Qualcomm: Strategic Ascent – Navigating Geopolitics and Pioneering the Intelligent Edge

Qualcomm demonstrates strong financial performance in the second quarter of fiscal year 2025. The company reported non-GAAP revenues of $10.8 billion and non-GAAP earnings per share of $2.85.[1] These figures exceeded mid-range guidance expectations.[1] This robust performance reflects a successful strategic transformation. Qualcomm is actively diversifying its revenue streams, moving away from traditional reliance on smartphones.[2] This shift targets high-growth sectors such as automotive and the Internet of Things (IoT).[2]

Qualcomm’s growth stems from several interconnected factors. Its leadership in on-device artificial intelligence (AI) is critical.[5] Its expanding presence in automotive and IoT sectors also drives growth.[3] Continuous innovation in 5G and future 6G technologies is essential.[6] A formidable patent portfolio provides a significant competitive advantage, ensuring stable, high-margin licensing revenues.[7] The company strategically navigates complex geopolitical landscapes[9] and invests in future technologies like quantum-inspired AI and robust cybersecurity solutions.[10]

The strong performance in Q2 2025 is not an isolated success. It serves as early validation of strategic diversification efforts initiated years earlier. The 38% year-over-year revenue growth in automotive and IoT[2] directly supports the CEO’s stated focus on diversification.[2] This demonstrates that the diversification strategy is already yielding tangible financial results, validating the strategic direction and indicating that overall strong earnings are partly a result of this transformation, not solely dependent on the traditional mobile sector.

Qualcomm’s focus on “critical controllable factors”[2] in a “macroeconomic and commercial”[2] environment suggests a pragmatic geo-strategy. It emphasizes internal strengths to mitigate external volatility. In a volatile global landscape, Qualcomm aims to build resilience by leveraging its core technological and operational strengths, adopting an adaptive strategy to neutralize unpredictable external forces like trade tensions through internal innovation and efficiency.

Financial Resilience and Market Positioning

Strong Earnings and Analyst Confidence

Qualcomm reported GAAP revenues of $11.0 billion in Q2 2025.[2] Non-GAAP earnings per share reached $2.85, exceeding mid-range guidance expectations.[1] The CDMA Technologies segment (QCT), which includes chip sales, recorded a 25% year-over-year growth in earnings before tax (EBT).[2] This strong EBT growth, alongside overall revenue growth,[1] indicates that even as reliance on smartphones decreases, Qualcomm’s core chip business remains highly profitable and efficient, providing capital for diversification.

Analysts largely maintain positive ratings. Bernstein reiterated an “Outperform” rating with a price target of $185.00, despite smartphone market concerns.[12] JP Morgan and Susquehanna also maintain “Overweight” and “Positive” ratings, respectively.[13]

Shareholder Value and Capital Allocation

Qualcomm consistently returns value to shareholders. The company announced a quarterly cash dividend of $0.89 per share,[14] payable in September 2025, maintaining its regular quarterly payout.[12] Qualcomm committed to returning 100% of its free cash flow to shareholders in fiscal year 2025,[3] signaling strong management confidence in the sustainability and profitability of its diversified revenue streams. This counters market skepticism about the company’s post-Apple prospects, demonstrating expectations of significant, reliable cash flow from new sectors.

The stock trades at a price-to-earnings (P/E) ratio of approximately 16.40,[16] at a significant discount to the S&P 500 and the Philadelphia Semiconductor Index (SOX).[12] This discount, despite strong financials and growth prospects,[12] suggests market skepticism and a lag in fully pricing the diversification story, implying potential undervaluation for long-term investors. Concerns about smartphones and the end of business with Apple[12] likely overshadow positive developments in automotive and IoT, suggesting untapped value for patient investors.

Table 1: Qualcomm Q2 2025 Financial Snapshot

| Financial Metric | Value | Sources |

|---|---|---|

| GAAP Revenues (Q2 2025) | $11.0 billion | [2] |

| Non-GAAP Revenues (Q2 2025) | $10.8 billion | [1] |

| GAAP Earnings per Share (Q2 2025) | $2.52 | [2] |

| Non-GAAP Earnings per Share (Q2 2025) | $2.85 | [1] |

| QCT EBT Growth (YoY) | 25% | [2] |

| Combined Automotive and IoT Revenue Growth (YoY) | 38% | [2] |

| Current Stock Price (as of July 21, 2025) | $158.97 | [17] |

| Market Capitalization | $176.83 billion | [7] |

| Price/Earnings Ratio (Normalized) | 14.30 | [7] |

| Dividend Yield (based on $0.89 quarterly) | 2.21% (forward) | [7] |

Strategic Diversification: Beyond Mobile Dominance

The Need for Multi-Sector Expansion

Qualcomm’s historical strength lies in mobile chips, particularly Snapdragon processors.[3] However, a maturing smartphone market and major customers like Apple developing in-house modems create significant challenges.[4] Apple’s decision to replace Qualcomm’s chips with its own baseband chips poses a medium- to long-term threat, as Apple accounts for nearly 20% of Qualcomm’s revenues and is expected to phase out Qualcomm chips by 2026.[18] This necessitates a strategic shift to new growth paths to mitigate future revenue risks.

Revenue Mix Rebalancing: 2029 Targets

Qualcomm aims to reduce its reliance on smartphone revenues from approximately 70% in 2024 to 50% by 2029,[4] targeting a balanced revenue mix where non-mobile sectors contribute equally.[4] Key growth areas include automotive, personal computers (PCs), extended reality (XR), wearables, and industrial IoT.[4] By 2029, Qualcomm projects $22 billion in annual revenues from these non-smartphone businesses.[4] This proactive diversification, coupled with its commitment to return 100% of free cash flow to shareholders,[3] signals management confidence in the long-term cash-generating potential of its new ventures.

Table 2: Qualcomm Revenue Diversification Targets (2024 vs. 2029)

| Sector | 2024 Revenues ($B) | 2029 Target Revenues ($B) | Percentage of Total Revenues (2024) | Percentage of Total Revenues (2029) |

|---|---|---|---|---|

| Mobile | ~20.9 (70%) | ~22 (50%) | 70% | 50% |

| Automotive | ~3 | 8 | ~10% | ~18% |

| PC | – | 4 | – | ~9% |

| Industrial IoT | 5.4 | 14 | ~18% | ~32% |

| XR | – | 2 | – | ~4% |

| Other IoT | ~2.9 | 4 (Industrial IoT) | ~10% | ~9% (General IoT) |

| Total | ~30 | ~44 | 100% | 100% |

Note: Percentages are based on estimated revenues of $30 billion in 2024 and $44 billion in 2029.[4]

Technological Innovation: Driving the Intelligent Edge

On-Device AI Leadership: Hardware and Software Foundations

Qualcomm pioneers on-device AI through its Qualcomm AI Engine, a system-on-chip (SoC) architecture integrating a neural processing unit (NPU), graphics processing unit (GPU), central processing unit (CPU), and a low-power sensing hub.[5] This delivers exceptional performance per watt, enabling complex generative AI models like Stable Diffusion to run on battery-powered devices such as smartphones, PCs, and vehicles.[5] This capability addresses critical market needs for low latency, enhanced privacy, cost efficiency, and reliable offline functionality.[5]

Qualcomm’s AI stack offers a “develop once, deploy anywhere” environment supporting major AI frameworks, with tools like Qualcomm AI Hub and AI Model Efficiency Toolkit (AIMET) lowering developer barriers.[5] On-device AI is a core enabler for diversification into automotive, IoT, and PCs, enhancing product value propositions across new markets.

Automotive Sector Growth: Snapdragon Digital Chassis and ADAS

The automotive sector is a key growth driver, with revenues surging 59% year-over-year to $959 million in Q2 2025.[3] Qualcomm’s Snapdragon Digital Chassis, a modular and scalable platform, unifies connectivity, digital cockpit, and advanced driver-assistance systems (ADAS).[23] The Snapdragon Ride platform, supporting autonomous driving, was selected by BMW for its Neue Klasse program.[23] The June 2025 acquisition of Autotalks integrates vehicle-to-everything (V2X) technology, critical for autonomous driving and safety.[16] Qualcomm targets $8 billion in annual automotive revenues by 2029.[3]

Expanding IoT Footprint: From PCs to Industrial Applications

Qualcomm’s IoT segment grew 27% year-over-year to $1.58 billion in Q2 2025,[3] driven by Snapdragon X Elite processors in premium Windows laptops and industrial IoT applications.[3] Snapdragon-powered devices captured ~9% of the premium Windows laptop market in Q1 2025 in the US and key European markets.[16] Qualcomm leads the global cellular IoT chipset market[25] and aims for $14 billion from industrial IoT and $4 billion from PC chip sales by 2029.[4]

5G and 6G Evolution: Driving Wireless Standards

Qualcomm, a leader in 3G, 4G, and 5G, is driving 5G Advanced (Release 18 and beyond) and laying the groundwork for 6G.[6] The Snapdragon X70 features the world’s first 5G AI processor in a modem-RF system, enhancing performance.[6] Expected to generate $13.1 trillion in global economic value by 2035,[6] 5G is an innovation platform, with Qualcomm’s contributions to 3GPP standards ensuring its leadership in the “connected intelligent edge” paradigm across multiple device categories.

Intellectual Property: A Core Competitive Advantage

Qualcomm’s $90 billion investment in R&D has yielded over 160,000 patents worldwide,[8] covering foundational technologies like CDMA and OFDMA that underpin 3G, 4G, and 5G networks.[7] Its standard-essential patent (SEP) licensing program, established over three decades ago, has enabled over 18 billion licensed devices and generated $8.2 billion in fiscal 2021.[30] This high-margin revenue stream reinforces Qualcomm’s market position and influence on global standards through active participation in bodies like 3GPP.[6]

Geopolitical and Macroeconomic Dynamics

Navigating Trade Tensions and Tariffs

US-China trade tensions pose challenges, with Section 232 investigations in April 2025 signaling concerns about strategic dependencies.[9] Potential tariffs could raise costs and dampen smartphone demand, with growth expected to decline in 2025-2026 due to price increases of 10% and 15%, respectively.[33] This reinforces the urgency of Qualcomm’s diversification into automotive and IoT as a risk mitigation strategy.

Global Semiconductor Market Trends and Qualcomm’s Positioning

The semiconductor market is projected to grow 11.2% in 2025 to $700.9 billion, driven by AI, cloud infrastructure, and consumer electronics.[34] Qualcomm’s focus on AI, automotive, and IoT aligns with these high-growth segments, buffering it against sector-specific headwinds.

Cybersecurity and Future Frontier

Qualcomm embeds robust cybersecurity across its product lines, enhancing security with on-device AI and hardware-level protections like TPM and Secure Boot.[11] Its early investments in quantum computing research, including backing Quantum Machines in 2021,[39] align with its “intelligent edge” vision, positioning it to leverage future advancements in AI and cloud computing.

Conclusion: Qualcomm’s Enduring Value Proposition

Qualcomm’s recent performance underscores a successful transformation, mitigating smartphone market challenges through diversification into high-growth sectors. Its leadership in on-device AI, 5G/6G, and a vast patent portfolio positions it as a key player in decentralized computing. Despite geopolitical challenges, Qualcomm’s strategic focus and forward-looking investments ensure resilience and long-term value creation for investors.

References

- www.alpha-sense.com

- Qualcomm Announces Second Quarter Fiscal 2025 Results

- Qualcomm’s Q3 Earnings: A Validation of Strategic Diversification and Long-Term Growth

- Qualcomm’s diversification strategy: Reducing smartphone reliance

- Qualcomm’s AI Strategy: Analysis of Dominance in Semiconductors – Klover.ai,

- 5G Wireless Technology – Qualcomm,

- QCOM Stock Price Quote | Morningstar

- Qualcomm Incorporated’s Response to the USPTO’s Request for Comments on Unlocking the Full Potential of Intellectual Propert – Regulations.gov

- The effects of tariffs on the semiconductor industry – McKinsey

- AI Research Areas | Intelligence on Devices – Qualcomm

- Best Laptops for IT professionals | Qualcomm

- Qualcomm stock rating reiterated at Outperform by Bernstein despite smartphone concerns

- Qualcomm Analyst Ratings

- investor.qualcomm.com

- Qualcomm Announces Quarterly Cash Dividend

- Qualcomm’s Next Gear: A Growth Story Wall Street Might Be Missing – MarketBeat

- QUALCOMM (QCOM) – Technical Analysis – Nasdaq 100 – Investtech

- Qualcomm at the Edge: How a Pivot Could Cement Its Future | L.E.K. Consulting,

- Qualcomm’s Gen AI: A Unique Opportunity Beyond Innovation | by Mark Vena | Medium

- Qualcomm AI Products | Intuitive AI Technology

- AI | Snapdragon – Qualcomm

- Optimizing Your AI Model for the Edge – Qualcomm

- Chipping in: Qualcomm automotive technology expands into auto value chain – S&P Global

- Smart Cars & Connected Car | Qualcomm Automotive Technology

- Qualcomm Retains Top Position in Global Cellular IoT Chipset Market in Q4 2021

- Qualcomm acquires chip designer Alphawave for $2.4B – SiliconANGLE

- Qualcomm to acquire Alphawave Semi in $2.4 billion deal – Evertiq

- Global 5G Leadership | Qualcomm 5G

- Research & Development | Invention & Innovation – Qualcomm

- A comparative IP management success story for Apple, Qualcomm, and IBM

- Latest Qualcomm Patents: In-Depth Examples and Analysis – PatentPC

- President Trump Initiates Section 232 Investigations into Pharmaceuticals, Semiconductors, Critical Minerals and Trucks – Pillsbury Winthrop Shaw Pittman,

- Smartphone Growth Will Return in 2027 After Tariffs Cause a Decline in 2025-2026

- WSTS Semiconductor Market Forecast Spring 2025

- ESG & Corporate Responsibility | Commitment to Sustainability – Qualcomm

- Qualcomm Technologies – Cyber Security Intelligence

- Mobile Security Suite | Snapdragon Security Platform – Qualcomm

- IoT Device Security | Scalable Security Solutions for the IoT – Qualcomm,

- Qualcomm Ventures Invests in Quantum Machines to Power the Future of Quantum Computing – PR Newswire

- Cloud AI Qualcomm Partners

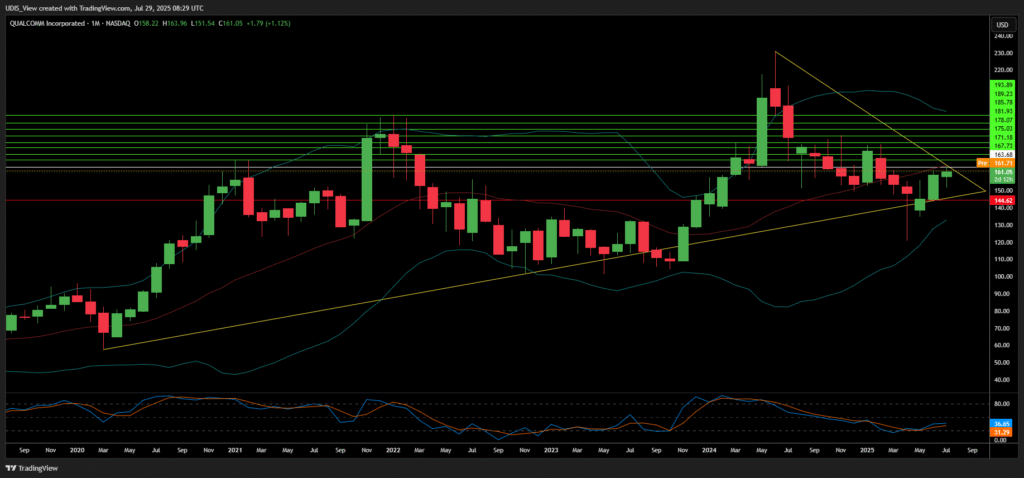

Qualcomm Long (Buy)

Enter At: 163.68

T.P_1: 167.73

T.P_2: 171.18

T.P_3: 175.03

T.P_4: 178.07

T.P_5: 181.93

T.P_6: 185.78

T.P_7: 189.23

T.P_8: 193.89

S.L:144.62