Merck’s recent trajectory demonstrates growth beyond typical pharmaceutical market dynamics. Its success stems from a strategic interplay of global forces and internal innovation. This report analyzes how geopolitical shifts, macroeconomic trends, scientific breakthroughs, technological adoption, robust patent strategies, and cyber resilience collectively drive Merck’s financial and strategic expansion. It positions Merck as a resilient leader in a complex global landscape.

Table 1: Key Growth Drivers & Strategic Impact on Merck

| Driver | Strategic Impact on Merck |

| Geopolitics & Geostrategy | Enhanced Market Access, Optimized Supply Chains, Mitigated Geopolitical Risk |

| Macroeconomics | Sustained Demand, Optimized R&D Efficiency, Secured Revenue Streams |

| Scientific Innovation | Competitive Advantage, Accelerated Drug Development, Diversified Pipeline |

| High-Tech Integration | Operational Efficiency, Faster Time-to-Market, Data-Driven Decisions |

| Patent Prowess | Secured Revenue Streams, Competitive Exclusivity, Mitigated Biosimilar Threat |

| Cyber Resilience | Protected Intellectual Property, Ensured Operational Continuity, Mitigated Financial Risks |

Global Currents: Navigating Geopolitical and Macroeconomic Tailwinds

Geopolitical and Geostrategic Influences on Merck’s Growth

Global power dynamics significantly shape pharmaceutical market access and supply chains. US-China tensions, for example, necessitate supply chain diversification and reshoring efforts for companies like Merck. This reduces reliance on single regions, mitigating geopolitical risk. Data security and intellectual property (IP) theft concerns in the US-China tech rivalry also directly impact research and development (R&D) collaboration and data sharing strategies.

The increasing geopolitical friction requires a fundamental change in global operational strategy. Traditional, centralized supply chains are vulnerable to disruptions and increased costs. Merck, as an international pharmaceutical giant, cannot rely on concentrated manufacturing. This necessitates a strategic shift towards a more distributed and regionalized manufacturing and supply chain network. This proactive diversification reduces vulnerability to localized disruptions, ensures continuity of drug supply, and mitigates risks associated with trade disputes or conflicts, thereby safeguarding revenue.

China’s “Healthy China 2030” initiative highlights the nation’s focus on domestic biotech innovation and local production. This presents both a massive market opportunity and a challenge regarding IP protection and market access for foreign companies. Merck faces a paradox: immense market potential versus heightened IP risks. This suggests Merck must adopt a nuanced strategy for China. Instead of solely importing drugs, it may need to engage in localized R&D, establish joint ventures, or license technologies to Chinese partners, accepting a degree of IP sharing to gain market access and meet localization requirements. This balances market capture with IP risk mitigation.

Trade agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP) influence market access and regulatory harmonization. These agreements can streamline drug approvals and reduce trade barriers, expanding Merck’s potential reach. Global health security initiatives and pandemic preparedness also drive investment in vaccine and therapeutic development, areas where Merck has significant expertise. Emerging markets, such as Africa, Latin America, and the Middle East, are experiencing growing healthcare spending, creating new high-growth markets for Merck’s products.

Macroeconomic and Economic Factors Driving Merck’s Performance

Global economic growth forecasts provide a positive backdrop for increased healthcare spending. Aging populations and rising chronic disease prevalence are fundamental demographic tailwinds, ensuring sustained demand for pharmaceutical products. This drives pharmaceutical market growth projections. These demographic and epidemiological shifts are not merely trends; they are fundamental, long-term drivers creating an inherent, expanding demand for Merck’s products. This forms a robust, almost inelastic, demand curve for the pharmaceutical industry. Merck’s focus on therapeutic areas addressing these conditions positions it to capitalize on this demographic dividend, ensuring sustained revenue growth irrespective of minor economic fluctuations.

Emerging markets are experiencing significant healthcare spending growth, fueled by economic development and expanding middle classes. This offers substantial untapped potential for Merck. Government healthcare policies and pricing controls remain a challenge, necessitating value-based healthcare models that demonstrate drug efficacy and cost-effectiveness.

Inflation and interest rate hikes impact R&D costs and financing for mergers and acquisitions (M&A) activity. Merck must manage these pressures through operational efficiencies and strategic capital allocation. Merck cannot simply pass all increased costs onto consumers or governments due to pricing controls and the shift towards value-based healthcare models. Therefore, sustained profitability requires aggressive internal cost optimization through manufacturing innovation, automation, and efficient R&D processes. Furthermore, demonstrating the value of drugs through real-world evidence becomes crucial for securing favorable pricing and reimbursement, rather than just focusing on efficacy. The biotech sector continues to attract significant investment, facilitating M&A for pipeline acquisition.

Innovation Engine: Scientific Breakthroughs and High-Tech Integration

Scientific Breakthroughs and R&D Prowess

Merck’s growth is fundamentally tied to its robust R&D pipeline and scientific leadership. Breakthroughs in gene editing technologies like CRISPR, mRNA technology, and cell and gene therapies are revolutionizing drug development. Merck’s partnership with Moderna for mRNA vaccines exemplifies its engagement with cutting-edge platforms.

Immuno-oncology remains a cornerstone, with Keytruda’s success and extended indications driving significant revenu. Merck also invests in neuroscience and rare disease research, diversifying its therapeutic focus. The shift towards personalized medicine and biomarker discovery allows for more targeted and effective therapies. Merck’s strategy to expand Keytruda’s indications is a critical defensive and offensive maneuver against patent expiry. By continuously demonstrating efficacy in new patient populations or disease states, Merck can extend the commercial life of the drug beyond its initial patent protection, effectively creating new revenue streams from an existing asset. This mitigates the impact of biosimilar competition and ensures a smoother transition as patent exclusivity wanes.

Merck is initiating the EXPrESSIVE Phase 3 clinical trials, evaluating MK-8527, an investigational once-monthly, oral pre-exposure prophylaxis (PrEP) for HIV {https://www.merck.com/news/merck-to-initiate-phase-3-trials-for-investigational-once-monthly-hiv-prevention-pill/}. The EXPrESSIVE-11 trial will enroll 4,390 sexually active people across 16 countries, beginning in August 2025 {https://www.merck.com/news/merck-to-initiate-phase-3-trials-for-investigational-once-monthly-hiv-prevention-pill/}. The EXPrESSIVE-10 trial will enroll 4,580 women and adolescent girls in sub-Saharan Africa, starting in the next few months {https://www.merck.com/news/merck-to-initiate-phase-3-trials-for-investigational-once-monthly-hiv-prevention-pill/}. This initiative addresses a significant unmet global need, as only 18% of global PrEP requirements are currently met {https://www.merck.com/news/merck-to-initiate-phase-3-trials-for-investigational-once-monthly-hiv-prevention-pill/}. Phase 2 trial results supported the decision to advance MK-8527, showing similar adverse event rates to placebo {https://www.merck.com/news/merck-to-initiate-phase-3-trials-for-investigational-once-monthly-hiv-prevention-pill/}. Merck is collaborating with the Gates Foundation on these trials, with the Gates Foundation providing grant funding for clinical research sites in Africa {https://www.merck.com/news/merck-to-initiate-phase-3-trials-for-investigational-once-monthly-hiv-prevention-pill/}.

The U.S. FDA also accepted a New Drug Application (NDA) for doravirine/islatravir (DOR/ISL), a once-daily, oral, two-drug regimen for virologically suppressed HIV-1 infection, with a target action date of April 28, 2026. If approved, DOR/ISL would be the first FDA-approved two-drug regimen without an integrase inhibitor to demonstrate non-inferior efficacy to a three-drug regimen. This NDA is supported by Week 48 findings from two pivotal Phase 3 trials (MK-8591A-051 and MK-8591A-052), where DOR/ISL showed non-inferiority to comparator therapies.

Furthermore, the FDA granted priority review for a supplemental Biologics License Application (sBLA) to update the label for WINREVAIR™ (sotatercept-csrk) based on Phase 3 ZENITH trial results {https://www.merck.com/news/fda-grants-priority-review-for-winrevair-sotatercept-csrk-to-update-label-based-on-results-from-zenith-trial/}. The ZENITH trial demonstrated a 76% reduction in the risk of a composite of all-cause death, lung transplantation, and hospitalization for PAH, leading to early cessation due to overwhelming efficacy {https://www.merck.com/news/fda-grants-priority-review-for-winrevair-sotatercept-csrk-to-update-label-based-on-results-from-zenith-trial/}. WINREVAIR was approved in 2024 for pulmonary arterial hypertension (PAH) and is approved in over 45 countries {https://www.merck.com/news/fda-grants-priority-review-for-winrevair-sotatercept-csrk-to-update-label-based-on-results-from-zenith-trial/}.

Merck Animal Health received U.S. FDA approval for BRAVECTO® QUANTUM, a once-yearly injectable product for flea and tick protection in dogs {https://www.merck.com/news/fda-approves-bravecto-quantum-fluralaner-for-extended-release-injectable-suspension-from-merck-animal-health/}. This product offers 12-month protection against fleas and most ticks, and 8-month protection against lone star ticks, setting a new standard for duration {https://www.merck.com/news/fda-approves-bravecto-quantum-fluralaner-for-extended-release-injectable-suspension-from-merck-animal-health/}. BRAVECTO QUANTUM is expected to be available in the U.S. by August 2025 and is already approved in over 50 countries {https://www.merck.com/news/fda-approves-bravecto-quantum-fluralaner-for-extended-release-injectable-suspension-from-merck-animal-health/}.

Open innovation models and academic partnerships are critical for accessing external expertise and early-stage research. Merck’s M&A strategy is key to acquiring promising pipelines from the biotech startup ecosystem, addressing R&D productivity challenges. The integration of artificial intelligence (AI) and big data is not merely an incremental improvement; it represents a fundamental paradigm shift in pharmaceutical R&D. By leveraging these technologies, Merck can significantly accelerate drug discovery, identify new targets more efficiently, optimize clinical trial design, and reduce development timelines. This directly addresses the long-standing R&D productivity challenge, allowing Merck to bring more innovative therapies to market faster and at a potentially lower cost, thereby fueling sustained revenue growth.

High-Tech Integration and Operational Excellence

Merck actively adopts high-tech solutions beyond R&D. Advanced manufacturing techniques, including continuous manufacturing, enhance efficiency and reduce production costs. Robotics in labs and high-throughput screening accelerate early-stage discovery.

Digital transformation initiatives permeate Merck’s operations. These include supply chain optimization using AI and digitalization, decentralized clinical trials, and real-world evidence generation. These technologies improve operational efficiency, reduce time-to-market, and provide valuable market insights. Merck has launched the AAW™ Automated Assay Workstation, powered by Opentrons, to automate routine lab experiments, reducing hands-on time and ensuring consistency {https://www.merckgroup.com/en/news/aaw-workstation-launch-28-07-2025.html}. This plug-and-play platform is designed for academic, biotech, and pharmaceutical labs to boost productivity {https://www.merckgroup.com/en/news/aaw-workstation-launch-28-07-2025.html}. It joins other digital innovations like M-Trace® Software, MyMilli-Q™ Services, and ChemisTwin® Platform {https://www.merckgroup.com/en/news/aaw-workstation-launch-28-07-2025.html}. Merck’s digital transformation is not a collection of disparate tech initiatives; it is a holistic strategy aimed at creating a systemic competitive advantage. By integrating digital tools across R&D, manufacturing, supply chain, and commercial operations, Merck achieves greater efficiency, faster decision-making, and enhanced responsiveness to market demands. This comprehensive digitalization reduces operational costs, accelerates drug development and delivery, and provides deeper market insights, directly contributing to increased profitability and market share. The rise of digital health and personalized medicine markets further encourages Merck’s investment in digital capabilities.

Fortifying the Future: Patent Prowess and Cyber Resilience

Patent Prowess and Intellectual Property Strategy

Merck’s intellectual property (IP) portfolio is a critical asset, underpinning its revenue streams and market dominance. The patent expiry of blockbuster drugs like Keytruda highlights the need for a robust IP strategy. Patent expiry directly impacts future revenue and opens the door to biosimilar competition.

Merck has announced plans to cut approximately 6,000 jobs globally as part of a broader cost-saving initiative aimed at reducing annual expenses by $3 billion by the end of 2027. This restructuring, affecting administrative, sales, and R&D roles, is driven by concerns over Keytruda’s upcoming patent protection loss. Other pharmaceutical companies, including Moderna, Bristol Myers Squibb, and Novartis, are also implementing significant workforce reductions.

Merck recently finalized the sale of its Surface Solutions business to Global New Material International (GNMI) for EUR 665 million. This divestment aligns with Merck’s strategy to sharpen its focus on technology-driven core businesses, particularly semiconductor solutions within its Electronics sector. The sale includes employment guarantees for German employees until 2032 and a long-term lease agreement for the Gernsheim site.

Merck actively engages in biosimilar defense strategies, which include new patent filings, lifecycle management, and legal challenges. Merck’s strategy around patent expiry is not merely reactive; it involves proactive patent lifecycle management. This includes not only aggressive biosimilar defense but also continuous R&D to develop new indications, formulations, or combination therapies that can extend the effective market exclusivity of a drug even after its primary patent expires. This multi-pronged approach aims to maximize the commercial life of key assets and smooth out the revenue impact of patent cliffs, ensuring long-term financial stability. The global nature of the pharmaceutical industry means navigating diverse IP protection landscapes, particularly in markets like China, where IP challenges are noted. Regulatory harmonization efforts can influence global patent enforcement and protection.

Table 2: Select Patent Portfolio Highlights & Expiry Dates (Illustrative)

| Key Drug/Therapy | Therapeutic Area | Primary Patent Expiry Date (approx.) | Strategic Significance |

| Keytruda | Oncology | 2028 (main compound patent) | Major revenue driver; focus for biosimilar defense and indication expansion |

| Gardasil | Vaccines | 2028 (main compound patent) | Significant vaccine franchise; ongoing lifecycle management |

| Januvia | Diabetes | 2022 (main compound patent) | Post-patent expiry management; focus on new formulations/combinations |

Cyber Resilience: Protecting Critical Assets

Merck’s significant cybersecurity investments are crucial for protecting its highly valuable intellectual property, especially R&D data. The increasing reliance on digital transformation and interconnected supply chains expands the attack surface, making robust cyber defenses imperative.

Cybersecurity threats to supply chains can disrupt operations and compromise product integrity. Concerns about data security and IP theft, particularly in the context of US-China tech rivalry, underscore the strategic importance of protecting proprietary research from state-sponsored or commercial espionage. In the modern pharmaceutical landscape, cybersecurity is no longer just an IT function; it is a critical strategic imperative directly impacting Merck’s competitive advantage and financial health. The immense value of proprietary R&D data and intellectual property makes Merck a prime target for sophisticated cyberattacks, including state-sponsored espionage. A breach could lead to loss of competitive edge, financial damages, and reputational harm. Robust cybersecurity investments are essential for safeguarding future revenue streams derived from innovation and ensuring the integrity and continuity of global operations and supply chains. Blockchain technology for clinical data represents a potential future solution for enhanced data security and integrity.

Strategic Imperatives: Market Positioning and Future Outlook

Market Positioning and Competitive Advantage

Merck’s market leadership is a direct result of its strong R&D pipeline, particularly in high-growth areas like oncology and vaccines. The success of Keytruda exemplifies its ability to develop and commercialize blockbuster therapies. Merck’s sustained competitive advantage is not solely dependent on internal R&D; it is a synergistic blend of organic innovation and strategic external growth. The company actively leverages M&A to acquire cutting-edge technologies and promising assets from the biotech ecosystem, while simultaneously fostering internal scientific breakthroughs. This dual approach allows Merck to rapidly adapt to emerging scientific trends, fill pipeline gaps, and mitigate the inherent risks and long timelines of internal drug development, thereby ensuring a continuous stream of new products and diversified revenue.

Strategic M&A and partnerships, such as with Moderna, are crucial for acquiring innovative technologies and expanding pipeline depth. Merck’s commitment to manufacturing innovation ensures efficient production and supply chain resilience. Digital transformation initiatives and data analytics capabilities enhance Merck’s ability to gain market insights, optimize operations, and adapt to evolving healthcare landscapes, including the growth of digital health and personalized medicine.

Future Growth Prospects and Strategic Initiatives

Merck’s future growth will be driven by continued investment in its late-stage pipeline, particularly in areas addressing unmet medical needs. The expansion of personalized medicine and orphan drug markets offers premium pricing opportunities.

Environmental, Social, and Governance (ESG) factors and corporate social responsibility (CSR), including addressing neglected tropical diseases, are increasingly important for investor relations and talent attraction. Merck’s commitment to ESG principles and CSR is not merely a compliance exercise or a marketing ploy; it is a strategic driver of long-term financial value. Strong ESG ratings attract socially conscious investors, potentially lowering the cost of capital. Furthermore, initiatives like addressing neglected tropical diseases enhance brand reputation, foster trust with stakeholders, and significantly aid in attracting and retaining top talent in a competitive industry. This creates a virtuous cycle where ethical practices contribute to financial performance and sustained growth. Merck’s ability to attract and retain top talent in a competitive biotech landscape is crucial for sustaining its innovation engine. Continuous adaptation to evolving regulatory pathways for novel therapies will also be key.

Conclusion: Sustaining Momentum in a Dynamic Landscape

Merck’s impressive growth trajectory is a testament to its multifaceted strategy. The company adeptly navigates complex geopolitical currents and macroeconomic shifts, leveraging them to its advantage. Its relentless pursuit of scientific breakthroughs, coupled with strategic high-tech integration, underpins its innovation engine. A robust patent portfolio, diligently defended, secures future revenue streams, while proactive cybersecurity measures protect its most valuable assets.

Moving forward, Merck’s ability to sustain momentum hinges on its continued strategic investment in cutting-edge R&D, agile adaptation to global market dynamics, and unwavering commitment to protecting its intellectual property in an increasingly digital and interconnected world. Merck is well-positioned to maintain its leadership in the evolving pharmaceutical landscape.

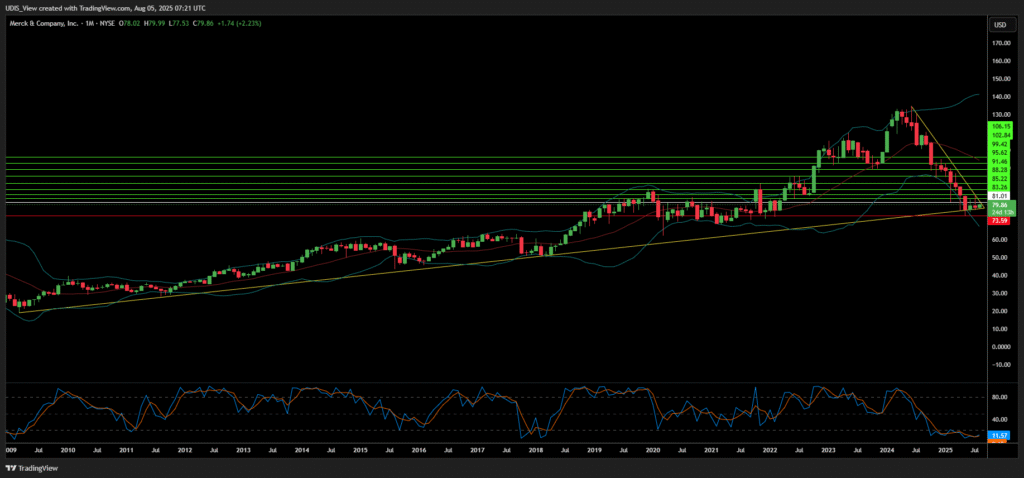

Merck Long (Buy)

Enter At: 81.01

T.P_1: 83.26

T.P_2: 85.22

T.P_3: 88.28

T.P_4: 91.46

T.P_5: 95.62

T.P_6: 99.42

T.P_7: 102.84

T.P_8: 106.15

S.L: 73.59