I. The Bovespa’s Recent Volatility

The Bovespa Index, Brazil’s primary stock market benchmark, has recently experienced significant volatility. This downturn reflects a complex interplay of domestic economic concerns and escalating geopolitical tensions. Understanding these multifaceted drivers proves crucial for investors and policymakers. The index’s performance is sensitive to various factors. These include corporate financial health, macroeconomic conditions, and external shocks.1 Recent developments, particularly new U.S. tariffs, introduced substantial uncertainty. They directly impacted investor sentiment and triggered immediate market reactions.

The Ibovespa measures high-quality stocks in the Brazilian equity market. It uses metrics like return on equity, accruals ratio, and financial leverage.2 Its constituents must actively trade on the BM&FBOVESPA. They also need to meet specific liquidity criteria. The 2 Major components include large-cap companies such as Petrobras, Vale, and Ambev. Their performance significantly influences the overall index.4 The index’s movement often reflects broader economic concerns within Brazil and globally.1

Recent declines in the Bovespa Index stem from growing economic concerns.1 President Trump’s threat of a 50% tariff on Brazil triggered immediate selling in Brazilian equities. Related ETFs like EWZ also saw rapid declines.5 The EWZ, an ETF tracking Brazilian assets, dropped 1.9% on July 9th. It fell another 1.6% on July 10th following tariff announcements.5 Continued fallout from trade tensions and political uncertainty caused a 3.0% drop in EWZ on July 18th. This marked its sharpest daily loss for the period.5 Market volatility surged. The CBOE Brazil ETF Volatility index jumped nearly 10%.5

The immediate and sharp declines in Brazilian equities following U.S. tariff threats illustrate a critical development. Geopolitical risk, specifically political interference in judicial matters, has become a quantifiable factor in Brazilian market valuations. This extends beyond traditional economic risk. When the U.S. announced tariffs, it explicitly linked them to the Bolsonaro trial.7 This political justification, rather than economic rationale, caused the market’s strong negative reaction. Investors are now pricing in the direct impact of foreign political interference on domestic judicial processes. This, by extension, affects economic stability. This situation creates a geopolitical risk premium on Brazilian assets. Traditional financial models, often reliant on macroeconomic fundamentals, may not fully capture these dynamics. Analysts must integrate political risk analysis more deeply into their valuations.

Table 3: Bovespa/EWZ ETF Price Movement in Response to US-Brazil Tensions (July 2025)

| Date | Event/Catalyst | EWZ Price (USD) | Daily Change (%) | Market Reaction |

| Jul 7 | Renewed political tensions, looming tariff threats | 28.60 | -2.42% | Broad sell-off in Brazilian assets 5 |

| Jul 9 | Trump threatened a 50% tariff on Brazil | 28.16 | -1.92% | Immediate selling in Brazilian equities 5 |

| Jul 10 | Confirmation of 50% US tariff | 27.72 | -1.56% | Intensifying US-Brazil trade conflict reaction 5 |

| Jul 11 | Continued pressure from US tariffs, possible retaliation | 27.53 | -0.69% | Brazilian assets remained under pressure 5 |

| Jul 14 | Concerns about US tariff effects, Bolsonaro trial depositions | 27.31 | -0.80% | Weighed on investor risk appetite 5 |

| Jul 18 | Continued fallout from trade tensions, political uncertainty | 26.85 | -3.03% | Sharpest daily loss for the period 5 |

| Jul 20 | Industrial and utility gains | – | +0.59% | Bovespa advanced, but volatility surged 5 |

II. Geopolitical Tensions: The Trump-Lula Standoff

The primary catalyst for the Bovespa’s recent downturn is the escalating geopolitical conflict between the United States and Brazil. This dispute, framed by the U.S. as an “economic emergency,” is fundamentally rooted in political disagreements rather than traditional trade imbalances. This creates significant uncertainty for the Brazilian economy.

A. Tariffs as Political Leverage

President Trump signed an executive order imposing a 50% tariff on Brazilian imports. This action escalated from an existing 10% levy.7 The official justification cited Brazil’s policies and the criminal prosecution of former President Jair Bolsonaro as an “economic emergency.”.7 Trump views Bolsonaro’s prosecution as a “politically motivated witch-hunt.” He likens it to his legal challenges.7 The White House statement also accused Brazil of “actions harming US companies.” It claimed Brazil infringed “free speech rights of US persons.”.7

Trump’s order invokes the 1977 International Emergency Economic Powers Act (IEEPA).7 IEEPA grants the President broad authority to regulate international commerce. This power activates during a declared national emergency. The emergency must stem from an “unusual and extraordinary threat to the national security, foreign policy, or economy of the United States.”.10 Historically, IEEPA has been used for sanctions against non-state actors like terrorists.10 Its application here, for a trade dispute with a sovereign nation based on judicial actions, represents a notable expansion.

Despite Trump’s claims of a trade deficit, the U.S. ran a $6.8 billion trade surplus with Brazil in 2024.8 The U.S. has maintained a trade advantage with Brazil for the past 18 years.13 This factual contradiction strongly suggests the tariffs serve primarily as political, not economic, leverage.13 The explicit use of tariffs and sanctions by the U.S. to influence Brazil’s domestic judicial process demonstrates a clear shift. It moves from traditional trade disputes, focused on economic imbalances, to a weaponization of economic tools for geopolitical and internal political leverage. This approach undermines established international trade norms. The primary motivation appears to be political pressure to influence Brazil’s internal affairs. This specifically targets the judicial process against a political ally. This sets a dangerous precedent for international relations. Economic measures could be deployed to interfere with the sovereign legal systems of other countries. This fosters distrust and reciprocal actions, leading to increased global trade instability.

Table 1: US-Brazil Goods Trade Balance (2024)

| Category | Value (USD Billions) | Change from 2023 |

| U.S. Total Goods Trade with Brazil | $92.0 | – |

| U.S. Goods Exports to Brazil | $49.7 | +11.3% ($5.0B) 12 |

| U.S. Goods Imports from Brazil | $42.3 | +8.3% ($3.2B) 12 |

| U.S. Goods Trade Surplus with Brazil | $7.4 | +31.9% ($1.8B) 12 |

B. Brazil’s Judicial Independence Under Scrutiny

Justice Alexandre de Moraes oversees the criminal case against Jair Bolsonaro. Bolsonaro faces charges of plotting a military coup to prevent Lula from taking office.7 Moraes is known for his crackdown on misinformation. This has included ordering social media companies to suspend accounts.15

The U.S. Treasury Department sanctioned Justice Alexandre de Moraes. It accused him of “arbitrary pre-trial detentions and suppress[ing] freedom of expression. “.9 These sanctions were imposed under Executive Order 13818. This order targets perpetrators of serious human rights abuses globally.17 The State Department also revoked visas for Moraes and his immediate family members on July 18th. It cited their complicity in an “unlawful censorship campaign” against U.S. persons 17

U.S. officials claim Moraes’s actions undermine Brazilians’ and Americans’ freedom of expression. They cite instances of arbitrary detention of journalists.17 Orders to U.S. social media companies (X, Rumble) to block accounts of critics are also mentioned.15 Rumble and Trump Media & Technology Group have filed a lawsuit against Moraes. They argue extraterritorial censorship violates U.S. constitutional rights.15 Some analysts suggest the social media dispute is also a trade issue. Big tech companies are crucial to the U.S. economy. They could face significant costs from Brazilian regulation [User Query].

The U.S. actions, particularly sanctions on Justice de Moraes for his social media rulings, highlight an emerging conflict. This involves national sovereignty over digital governance and the U.S. interpretation of free speech and corporate interests. This signifies a new frontier in geopolitical disputes. This is not merely a trade dispute. It represents a clash of legal and philosophical principles. Brazil asserts its right to regulate its digital space and combat perceived threats like misinformation. The U.S. asserts universal free speech principles and protection of its tech companies’ operations abroad. The cyber aspect is deeply intertwined with geopolitics. This conflict foreshadows increasing international friction over digital sovereignty, data governance, and content moderation. It could lead to a more fragmented global internet. Countries may impose their digital regulations, creating barriers for multinational tech companies. This could also impact cross-border information flow.

C. Lula’s Assertive Stance

President Lula condemned the U.S. sanctions and tariffs as “unjustifiable” and “unacceptable interference” in Brazil’s judicial system.19 Lula stated Brazil would not negotiate “as if it were a small country.” He affirmed Brazil would act as a sovereign nation [User Query]. He left an animal rights event early to defend “the sovereignty of the Brazilian people.”.7

Brazil expressed willingness to negotiate trade issues. However, it insisted Bolsonaro’s legal future was a non-negotiable judicial matter [User Query]. Lula’s government closed ranks behind JusticeMoraes. 21

Brazil hinted at possible retaliation under its Economic Reciprocity Act. This act allows for countermeasures.19 The Brazilian government stated it would not “give up on the tools it had at hand to defend itself. “.21 Retaliation by Brazil could generate a “larger negative impact” on economic activity and inflation [User Query].

III. Macroeconomic and Sectoral Repercussions

The politically motivated tariffs, despite some exemptions, threaten significant economic fallout for Brazil. This is particularly true for its vital export sectors. This external shock exacerbates existing macroeconomic vulnerabilities. It forces a re-evaluation of Brazil’s domestic economic resilience.

A. Trade War’s Economic Fallout

The 50% tariff, combined with existing duties, could push the total import cost of Brazilian beef to 76.4%. This effectively prices it out of the U.S. market.23 Brazilian beef-packers, including major firms like JBS and Marfrig, could face up to $1 billion in annual losses.23 U.S. imports of Brazilian beef plummeted by 80% from April to July 2025. This occurred in anticipation of the tariffs.23

Coffee, a key Brazilian export, is not exempt from the higher tariff.14 Brazil is the world’s largest coffee producer. It supplies about 30% of U.S. coffee imports [User Query]. A 50% tariff on coffee would make Brazilian coffee unworkable for U.S. roasters. This would lead to price hikes for American consumers. It would also force Brazil to redirect shipments.14 The impact on Brazilian coffee exporters would be “significant.” They would need to find new markets for 8.1 million tonnes of coffee [User Query].

The tariffs threaten to disrupt supply chains. This affects businesses and potentially increases prices for U.S. consumers on goods like beef and coffee.14 Disruption in Brazilian coffee supply, a benchmark for global pricing, could lead to worldwide shortages and price hikes.14

The Brazilian industry lobby (CNI) estimates the tariffs could result in over 100,000 job losses. It also projects a 0.2 percentage point drop in Brazil’s annual economic growth.19 Brazil’s agribusiness lobby (CNA) warns exports to the U.S. could fall by half.19 While some key sectors like civil aircraft, pig iron, precious metals, wood pulp, energy, and fertilizers are exempt, 19, the overall impact is still expected to be significant.19

Table 2: Projected Economic Impact of US Tariffs on Brazil

| Affected Sector | Projected Annual Loss (USD) | Estimated Job Losses | Estimated GDP Growth Reduction |

| Beef Export Industry | Up to $1 billion 23 | – | – |

| Coffee Export Industry | Significant impact, redirection of 8.1M tonnes 14 | – | – |

| Overall Brazilian Economy | – | Over 100,000 19 | 0.2 percentage points 19 |

The direct link between the Bolsonaro trial, U.S. sanctions on a judge, and the resulting economic tariffs reveals a critical connection. Judicial decisions in Brazil are now inextricably tied to its economic health and international trade relations. This extends far beyond typical legal ramifications. The U.S. explicitly justifies tariffs and sanctions based on the prosecution of Bolsonaro and the actions of Justice de Moraes.7 These tariffs are projected to cause significant losses in key Brazilian export sectors. They will also impact GDP growth and employment.14 A domestic judicial process, typically considered an internal sovereign matter, has become a direct trigger for severe external economic penalties. This highlights a critical, previously less emphasized, causal link between judicial independence and national economic stability. For emerging markets, this suggests that the rule of law and the perceived fairness of judicial processes can now directly influence international trade relations and investor confidence. This demands greater transparency and adherence to international legal norms to mitigate economic risk. It also implies that domestic political stability, even at the level of individual legal cases, can have immediate and substantial economic consequences.

B. Technology and Cyber Landscape

The U.S. Trade Representative (USTR) initiated a Section 301 investigation into Brazil’s trade practices. It cited concerns about blocking access to digital markets and inadequate intellectual property (IP) protection.13 U.S. officials claim Brazil fails to protect American intellectual property. This affects software, creative industries, and agriculture.13 Brazil’s digital policy, including new regulations on AI and cloud computing, may be seen as detrimental to American technology companies.27

Brazilian courts, under Justice de Moraes, have pressured U.S. social media platforms. They ordered the removal of political content, particularly posts supporting Jair Bolsonaro.13 Rumble has been blocked in Brazil since February 2025. This occurred for refusing to comply with court orders.15 The U.S. views these actions as infringing on the free speech rights of U.S. persons and companies.7

Brazil is actively developing its digital policy framework. This includes the General Telecommunications Act, Civil Rights Framework for the Internet, and General Data Protection Law.27 New legislation is being debated on AI, cloud computing, and data centers.27 These regulatory developments, coupled with the U.S. trade dispute, create uncertainty for technology companies investing in Brazil.27 Brazil’s R&D expenditures are below OECD countries. Business expenditures on ICT are a smaller share.28

The U.S. Section 301 investigation cites Brazil’s digital market access and IP concerns. This, alongside Brazilian court orders against U.S. social media companies, indicates a trend. Digital governance and intellectual property rights are rapidly becoming significant non-tariff trade barriers.13 The U.S. frames Brazil’s digital regulations and judicial actions on content moderation as “unfair trade practices.” These are seen as “barriers to American companies.” This elevates issues like digital sovereignty, data localization, content censorship, and IP enforcement. They move from purely regulatory or legal matters into core trade disputes. This trend suggests future trade agreements and disputes will increasingly involve digital policy. Countries with stricter digital regulations or different interpretations of free speech online may face economic repercussions. This could lead to a more fragmented global digital economy. It could also force companies to navigate a complex web of national digital laws.

C. Broader Economic Indicators

Basic interest rates (SELIC) and GDP significantly affect stock returns. Inflation and market expectations have less impact 3 Macroeconomic conditions directly influence company sales and margins.3 Brazil’s inflation rate accelerated in September 2023. This was due to rising fuel costs.1 Managers lowered Selic rate projections, fearing Trump’s tariffs.1

Brazil’s economy shows resilience. Its 2025 GDP is forecasted to grow at +2.3%.29 Domestic consumption remains strong due to a tight labor market.29 The country benefits from being a domestic-focused economy. It is relatively shielded from global trade volatility.29 However, high public debt and fiscal dynamics remain a key consideration 29 Expectations of interest rate cuts by Q1 2026 could spur corporate growth. This could also drive a rotation into equities.29

IV. Strategic Shifts and Future Outlook

The current trade tensions are compelling Brazil to reassess its global economic strategy. This fosters a pivot towards diversification and strengthening alliances with non-Western economies. This shift, while potentially mitigating immediate U.S. pressure, introduces new dynamics into the global economic landscape. It also alters Brazil’s investment appeal.

A. Diversification and New Alliances

The U.S. tariffs are forcing Brazil to diversify its export markets. This is particularly true for affected sectors like beef and coffee.14 The Brazilian Association of Meat Exporters (ABIEC) has opened offices in Washington, D.C., Brussels, and Beijing. This aims to secure new partnerships.23 New markets are opening in Asia, which saw a 19.4% increase in Brazilian coffee imports last year [User Query]. Arab countries also imported 31.5% more [User Query]. Brazilian coffee exporters like Expocacer are doubling down on diversification of markets and roles.14

Under President Lula, Brazil has joined the Belt and Road Initiative. It has also deepened BRICS cooperation.14 Brazil has signed multiple bilateral agricultural agreements with Beijing. These include deals for soybeans, beef, and notably, coffee.14 China is already Brazil’s main export destination. It is a strategic investor in logistics and infrastructure supporting Brazil’s export capacity. 14 BRICS countries, including Brazil, are discussing reducing reliance on the U.S. dollar. This could involve using local currencies or a shared payment system 13

This pivot could intensify competition among regional producers. This might potentially drive down global prices.23 A more fragmented, volatile, and geopolitically charged coffee market could emerge.14 The U.S. risks losing influence in global trade deals if BRICS nations reduce reliance on the dollar.13 The U.S. tariffs, intended to exert pressure, are inadvertently accelerating Brazil’s strategic pivot. This moves Brazil away from U.S. economic reliance towards deeper integration with BRICS and Asian markets.13 This could fundamentally reshape global trade routes and power dynamics. The tariffs, rather than compelling Brazil to comply, reinforce Brazil’s existing strategy. This involves reducing dependence on Western economies. This creates a stronger incentive for Brazil to solidify its position within emerging market blocs. This acceleration contributes to a broader geoeconomic rebalancing. It could diminish the U.S.’s traditional economic leverage in Latin America. It also strengthens multipolar trade systems. This could lead to a more complex and less predictable global trade environment for multinational corporations.

B. Investment Climate and Risk Assessment

Uncertainty regarding future U.S. policy and Brazil’s political developments increases risk. This may trigger further outflows from Brazilian assets.5 The CBOE Brazil ETF Volatility index jumped nearly 10% following tariff news.5 Despite the tensions, the EWZ ETF has shown some resilience. It recovered losses from the previous tariff news.5

The path forward remains uncertain. It is unclear whether Brazil and Washington will negotiate a new deal. A mutual trade war could also escalate [User Query]. Trump shows no sign of backing down. Lula states he will not be intimidated [User Query]. The negotiation period before tariffs take effect allows for potential stabilization and positive catalysts.5

The U.S. Section 301 investigation and potential retaliatory measures could inject uncertainty. This affects the bilateral economic partnership. It impacts businesses operating in both markets.22 There is a risk that Brazil will start working more closely with China or India. They may focus on alternative platforms to reduce dependence on American technology 13

V. Conclusion: Navigating a New Geoeconomic Landscape

The Bovespa Index’s recent decline is a stark indicator of the profound impact of geopolitical tensions on financial markets. This is not a conventional trade dispute. It is a politically charged confrontation. U.S. tariffs and sanctions aim to influence Brazil’s domestic judicial processes. This situation underscores the increasing interconnectedness of politics, law, and economics in shaping global financial stability.

The Bovespa’s volatility directly reflects the U.S.-Brazil standoff. This conflict is rooted in the Bolsonaro prosecution. It also stems from U.S. concerns over Brazilian judicial actions against American interests.7 The use of IEEPA and the USTR’s Section 301 investigation highlights the weaponization of economic tools for political leverage. This challenges traditional trade rationales.10 Significant economic repercussions are projected for key Brazilian sectors like beef and coffee. This impacts jobs and GDP, despite some exemptions.19 The dispute also extends to the technology and cyber domain. This includes U.S. concerns over digital market access and Brazilian courts’ actions against social media platforms.13

The U.S. trade surplus with Brazil fundamentally contradicts the economic justification for the tariffs. This confirms the political motivation .8 Brazil views the U.S. actions as an unacceptable interference in its sovereignty and judicial independence.19

The path forward remains uncertain. Both President Trump and President Lula show assertive stances [User Query]. While negotiation remains a possibility, Brazil is prepared for potential retaliation. This could further destabilize the economic relationship 19 Brazil’s accelerated pivot towards diversification and strengthening ties with non-Western economies signals a long-term strategic reorientation. This will occur regardless of the immediate outcome of the current dispute.13 Investors must continue to monitor not only traditional economic indicators but also the evolving geopolitical landscape. This landscape directly impacts market stability.

The market reacted strongly and negatively to the political justification of tariffs, not just the economic impact.5 The dispute’s resolution is unpredictable, with both leaders entrenched [User Query]. The core issue is not a trade imbalance. It is a fundamental disagreement over sovereignty and judicial independence. Even if a trade deal is struck, the underlying political tension and the willingness to use economic tools for political ends will persist. This means similar politically driven shocks could re-emerge. This will keep Brazilian markets under a cloud of uncertainty. This suggests a shift in the global investment paradigm. Geopolitical risk is no longer a peripheral consideration. It is a central, ongoing determinant of market stability, particularly for countries engaged in sensitive political or judicial reforms. Investors will demand higher risk premiums or seek more insulated markets.

Reference:

- Ibovespa USD Index Today (BVSPUSD) – Investing.com

- S&P/BOVESPA Quality Index Methodology

- Stock returns, macroeconomic variables, and expectations: Evidence from Brazil

- Brazil Stock Market (BOVESPA) – Quote – Chart – Historical Data – News

- iShares MSCI Brazil ETF Stock Price: Quote, Forecast, Splits & News …,

- $TRUMP THREATENS 50% TARIFF ON BRAZILIAN GOODS — MARKETS RE | SaaaD Crypto on Binance Square

- Another blow for Brazil! US slaps 50% tariff to safeguard American interests; cites Bolsonaro’s prosecution as economic emergency.y

- Trump signs order to justify 50% tariffs on Brazil | AP News

- U.S. sanctions Brazilian Judge Alexandre de Moraes, who’s overseeing the case against Trump ally Jair Bolsonaro – CBS News

- The International Emergency Economic Powers Act: Origins, Evolution, and Use

- International Emergency Economic Powers Act – Wikipedia

- Brazil | United States Trade Representative

- U.S. Targets Brazil Over Trade and Tech Rules – TECHi

- How 50% US tariffs on Brazil could reshape coffee – Coffee …,

- Brazil Supreme Court’s Legal War With Truth Social, Rumble Escalates – Newsweek

- The truth about Brazil’s Rumble ban – Reason Magazine

- Treasury Sanctions Alexandre de Moraes | U.S. Department of the …

- Announcement of Visa Restrictions on Brazilian Judicial Officials …

- Unjustified: President Lula slams Trump over tariffs and sanctions on …

- Brazil slams ‘unacceptable’ US sanctions on judge overseeing Bolsonaro case – Al Jazeera

- Trump hits Brazil with tariffs, sanctions, but key sectors excluded – The Economic Times.s

- U.S. Tariffs and Brazil’s Potential Response: A Guide for Businesses

- Trump’s Tariff Threats and the Global Beef Market: Navigating …

- Trump’s Tariff Threat Could Cost Brazil $1 Billion in Beef Exports – Agrolatam

- How new tariffs on Brazil could impact Portland’s coffee scene – News Center Maine

- “Brazil has fully aligned with international standards”: IP experts react to USTR’s Section 301 investigation – Montaury Pimenta, Machado.

- Brazil’s Digital Policy in 2025: AI, Cloud, Cyber, Data Centers, and Social Media

- Going Digital in Brazil – OECD

- Brazil: A Rare Bright Spot in a Turbulent Global Market – VanEck

- Brazil Trade Balance [Up-to-date Chart & Data] | 1959 – 2025 – CEIC

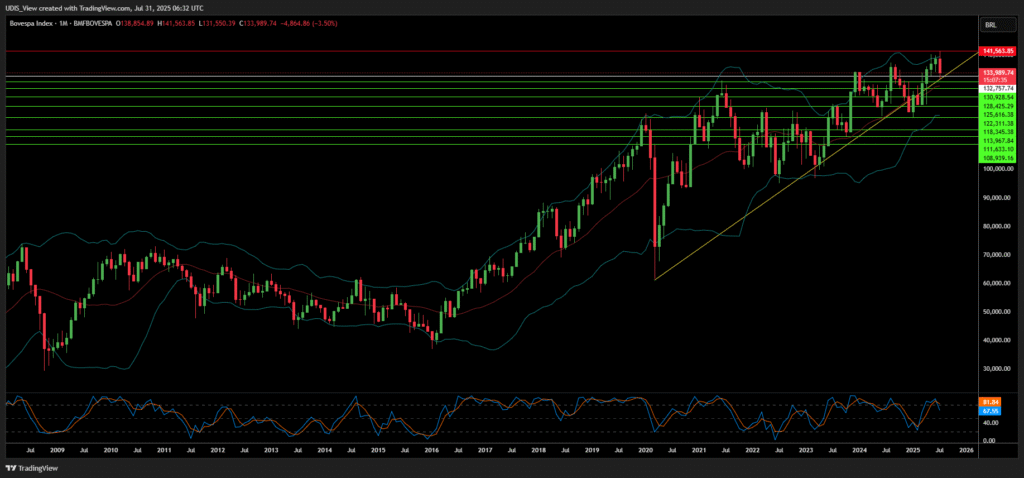

Bovespa Short (Sell)

Enter At: 132,757.74

T.P_1: 130,928.54

T.P_2: 128,425.29

T.P_3: 125,616.38

T.P_4: 122,311.38

T.P_5: 118,345.38

T.P_6: 113,967.84

T.P_7: 111,633.10

T.P_8: 108,939.16

S.L: 141,563.85