Nissan Motor Company faces a complex confluence of financial setbacks, strategic missteps, and external pressures. While fiscal year 2023 showed some improvement in profits, FY2024 (ending March 2025) marked a sharp decline, with a significant drop in operating profit and a net loss.1 This downturn stems from intensified sales competition, costly product recalls, and a perceived technological lag.

The company actively implements its “Re: Nissan” recovery plan, focusing on aggressive cost reductions, plant consolidation, and a strategic pivot towards electrification and advanced technologies.2 However, geopolitical uncertainties, particularly looming tariffs, and ongoing reputational challenges present substantial hurdles to its recovery. This report dissects these multifaceted issues, offering a comprehensive view of Nissan’s current standing and its arduous path forward.

Financial Performance and Market Position

Revenue and Profitability Trends

Nissan’s financial performance presents a mixed yet challenging picture. For fiscal year 2023, ending March 31, 2024, consolidated net revenue reached 12.686 trillion yen, a 19.7% increase from FY2022.4.Operating profit also saw a significant rise, increasing by 51% to 568.7 billion yen, resulting in a 4.5% operating margin.4 This profit increase was partly due to the reversal of a previously recorded litigation provision, not solely operational strength.4

Fiscal year 2024, ending March 31, 2025, brought a sharp downturn. Consolidated net revenue was 12.6 trillion yen, a slight decrease from FY2023.1.Operating profit plummeted by 498.9 billion yen to a mere 69.8 billion yen, representing a meager 0.6% operating margin.1 Nissan reported a net loss of 670.9 billion yen for FY2024, a significant reversal from the 426.6 billion yen net income in FY2023.1. This loss includes substantial impairments exceeding 460 billion yen and restructuring costs of 60 billion yen.5 Both automotive free cash flow and operating profit turned negative in FY2024.1. The company’s FY2025 operating profit and net income forecasts remain “to be determined” due to tariff uncertainty.1

The dramatic drop in operating profit and the shift to a net loss in FY2024, despite only a marginal decrease in net revenue, indicate a severe erosion of underlying profitability. This suggests Nissan’s cost structure is disproportionately high relative to its revenue, or that its revenue quality, such as pricing power or sales mix, has significantly deteriorated. “Intensified sales competition” 1 likely forced aggressive discounting 6, directly impacting profitability. Additionally, “higher selling expenses,” “rising monozukuri costs” 7, and a general “high cost structure” 5 point to operational inefficiencies. Exceptional costs like impairments and restructuring 5, ongoing recall costs 8, and hidden lease losses 9 represent systemic financial drains. This indicates Nissan’s financial health is more precarious than a simple revenue dip suggests, requiring fundamental restructuring.

A significant, often overlooked, financial drain stems from losses incurred by buying back leased vehicles at values far exceeding their market worth. Nissan “juices” lease residuals, overstating future values, leading to substantial losses when leased vehicles are repurchased and resold.9 The company spent 756,002 million yen buying back leased vehicles but only made 495,379 million yen selling them, illustrating a large loss on these transactions.9 Nissan faces billions in potential losses from these “lease residual haircuts” due to collapsed used car prices, particularly for leases initiated in 2022 and 2023.9. This practice, linked to an “aggressive volume-driven sales strategy” 6, artificially inflates short-term sales but creates massive future liabilities. The financial statements might not fully capture the extent of these future obligations. This hidden financial weakness undermines investor confidence and complicates any turnaround efforts, suggesting a history of prioritizing short-term volume over long-term financial health.

Table: Nissan Motor: Key Financial Performance (FY2022-FY2024)

| Metric (Billion JPY) | FY2022 (Actual) | FY2023 (Actual) | FY2024 (Actual) | Variance FY23 vs FY22 | Variance FY24 vs FY23 |

| Net Revenue | 10,596.7 4 | 12,685.7 4 | 12,633.2 1 | +2,089.0 | -52.5 |

| Operating Profit | 377.1 4 | 568.7 4 | 69.8 1 | +191.6 | -498.9 |

| Operating Margin (%) | 3.6% 4 | 4.5% 4 | 0.6% 1 | +0.9 ppt | -3.9 ppt |

| Net Income | 221.9 4 | 426.6 4 | -670.9 1 | +204.7 | -1,097.5 |

Global Sales and Market Share Dynamics

Nissan’s global sales volume remained stagnant at 3.44 million units in FY2023, impacted by heightened sales competition.4 Global sales further decreased to 3.346 million units in FY2024.1 Nissan forecasts a further decline to 3.25 million units in FY2025.5 China volumes were nearly 100,000 units lower in FY2024, with an expected 18% sales decline in FY2025 due to intense competition from domestic brands.5

While U.S. sales showed some recovery in calendar year 2024, increasing by 2.8% to 924,008 units 1,0, this positive regional trend masks a deeper global sales decline, particularly in the crucial Chinese market. This indicates Nissan’s reliance on specific market strengths might be unsustainable if overall global demand or competitive pressures intensify elsewhere. North American sales increased by 3.3% in FY2024, offsetting declines in Europe (down 2.9%), Japan (down 4.8%), and other markets (down 1.2%).5 U.S. sales were driven by strong performance in models like Kicks (+51.1%), Versa (+91%), Pathfinder (+44.2%), Sentra (+43.7%), and Ariya (+30.2%) in Q4 2024.10 However, some key models like Rogue (-9.5%) and Altima (-11.0%) saw declines in CY2024.10 Infiniti sales also decreased by 10.2% in CY2024.10

Nissan Group held a 7% U.S. market share in 2024, trailing behind major competitors like GM (17%), Toyota (15%), and Ford (13%).11 In Japan, Nissan is the third most popular brand with a 9.4% market share.12 Nissan’s sales strategy appears fragmented. While some newer or refreshed models perform well in specific markets like the U.S., the broader product portfolio and market penetration are struggling globally, especially against aggressive domestic EV competitors in China.13 The “Re: Nissan” plan’s focus on “redefine product and market strategy with sharper focus” 5 confirms this recognition. Nissan needs a more cohesive global strategy, particularly for growth markets and competitive segments, to reverse the overall sales decline. Relying on regional bright spots will not suffice for long-term health.

The sales increases in some U.S. models, while positive on the surface, may be linked to the aggressive discounting and “juiced” lease residuals that have historically eroded brand value and are now causing significant financial losses. Nissan’s “aggressive volume-driven sales strategy, focusing on fleet sales and heavy discounting”, 6 damaged its brand image and resale values.6 This strategy creates a short-term sales boost but undermines long-term profitability, brand perception, and financial stability. This is a critical internal contradiction in their sales approach. Nissan must shift from a volume-at-any-cost approach to one focused on profitable sales and brand equity. The “Re: Nissan” plan’s goal to “prioritize self-improvement with greater urgency and speed, aiming for profitability that relies less on volume” 2 acknowledges this.

Table: Nissan Group U.S. Quarterly Sales (2022-2024)

| Quarter | 2022 Sales (Units) | % Change vs. Prior Year | 2023 Sales (Units) | % Change vs. Prior Year | 2024 Sales (Units) | % Change vs. Prior Year |

| Q1 (Jan-Mar) | 201,081 14 | -29.6% 14 | 235,818 14 | +17.3% 14 | 252,735 14 | +7.2% 14 |

| Q2 (Apr-Jun) | 183,171 14 | -38.6% 14 | 244,353 14 | +33.4% 14 | 236,721 14 | -3.1% 14 |

| Q3 (Jul-Sep) | 154,086 14 | -22.6% 14 | 216,878 14 | +40.8% 14 | 212,068 14 | -2.2% 14 |

| Q4 (Oct-Dec) | 191,012 14 | -2.0% 14 | 201,747 14 | +5.6% 14 | 222,484 10 | +10.3% 10 |

| Calendar Year Total | 729,350 | N/A | 898,796 | N/A | 924,008 | +2.8% 10 |

Geopolitical and Macroeconomic Pressures

Trade Tensions and Tariffs

Geopolitical factors significantly impact Nissan’s operational landscape. The looming July 9, 2025, deadline for Section 232 tariffs poses a significant threat, potentially imposing a 24% tariff on Japanese auto exports to the U.S..15 Such tariffs would directly hurt the profitability and share prices of Japanese automakers, including Nissan, which heavily relies on U.S. sales.15 U.S. tariffs on EU goods, particularly in the automotive sector, have already created a complex landscape of risks.16 Nissan’s strategy of strengthening its U.S. production footprint helps mitigate some import tariff risks, but models with international components or advanced systems may still face price fluctuations.17

The “uncertainty related to tariff environment” 1 is not just a financial risk but a strategic impediment. It leads to Nissan’s “FY25 forecast to be determined” for key financial metrics like operating profit and net income. This inability to forecast hinders investment planning and long-term strategy. The company’s “Re: Nis san” plan includes a “mitigation strategy” for U.S. tariff policy, prioritizing U.S.-built products, optimizing local capacity, and reallocating tariff-exposed production.1 Beyond the direct financial hit, the

Uncertainty creates a strategic paralysis, forcing a reactive, rather than proactive, strategic posture.

A concerning trend of “tariff diplomacy” also emerges, where non-trade issues are weaponized in trade negotiations. The U.S. is potentially using fentanyl allegations against Japan as “trade leverage”, 15 highlights this. This creates reputational friction and complicates diplomatic relations, adding another layer of risk beyond pure economic factors. The U.S. administration’s focus on fentanyl as a tool for trade leverage raises the risk of similar tactics against Japan if tensions escalate.15 This demonstrates how geopolitical issues can be manufactured or exaggerated to exert economic pressure, creating an unpredictable operating environment for international businesses. Companies like Nissan must now factor in complex geopolitical risk assessments, including non-economic leverage points, into their strategic planning.

Economic Headwinds

Nissan’s profitability faces pressure from persistent macroeconomic factors. The company expects continued challenges from “intense competition, forex and inflationary pressure” in FY2025.1 Strong currency fluctuations and increases in raw material prices significantly impacted performance in FY2022 and continued to be a factor in FY2023.18 While yen depreciation positively impacted FY2022 18, the strong U.S. dollar in FY2024 was offset by declines in other currencies.5 Supply chain disruptions, particularly semiconductor shortages, and rising COVID-19 infections also affected production and sales volumes.18

Despite some positive impact from raw material costs in FY2024 5, the overall narrative points to persistent inflationary pressures and supply chain vulnerabilities, such as semiconductor shortages and logistics issues.4 These factors directly increase “monozukuri costs” 7, squeezing margins. Nissan’s cost structure is highly susceptible to global economic volatility, suggesting a lack of robust hedging strategies against currency fluctuations or insufficient supply chain resilience. The company’s efforts to “restructure its supplier panel to secure more volume for fewer suppliers, eliminating inefficiencies and challenging legacy standards” 2 are a direct response to this vulnerability. In a globally interconnected industry, managing macroeconomic risks is paramount. Nissan’s struggles highlight the need for diversified supply chains and dynamic pricing strategies to absorb external shocks.

Consumer Confidence and Spending

Consumer confidence significantly influences automobile sales, with high confidence leading to greater willingness for large purchases and uncertainty causing deferred spending or a shift to budget-friendly options.19 The automotive market acts as an economic bellwether, with shifts towards used vehicles or extended ownership cycles during uncertain times.19

Nissan faces an additional layer of challenge: its specific quality issues directly erode consumer trust, making its sales more vulnerable even when broader confidence might be improving. Consumer surveys reveal 36% of U.S. buyers now rank recalls as a top concern when purchasing a vehicle, up from 22% in 2019.8. Nissan’s Q1 2025 U.S. sales dropped 8% year-on-year, with the Rogue, a model affected by a major recall, experiencing a 14% decline.8 Competitors, such as Toyota’s RAV4, capitalized on this, seeing a 6% sales increase during the same period.8 This directly links product quality and brand trust to consumer confidence and sales performance. Nissan cannot simply wait for an economic upturn; it must proactively address its quality issues and rebuild brand trust to restore confidence in its specific products.

The recent CDK outage, an industry-wide disruption, also severely impacted sales processes at dealerships, leading to inventory backlog and delayed sales for many, including Nissan, in Q2 2025.20. However, Nissan dealerships saw a substantial 32% drop in days’ supply of new vehicles, signaling healthier sales velocity and potential for stronger financial performance.20 This indicates that effective inventory management and responsiveness to market demand are crucial for sales and profitability, even amidst external disruptions.

Technological Lag and Innovation Gaps

Electric Vehicle (EV) Strategy and Competition

Nissan pioneered mass-market EVs with the LEAF in 2010.6 However, the company “failed to aggressively innovate and refine its EV lineup,” losing ground to Tesla, Toyota, and new entrants like Rivian and BYD.6 The LEAF’s range and charging capabilities became outdated.6 Nissan’s next-gen EV, the Ariya, arrived late and “hasn’t yet made a major impact” on the market.6 Nissan was also “late to react to rising hybrid demand” in key markets like the U.S., losing out on a lucrative transitional segment and contributing to a 99% drop in U.S. operating profit.21

Nissan is now pivoting its EV strategy. It focuses on bidirectional charging and grid integration through a partnership with ChargeScape, co-owned with BMW, Ford, and Honda, turning LEAFs into distributed energy assets.23 Collaboration with The Mobility House further extends its reach into renewable energy storage.23 Nissan is also betting on solid-state batteries, targeting mass production by 2029, which promises 30% lower costs and 20% higher energy density.13 This focus on V2G technology and solid-state batteries represents a high-risk, high-reward strategy. While it offers a “first-mover advantage” in a niche 23 and promises future cost/energy benefits 13, it delays full EV competitiveness and faces execution risks. Nissan delayed the 2028 production launch of two electric SUVs at its Canton, Mississippi, plant by 10 months.24 In China, Nissan faces an “existential threat” from domestic EV giants like BYD and Xiaomi, which dominate the market with affordable, tech-packed vehicles.13

Autonomous Driving Development

Nissan aims for “zero fatalities” through its Nissan Intelligent Mobility initiatives, including autonomous driving.25 The company initially planned to roll out single-lane autonomous driving by late 2016, multi-lane capabilities by 2018, and city street autonomy by 2020.25. However, Nissan now plans to launch its next-generation ProPILOT technology from fiscal year 2027.26. This system will feature Nissan Ground Truth Perception technology with next-generation Lidar and Wayve AI Driver software.26

The shift from a 2020 target for city street autonomy to a 2027 launch for “next-generation ProPILOT” indicates substantial delays in their autonomous driving roadmap.25 This lag could impact future competitiveness in a rapidly evolving sector. These delays mirror the company’s broader struggles with technological stagnation and product commercialization, suggesting systemic R&D and implementation hurdles. Despite early ambitions and R&D investments, Nissan has struggled with the complex integration and commercialization of cutting-edge technologies, potentially putting it behind rivals. In the race for future mobility, delays in critical technologies like autonomous driving can lead to significant competitive disadvantages and missed market opportunities, impacting long-term revenue streams and brand perception as a technology leader.

Innovation Effectiveness and R&D Challenges

Nissan’s R&D efforts focus on “Nissan Intelligent Mobility,” aiming for zero emissions and zero fatalities through EVs, autonomous driving, and connected cars.25 The company has faced challenges with on-premise High-Performance Computing (HPC) systems, including limited power, high costs, and low utilization (40-80%), which threatened innovation and time-to-market.28 Nissan shifted to a cloud-enabled platform (Rescale) for agility, eliminating queuing time (previously 2-3 days), achieving 18% cost optimization in applications/productivity, and a 50% reduction in HPC operating expenses.28

Despite these efforts, Nissan’s product lineup has been criticized as “outdated,” with many models going years without significant updates.6 This includes the Altima, which lagged behind competitors, and the GT-R, which saw little innovation.6 This suggests a disconnect between internal R&D process improvements and external product competitiveness. While the

process of innovation might be more efficient, the output (new, compelling vehicles) is still insufficient. This indicates that the problem is not just a lack of R&D investment, but potentially a failure in strategic R&D direction, commercialization, or market responsiveness.

Nissan possesses a “remarkable” patent portfolio, boasting 10,163 active patent families globally as of late 2023.29 Most patents are filed in Japan, followed by the U.S. and Europe.29 Patents in CASE (Connected, Autonomous, Shared, Electric) areas account for approximately 60% of their portfolio, reflecting a focus on strengthening these areas.30 Nissan focuses on creating, protecting, and utilizing intellectual property, aiming to strengthen its portfolio.30 However, the struggle with “outdated products” 6 suggests a disconnect between patent generation and effective commercialization or market-relevant innovation. Simply having many patents does not equate to market leadership or successful product innovation; the challenge lies in translating patented inventions into compelling, commercially successful vehicles.

Table: Nissan’s Key Technology Partnerships and Focus Areas

| Partner | Key Technology/Focus Area | Objective/Impact |

| ChargeScape | Bidirectional Charging & Grid Integration (V2G) | Turns LEAF EVs into distributed energy assets; building a utility-grade platform 23 |

| The Mobility House | Renewable Energy Storage & Grid Stabilization | Extends Nissan’s reach into renewable energy storage; “smart island” project in Portugal 23 |

| Baidu | Autonomous Driving Software | Likely involves autonomous driving software for China’s AI landscape 23 |

| AWS (Amazon Web Services) | Cloud Infrastructure | Underpins connected-car services and real-time grid management systems 23 |

| Panasonic | Battery Technology | Deepening ties for supplying cells for next-gen solid-state batteries 23 |

Cybersecurity and Reputational Risks

Data Breaches and Security Incidents

Nissan has experienced multiple cybersecurity incidents, contributing to reputational concerns. In December 2023, Nissan Motor Corporation and Nissan Financial Services in Australia and New Zealand (Nissan Oceania) suffered a cybersecurity breach where an unauthorized third party gained access to local IT servers.31 Approximately 100,000 individuals were affected, with 10% having government identification (Medicare cards, driver’s licenses, passports, tax file numbers) compromised.31 The remaining 90% had other personal information, such as loan statements, employment/salary data, or dates of birth, impacted.31

This was not an isolated incident. In June 2022, a third-party breach exposed data of 18,000 Nissan North America clients, including full names, dates of birth, and NMAC account numbers, due to a poorly constructed database in a public cloud repository.32 This followed a January 2021 incident where a Git server was exposed, leading to 20 GB of leaked data, including source code.32 The recurring nature and varying sources of these data breaches suggest a systemic weakness in Nissan’s cybersecurity posture, not just isolated incidents. This directly contributes to the erosion of consumer trust, which is already under pressure from product recalls. Cybersecurity is no longer just an IT problem; it is a fundamental business risk impacting brand reputation and customer loyalty, especially in an era of connected cars and personal data. The cumulative effect of these breaches, combined with product recalls, creates a perception of a company struggling with basic operational integrity.

Product Recalls and Quality Concerns

Nissan faces significant product recall challenges that directly impact its market standing. In 2024, Nissan initiated a recall of over 480,000 vehicles in the U.S. and Canada due to defective engine bearings in its 1.5L and 2.0L VC-Turbo engines.8 This defect could lead to engine stalling, a complete loss of power, and potential crashes or fires.8 Estimated repair costs for this recall could reach $500 million.8

This recall follows a history of quality issues for Nissan, including persistent complaints about Continuously Variable Transmissions (CVTs) and a 2019 recall for antilock brake system malfunctions that could cause electrical shorts and fires.22 These frequent and severe product recalls, particularly the engine defect, create a significant “trust deficit” with consumers. Consumer surveys show 36% of U.S. buyers now rank recalls as a top concern when purchasing a vehicle, up from 22% in 2019.8.T.. his deficit directly translates into a competitive disadvantage, as buyers opt for rivals perceived as more reliable. Nissan’s Q1 2025 U.S. sales dropped 8%, with the Rogue, a model affected by the recall, experiencing a 14% decline, while competitors like Toyota’s RAV4 saw sales increases.8

Paradoxically, Nissan was named #1 for New Vehicle Quality among Mass Market brands in the J.D. Power 2025 U.S. Initial Quality Study.34 However, this ranking for

initial quality might not capture long-term reliability issues or the impact of major, system-wide defects like the engine bearing problem. The perceived quality issues, reinforced by repeated recalls, are more impactful on consumer purchasing decisions than positive initial quality rankings. This indicates a disconnect between internal quality control metrics and real-world customer experience and perception. Rebuilding consumer trust is a long and arduous process, requiring not just fixes but transparent communication and a consistent track record of reliability.

Leadership and Strategic Missteps

Post-Ghosn Era

Carlos Ghosn’s arrest in 2018 for financial misconduct created a “leadership vacuum” and led to “inconsistent strategic direction” and “corporate infighting” within Nissan.6 Shareholders expressed “fury” over crashing stock prices, zero dividends, and quarterly losses following Ghosn’s departure.35 Ghosn, who had previously led a “Nissan Revival Plan” in 1999 that saved the company from near bankruptcy and significantly improved its financial performance 36, was accused of understating his salary and misusing company funds.36 The scandal “tarnished” Nissan’s reputation and led to perceived “confusion in management.” 35

Ghosn’s highly centralized leadership, while initially effective in turning Nissan around, left the company vulnerable to severe disruption upon his dramatic exit. The subsequent “leadership vacuum” and “corporate infighting” highlight a lack of robust succession planning and distributed leadership. The Ghosn scandal exposed deep governance flaws and a lack of institutional resilience at Nissan. The company’s subsequent struggles in adapting to market changes and maintaining a clear strategic path are a direct consequence of this leadership crisis. Over-reliance on a single leader, even a highly successful one, can create long-term organizational fragility. Strong corporate governance, distributed leadership, and robust succession planning are crucial for sustainable performance.

Sales Strategy and Brand Erosion

Nissan adopted an “aggressive volume-driven sales strategy,” relying heavily on “fleet sales and heavy discounting”. .6 This approach “damaged Nissan’s brand image and resale values,” making its cars “less desirable” in the long run.6 It also “strained dealer relations” as dealers became reliant on incentives to move inventory.6

This aggressive discounting and lease strategy created a “self-inflicted wound” by eroding brand value and generating massive hidden financial liabilities. The “juicing” of lease residuals, where Nissan overstated residual values, led to “billions of losses” when used car prices collapsed, further demonstrating the unsustainability of this volume-at-all-costs strategy.9 For example, Nissan spent 756,002 million yen buying back leased vehicles but only made 495,379 million yen selling them.9 This is a classic example of prioritizing short-term metrics, such as sales volume, over long-term strategic health, including brand equity and profitability. The aggressive sales tactics created a vicious cycle: lower perceived value required more discounts, further eroding value. The lease losses are the delayed but inevitable financial consequence of this strategy. Sustainable growth requires a balanced approach that protects brand value and ensures profitable sales, rather than chasing volume at any cost.

Restructuring and Cost-Cutting Initiatives

Nissan launched the “Re: Nissan” recovery plan to “enhance performance and create a leaner, more resilient business” that adapts quickly to market changes.2 This plan targets 500 billion yen in total cost savings by FY2026, with 250 billion yen from variable costs and 250 billion yen from fixed costs.2

The restructuring involves consolidating vehicle production plants from 17 to 10 by FY2027.2 It also includes a significant workforce reduction of 20,000 employees by FY2027, covering direct/indirect and contractual roles across manufacturing, SG&A, and R&D functions.2 The plan aims for positive operating profitability and free cash flow in the automotive business by fiscal year 2026.2. This represents a drastic, necessary overhaul of Nissan’s operations. However, such aggressive cost-cutting and restructuring carry significant execution risks, including potential disruption to operations, employee morale issues, and the risk of cutting too deeply into essential R&D or talent.5 The sheer scale of the cuts indicates the severity of Nissan’s financial distress. The success of “Re: Nissan” depends entirely on flawless execution and the ability to maintain innovation capacity despite significant resource reductions. This restructuring is a make-or-break moment for Nissan.

Outlook and Path Forward

Strategic Responses and Partnerships

Nissan’s “Re: Nissan” plan is a “bold, multifaceted strategy” addressing both immediate financial pressures and long-term industry shifts.13 Key drivers include reducing costs to aim for breakeven, redefining product and market strategy with a sharper focus, and reinforcing partnerships to complement its strategies.5 The company prioritizes U.S.-built products, optimizes local capacity, reallocates tariff-exposed production, and localizes suppliers to mitigate tariff impacts.1

Nissan’s path forward is characterized by a simultaneous, aggressive retrenchment and strategic reinvestment. The company implements massive cost cuts, plant closures, and job reductions.2 Simultaneously, it invests in new technologies like V2G, solid-state batteries, and AI through strategic tech partnerships (ChargeScape, The Mobility House, Baidu, AWS, Panasonic).13 These partnerships aim to drive a “digital pivot” and strengthen their position in EV infrastructure, AI, and battery technology.23 Nissan’s focus on V2G technology is a “niche where it holds a first-mover advantage.” 23 This dual approach is critical for survival but demands exceptional management to balance short-term austerity with long-term growth. The challenge lies in maintaining R&D capabilities and attracting talent amidst significant downsizing, and ensuring that cost savings free up capital for crucial investments rather than merely shoring up losses.

Challenges and Opportunities

Challenges:

- Execution Risk: The “Re: Nissan” plan’s success hinges on precise execution; missteps in plant closures, workforce reductions, or supply chain renegotiations could derail its recovery.13

- EV Market Dynamics: Softening EV demand in some markets and intense competition, especially from Chinese EV giants like BYD and Xiaomi, pose significant threats.13

- Alliance Volatility: The Renault-Nissan-Mitsubishi alliance, while offering R&D collaboration, has faced internal conflicts and divergent strategies.13

- Reputational Damage: Recovering from multiple product recalls and cybersecurity breaches will be a long and arduous process, as these incidents erode consumer trust.8

- Hidden Financial Liabilities: The ongoing impact of lease residual haircuts remains a significant concern, representing billions in potential losses.9

- Tariff Uncertainty: The potential for U.S. tariffs on Japanese auto exports creates ongoing financial and strategic uncertainty, hindering long-term planning.1

Opportunities:

- Technological Niche: Nissan holds a first-mover advantage in V2G technology, which could be a differentiating factor in the future energy landscape.23

- Future Battery Technology: The long-term potential of solid-state batteries, targeted for mass production by 2029, could restore cost parity and energy density leadership.13

- Strategic Partnerships: Leveraging collaborations with ChargeScape, The Mobility House, Baidu, AWS, and Panasonic can accelerate innovation and improve efficiency.23

- U.S. Market Recovery: Recent U.S. sales growth, particularly in specific models like Kicks and Versa, offers a positive regional trend to build upon.10

- Cost Efficiency: The “Re: Nissan” plan aims to create a leaner, more resilient operation, potentially improving long-term profitability and free cash flow.2

Nissan faces a critical race against time. It must implement its aggressive restructuring and technological pivot before competitive pressures, especially from Chinese EV manufacturers, and the erosion of consumer trust become irreversible. The company’s survival hinges on its ability to execute flawlessly and quickly. The “Re: Nissan” plan is a last-ditch effort to regain financial footing. However, the market is not static; competitors are advancing, and consumer patience is finite. Nissan’s ability to regain trust and deliver compelling products will be paramount. This situation serves as a case study for the automotive industry’s rapid transformation, where legacy automakers must adapt or risk obsolescence.

Conclusion

Nissan Motor Company stands at a critical juncture, battling a multifaceted decline rooted in financial underperformance, strategic missteps, and external pressures. The dramatic drop in FY2024 profitability, coupled with persistent global sales challenges outside the U.S., underscores the severity of its situation.

Leadership turmoil following the Carlos Ghosn scandal, an aggressive but ultimately damaging sales strategy reliant on discounting and problematic leases, and a failure to sustain early innovation in electric vehicles have collectively eroded brand value and financial stability. Recurring product recalls and cybersecurity breaches further compound the trust deficit with consumers.

The “Re: Nissan” recovery plan, with its ambitious cost-cutting, plant consolidation, and strategic pivot towards advanced technologies like V2G and solid-state batteries, represents a necessary, albeit high-risk, overhaul. Its success hinges on precise execution, effective management of geopolitical uncertainties like tariffs, and a rapid re-establishment of consumer confidence through demonstrable product quality and innovation.

Nissan’s journey back to sustainable profitability and market leadership will be arduous, demanding unwavering focus and disciplined strategic alignment to navigate the turbulent automotive landscape.

References

- Nissan reports financial results for fiscal year 2024

- Nissan sets the stage for change with the bold Re: Nissan plan

- Nissan sets the stage for change with the bold Re: Nissan plan

- Nissan reports financial results for fiscal year 2023

- CEO Ivan Espinosa – Nissan Global

- Nissan’s Downward Spiral: How Missteps in Strategy and Innovation Led to Its Decline

- Nissan reports first-half results for fiscal year 2024

- Nissan’s Engine Recall Crisis: A Crossroads for Automotive Safety and Investor Confidence

- Nissan is still a profitable company. So why is their CFO warning that they’re going out of business next year? I think I have the answer: r/cars – Reddit

- Nissan Group reports 2024 fourth quarter and 2024 calendar year U.S. Sales

- Ranked: Automakers by U.S. Market Share – Visual Capitalist

- Japan Car Sales Data | GCBC

- Nissan’s Global Restructuring: Implications for Investors in the EV Transition Era – AInvest

- U.S. Sales Reports – Nissan News USA

- Japan-U.S. Trade Tensions and Fentanyl Allegations: Navigating …

- Navigating the Trump Tariff Landscape: Strategic Opportunities in the EU’s Retaliatory Measures and Trade Negotiations – AInvest

- Tariff Impact on Nissan Prices: How to Budget and Plan Ahead

- Nissan reports April-December results for fiscal year 2022

- Consumer Confidence and Its Role in Automobile Sales and Business Performance AUTHOR – ResearchGate

- Navigating the Impact of Q2 Auto Retail Trends and Inventory Fluctuations – Dealership Buy-Sell Advisors – Haig Partners

- Analysis: The Decline of Nissan – A Lesson in Strategic Management and Innovation – Nimble Legacy | Organisational Development & Strategy

- Nissan Pulls 440K Cars from the Road Due to Engine Defects

- Nissan’s Digital Pivot: Can EV Tech and Strategic Partnerships Drive

- Nissan ending production at Japan plant | Automotive Dive

- Building Tomorrow’s Sustainable Mobility Society – Nissan Global

- Nissan to launch the next generation of autonomous driving technology in fiscal year 2027

- Innovation | Nissan Motor Corporation Global Website

- Nissan and Rescale: Innovation that Excites

- Check Patent Portfolio For NISSAN MOTOR: Key Stats & Figures – TT Consultants

- Intellectual Property – Nissan Global

- Nissan Motor Corporation and Nissan Financial Services data breach | NSW Government

- Data of 18.000 Nissan North America Clients Exposed by a Third-party Breach

- Nissan recalls more than 480,000 vehicles over engine failure risk – CBS News.

- Battle-Tested: Nissan Quality Isn’t Just Promised – It’s Recognized – Business Wire

- Nissan shareholders furious at Ghosn scandal, dismal results – AP News

- Carlos Ghosn – Wikipedia

- TIL Nissan was losing money for 8 straight years until Carlos Ghosn made it profitable in just 3—after vowing at the Tokyo Auto Show that the board would resign if he failed. : r/todayilearned – Reddit

- Case Study: The Downfall of Nissan’s Carlos Ghosn – MBA Knowledge Base

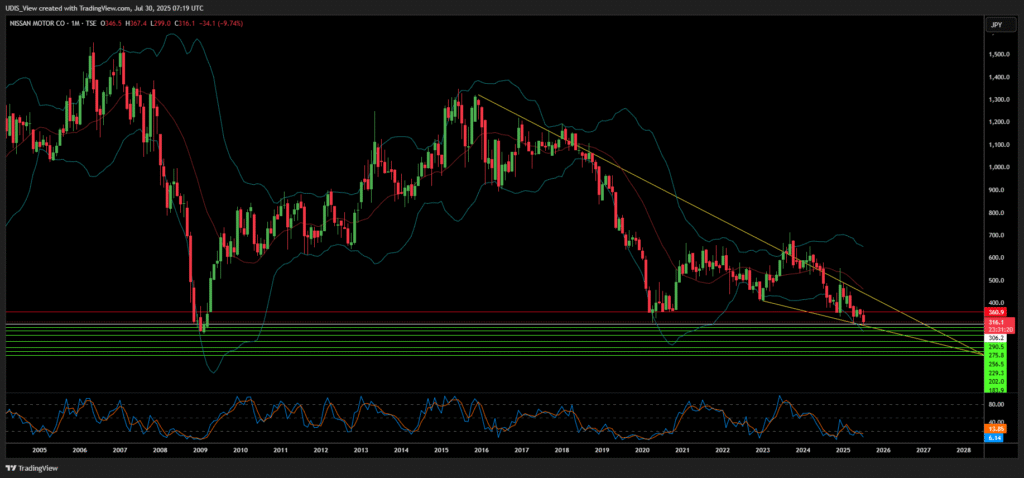

Nissan Short (Sell)

Enter At: 306,2

T.P_1: 290,5

T.P_2: 275,8

T.P_3: 256,5

T.P_4: 229,3

T.P_5: 202,0

T.P_6: 183,9

T.P_7: 168,0

S.L: 360,9