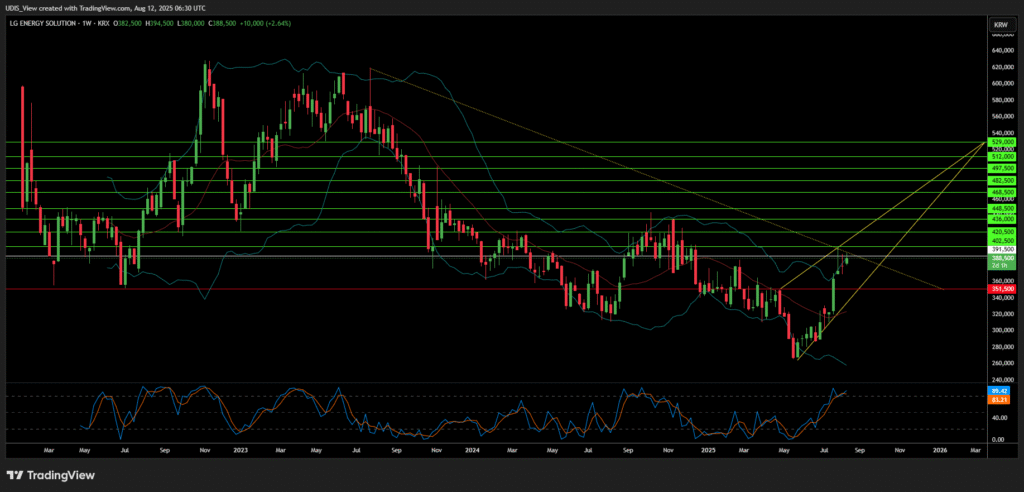

LG Energy Solution dominates the battery sector with bold moves in 2025. The company secures massive deals and expands production amid global shifts. Its stock climbs 11.49% year-to-date, reaching 388,000 KRW by August 12. Investors eye LG’s Tesla partnership and patent victories. This article dissects growth factors across critical domains. LG positions itself as a leader in sustainable energy.

Geopolitics: Navigating US-China Tensions

US tariffs on Chinese batteries force shifts in supply chains. LG capitalizes by supplying Tesla with $4.3 billion in LFP batteries from Michigan. This reduces Tesla’s China reliance and boosts LG’s US footprint. Geopolitical risks, like mineral supply disruptions, favor non-Chinese players. LG strengthens ties with Western firms amid trade wars. The company leads in clean energy amid global rivalries. Tariffs create opportunities; LG grabs them assertively.

Geostrategy: Expanding US Manufacturing Dominance

LG ramps up US production to secure strategic advantages. Its Michigan factory hits 17GWh capacity by 2025-end, doubling to 30GWh by 2026. Partnerships with GM and Tesla fortify North American bases. LG repurposes EV lines for ESS, outpacing rivals’ greenfield builds. This strategy hedges against supply disruptions and taps IRA incentives. LG dominates the US energy storage market through smart expansions. Strategic moves ensure long-term market control.

Macroeconomics: Capitalizing on ESS Boom Amid EV Slowdown

Global EV demand slows, but energy storage surges with renewables and AI data centers. LG reports stable EV sales yet pivots to ESS for growth. Q2 2025 operating profits rise 31.4% to KRW 492.2 billion despite revenue dips. Macro trends like rising clean energy adoption drive demand. LG benefits from non-Chinese ITC eligibility rules, offsetting tariffs. Economic pressures favor diversified players; LG adapts swiftly. Macro shifts propel LG’s upward trajectory.

Economics: Securing Lucrative Deals and Incentives

LG inks a $4.3 billion Tesla contract, eclipsing Q2 revenue of KRW 5.6 trillion. This deal, extendable to 2037, boosts volumes and margins. US production incentives yield nearly all Q2 profits at $491 million. Market cap hits 90.792T KRW, with 18.11% one-year returns. Analysts target 426,569 KRW, signaling confidence. Economic incentives and big contracts fuel profitability. LG’s economics scream investment potential.

Technology: Pioneering Battery Innovations

LG advances LFP and LMR technologies for higher capacity and safety. LMR batteries promise 30% more energy density than LFP by 2028. Fast-charging cells under 10 minutes target next-gen EVs. Tech leadership secures deals like Tesla’s ESS supply. LG innovates in prismatic cells for vehicles and storage. Technology drives competitive edges in high-output batteries. Bold tech pushes LG ahead.

Cyber and Science: Safeguarding IP in Advanced Chemistry

Cyber threats loom in battery tech, but LG counters with robust patent enforcement. Scientific breakthroughs in electrode and separator arrangements enhance lithium-ion efficiency. LG’s chemistry innovations apply to EVs and ESS, boosting output and capacity. Cyber defenses protect R&D from espionage amid industry freeriding. Science underpins LG’s core advancements. LG asserts control through cyber vigilance and scientific prowess.

High-Tech: Leading in Sustainable and AI-Enabled Energy

LG integrates high-tech in smart grids and device innovations. RE100 commitment transitions to 100% renewables by 2030, ahead of peers. High-tech ESS supports AI data centers’ power needs. Collaborations like GM’s LMR tech highlight IP strength. LG’s high-tech focus reshapes energy landscapes. High-tech strategies ensure enduring leadership.

Patent Analysis: Enforcing a Strong Portfolio

LG holds over 200 LMR patents and wins injunctions against Sunwoda in Germany. Courts order recalls and damages for infringed electrode tech. Patent strategy targets freeriders, establishing fair licensing markets. From 2020-2024, LG registers numerous innovations in separators and arrangements. Analysts note LG’s portfolio as a barrier to competitors. Patents protect and monetize tech edges. Aggressive enforcement solidifies LG’s dominance.

LG Energy Solution thrives in 2025 through strategic agility and innovation. Growth spans geopolitics to patents, positioning it for sustained gains. Investors should watch this battery powerhouse closely.

LG Energy Long (Buy)

Enter At:391500

T.P_1: 402500

T.P_2: 420500

T.P_3: 436000

T.P_4: 448500

T.P_5: 468500

T.P_6: 482500

T.P_7: 497500

T.P_8: 512000

T.P_9: 529000

S.L: 351500