Rivian’s Complex Trajectory

Rivian Automotive Inc. reported a consolidated revenue of $1.3 billion for the second quarter of 2025, aligning with initial forecasts.1 This revenue stability, however, contrasts sharply with a wider-than-expected loss per share of $0.97, significantly missing the anticipated $0.66 loss.1 The company’s gross profit also reverted to negative territory after two consecutive positive quarters, signaling persistent challenges in achieving profitability.2 Despite these financial setbacks, Rivian’s stock demonstrated a slight uptick in after-hours trading, closing at $12.49.1

Rivian confronts a confluence of external pressures and internal scaling hurdles. These encompass volatile macroeconomic conditions, intricate geopolitical trade policies, intense market competition, and the inherently capital-intensive nature of electric vehicle (EV) manufacturing. The company’s management explicitly acknowledges a “complex and rapidly evolving policy environment” as a significant factor in its operations.1

In response, Rivian actively addresses these challenges through strategic investments and operational adjustments. A notable development is the $1 billion equity injection from Volkswagen Group, a move designed to bolster Rivian’s financial position and accelerate technology development.1 Rivian also prioritizes scaling R2 production and enhancing overall manufacturing efficiency, essential steps for long-term viability.1

Financial Headwinds and Profitability Challenges

Rivian’s Q2 2025 financial results highlight a critical juncture for the electric vehicle manufacturer, balancing revenue stability with deepening profitability concerns. The company’s consolidated revenue reached $1.3 billion, meeting market expectations.1 Automotive revenue contributed $927 million, while software and services generated $376 million.1 However, the reported earnings per share (EPS) loss of $0.97 starkly missed the forecasted loss of $0.66, representing a substantial 46.97% deviation.1 This significant miss underscores the company’s ongoing difficulties in managing costs and achieving operational efficiencies.

The company’s gross profit swung back to a negative ($206 million in Q2 2025, following two quarters of positive gross margins.2 Over the last twelve months, Rivian’s gross profit margin stands at a concerning -9.33%.1 These figures reveal the inherent difficulty in producing vehicles profitably at current volumes and cost structures. Furthermore, Rivian widened its forecast for full-year adjusted EBITDA losses to between $(2,000) million and $(2,250) million for 2025.2. This revised guidance emphasizes the persistent high operating costs and substantial investments required for future growth initiatives.

Despite these profitability challenges, Rivian maintains a robust cash and equivalents position of $7.5 billion, set against $4.87 billion in total debt.1 Its current ratio of 3.73 indicates solid short-term financial stability.1 The recent $1 billion investment from Volkswagen Group further strengthens this liquidity, providing crucial capital for ongoing operations and strategic endeavors.1

Rivian targets achieving an EBITDA breakeven by 2027, a timeline that aligns with its plans to expand manufacturing capabilities in Georgia and launch the R2 model.1 The R2 is specifically designed to achieve a positive gross margin, a critical factor for improving overall company profitability.1 In terms of production and delivery, Rivian produced 5,979 vehicles and delivered 10,661 in Q2 2025.1 However, vehicle deliveries fell short year-over-year, attributed to persistent supply chain and trade policy challenges.2 The company’s 2025 delivery guidance remains flat at 40,000 to 46,000 vehicles.1

The stable revenue contrasted with widening losses reveals a classic growth-stage dynamic. Rivian prioritizes scaling production and investing in future models, particularly the R2, over immediate profitability.1 This strategy, while common for startups in capital-intensive industries, necessitates sustained cash burn and subjects Rivian to intense investor scrutiny regarding its eventual path to breakeven. The strategic focus on the R2’s anticipated positive gross margin confirms this long-term profitability objective.1 This approach requires significant capital and sustained investor confidence, making the Volkswagen investment crucial for its continuation.1

Persistent supply chain disruptions directly impact vehicle deliveries and contribute significantly to high operating costs.2 Rivian’s emphasis on “building supply chain resilience” is not merely an operational concern; it is a fundamental component of its profitability strategy.2 The recognition that these disruptions are not temporary inconveniences but fundamental barriers to achieving positive gross margins and overall profitability drives investments in resilience, such as the new supplier park.4 This directly aims to reduce variable costs and improve production predictability, thereby impacting the bottom line. In a globalized and complex EV supply chain, securing materials and components becomes as critical as vehicle design and demand generation for financial success.

Rivian Q2 2025 Financial Performance Summary

| Metric | Q2 2025 Actual | Q2 2025 Forecast | Variance (Actual vs. Forecast) | Y/Y Change (Q2 2024 vs. Q2 2025) | Source |

| Revenue | $1.3 billion | $1.3 billion | 0% | 12.5% | 1 |

| Automotive Revenue | $927 million | N/A | N/A | N/A | 1 |

| Software & Services Revenue | $376 million | N/A | N/A | N/A | 1 |

| EPS | $(0.97) | $(0.66) | -46.97% | 33.6% | 1 |

| Gross Profit | $(206) million | N/A | N/A | 54.3% | 2 |

| Adjusted EBITDA Losses | $(667) million | $(857) million | 22.2% | 22.2% | 1 |

| Cash & Equivalents | $7.5 billion | N/A | N/A | N/A | 1 |

| Total Debt | $4.87 billion | N/A | N/A | N/A | 1 |

| Current Ratio | 3.73 | N/A | N/A | N/A | 1 |

| Vehicles Produced | 5,979 | N/A | N/A | N/A | 1 |

| Vehicles Delivered | 10,661 | N/A | N/A | Shortfall Y/Y | 1 |

| 2025 Delivery Guidance | 40,000-46,000 vehicles | 40,000-46,000 vehicles | 0% | Flat | 1 |

This table provides a concise overview of Rivian’s financial performance, highlighting areas of strength like revenue stability and liquidity, alongside areas of concern such as the EPS miss and negative gross profit. The variances against forecasts, particularly for EPS, underscore the challenges in cost management and achieving profitability. The inclusion of liquidity metrics offers a balanced perspective, indicating that despite losses, the company possesses financial runway. This data forms a foundational understanding for the subsequent analyses, grounding the discussion in concrete financial realities.

Geopolitical and Trade Policy Pressures

Rivian’s operational landscape is significantly shaped by global geopolitical dynamics, particularly concerning critical raw materials and evolving trade policies. China currently dominates the global supply chain for rare earth elements (REEs), controlling 60% of total production and 90% of global processing capacity.5 These elements, including neodymium, dysprosium, and terbium, are indispensable for EV traction motors and other magnetic components.5 This concentrated supply provides China with considerable geopolitical leverage over the electric vehicle sector.

China has introduced new licensing rules for REE exports, complicating the process for international buyers.5 This measure, implemented following US tariff increases, directly impacts American manufacturers and creates broader global supply chain disruptions.5 While China states the intent is regulatory enforcement, the practical effect is increased vulnerability for EV production worldwide.5 For example, Ford temporarily shut down a production line in June due to REE shortages, illustrating the fragility inherent in the current supply chain.5

The United States also imposed a 25% tariff on imported cars and light trucks starting April 2, 2025.6. Since Rivian manufactures its EVs in Illinois, it avoids the direct impact of these tariffs and could potentially benefit from the increased pricing of imported EVs, making its domestic products more competitive.6 However, Rivian remains reliant on overseas parts. If these components become more expensive or face trade-related delays, Rivian’s production costs could escalate.6 Moreover, a general increase in overall car prices could deter consumer demand, negatively affecting all automakers, including Rivian 6

China’s dominance over REE supply and its new export controls are not abstract geopolitical concerns; they directly translate into higher material costs and potential production delays for EV manufacturers like Rivian.5 This directly impacts the company’s profitability and its ability to meet production targets. This geopolitical leverage acts as a direct cost driver for Rivian. The fragility of the supply chain, as demonstrated by Ford’s production halt 5, means Rivian must either absorb higher costs, pass them on to consumers (risking demand), or invest substantially in supply chain diversification and circular economy practices.7 This directly contributes to the ongoing challenges in achieving profitability. Geopolitical strategy surrounding critical minerals has thus become a core economic factor for high-tech manufacturing, influencing investment decisions and supply chain design.

While US tariffs on imported vehicles might appear beneficial for Rivian’s domestic production, the company’s reliance on global component supply chains introduces a hidden vulnerability.6 The advantage of reduced foreign competition could be offset by increased input costs and a dampened overall market demand. This reveals a nuanced impact: tariffs on finished goods may offer a competitive edge, but tariffs or disruptions on components can significantly increase costs. The broader implication of reduced consumer demand due to higher overall car prices also presents a substantial risk. Therefore, these tariffs, while seemingly positive, introduce new layers of cost and demand uncertainty for Rivian, contributing to its complex operating environment. “Made in America” does not fully insulate a company from global supply chain dependencies or broader market reactions to trade policies. True resilience requires deep integration and control across the entire value chain.

Evolving Macroeconomic and Regulatory Landscape

The macroeconomic and regulatory environment for electric vehicles is undergoing significant shifts, presenting both challenges and opportunities for manufacturers like Rivian. A key development is the impending expiration of federal EV tax credits. The federal tax credit for new EVs, offering up to $7,500, is set to conclude on September 30, 2025.8. Similarly, the credit for used EVs, up to $4,000, and for qualified commercial clean vehicles, also ends on this date.8

The expiration of these substantial incentives could significantly dampen consumer demand for EVs, including Rivian’s R1T and R1S models, which currently qualify. Removing a key purchase motivator for many buyers could slow EV adoption rates and increase pressure on pricing for manufacturers.

Furthermore, a recently enacted law effectively ends the enforcement of federal Corporate Average Fuel Economy (CAFE) standards from 2025, with fines waived retroactively to 2022.10 CAFE standards previously incentivized automakers to improve fuel efficiency and produce more EVs. Companies like Tesla, for instance, earned substantial revenue by selling regulatory credits to other automakers to help them meet emissions targets.10

The cessation of CAFE enforcement removes a significant regulatory push for traditional automakers to produce fuel-efficient vehicles or invest heavily in EVs.10 This could lead to a “return to bigger engines” and reduce the urgency for legacy automakers to transition to EVs, intensifying competition for companies like Rivian that are solely focused on electric vehicles.10 It also eliminates a potential revenue stream from selling regulatory credits for Rivian.

Rivian’s CEO, RJ Scaringe, has openly expressed concerns about “policy uncertainty” and the “potential of the shrinking EV tax credit”.6 The company also notes that the “policy environment continues to be complex and rapidly evolving. “.1 These statements confirm that management is acutely aware of regulatory shifts as a significant external risk factor impacting its business trajectory.

The simultaneous expiration of consumer tax credits and the effective end of CAFE enforcement create a significant challenge for the EV market and Rivian. Consumer demand may soften due to higher effective prices, while competitive pressure from traditional internal combustion engine (ICE) vehicles could increase as legacy automakers face less regulatory impetus to electrify.8 The removal of both demand-side (tax credits) and supply-side (CAFE) incentives simultaneously could substantially slow the broader EV transition in the US. For Rivian, this translates into a more challenging sales environment due to reduced consumer incentives and potentially less urgency for competitors to shift away from profitable ICE vehicles, making Rivian’s path to scale and profitability more arduous. This regulatory shift directly contributes to a less favorable market environment for pure-play EV manufacturers. Government policy plays a critical role in shaping nascent industries, and the rollback of supportive policies can create significant headwinds, even for companies with strong products.

The end of CAFE enforcement could fundamentally alter the competitive landscape. Legacy automakers, no longer compelled to buy credits or aggressively electrify, might reprioritize internal combustion engine (ICE) vehicle development or delay EV investments.10 This could disadvantage pure-play EV companies like Rivian, which rely on the market’s accelerated shift to electric vehicles. This regulatory change removes a key financial incentive for legacy automakers to accelerate their EV transition. They may choose to focus on higher-margin ICE vehicles or larger engines, potentially slowing the overall market shift to EVs. This directly impacts Rivian by reducing the “tailwinds” of a rapidly electrifying market and potentially increasing the competitive viability of ICE alternatives, making Rivian’s market penetration more arduous. Companies must build strategies resilient to policy shifts, especially when their business model relies on specific governmental incentives or mandates.

Technological Evolution and Strategic Pivots

Rivian’s core strength is its vertically integrated technology platform.2 This encompasses in-house vehicle hardware, advanced driver-assistance features, and a comprehensive vehicle software stack.2 Its unique “skateboard” platform, a modular chassis integrating the battery, drive units, suspension, and thermal system, supports both current and future vehicle designs.12 This platform also offers potential for adoption by other companies, highlighting its versatility.12

Rivian currently manufactures its R1 vehicles and commercial vans at its Normal, Illinois, plant.13 The company is undertaking a significant expansion of this facility, adding 1.1 million square feet to support the production of its R2 model, slated to begin in 2026.13 This expansion will increase the plant’s total annual production capacity to 215,000 vehicles by 2026.13 The R2 is strategically positioned as a midsized, lower-cost EV, crucial for achieving manufacturing scale and improving overall profitability.1

A pivotal strategic development for Rivian is its joint venture with Volkswagen Group. Established in 2024, Rivian and Volkswagen Group Technologies are a 50/50 partnership.3 Volkswagen has committed up to $5.8 billion to this venture, including an initial $1 billion loan and $1.3 billion in equity investment.1 The joint venture focuses on developing “next-generation electrical architecture and best-in-class software technology” for future EVs across all vehicle segments.3 Key areas of development include operating systems, zonal controllers, and cloud connectivity solutions.3 Rivian’s zonal architecture, which reduces the number of electronic control units and simplifies vehicle wiring, is a central component, aiming for lower costs and improved system reliability.3 This partnership aims to reduce production costs and enhance competitiveness by combining Rivian’s software expertise with Volkswagen’s extensive manufacturing experience.3 The collaboration has already demonstrated operational efficiency by integrating Rivian’s zonal hardware and software into a Volkswagen test vehicle within just twelve weeks of its formation.3

Artificial intelligence (AI) plays a transformative role in Rivian’s manufacturing and operational strategies. AI is fundamentally reshaping EV manufacturing by automating production lines, optimizing battery life, and developing advanced driver assistance systems.16 It contributes to reducing production costs, improving quality control, enhancing battery efficiency, and streamlining logistics across the board.16 Key applications include AI-powered robots ensuring precision assembly 16, predictive maintenance preventing costly factory downtime 16, and computer vision systems detecting defects in real-time.16 AI also optimizes battery management and assists in developing next-generation battery technologies.16 Furthermore, AI enhances supply chain management through sophisticated demand forecasting and logistics optimization 16

The R2 model is not merely an addition to Rivian’s product line; it represents a strategic pivot designed to achieve manufacturing scale and positive gross margins, directly addressing the company’s current profitability challenges.1 The substantial investment in expanding the Illinois plant and developing a new supplier park specifically for R2 production underscores its critical importance.4 This indicates that the current challenges in profitability are being directly addressed through a strategic product and manufacturing shift. The R2 represents Rivian’s concentrated effort to move beyond niche, high-cost premium vehicles to a mainstream, higher-volume, and crucially, profitable product line. The entire manufacturing strategy, including the Illinois expansion and supplier park, is geared towards achieving the economies of scale necessary to support “millions” of vehicles per year.14 For EV startups, the transition from low-volume, high-margin niche products to high-volume, lower-cost, profitable mass-market vehicles is the ultimate test of long-term viability.

The Volkswagen joint venture is more than a financial lifeline; it serves as a strategic hedge against the high research and development costs associated with software-defined vehicles and acts as an accelerant for Rivian’s technological development.3 This partnership validates Rivian’s software expertise and provides access to Volkswagen’s manufacturing scale and broader market reach. Developing advanced electrical architecture and software for software-defined vehicles is incredibly capital-intensive and complex. The joint venture allows Rivian to share this burden and leverage Volkswagen’s manufacturing experience, potentially accelerating its own software-defined vehicle development and reducing its per-unit software costs. This partnership directly addresses the financial strain of R&D and manufacturing scale, which contribute to Rivian’s current losses. Strategic partnerships and technology sharing are becoming essential for EV companies to manage immense development costs and achieve scale in a rapidly evolving, capital-intensive industry.

Rivian’s utilization of AI across manufacturing, battery management, and supply chain is not merely an incremental improvement but a foundational element for achieving the cost reductions and efficiency gains necessary for profitability.16 Given Rivian’s negative gross margins and high operating costs 1, the strategic deployment of AI is critical. It is not just about producing better cars; it is about making them profitably. AI-driven predictive maintenance, automated quality control, and supply chain optimization directly target the inefficiencies that contribute to current losses. This emphasis on AI is a direct response to the challenges in profitability. In the competitive EV market, technological sophistication in manufacturing processes, driven by AI, is as crucial as product innovation for achieving financial sustainability.

Rivian Production & Delivery Milestones and Projections

| Metric | Year/Period | Value | Source |

| Vehicles Produced | 2022 | 24,337 vehicles | 12 |

| Vehicles Produced | Q2 2025 | 5,979 vehicles | 1 |

| Vehicles Delivered | Q2 2025 | 10,661 vehicles | 1 |

| 2025 Delivery Guidance | 2025 | 40,000-46,000 vehicles | 1 |

| R2 Production Start | 2026 | Projected | 14 |

| Annual Production Capacity | By 2026 | 215,000 units | 13 |

This table illustrates Rivian’s scaling efforts and future production ambitions. It provides a clear timeline and quantitative measure of Rivian’s manufacturing ramp-up. The significant gap between current production/delivery figures and the projected annual capacity of 215,000 vehicles by 2026 13 highlights the substantial manufacturing challenge Rivian faces to achieve profitability and scale. This visually reinforces the importance of the R2 as the primary volume driver for the company’s future. For investors, production and delivery figures are key indicators of a manufacturer’s ability to execute its business plan and achieve economies of scale.

Cybersecurity: The Unseen Risk in Connected Vehicles

The automotive sector’s profound shift towards software-defined vehicles (SDVs), characterized by cloud-based operating platforms and over-the-air (OTA) updates, presents unprecedented opportunities for innovation but simultaneously exposes manufacturers to a rapidly evolving cyber threat landscape.18 Vehicle cyber threats have escalated dramatically, increasing by 600% over the past four years, with attacks now targeting a wide range of systems from infotainment to remote vehicle takeovers and critical electronic control units (ECUs).18 Modern vehicles are essentially “computers on wheels,” containing up to 100 million lines of code and a growing number of wireless interfaces, each representing a potential entry point for hackers.19

The regulatory environment for automotive cybersecurity is becoming increasingly harmonized and comprehensive globally.18 ISO 21434 mandates end-to-end cybersecurity risk management throughout the vehicle lifecycle, from concept to decommissioning.18 Compliance with this standard is now a prerequisite for market access in most regions. Complementing this, UNECE R155/R156 regulations require all vehicles produced from July 2024 onward to incorporate Cyber Security Management Systems (CSMS) and Software Update Management Systems (SUMS).18 Special-purpose and small-series vehicles must comply by July 2026.18. At a broader digital product level, the EU Cyber Resilience Act (CRA) expands obligations for secure software development, vulnerability handling, and incident reporting for connected vehicles. This is reinforced by the updated Product Liability Act, which holds OEMs accountable for software defects and cybersecurity breaches, with only limited legal exemptions.18

Artificial intelligence (AI) is poised to play a critical role in automotive cybersecurity, particularly in detecting and responding to cyber threats in real-time by 2025.1.9. Machine learning models embedded within vehicles will recognize unusual patterns, isolate threats instantly, and proactively update defenses.19 AI is essential for autonomous vehicles, as it enhances sensor data interpretation, enables real-time threat detection, and guarantees secure decision-making in unpredictable conditions.18 Furthermore, generative AI-powered simulations can replicate real-world driving scenarios, significantly reducing dependence on costly physical road testing and potentially shortening launch timelines by 21% while enhancing productivity by nearly 40%.18

The escalating cyber threats and stringent regulatory compliance requirements for software-defined vehicles represent a significant and growing cost burden for automakers like Rivian.18 However, robust cybersecurity also emerges as a critical differentiator, directly impacting public trust, insurance rates, and market access.18 This investment is not optional; it is mandated by international law, with non-compliance leading to exclusion from key markets.18 Therefore, cybersecurity becomes a substantial, unavoidable operational cost. For a high-tech EV company like Rivian, strong cybersecurity can also be a competitive advantage, building consumer trust and potentially influencing insurance rates.19 This cost-benefit dynamic directly impacts Rivian’s financial health and market positioning. As vehicles become more software-defined, cybersecurity shifts from an IT concern to a core product development and business risk, with direct financial and reputational consequences.

While AI is crucial for enhancing cybersecurity defenses in software-defined vehicles, its increasing integration also expands the attack surface.18 The complexity of AI systems can introduce new vulnerabilities if not rigorously secured, creating a paradox where the solution itself can become a new risk. The reliance on AI for complex functions, such as autonomous driving, means that any vulnerability in the AI itself, or in the data pipelines feeding it, could have catastrophic safety and security implications. This creates a new layer of cybersecurity risk. Rivian, with its focus on advanced technology and software, must navigate this dual nature of AI. A rapid deterioration in security posture could occur if AI systems are compromised. The increasing sophistication of automotive technology necessitates an equally sophisticated and proactive approach to cybersecurity, constantly evaluating new attack vectors introduced by emerging technologies.

Patent Portfolio and Competitive Edge

Rivian’s intellectual property portfolio contributes significantly to its long-term differentiation and competitive positioning. The company holds patents related to Vehicle-to-Everything (V2X) and Vehicle-to-Load (V2L) charging technologies.20 V2X allows for the transfer of electricity stored in EV batteries to the grid, buildings, or other vehicles, while V2L enables the powering of external plug-in electric devices, equipment, and appliances directly from the EV battery.20 These capabilities offer unique utility and energy management solutions, appealing to a specific segment of EV buyers who value versatility and off-grid power.

A cornerstone of Rivian’s vehicle architecture is its unique “skateboard” platform.12 This modular chassis integrates the battery, drive units, suspension, and thermal system, providing a flexible foundation for current and future vehicles.12 This platform also holds potential for adoption by other companies, suggesting future licensing opportunities.12

These intellectual property assets are crucial for Rivian’s long-term value. The “skateboard” platform provides manufacturing flexibility and potential licensing opportunities, enhancing long-term revenue streams. Rivian’s acquisition of Iternio, the Swedish mapping company known for its popular EV route-planning app, A Better Route Planner (ABRP), in June 2023, further demonstrates a commitment to enhancing user experience and leveraging software for competitive advantage.12 This strategic move integrated ABRP into Rivian’s in-car navigation system, improving the overall customer offering.12

Rivian’s patents in V2X/V2L are not merely vehicle features; they represent potential future revenue streams through licensing or by enabling a broader energy ecosystem around Rivian vehicles.20 This shifts the value proposition beyond just vehicle sales. This technology positions Rivian as a player in the broader energy management and grid integration space. These patents could become valuable assets for licensing to other original equipment manufacturers (OEMs) or energy companies, creating new revenue streams beyond direct vehicle sales. This could mitigate the impact of challenges in vehicle profitability by diversifying income. The “skateboard” platform also offers similar licensing potential, providing a flexible and adaptable base for various vehicle types and potentially for other manufacturers.12 In the evolving EV market, intellectual property related to energy management and vehicle integration with infrastructure can create significant long-term value and competitive advantages.

The acquisition of Iternio and the focus on in-house software development, including the Volkswagen joint venture, highlight Rivian’s commitment to software and user experience as core competitive advantages.3 This strategy aims to build brand loyalty and differentiate Rivian beyond hardware specifications. In a market where hardware is rapidly becoming commoditized, software and the user experience become paramount for differentiation and customer retention. Rivian’s vertical integration in software, combined with strategic acquisitions like Iternio, suggests a long-term strategy to build an ecosystem around its vehicles. This focus on software could help offset challenges in hardware-centric profitability by creating recurring revenue streams and enhancing brand stickiness. The automotive industry is rapidly transforming into a software-defined industry, where user experience and digital services are as important as vehicle performance.

Outlook and Strategic Imperatives

Rivian stands at a pivotal juncture, navigating a complex landscape defined by persistent profitability challenges, fragilities within global supply chains, and a shifting regulatory environment.1 The company’s Q2 2025 earnings underscore the ongoing struggle to translate revenue stability into positive margins amidst high operational costs and significant research and development investments.

Rivian’s strategic responses are critical for its future. These include the aggressive ramp-up of R2 production, the transformative Volkswagen joint venture, and the integration of AI for efficiency.1 These initiatives aim to address the core issues of scale, cost reduction, and technological competitiveness. The R2 model is central to Rivian’s strategy for achieving manufacturing scale and profitability.1 The significant investment in expanding the Illinois plant to 215,000 units of annual capacity by 2026, alongside the new supplier park, demonstrates this commitment.4 This scale is crucial for improving gross margins and reducing per-unit costs.

The partnership with Volkswagen is pivotal for accelerating software-defined vehicle development, sharing R&D costs, and potentially accessing broader markets.3 This collaboration is a key enabler for Rivian’s future technological competitiveness and cost efficiency. Rivian’s widening EBITDA losses underscore the urgent need for rigorous cost management and operational efficiency improvements.2 The adoption of AI in manufacturing and supply chain management is a critical lever for achieving these efficiencies.16

Rivian must proactively manage geopolitical risks, including rare earth element supply chain vulnerabilities and evolving trade policies.5 Diversifying supply chains and exploring circular economy practices are essential for long-term resilience.7 Adapting to changes in EV incentives and regulatory environments will also be crucial for demand generation.8 Rivian’s success hinges on its ability to execute the R2 launch flawlessly, achieve planned production scale and positive gross margins, and effectively leverage the Volkswagen partnership for technological advancement and cost reduction. Maintaining financial discipline amidst high investment needs is paramount.

Rivian’s strategy is a high-stakes race against time and capital burn. The company must achieve significant scale and profitability with the R2 before its substantial cash reserves dwindle, especially in a tightening regulatory and competitive environment.1 The current profitability challenges are a direct consequence of this aggressive growth strategy. The critical success factor is whether the R2’s positive gross margin and high volume can materialize quickly enough to offset the current cash burn and achieve breakeven before external funding becomes more difficult or expensive. The Volkswagen investment provides a buffer, but the timeline for profitability remains a key concern. For capital-intensive startups, the interplay between investment, scaling, and time-to-profitability determines long-term survival.

Rivian’s long-term viability depends not only on selling vehicles but also on monetizing its software capabilities and unique technologies, such as V2X/V2L and the skateboard platform.3 This diversification of the value proposition could provide resilience against market fluctuations in vehicle sales. To counter challenges in vehicle-specific profitability, Rivian must actively explore and execute strategies to monetize its software and platform intellectual property. This could involve licensing, subscription services, or partnerships that extend beyond direct vehicle sales. This diversified approach to value creation is crucial for long-term financial health, moving beyond a purely transactional vehicle sales model. The future of automotive profitability lies increasingly in software, services, and intellectual property, rather than solely in hardware manufacturing.

Conclusion: A Pivotal Juncture for Rivian

Rivian stands at a pivotal juncture, navigating a complex landscape defined by persistent profitability challenges, global supply chain fragilities, and a shifting regulatory environment. The company’s Q2 2025 earnings underscore the ongoing struggle to translate revenue stability into positive margins amidst high operational costs and significant R&D investments.

Rivian’s strategic responses, including the aggressive ramp-up of R2 production, the transformative Volkswagen joint venture, and the integration of AI for efficiency, are critical for its future. These initiatives aim to address the core issues of scale, cost reduction, and technological competitiveness.

While the path to sustained profitability remains challenging, Rivian’s commitment to innovation, strategic partnerships, and manufacturing scale offers a credible pathway forward. Its ability to execute these ambitious plans, particularly the R2 launch, will determine its long-term success in the dynamic and fiercely competitive electric vehicle market. The company’s future trajectory hinges on turning its technological prowess and strategic investments into tangible financial returns.

References

- Earnings call transcript: Rivian Q2 2025 shows revenue stability, EPS miss – Investing.com

- Rivian (RIVN) Q2 Revenue Rises 12% – Mitrade

- Rivian and Volkswagen Group Technologies – Wikipedia

- Rivian commits to building a $120m supplier park attached to its EV manufacturing plant in Illinois – Automotive Logistics

- Can EV Makers End Reliance on China’s Rare Mineral Supplies? – EV Magazine,

- How New Auto Tariffs Could Impact Rivian – RivianTrackr

- EV Manufacturers Can Reduce Reliance on Rare-Earth Minerals – Assembly Magazine

- The Implementation Timeline of the One Big Beautiful Bill Act – Center for American Progress

- Electric Vehicle and Energy Incentives | Tesla Support

- America Now Effectively Has No Fuel Economy Rules – Kelley Blue Book

- Corporate average fuel economy – Wikipedia

- Rivian – Wikipedia

- Rivian Expands Illinois Manufacturing Plant for R2 Production – Motor Illustrated

- Rivian’s R2 Plant Expansion Is ‘Substantially Complete’ – InsideEVs

- Rivian and VW’s $5.8B Joint Venture Will Power A Lot, Including ‘Subcompact Cars’

- AI-Driven Innovations in Electric Car Manufacturing

- The Role of Artificial Intelligence in EV Manufacturing – – Humans of EV

- Executive Summary | 2025 State of Automotive Cyber Security, Connectivity & Software-Defined Vehicles

- The Future of Automotive Cybersecurity: Safeguarding the Next Generation of Mobility

- V2X / V2L patents by Rivian

- Rivian R2 Program Gets Promising Update From CEO R.J. Scaringe – InsideEVs

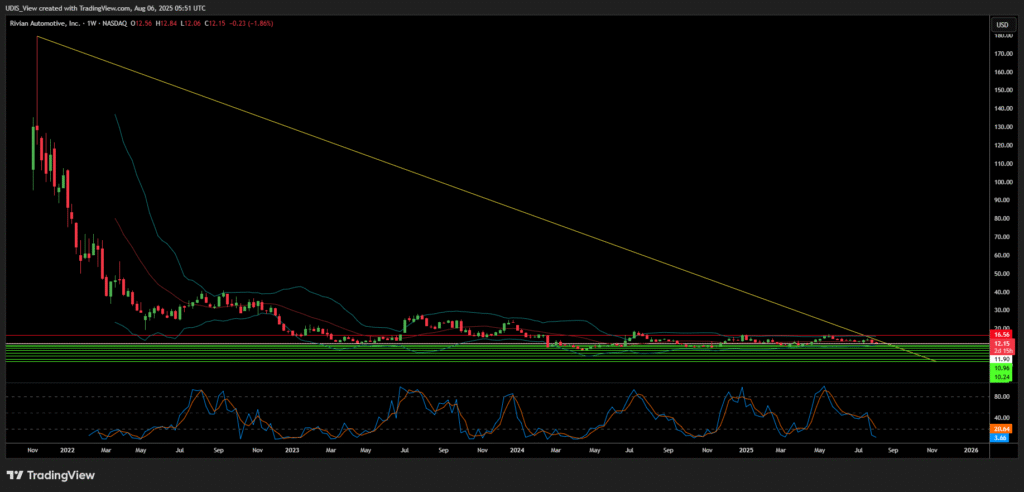

Rivian Short (Sell)

Enter At: 11.90

T.P_1: 10.96

T.P_2: 10.24

T.P_3: 9.26

T.P_4: 8.19

T.P_5: 6.79

T.P_6: 5.07

T.P_7: 3.24

T.P_8: 2.01

S.L: 16.56