Sirius XM Holdings (NASDAQ: SIRI), the leading satellite radio and streaming service in North America, has captured significant attention from Warren Buffett’s Berkshire Hathaway, which now holds a 37% stake valued at approximately $2.6 billion CNBC, 2025. Despite challenges like declining subscribers and revenue, Buffett’s continued investment signals confidence in Sirius XM’s long-term potential. This article analyzes the reasons behind this investment across multiple domains: macroeconomics, economics, technology, high-tech, geopolitics, geostrategy, cyber, science, and patent analysis. By exploring these areas, we uncover why Sirius XM remains an attractive opportunity for value investors.

Macroeconomic and Economic Factors

Sirius XM’s subscription-based revenue model, generating over $1 billion in annual free cash flow, provides stability in volatile economic conditions Motley Fool, 2025. With 34 million subscribers as of Q2 2025, the company benefits from predictable cash flows, unlike ad-driven media firms that face revenue fluctuations during downturns Sirius XM Investor Relations. This stability aligns with Buffett’s preference for businesses with consistent earnings, making Sirius XM a compelling investment during economic uncertainty.

The company’s fortunes are closely tied to the automotive industry, as many subscriptions are bundled with new car sales. Macroeconomic factors like interest rates and consumer confidence directly influence car purchases. Higher interest rates could reduce car sales, slowing subscriber growth, while a robust economy could boost both Forbes, 2025. Inflation poses another challenge, potentially straining consumer budgets and increasing churn. However, Sirius XM’s history of passing on cost increases through price hikes mitigates this risk.

The company’s 5% dividend yield, well-covered by earnings, appeals to income-focused investors like Buffett. Additionally, Sirius XM’s cost-cutting initiatives, targeting $200 million in annualized savings by 2025, enhance its financial resilience PR Newswire, 2024. These factors collectively make Sirius XM an attractive economic play, despite short-term challenges.

Table 1: Sirius XM Financial Snapshot (Q2 2025)

| Metric | Value |

| Subscribers | 34 million |

| Annual Free Cash Flow | $1 billion |

| Dividend Yield | 5% |

| Forward P/E Ratio | 7.2x |

| Cost Savings Target | $200 million by 2025 |

Technological and High-Tech Advancements

Sirius XM is actively adapting to the digital media landscape, competing with streaming giants like Spotify and Apple Music. The company has introduced innovative offerings, such as an ad-supported free version in select vehicles and a three-year dealer-sold subscription package, to attract a broader audience and diversify revenue streams Investopedia, 2024. The acquisition of Pandora has bolstered its digital presence, enabling Sirius XM to offer personalized content and on-demand programming through its 360L platform, rolled out in vehicles from manufacturers like Stellantis and Ford Wikipedia, 2025.

Investments in streaming technology and smart device integration are critical for enhancing user experience and retaining subscribers. The company’s focus on exclusive content, such as high-profile podcasts like Call Her Daddy, aims to attract younger demographics and differentiate its offerings CMC Markets, 2024. These technological advancements align with market trends, positioning Sirius XM for potential subscriber growth.

Cybersecurity is another critical area. With millions of subscribers, Sirius XM handles vast amounts of personal data, making it a potential target for cyberattacks. Robust cybersecurity measures are essential to protect user trust and comply with regulations, especially in a digital-first environment where cyber threats are rising EY, 2025. These efforts underscore Sirius XM’s commitment to staying competitive in the high-tech media sector.

Geopolitical and Geostrategic Considerations

Sirius XM’s reliance on satellite technology subjects it to international regulations governed by bodies like the International Telecommunication Union (ITU). Changes in satellite orbit allocations or frequency assignments could impact operations, though existing licenses provide stability Wikipedia, 2025. Geopolitical tensions, such as trade disputes or tariffs, could affect the automotive industry, a key distribution channel for Sirius XM. For instance, proposed tariffs of up to 20% on trading partners like the EU and China could increase vehicle prices, potentially reducing car sales and subscriber growth Lazard, 2025.

Cybersecurity risks are heightened in a geopolitically unstable world. Companies like Sirius XM, managing large datasets, are prime targets for state-sponsored or independent cyberattacks. Ensuring robust defenses is critical for maintaining subscriber confidence and avoiding financial losses S&P Global, 2024. While specific geopolitical impacts on Sirius XM in 2025 are not extensively documented, the broader context of satellite technology and automotive trade highlights the need for strategic vigilance.

Table 2: Geopolitical Risks Impacting Sirius XM

| Risk Factor | Potential Impact |

| Satellite Regulations | Changes in ITU policies could affect operations |

| Trade Tariffs | Higher vehicle prices may reduce car sales |

| Cybersecurity Threats | Data breaches could harm reputation |

Patent Analysis and Innovation

Patents are vital for maintaining a competitive edge in the high-tech sector. While Sirius XM’s specific patent portfolioස

irius XM’s specific patent portfolio is not publicly detailed, the company likely holds intellectual property related to satellite communication, streaming technology, and content delivery systems. These assets could provide technological leadership and potential licensing revenue. For example, innovations in the 360L platform, which integrates satellite and streaming content, may be protected by patents, enhancing Sirius XM’s market position Wikipedia, 2025.

The company’s focus on exclusive content, such as podcasts and live events, further strengthens its competitive moat. Recent deals, like the acquisition of high-profile podcasts, differentiate Sirius XM from competitors and drive subscriber loyalty CMC Markets, 2024. These innovations align with Buffett’s investment philosophy, which prioritizes companies with durable competitive advantages. Continued investment in proprietary technology and content could position Sirius XM for long-term growth.

Conclusion

Warren Buffett’s substantial investment in Sirius XM reflects his belief in its undervaluation and potential for a turnaround. The subscription-based model ensures stable cash flows, while technological advancements and exclusive content offerings position the company to compete in a digital-first market. Geopolitical risks, such as satellite regulations and trade policies, present challenges, but Sirius XM’s established infrastructure and cost-cutting measures mitigate these concerns. Economically, ties to the automotive industry and inflation pressures require careful management, yet the company’s strong free cash flow and 5% dividend yield make it a compelling value play.

With Buffett’s backing, Sirius XM has the strategic support to navigate these complexities. The company’s focus on cost efficiency, subscriber growth, and innovation could drive significant value for shareholders. As Sirius XM continues to adapt, it remains a stock to watch for investors seeking value and income in 2025 and beyond.

References:

- Motley Fool: Warren Buffett Invested $54M Into Sirius XM This February

- CNBC: Warren Buffett’s Berkshire Hathaway Scoops Up More Sirius XM

- Investopedia: SiriusXM Stock Surges After Buffett’s Stake Increase

- Sirius XM Holdings Inc. Investor Relations

- PR Newswire: SiriusXM Strategic Update

- Wikipedia: Sirius XM Overview

- CMC Markets: Why Buffett Bought SiriusXM

- Lazard: Top Geopolitical Trends 2025

- S&P Global: Geopolitical Risks 2025

- Forbes: Sirius XM Stock Analysis

- EY: 2025 Geostrategic Outlook

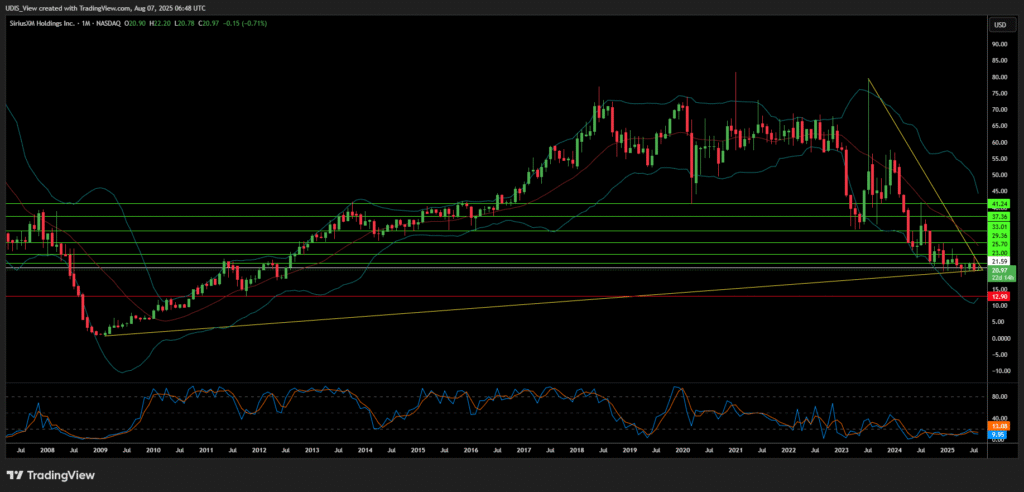

Sirius Long (Buy)

Enter At: 21.59

T.P_1: 23.00

T.P_2: 25.70

T.P_3: 29.36

T.P_4: 33.01

T.P_5: 37.36

T.P_6: 41.24

S.L: 12.90