The Trade Desk (TTD) shares recently surged, marking a significant market event. This article explores the multifaceted factors behind this rise. It analyzes both immediate catalysts and underlying fundamental strengths. TTD’s stock jumped 14% in extended trading on Monday.1 This followed news of its S&P 500 inclusion.1 The company replaces Ansys Inc. in the index.1 Ansys is being acquired by Synopsys Inc..1 This inclusion takes effect prior to market opening on Friday, July 18.1

The S&P 500 Catalyst: Mandated Demand and Market Validation

TTD shares jumped 9.9% in afternoon trading after S&P 500 inclusion reports.2 The stock shot up 14% in overnight action.1 This immediate surge reflects market confidence. It highlights the perceived value of index inclusion.

S&P 500 inclusion triggers substantial demand.1 Index funds and exchange-traded funds (ETFs) tracking the S&P 500 must purchase TTD shares.1 This mirrors the index’s new composition.2 Index funds are passive investors. They must replicate the index’s holdings. Therefore, TTD’s inclusion guarantees significant buying pressure.1 This creates an immediate, artificial demand floor. This demand is distinct from fundamental valuation.

Inclusion in the S&P 500 signifies maturity and market importance.2 It grants TTD greater visibility.2 It also potentially increases share liquidity.2 S&P 500 membership validates a company’s standing.2 This enhances its reputation among institutional investors. Increased liquidity reduces trading friction. This makes the stock more attractive to larger funds.

The Trade Desk holds a $37 billion market capitalization. This positions it centrally within the S&P 500 by valuation. TTD’s size makes it a suitable candidate. Its inclusion is not merely due to Ansys’s exit. It reflects its substantial market presence.

TTD shares show significant volatility. They had 25 moves greater than 5% last year.2 The stock is down 36% in 2025.2 This follows a 63% jump in 2024 and 61% in 2023. The current jump, while significant, occurs within a volatile history. The market views this news as meaningful.2 However, it does not fundamentally alter the business perception.2 The stock’s previous highs were much higher, indicating room for recovery. The 200-day moving average acts as a resistance level.3 Breaking it historically leads to compelling returns.3 This suggests a potential bull case validation.3

The Structural Shift: Programmatic Advertising’s Ascendancy

The digital advertising landscape is undergoing a fundamental shift. Programmatic solutions increasingly displace traditional media buying. This is not a fleeting trend. It represents a permanent change in how ads are bought and sold.

Programmatic advertising is a tectonic shift.3 By 2025, it should command nearly 90% of digital display ad spending.3 The global market size will hit $15.7 billion.3 This market growth provides a strong tailwind for TTD. It indicates a secular trend, not just cyclical demand. TTD benefits from this broader industry evolution.

Several forces drive programmatic growth. Advertisers demand ROI transparency.3 Programmatic’s real-time bidding and targeting capabilities deliver this.3 This addresses a core advertiser need. It ensures optimal ad spend and measurable results. Content creators like Netflix and Warner Bros. Discovery bypass “walled gardens”.3 They leverage platforms like TTD’s OpenPath to sell inventory directly.3 This empowers publishers. It diversifies their revenue streams beyond dominant platforms like Google and Meta. TTD facilitates this open ecosystem. Furthermore, AI platforms like TTD’s Kokai reduce cost per acquisition (CPA) by 20%.3 They also reduce cost per unique reach (CPU) by 42%.3 AI makes programmatic a competitive necessity.3 It drives superior performance for advertisers.

The Trade Desk’s Strategic Leadership

Kokai is TTD’s core competency.5 Two-thirds of TTD’s clients now use it.3 It automates bid optimization and reduces waste.3 High client adoption demonstrates Kokai’s value. Its efficiency gains drive strong client retention.3 This creates a sticky customer base. Client retention exceeds 95% even with competitors like Google’s DV360 and Amazon DSP.3 This high retention rate signifies strong product-market fit. It indicates TTD’s platform delivers superior value.

The company leverages strategic partnerships and market expansion. TTD’s OpenPath partnerships with Netflix and Warner Bros. Discovery unlock premium Connected TV (CTV) inventory.3 The New York Post saw programmatic revenue surge 97% with OpenPath.3 CTV is a high-growth segment. TTD’s direct publisher relationships circumvent traditional ad models. This positions TTD for significant growth in a lucrative market. TTD’s infrastructure also assists advertisers. It helps them navigate new retail media ecosystems.3 Brands like Walmart and Target build their own ad platforms.3 Retail media is an emerging advertising channel. TTD provides the tools for advertisers to effectively utilize it.

TTD’s Q2 2025 results show remarkable resilience.3 Adjusted EBITDA margins hit 38%, up 400 basis points from Q1.3 This is due to operational leverage and reduced infrastructure reliance.3 Strong margins indicate efficient operations. This financial strength allows for continued investment in innovation. It also provides a buffer against market fluctuations. TTD quickly turned around its business after weak Q4 results and Q1 guidance.8 It produced 25% growth for the March quarter.8 This included a $41 million revenue beat.8 This demonstrates strong management execution. It alleviates concerns about previous “hiccups”.

Financial Performance and Valuation Outlook

TTD’s revenue grew 17% in Q2 2025.3 This outpaces peers and the broader programmatic market’s 14.6% annual growth.3 This suggests accelerating market share gains.3 It reinforces TTD’s leadership position. The company forecasts Q2 2025 revenues of $682 million.7 It anticipates strong adjusted EBITDA of $259 million.7 This implies a 38% margin.7 Consistent revenue growth and high margins are hallmarks of a strong business model. This supports a premium valuation.

TTD trades at over 13x 2025 sales targets of $2.9 billion. Its 11.86x forward price-to-sales ratio is nearly four times the S&P 500 average.3 This indicates a premium valuation. The market prices in significant future growth. TTD is highly profitable. It trades at 35x 2026 EPS targets of $2.13. It boasts large margins (34% adjusted EBITDA in Q1).8 This leads to strong cash flow and $1.7 billion cash on the balance sheet.8 High profitability and strong cash reserves provide financial flexibility. This enables strategic investments and share buybacks.

Investors who bought $1,000 worth of TTD shares five years ago now have $1,883.2 The company bought $386 million worth of shares in Q1. This highlights historical investor returns. Share buybacks demonstrate management’s confidence and commitment to shareholder value. TTD relies heavily on stock-based compensation. It spent an estimated $128 million in Q1 2025. While common in tech, high stock-based compensation can dilute shareholder value. This is a point for investors to monitor.

Risks and Challenges

The competitive landscape remains intense. Competitors like Google and Amazon DSP vie for attention.3 Google and Meta control over half the $935+ billion ad market. The ad tech market is highly competitive. Dominant players pose a significant threat.

Regulatory scrutiny, especially over data privacy and antitrust, could disrupt the industry.3 Antitrust actions against Google and Meta could force them to unwind ad tech advantages.3 Regulatory changes present both risks and opportunities. While posing a threat, they could also level the playing field for TTD.

Execution risks exist within specific segments. The loss of hardware partner Sonos highlights execution risks in CTV.3 Even strong companies face operational challenges. These can impact growth in specific segments.

The premium valuation prices in perfection.3 Any failure to meet growth expectations could lead to significant stock declines. A high valuation leaves little room for error. Investors demand sustained high performance.

Conclusion: A Data-Driven Outlook

The Trade Desk stands as a primary beneficiary of advertising’s structural shift to programmatic. Its AI-driven platform, strategic publisher partnerships, and margin resilience position it strongly. The company is poised to capitalize on a $33 billion market by 2030.3

The S&P 500 inclusion provides an immediate, tangible boost. It creates mandated buying pressure and enhances market visibility. This validates TTD’s growing stature in the financial landscape.

While its premium valuation demands patience, TTD’s consistent market share gains and strong financial health support its investment case. The company’s ability to navigate past challenges and deliver robust growth reinforces its leadership. The long-term investment narrative remains compelling for those viewing TTD as a “software company in adtech”. Continued innovation and strategic market penetration will be key to sustaining its upward trajectory.

References

- Trade Desk Is Joining The S&P 500. Should You Buy TTD Stock Here?, accessed July 16, 2025

- The Trade Desk (TTD) Shares Skyrocket, What You Need To Know, accessed July 16, 2025

- The Trade Desk: Riding the Wave of Programmatic’s Dominance in …, accessed July 16, 2025

- FWD25 | Driving CTV Success and Transparency with Warner Bros. Discovery – YouTube, accessed July 16, 2025

- Kokai – TTD Partner Portal – The Trade Desk, accessed July 16, 2025

- Everything You Need to Know About The Trade Desk Kokai – Ventura Growth, accessed July 16, 2025

- The Trade Desk’s 15% Surge: Strategic Momentum or Overextended …, accessed July 16, 2025

- Earnings call transcript: The Trade Desk surpasses Q1 2025 expectations, stock surges, accessed July 16, 2025,

- investors.thetradedesk.com, accessed July 16, 2025

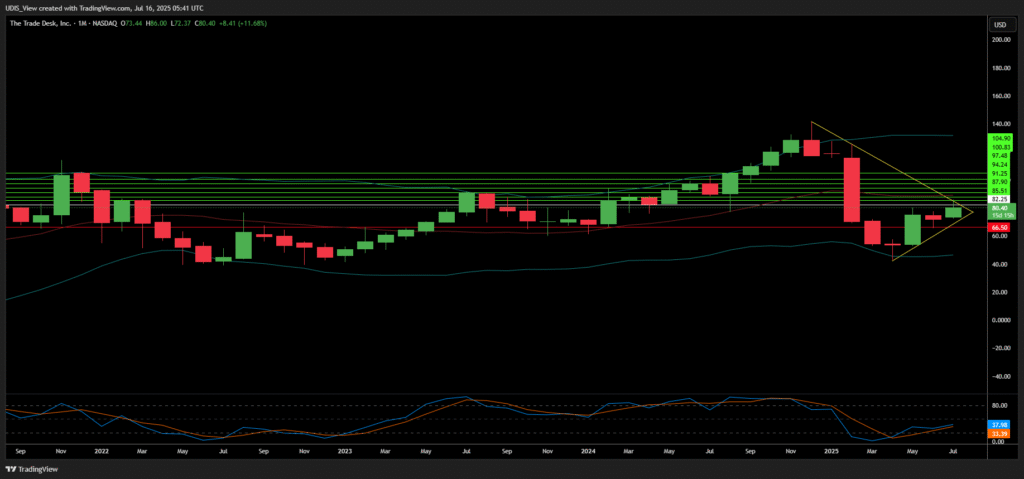

The Trade Desk Long (Buy)

Enter At: 82.25

T.P_1: 85.51

T.P_2: 87.90

T.P_3: 91.25

T.P_4: 94.24

T.P_5: 97.48

T.P_6: 100.83

T.P_7: 104.90

S.L: 66.50