cybersecurity in Satellite Communication Networks: Key Threats and Neutralization Measures – ResearchGate

- Will Starlink fail like Iridium? – Telecom & ICT – telecomHall Forum

- Iridium NEXT – eoPortal

- LEO and GEO Satellites: Differences, Advantages and Challenges in Satellite Connectivity

Additional Reading Materials:

- Privacy Policy | Iridium Satellite Communications

- Comparison Between Low Earth Orbit Satellite and Geostationary Earth Orbit Satellite in Direct-to-Phone Satellite Communication Technology | Applied and Computational Engineering

- Iridium Communications Reports Steady 5% Revenue Growth Amid Rising Market Demand: A Resilient Player in Satellite Communications

- Iridium Announces First Quarter 2025 Results – Apr 22, 2025

- New message

- tm2331396d2_ars.pdf

- May- Governor Glenn Youngkin Announces Iridium Communications Expanding Headquarters in Fairfax County | Governor.Virginia.gov

- https://growjo.com/company/Iridium_Communications

- https://mifsee.com/en/irdm/

- Iridium: SpaceX’s first partner, global communications giant

- Iridium Communications Stock Price, Funding, Valuation, Revenue & Financial Statements

- Iridium Communications (IRDM): Future Growth and Stock Forecast – MiFsee

- The Top Benefits of Using Iridium Satellite Phones for Business Continuity – N-Sat Corporation

- Htt.io

- Iridium Communications Inc Market share relative to its competitors, as of Q2 2025 – CSIMarket

- Patents Assigned to Iridium Satellite LLC – Justia Patents Search

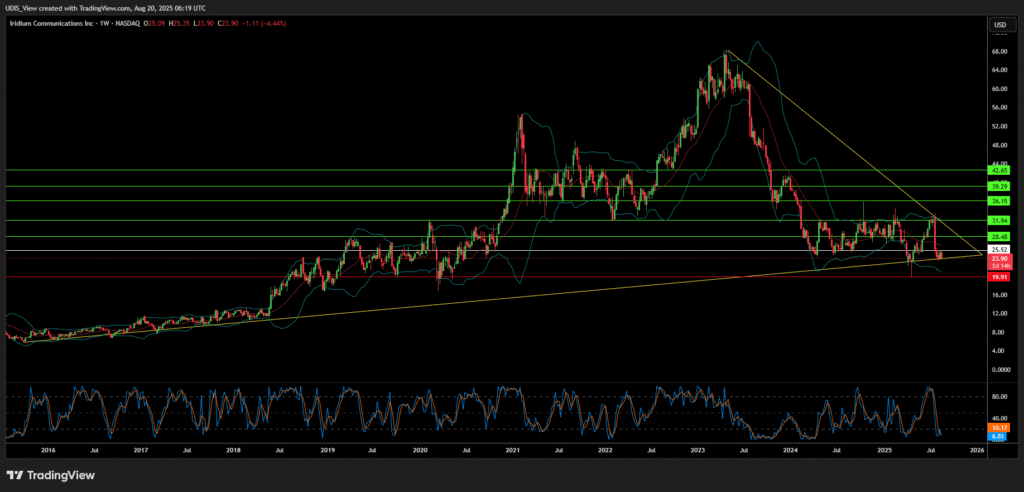

Iridium Long (Buy)

Enter At: 25.52

T.P_1: 28.48

T.P_2: 31.94

T.P_3: 36.15

T.P_4: 39.29

T.P_5: 42.65

S.L: 19.91