Spain’s Market at a Crossroads

The IBEX 35, Spain’s benchmark equity index, reflects the performance of its 35 most liquid stocks traded on the Madrid Stock Exchange.1 It serves as a key indicator for the Spanish economy and its listed companies.2 Despite recent robust economic growth, a confluence of internal and external pressures threatens the IBEX 35’s stability. These factors create significant downside risks for investors.

The IBEX 35 has shown positive returns in Q1 2025 and year-to-date.3 However, the index’s composition, which includes sectors such as construction, banking, and real estate 1, reveals inherent vulnerabilities. These specific sectors are already experiencing the direct impact of political uncertainty and have underperformed their European counterparts in 2025.6 This divergence indicates that while Spain’s overall economic narrative may appear strong, the IBEX 35’s specific sectoral exposure makes it particularly sensitive to domestic political and regulatory risks. This sensitivity suggests a potential for the index to decline, even if the broader economy maintains its growth trajectory.

This article explores the intricate web of political, social, macroeconomic, and geopolitical forces poised to challenge Spain’s market performance. It examines the historical context shaping the current landscape, providing a comprehensive view for financial professionals.

Spain’s Economic Foundation: Strengths and Structural Vulnerabilities

Current Macroeconomic Performance: A Mixed Picture

Spain’s economy has demonstrated surprising resilience. Real GDP growth expanded by 3.2% in 2024, outperforming the Eurozone average.7 Forecasts project continued robust growth at 2.6% in 2025 and 2.0% in 2026.7 Domestic demand, driven by private consumption and investment, remains a key growth driver.7 The labor market is dynamic; employment growth is expected at 2.1% in 2025, and unemployment projects to decline below 10% by 2026.7

Inflation is projected to ease, with headline inflation reaching 1.9% in 2026.7 However, recent months saw a rebound to 3.5%, partly due to energy price step effects and VAT reversals.8 Inflationary pressures persist in services, particularly tourism-related sectors.8 Public debt remains high, at 101.8% of GDP in 2024, though it projects to decline slightly to 100.9% in 2025.7 The general government deficit is set to decrease to 2.8% of GDP in 2025.7 Despite overall GDP growth, corporate and housing investment continue to lag pre-pandemic levels, undermining potential output.8 This highlights a structural weakness.

Spain’s current economic robustness, largely driven by domestic demand and immigration, masks underlying structural vulnerabilities. These could be exacerbated by external shocks. While current growth appears healthy, it may not be sustainable without addressing these structural investment gaps and over-reliance on vulnerable sectors. A downturn in global tourism or a significant external shock could expose these weaknesses, impacting overall economic stability and investor confidence in the IBEX 35. The positive economic data, while encouraging, does not fully mitigate the long-term risks.

Table 1: Spain’s Key Macroeconomic Indicators & Forecasts (2024-2026)

| Indicator | 2024 | 2025 | 2026 |

| GDP growth (%, yoy) | 3.2 | 2.6 | 2.0 |

| Inflation (%, yoy) | 2.9 | 2.3 | 1.9 |

| Unemployment (%) | 11.4 | 10.4 | 9.9 |

| General government balance (% of GDP) | -3.2 | -2.8 | -2.5 |

| Gross public debt (% of GDP) | 101.8 | 100.9 | 100.8 |

| Current account balance (% of GDP) | 3.1 | 2.7 | 2.8 |

Source: European Commission Economic Forecast 7

Reliance on Tourism and Services: A Double-Edged Sword

Tourism forms a cornerstone of the Spanish economy, contributing 12.3% to GDP and employing millions.13 Spain expects to welcome 100 million international tourists in 2025.14 However, the industry faces a projected slowdown in revenue growth. This is due to global economic uncertainties, U.S. tariff negotiations, reduced consumer spending, and tightening international air travel.14 Airlines anticipate lower demand for European flights.14

Over-reliance on tourism has led to precarious employment, low wages, and unstable working conditions for many workers.13 This has fueled dissatisfaction and protests, highlighting socio-environmental impacts of unchecked tourism expansion.13

Agricultural Sector Challenges: Climate Change and Supply Chain Impacts

Spain, a major global agrifood producer, faces severe and prolonged drought conditions.15 These conditions strain water reservoirs and threaten primary production.15 The first four months of 2023 were the driest on record.15 This has led to significant projected losses in harvests, including wheat, barley, rice, olive oil (up to 50%), and almonds (50%).15 Reduced production is expected to keep food inflation higher for longer.15 Climate change projects to intensify and lengthen droughts in the Mediterranean region, making adaptation and water management critical.15

Historical Context: Lessons from Past Crises

Spain experienced a deep recession during the Great Recession, with unemployment exceeding 25% by 2012.9 This followed a property boom and bust (2003-2014) and the Euro debt crisis.9 The 2020 pandemic hit Spain harder than other countries due to its tourism reliance.9 However, GDP fully recovered to pre-pandemic levels by Q1 2023.9 The boom years saw an influx of immigrants filling jobs in construction and agriculture.17 Post-2007, as the construction boom ended, unemployment surged, and tolerance towards immigrants decreased.17

Political Instability: Eroding Investor Confidence

Impact of Corruption Scandals and Legislative Gridlock

Spain’s political landscape faces significant instability from corruption scandals, internal party purges, and pressure for early elections.6 These issues expose systemic weaknesses and threaten the country’s political and economic trajectory.18 The current Socialist-led minority government lacks a parliamentary majority, struggling to pass national budgets.12 The last approved budget was in late 2022, with extensions in 2023 and 2024.12 This scenario is likely to repeat in 2025.12 Legislative gridlock hinders decision-making and the implementation of structural reforms in critical areas like investment, the job market, and human capital qualification.10

Challenges of Coalition Governance and Policy Implementation

Reliance on smaller parties for parliamentary support makes policy passage difficult.12 This includes key government agenda items like reducing the labor week or addressing the housing crisis.12 Opposition parties, particularly the conservative People’s Party (PP) and far-right Vox, continue to demand the Prime Minister’s resignation and early elections.12 Vox’s support for PP could introduce policies hostile to foreign investment, such as stricter immigration controls and climate policy rollbacks.6 Trust in the national government is slightly below the OECD average (37% vs. 39% in 2023), indicating public skepticism.20

Political fragmentation and legislative paralysis create a vicious cycle. This deters foreign investment, undermines structural reforms, and ultimately constrains Spain’s long-term economic potential. This directly impacts IBEX 35 sectors reliant on government stability and public contracts. The prolonged period of political gridlock and perceived corruption reduces the predictability and attractiveness of the Spanish market. This not only deters new foreign investment but also creates an environment where existing businesses face increased regulatory uncertainty and difficulty in planning long-term projects. This directly translates into lower earnings expectations for politically exposed IBEX 35 companies, contributing to their underperformance and potential declines.

Effects on Foreign Direct Investment (FDI) and Public Contracts

Political instability has pushed Spain out of the top ten most attractive foreign investment destinations, dropping from ninth to eleventh place in 2025.21 Investors cite concerns about increased regulation and political instability.21 While Spain’s FDI inflows have performed well globally and in the euro area over the past decade 22, the current uncertainty could affect transaction volumes and patterns.23

Sectors tied to domestic governance, such as construction, banking, and real estate, bear the brunt of political uncertainty.6 Construction firms like Ferrovial and Acciona face scrutiny over alleged bid-rigging, impacting their stock performance as investors question future public contracts.6 Spanish banks face reputational risks and limited lending expansion due to uncertainty.6

Social Dynamics: Undercurrents of Economic Risk

Anti-migrant Sentiment and its Potential Economic Ramifications

Violent anti-migrant protests have erupted in Spanish towns like Torre Pacheco, following alleged assaults by Moroccan men [User Query]. These incidents involve far-right groups and calls for attacks against people of North African origin [User Query]. Historically, anti-immigration protests have occurred in Spain, such as in El Ejido in 2000 [User Query]. Post-2007, tolerance towards immigrants decreased as unemployment rose.17

Spain’s economy heavily relies on foreign workers, particularly in agriculture, hospitality, and construction, filling jobs undesirable to locals.17 Foreign-born workers accounted for 45% of all jobs created since 2022.25 Immigration is crucial for sustaining Spain’s aging population and social security system; estimates suggest a need for 30 million working-age migrants over 30 years.24

The localized anti-migrant unrest, while seemingly isolated, represents a significant social risk. This could escalate into broader policy shifts, directly threatening Spain’s critical labor supply and undermining the economic growth driven by immigration. The protests, fueled by far-right elements, could pressure the government to adopt more restrictive immigration policies.6 Such policies would directly counter the economic necessity of continued immigration for labor shortages in agriculture, construction, and tourism 24 and for sustaining the social security system.25 A significant disruption to the inflow or retention of foreign labor, driven by social or political pressures, would lead to severe labor shortages in critical sectors, dampening economic output, increasing costs, and potentially undermining the social security system. This directly translates into reduced corporate profitability and investor concerns, negatively impacting the IBEX 35, particularly companies in agriculture, construction, and tourism.

Labor Market Shifts and Social Tensions in Key Sectors

Despite overall employment growth, specific sectors face labor shortages.24 For instance, 64% of hospitality companies and 56% of construction firms struggle to find workers.24 The tourism sector, a major employer, faces worker dissatisfaction due to excessive hours, precarious employment, and low pay.13 This has led to protests and the formation of citizen platforms advocating for better conditions.13 Rising cost of living, particularly housing prices in tourist-heavy regions, exacerbates the challenges for tourism workers.13

The growing dissatisfaction and precariousness within the vital tourism sector, combined with rising living costs, could lead to labor unrest or reduced attractiveness of these jobs. This creates a self-reinforcing cycle of economic vulnerability for a key industry. If these conditions persist or worsen, the sector could face increasing labor shortages, as young Spaniards already avoid these jobs.13 This would force businesses to either increase wages significantly, impacting profitability, or face operational constraints. A decline in the quality or availability of labor in tourism, or increased labor disputes, would directly impair the sector’s ability to maintain its economic contribution. This would affect airlines, hotel chains, and related services, many of which are represented in the IBEX 35. This internal social tension could thus translate into a tangible economic drag.

Housing Crisis and Broader Societal Implications

The housing crisis is identified as a key structural challenge for Spain’s economy in 2025.10 The average level of household debt tripled in less than a decade during the property boom, highlighting past vulnerabilities.9 The government’s agenda includes building new homes to cope with the housing crisis, but implementation depends on parliamentary support.12

Geopolitical and Geostrategic Pressures

Global Trade Tensions: US Tariffs and BRICS Exposure

Rising global uncertainty and resurfacing trade tensions with the United States pose a risk.27 The Trump administration’s “reciprocal tariff” threats, including a universal 10% tariff on all non-China imports and additional 10% tariffs on countries aligning with BRICS policies, create significant uncertainty.28 Previous EU responses to US tariffs (e.g., 25% levies on 180+ products in 2018) showed a 50% fall in Spanish imports of taxed US goods.27 While the EU found alternative suppliers, new tariffs could still impact specific sectors.27

Spanish companies within the IBEX 35 have business ties with the BRICS bloc (Brazil, Russia, India, China, South Africa).28 Inditex maintains a diversified presence in South Africa, Brazil, and China.28 Acerinox operates a facility in South Africa.28 Santander and Mapfre have significant exposure in Brazil.28 Policy uncertainty surrounding global trade and tariffs is set to weigh on private investment growth, even if Spain’s direct exposure to the US in terms of exports is limited.7 More export-oriented sectors (manufacturing, automotive, chemicals, pharmaceuticals, machinery, and some services) are most exposed.29

The dual threat of rising global trade protectionism (US tariffs) and Spain’s significant exposure to BRICS markets creates a direct and immediate risk to the revenue and profitability of major IBEX 35 multinationals. This could lead to downward revisions in earnings forecasts. These tariffs, if implemented, would increase operational costs, disrupt supply chains, and potentially reduce demand for Spanish exports in affected markets.27 Even if Spain’s overall economy is less exposed to US exports, the specific vulnerability of these large, globally active IBEX 35 components makes the index highly susceptible to these geopolitical trade shocks. This direct hit on the international operations of IBEX 35 heavyweights could trigger significant sell-offs in their stocks, pulling the overall index down.

Energy Security Challenges and the Green Transition’s Complexities

Spain aims to lead Europe’s cleantech revolution, accounting for 20% of green hydrogen projects in the EU.30 This positions Spain as a potential European energy powerhouse.30 However, Spain faces challenges in providing affordable energy prices, partly due to state-interventionist policies, high taxes, and subsidies.31 These policies have increased energy costs.31 Achieving energy transition goals requires substantial upfront investment (high CAPEX), robust and predictable policy frameworks, and public-private collaboration.30 Market uncertainty, regulatory reliance, and technological risks deter private investment.30

Effectiveness and Transparency of EU NextGenerationEU Funds

NextGenerationEU (NGEU) funds, particularly the Recovery and Resilience Facility (RRF), are designed to boost capital stock and potential output in EU member states.32 Spain was allocated a significant portion of grants (€69.5 billion).32 However, Spain has requested only 30% of its allocated NGEU money (€47.96 billion) by mid-2025.19 This contrasts sharply with Italy, which received 72% of its funds.19 The European Court of Auditors (ECA) identified Spain as the least effective spender of Brussels’ money, citing opacity and bureaucracy.19 The IMF also noted a “lack of systematic and comprehensive information on execution” of NGEU funds in Spain.19 Political instability and the government’s inability to pass budgets have contributed to the ineffective deployment of EU funds.19

The mismanagement and underutilization of NextGenerationEU funds, exacerbated by political instability, represents a missed opportunity to drive transformative investment and reforms. This limits Spain’s long-term growth potential and increases its vulnerability to future shocks. By not fully utilizing these funds effectively, Spain is missing a critical opportunity to modernize its economy, enhance competitiveness, and address structural challenges.10 This underutilization means the anticipated “pick-up of gross fixed capital formation” 7 from RRP implementation might be less impactful than projected. This failure to fully leverage EU recovery funds means Spain’s economy remains more reliant on traditional, potentially vulnerable drivers (like tourism) and less equipped to face future economic or geopolitical headwinds. The long-term growth trajectory is dampened, making the economy (and by extension, the IBEX 35) more susceptible to downturns when other factors converge.

Spain’s Evolving Position in Global Supply Chains

Geopolitical tensions and supply chain vulnerabilities are prompting multinational firms to reconsider investment strategies, adopting near-shoring or friend-shoring.23 Spain’s FDI stock shows relatively low exposure to geopolitical risk, with nearly 50% from other EU countries and 14% from the US.22 However, uncertainty surrounds the stability of traditional geopolitical alignments.22 Increased tariffs and trade fragmentation could affect not only FDI volumes but also bilateral patterns.23

IBEX 35 Sectoral Analysis: Vulnerabilities and Resilience

Sectors Most Exposed to Political and Regulatory Risks

The IBEX 35 has underperformed European peers in 2025, with sectors tied to domestic governance bearing the brunt.6

- Construction and Infrastructure: Firms like Ferrovial (FER.MC) and Acciona (ANA.MC) face scrutiny over alleged bid-rigging in infrastructure projects.6 Their stocks have dipped as investors question the sustainability of future public contracts under a politically weakened government.6

- Banks: Spanish banks such as CaixaBank (CABK.MC), Sabadell (SAB.MC), Santander (SAN.MC), BBVA (BBVA.MC), and Bankinter (BKT.MC) face reputational risks tied to corruption scandals.6 Uncertainty has limited their ability to expand lending, suppressing short-term growth.6 While their financial health remains strong 6, political instability creates a headwind.

- Real Estate: This sector is also identified as vulnerable to domestic governance issues.6 Companies like Inmobiliaria Colonial (COL.MC) and Merlin Properties (MRL.MC) are constituents.1

- Mining and Quarrying: This industry shows significant exposure to US tariffs (3.0% of sector’s value added) and is highly investment-intensive, making it vulnerable to increased uncertainty.29

- Agriculture: While overall exposure to the US is low (2.4%), specific products like olive oil and wine are more exposed to tariffs.29 The sector also faces severe climate change impacts (droughts) and reliance on migrant labor.15

Defensive Sectors Offering Resilience

Despite political turmoil, certain sectors remain resilient.6

- Utilities and Renewable Energy: Iberdrola (IBE.MC), Spain’s largest utility, thrives due to its regulated pricing model and leadership in offshore wind and grid infrastructure.6 The EU’s Green Deal and Spain’s 2030 renewable targets ensure demand.6 However, the energy sector is expected to see earnings decline by 13% per year over the next few years.5

- Healthcare: Defensive stocks like Grifols (GRF.MC) and other pharmaceutical firms benefit from steady demand, being less cyclical and less vulnerable to political shifts.6 Laboratorios Rovi (ROVI.MC) is another constituent.1

- Consumer Staples: Companies like Inditex (ITX.MC) and Puig (PUIG.MC) 1 benefit from stable demand for essentials, even during political crises.6 However, Inditex has exposure to BRICS tariff risks.28

- Telecommunications: Telefónica (TEF.MC) is a major player.1 Analysts are optimistic about the Telecom sector, expecting annual earnings growth of 35% over the next 5 years.5

The divergent performance between politically exposed sectors and defensive sectors within the IBEX 35 creates a bifurcated market. Overall index performance will be heavily influenced by the extent of political and regulatory contagion. This indicates that political instability does not uniformly impact the entire index but creates specific winners and losers. The overall index’s potential declines will depend on the weighting and magnitude of decline in the vulnerable sectors relative to the resilience of the defensive ones. Investors in the IBEX 35 cannot simply rely on broad economic indicators. They must adopt a highly granular, sector-specific approach. Political risks will likely cause significant volatility and potential downturns in specific, heavily weighted sectors, pulling the overall index down, even if other parts of the economy or index components remain stable.

Table 2: IBEX 35 Sectoral Vulnerability & Resilience

| Sector | Key Companies (IBEX 35 Constituents) | Primary Risks | Resilience Factors |

| Vulnerable Sectors | |||

| Construction & Infrastructure | ACS, Acciona, Ferrovial, Sacyr | Political instability, regulatory scrutiny (bid-rigging), public contract uncertainty | N/A |

| Financial Services (Banks) | BBVA, Bankinter, CaixaBank, Sabadell, Santander, Unicaja | Reputational risks (corruption scandals), limited lending expansion due to uncertainty | Strong capital ratios, low non-performing loans (financial health) |

| Real Estate | Inmobiliaria Colonial, Merlin Properties | Domestic governance issues, political instability | N/A |

| Mining & Quarrying | Acerinox, ArcelorMittal | US tariffs, high investment intensity, increased uncertainty | N/A |

| Agriculture | N/A (indirect exposure through supply chain) | Climate change (droughts), reliance on migrant labor, US tariffs (specific products) | N/A |

| Resilient Sectors | |||

| Utilities & Renewable Energy | Acciona Energía, Endesa, Enagás, Iberdrola, Naturgy, Redeia Corporación, Solaria | State-interventionist policies, high CAPEX for green transition | Regulated pricing model, leadership in renewables, EU Green Deal alignment |

| Healthcare | Grifols, Laboratorios Rovi | N/A (generally defensive) | Steady, non-cyclical demand, less vulnerable to political shifts |

| Consumer Staples | Inditex, Puig | US tariffs (BRICS exposure for Inditex) | Stable demand for essentials, even during crises |

| Telecommunications | Cellnex Telecom, Telefónica | N/A (analyst optimism for growth) | Expected high earnings growth |

Source: 1

Outlook: Synthesizing Downside Risks for the IBEX 35

Consolidating the Interconnected Factors

The optimistic macroeconomic forecasts for Spain 7 face significant headwinds from persistent political instability.6 Legislative gridlock and corruption scandals deter foreign investment and hinder crucial reforms.10 This directly impacts IBEX 35 sectors reliant on public contracts and a stable regulatory environment.6

Social tensions, particularly anti-migrant sentiment, threaten Spain’s vital foreign labor supply.17 This impacts agriculture, construction, and tourism. Worker dissatisfaction in tourism also poses a risk.13 Globally, resurfacing trade protectionism, specifically US tariffs, creates direct revenue and profitability risks for globally exposed IBEX 35 companies with BRICS ties.28 The underutilization and mismanagement of NGEU funds represent a missed opportunity for long-term growth and resilience.19 Climate change impacts on agriculture (droughts) contribute to inflationary pressures and supply chain vulnerabilities.. 15

Discussion of Analyst Forecasts and Market Sentiment

Some general forecasts for the IBEX 35 suggest a gradual upward trend for 2025 (e.g., Wallet Investor projecting 9026 points by end of 2025).5 However, other sources indicate the IBEX 35 has already underperformed European peers in 2025.6 Market participants show pessimism about the Spanish market, with a current PE ratio significantly lower than its 3-year average, indicating expectations of slower earnings growth.5 Equity volatility (VIX index) has oscillated above historical norms in 2025, reaching highs during tariff announcements.36 This reflects investor caution. While some individual IBEX 35 companies (e.g., Santander, BBVA, Telefónica) have positive analyst price targets 5, these are often based on specific company fundamentals, not necessarily the broader macro/political headwinds. The energy sector, for instance, faces expected earnings decline.5

Despite some positive analyst forecasts for individual companies, the broader market sentiment for the IBEX 35 is pessimistic. This reflects an awareness that the cumulative impact of political instability, social tensions, and geopolitical risks could outweigh Spain’s underlying economic momentum. This could lead to a re-evaluation of the index’s future performance. Investors appear to be factoring in the “policy uncertainty surrounding global trade and tariffs” 7, the “political instability” 6, and the undercurrents of economic risk from social dynamics. The higher volatility observed in the VIX index 36 further confirms this cautious sentiment. The current pessimism suggests that even strong economic data might not be enough to offset the cumulative weight of these non-economic factors on the index’s valuation. This makes it susceptible to significant downward movements if any of these risks intensify.

Potential Scenarios and Their Implications for the Index

- Scenario 1: Prolonged Political Gridlock: If the government continues to struggle with budget passage and reforms, and corruption scandals persist, investor confidence will further erode. This would exacerbate the underperformance of politically exposed sectors, leading to significant downward pressure on the IBEX 35, potentially causing deeper and more sustained declines.

- Scenario 2: Escalation of Social Tensions: Increased anti-migrant unrest or labor disputes in key sectors could disrupt economic activity. This would lead to labor shortages and increased operational costs for businesses. This would directly impact the profitability of companies in tourism, agriculture, and construction, translating into negative pressure on the index.

- Scenario 3: Intensified Geopolitical Trade Wars: Should US tariffs materialize or expand, or if global trade fragmentation deepens, IBEX 35 multinationals with significant international exposure would face direct hits to their revenues and earnings. This could trigger sharp, immediate drops in their stock prices, pulling the overall index down.

- Scenario 4: Limited Impact on IBEX 35: A less likely scenario, where Spain’s underlying economic strengths (driven by domestic demand and continued immigration) prove more resilient, and political/geopolitical risks remain contained. In this case, the IBEX 35 might see more moderate growth, but the identified risks still represent potential catalysts for volatility.

Conclusion: Prudent Navigation in Uncertain Waters

Spain’s IBEX 35 faces a complex and challenging outlook. While the Spanish economy demonstrates notable resilience, driven by domestic demand and immigration, it grapples with deep-seated structural vulnerabilities. Persistent political instability, marked by corruption scandals and legislative gridlock, directly erodes investor confidence and hampers critical reforms. This disproportionately impacts key IBEX 35 sectors like construction, banking, and real estate.

Emerging social tensions, particularly anti-migrant sentiment, threaten the essential foreign labor supply, a cornerstone of Spain’s recent growth. Dissatisfaction within the vital tourism sector also poses a risk. Globally, resurfacing trade protectionism, coupled with the significant BRICS exposure of major Spanish multinationals, presents a tangible threat to corporate revenues and profitability. The underutilization of EU recovery funds further limits Spain’s long-term growth potential. These interconnected factors create a compelling case for potential downside pressures on the IBEX 35. Investors must remain vigilant, adopting a granular, sector-specific approach. Prudent navigation, favoring resilient sectors and closely monitoring political and geopolitical developments, will be paramount in these uncertain waters.

References

- IBEX 35 – Wikipedia, accessed July 14, 2025, https://en.wikipedia.org/wiki/IBEX_35

- IBEX 35 Indices | BME Exchange, accessed July 14, 2025, https://www.bolsasymercados.es/bme-exchange/en/Indices/Ibex

- EXANTE Quarterly Macro Insights – 3 kwietnia 2025 | Insights, accessed July 14, 2025, https://pl.exante.eu/press/publications/2571-exante-quarterly-macro-insights/

- IBEX 35 Price Analysis & Forecast – NAGA, accessed July 14, 2025, https://naga.com/en/news-and-analysis/articles/ibex-35-price-analysis-and-forecast

- IBEX 35 price analysis and forecast for today, 2022, 2025, 2030 – CAPEX.com, accessed July 14, 2025, https://capex.com/en/overview/ibex35-price-analysis-and-forecast

- Spain’s Political Turmoil: Navigating Short-Term Volatility for Long-Term Gains – AInvest, accessed July 14, 2025, https://www.ainvest.com/news/spain-political-turmoil-navigating-short-term-volatility-long-term-gains-2507/

- Economic forecast for Spain – European Commission – Economy and Finance, accessed July 14, 2025, https://economy-finance.ec.europa.eu/economic-surveillance-eu-economies/spain/economic-forecast-spain_en

- Spanish economic forecasts: 2024-2025 – Funcas, accessed July 14, 2025, https://www.funcas.es/wp-content/uploads/2024/07/Raymond-13-4.pdf

- Economy of Spain – Wikipedia, accessed July 14, 2025, https://en.wikipedia.org/wiki/Economy_of_Spain

- Political fragmentation, sluggish productivity and housing: the main challenges facing Spain’s economy in 2025, says Esade, accessed July 14, 2025, https://www.esade.edu/en/news/political-fragmentation-sluggish-productivity-and-housing-the-main-challenges-facing-spains

- Lower budget deficit in 2025 in Spain, but the structural challenges persist, accessed July 14, 2025, https://www.caixabankresearch.com/en/economics-markets/public-sector/lower-budget-deficit-2025-spain-structural-challenges-persist

- In Spain, Sanchez’s Struggles Risk Rendering His Government Ineffective – Stratfor, accessed July 14, 2025, https://worldview.stratfor.com/article/spain-sanchezs-struggles-risk-rendering-his-government-ineffective

- Spain’s Tourism Sector: The Rising Demand For Workers And Declining Job Quality, accessed July 14, 2025, https://www.travelandtourworld.com/news/article/spains-tourism-sector-the-rising-demand-for-workers-and-declining-job-quality/

- Spain’s Tourism Faces A Decline In Summer Sales Due To Global Economic Instability, What Prospective Travellers Should Know Now, accessed July 14, 2025, https://www.travelandtourworld.com/news/article/spains-tourism-faces-a-decline-in-summer-sales-due-to-global-economic-instability-what-prospective-travellers-should-know-now/

- Impact of drought on Spanish agriculture – October 2023, accessed July 14, 2025, https://www.mfat.govt.nz/en/trade/mfat-market-reports/impact-of-drought-on-spanish-agriculture-october-2023

- The challenge for Spain’s agrifood sector of remaining competitive in the face of adverse conditions – CaixaBank Research, accessed July 14, 2025, https://www.caixabankresearch.com/en/sector-analysis/agrifood/challenge-spains-agrifood-sector-remaining-competitive-face-adverse

- (PDF) Immigrants in Spain: Their Role in the Economy and the Effects of the Crisis, accessed July 14, 2025, https://www.researchgate.net/publication/228120849_Immigrants_in_Spain_Their_Role_in_the_Economy_and_the_Effects_of_the_Crisis

- Spain’s Political Crisis: A Catalyst for Market Volatility and Defensive Plays in Europe, accessed July 14, 2025, https://www.ainvest.com/news/spain-political-crisis-catalyst-market-volatility-defensive-plays-europe-2506/

- Spain’s Vanished Billions – FEE.org, accessed July 14, 2025, https://fee.org/articles/spains-vanished-billions/

- Government at a Glance 2025: Spain – OECD, accessed July 14, 2025, https://www.oecd.org/en/publications/government-at-a-glance-2025-country-notes_da3361e1-en/spain_57f4ebd0-en.html

- Political instability pushes Spain out of the Top 10 Most attractive foreign investment destinations | News – El Mundo America, accessed July 14, 2025, https://www.mundoamerica.com/news/2025/06/20/6854f846fc6c83a4428b45a9.html

- 2025/Q3 Article 03. Foreign direct investment in Spain in a context of fragmenting international relations – Economic Bulletin – Banco de España, accessed July 14, 2025, https://www.bde.es/wbe/en/publicaciones/analisis-economico-investigacion/boletin-economico/2025t3-articulo-03–la-inversion-extranjera-directa-en-espana-en-un-contexto-de-fragmentacion-de-las-relaciones-internacionales.html

- Foreign direct investment in Spain in a context of fragmenting international relations. ECONOMIC BULLETIN 2025/Q3. Article 03 – Banco de España, accessed July 14, 2025, https://www.bde.es/f/webbe/SES/Secciones/Publicaciones/InformesBoletinesRevistas/BoletinEconomico/25/T3/Files/be2503-art03e.pdf

- Spanish pride: The economic benefits of a lenient migration policy – The Insider, accessed July 14, 2025, https://theins.ru/en/economics/277771

- Foreign workers help Spain’s economic growth outpace the U.S. and the rest of Europe, accessed July 14, 2025, https://apnews.com/article/spain-migration-economy-growth-trump-us-c3abff0d83b60c9712fe4932b780eb21

- Spain’s Economy Booms as Foreign Workers Fill Critical Labor Gaps – ETIAS.com, accessed July 14, 2025, https://etias.com/articles/spain%E2%80%99s-economy-booms-as-foreign-workers-fill-critical-labor-gaps

- Spain | Trade Effects of European Tariffs on US Goods – BBVA Research, accessed July 14, 2025, https://www.bbvaresearch.com/en/publicaciones/spain-trade-effects-of-european-tariffs-on-us-goods/

- IBEX 35 Companies Eye BRICS Tariff Risks – Plus500, accessed July 14, 2025, https://www.plus500.com/en/newsandmarketinsights/ibex-35-companies-eye-brics-tariff-risks

- Tariff tensions and reconfiguration of trade flows: impact on Spain – CaixaBank Research, accessed July 14, 2025, https://www.caixabankresearch.com/en/sectoral-analysis/sectoral-observatory/tariff-tensions-and-reconfiguration-trade-flows-impact-spain

- Spain is leveraging industrial clusters to lead Europe’s energy transition | World Economic Forum, accessed July 14, 2025, https://www.weforum.org/stories/2025/01/spain-energy-hubs-europe-energy-transition/

- A Free-Market Environmentalist Enquiry on Spain’s Energy Transition along with Its Recent Increasing Electricity Prices – PubMed Central, accessed July 14, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC9367738/

- Next Generation EU: A euro area perspective – European Central Bank, accessed July 14, 2025, https://www.ecb.europa.eu/press/economic-bulletin/articles/2022/html/ecb.ebart202201_02~318271f6cb.en.html

- EIF uses NextGenerationEU funds to mobilise €2.5 billion of new financing for Spanish small businesses wishing to invest in innovation, sustainability and competitiveness, accessed July 14, 2025, https://www.eif.org/InvestEU/news/2025/fei-movilizara-con-fondos-next-generation-eu2-500-millones-de-euros-de-nueva-financiacion-para-pymes-espanolas-que-quieran-invertir-en-innovacion-sostenibilidad-competitividad.htm

- Spain: 2025 Article IV Consultation-Press Release; and Staff Report – International Monetary Fund (IMF), accessed July 14, 2025, https://www.imf.org/-/media/Files/Publications/CR/2025/English/1espea2025001-print-pdf.ashx

- European Stocks Sell-Off Amid Economic Uncertainty, Airline Moves – AInvest, accessed July 14, 2025, https://www.ainvest.com/news/european-stocks-sell-economic-uncertainty-airline-moves-2507/

- 2025 Mid-Year Market Outlook: 9 Key Questions – Kitces.com, accessed July 14, 2025, https://www.kitces.com/blog/mid-year-2025-market-outlook-investment-advisor-client-convesations-analysis-tariff-economic-impact-us-trade/

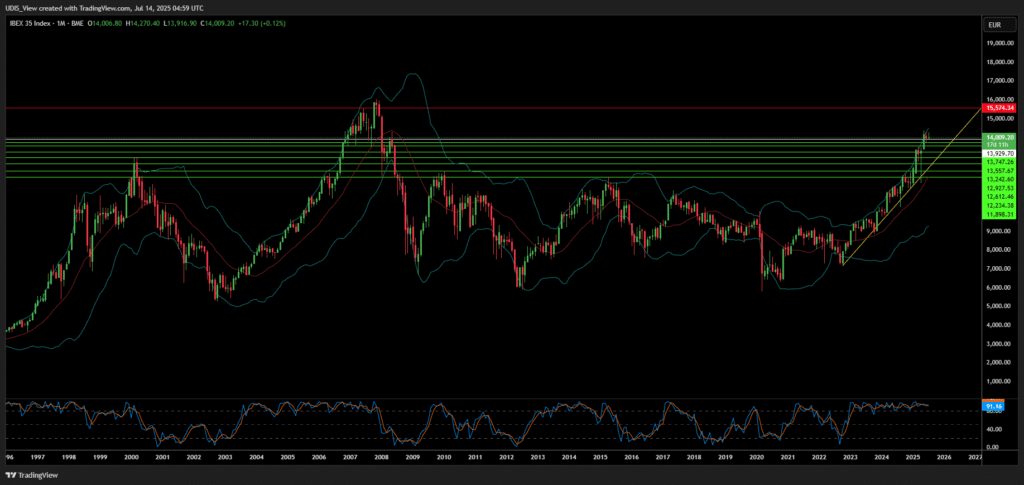

IBEX 35 Short (Sell)

Enter At: 13929.70

T.P_1: 13747.26

T.P_2: 13557.67

T.P_3: 13242.60

T.P_4: 12927.53

T.P_5: 12612.46

T.P_6: 12234.38

T.P_7: 11898.31

S.L: 15574.34