Pioneering Decentralized Cell and Gene Therapy

Orgenesis Inc. (OTCQX: ORGS) stands as a global biotechnology company. It focuses on unlocking the full potential of cell and gene therapies (CGTs). The company aims to make these advanced treatments affordable and accessible for patients worldwide.1 Orgenesis achieves this through its distinctive POCare Platform. This platform emphasizes decentralized processing, bringing therapy production closer to the patient.1

Moreover, the company addresses critical industry challenges. These include the high costs, complex logistics, and limited patient access often associated with conventional CGT manufacturing.5 Its innovative approach positions Orgenesis as a pivotal player within the rapidly expanding CGT market. The company is not merely developing new therapies. It is strategically addressing the fundamental economic and logistical bottlenecks of the entire CGT industry. This positions Orgenesis as a potential enabler of wider market penetration, moving beyond product-specific competition. Its business model inherently tackles the “how” of delivery, which is as critical as the “what” of the therapy itself. This suggests a disruptive potential in the market.

The company possesses a robust technological foundation. This includes its Orgenesis Mobile Processing Units and Labs (OMPULs).1 It also has a promising therapeutic pipeline, exemplified by its ORG-101 CAR-T therapy.8 Strategic partnerships further bolster its market position and global reach.7 The global CGT market projects significant growth, with valuations expected to reach $128.8 billion by 2035.11 Orgenesis’ decentralized model aligns directly with future trends, including personalized medicine and localized treatment delivery.6 The company is thus poised for potential long-term value creation.

The Rise of Orgenesis: Addressing Critical Gaps in Advanced Therapies

Cell and gene therapies (CGTs) offer transformative potential. They target the root causes of diseases, moving beyond symptomatic treatment.11 Despite this promise, their development and delivery remain complex and expensive.1 Traditional centralized manufacturing processes contribute significantly to these challenges. Patients often face issues like long waiting times, leading to disease progression, and logistical hurdles in accessing these life-saving treatments.5 Indeed, a significant portion of patients referred for CAR-T therapy do not receive it due to these barriers.5

Orgenesis recognized these systemic limitations. Since 2020, the company has championed a decentralized approach to CGT processing.2 Its mission centers on unlocking CGT’s full potential. The company aims for affordability and accessibility, delivering therapies directly at the point of care.1 This vision directly counters the prevailing challenges of high cost and limited access.

Orgenesis’ core strategy revolves around its POCare Platform. This platform operates through three interconnected pillars, designed to simplify and streamline the complex process of drug development and scale-up for advanced therapies.1

- POCare Therapies: Orgenesis identifies and partners with early-stage biotechnology developers. This strategy brings development and validation in-house. It creates a robust pipeline of owned, licensed, and partnered therapies.1 This approach expands the range of treatment options available to patients.

- POCare Technology: The company works with technology partners. They build customized, automated processing systems. These systems streamline therapy production.1 They ensure Good Manufacturing Practice (GMP) compliance, a critical standard for pharmaceutical quality and safety.12 The POCare Technology is described as a “fully integrated, closed loop all-in-one bioprocessing unit”.1 This closed-loop system offers benefits beyond mere efficiency and cost reduction. It significantly enhances product quality, reduces contamination risks, and improves batch-to-batch consistency. These attributes are crucial for highly sensitive biological products like CGTs. This directly supports GMP compliance and addresses manufacturing problems cited as a barrier to therapy access. For a financial audience, this implies reduced regulatory risk and potentially faster market approval for therapies processed this way, enhancing confidence in the platform’s reliability.

- POCare Network: This pillar involves aligning with global academia, research, and hospital partners.1 The network acts as a foundation for the entire platform. It enables the development, production, and distribution of advanced therapies directly at the point of care.1 This extensive network is not just a distribution channel. It serves as a strategic asset. It facilitates early access to promising therapies. It also provides real-world clinical data. This collaborative ecosystem can accelerate clinical development and commercialization. It also reduces the capital intensity and risk typically associated with biotech research and development. For investors, this network represents a significant barrier to entry for competitors attempting to replicate Orgenesis’ decentralized model, creating a sustainable competitive advantage.

The following table summarizes the core components and benefits of the Orgenesis POCare Platform:

| Component | Description | Key Benefit |

| POCare Therapies | Pipeline of owned, licensed, and partnered therapies. | More and better options for patients. |

| POCare Technology | Customized, automated, closed-loop bioprocessing units for therapy production. | More affordable, harmonized production; enhanced quality and safety. |

| POCare Network | Global collaborations with academia, research institutes, and hospitals. | More breakthroughs via collaboration; expanded patient access at point of care. |

Technological Innovation: Orgenesis’ Engine for Growth

Orgenesis’ strategic position stems from its technological advancements and a growing therapeutic pipeline. These elements underpin its decentralized model.

Decentralized Processing: The OMPUL Advantage

At the core of Orgenesis’ technological innovation are its Mobile Processing Units and Labs (OMPULs).7 These are autonomous, multi-purpose, Good Manufacturing Practice (GMP) facilities.7 They represent fully integrated, closed-loop bioprocessing units.1 OMPULs enable onsite development and manufacturing of CGTs directly at the point of care.7 This model drastically lowers costs. It also eliminates logistical and administrative challenges associated with traditional centralized production.1 This directly addresses critical barriers to patient access, such as cancer progressing too quickly due to long manufacturing times, and various logistical issues.5

The decentralized approach expedites capacity setup. It enhances production efficiency, ensuring therapies can reach patients faster.9 This allows for scalable, harmonized production globally, making advanced therapies more accessible regardless of patient location.1

Therapeutic Pipeline: Clinical Successes and Strategic Acquisitions

Orgenesis continues to build its therapeutic portfolio through internal development and strategic acquisitions.

ORG-101 CAR-T Therapy

Orgenesis’ CD19-directed chimeric antigen receptor T-cell (CAR-T) therapy, ORG-101, has demonstrated strong efficacy in a real-world study conducted in China.8 The therapy achieved an 82% complete response (CR) rate in adults. It also showed a 93% CR rate in children with CD19+ B-cell acute lymphoblastic leukemia (ALL).8

Furthermore, ORG-101 exhibited a favorable safety profile. The incidence of severe Cytokine Release Syndrome (CRS), a common and serious side effect of CAR-T therapies, was remarkably low. It was observed in 2% of treated adults and 6% of treated children.8 This rate is notably lower compared to currently approved CAR-T treatments.8 This addresses a key concern about CAR-T side effects, which can deter patients and physicians.5 This dual validation of high efficacy and a favorable safety profile in a real-world setting is crucial. It proves not only that Orgenesis can develop an effective therapy, but also that its decentralized platform can produce it safely and cost-effectively. This mitigates two major risks in CGT: clinical efficacy/safety and manufacturing scalability/affordability.

ORG-101 utilizes a third-generation lentiviral vector with a proprietary CAR construct.9 Lentiviral vectors are essential for genetically modifying T cells in CAR-T therapy.12 Its production is adapted to a decentralized model, further reducing treatment costs compared to traditional centralized manufacturing.9

The following table presents key clinical data for ORG-101 CAR-T Therapy:

| Metric | ORG-101 Data | Comparison (vs. Approved CAR-Ts) |

| Complete Response (CR) Rate – Adults | 82% | High efficacy |

| Complete Response (CR) Rate – Children | 93% | High efficacy |

| Severe Cytokine Release Syndrome (CRS) – Adults | 2% | Low incidence |

| Severe Cytokine Release Syndrome (CRS) – Children | 6% | Low incidence |

Neurocords LLC Acquisition and Regenerative Medicine Expansion

In March 2025, Orgenesis strategically acquired intellectual property assets from Neurocords LLC.10 This move significantly expands its regenerative medicine portfolio. The acquisition focuses on advanced therapies for spinal cord injuries (SCI).10

The acquired technology differentiates induced pluripotent stem cells (iPSC) into spinal cord neurons.10 This process leverages Orgenesis’ decentralized cell processing approach. It also integrates with Orgenesis’ MIDA Technology, which facilitates AI-based generation of autologous stem cells.10 This acquisition represents more than just adding a new product. It validates the versatility and applicability of Orgenesis’ decentralized platform beyond oncology. It demonstrates that the OMPUL and POCare model can adapt to different therapeutic areas and cell types. This diversification reduces reliance on a single therapeutic area. It also expands the total addressable market.

The global SCI treatment market presents a substantial opportunity. It was valued at $7.5 billion in 2023. Projections indicate it will reach $11.2 billion by 2031.10 The acquisition was structured as an equity transaction. Orgenesis issued 1,200,000 shares of common stock to Neurocords as consideration for the purchased assets.10 The use of an equity transaction for the acquisition reflects a capital-efficient growth strategy, preserving cash resources.

Navigating the Market: Orgenesis’ Financial and Partnership Landscape

Orgenesis’ strategy for growth and market penetration relies heavily on a robust network of collaborations and a resilient approach to its financial landscape.

Strategic Partnerships for Global Reach

Orgenesis actively forges relationships with diverse stakeholders. These include biotech industry players, leading academic institutions, research institutes, and hospitals.1 This collaborative model is central to its POCare Network.1 These partnerships are not just about distribution. They allow Orgenesis to leverage external capital, expertise, and infrastructure. This effectively de-risks its ambitious global decentralized CGT strategy. This shared-risk, shared-reward model is crucial for a company operating in a high-cost, high-risk sector. It indicates a prudent management approach to capital allocation and growth.

The partnership with MIDA Biotech exemplifies this strategic approach.7 Through this collaboration, Orgenesis and MIDA Biotech are establishing POCare centers and deploying OMPULs across Western Europe. This includes key regions like Italy, Germany, Spain, and Benelux.7 These collaborations enable joint research, development, and validation activities, accelerating the path to market for new therapies.7 Ultimately, these partnerships provide a rapid, globally harmonized pathway. They help advanced therapies reach a larger number of patients more cost-effectively and with better outcomes.2

Financial Landscape and Nasdaq Delisting

In October 2024, Orgenesis’ common stock commenced trading on the OTCQX® Best Market.2 This followed a delisting from Nasdaq. The delisting resulted from the company’s failure to meet the required stockholders’ equity threshold.2

Vered Caplan, CEO of Orgenesis, expressed disappointment regarding the delisting. However, she affirmed the company’s firm focus on driving the business forward.2 Orgenesis plans to address the stockholders’ equity deficiency. It intends to reapply for a Nasdaq listing as soon as practical.2 While concerning, the delisting appears to be a financial compliance issue rather than an indictment of Orgenesis’ core technology or strategic direction. For investors, the key is the company’s ability to resolve this deficiency and its continued operational progress. The CEO’s assertive statement about “driving the business forward” and “advancing the development of cutting-edge therapies” despite the delisting is important. It suggests confidence in the underlying value proposition.

Shares continue to trade under the symbol “ORGS” on OTCQX. This provides shareholders with ongoing access to their investments and liquidity.2 The company’s market capitalization stands at $7.92 million.10 The relatively low market cap after the delisting might present a valuation opportunity if the company successfully executes its plan and relists.

The Future of Pharmaceuticals: A Cell and Gene Therapy Revolution

The pharmaceutical industry is undergoing a profound transformation, with cell and gene therapies (CGTs) leading the revolution.

Explosive Market Trajectory

The global Cell and Gene Therapy market is experiencing rapid expansion.6 Valued at $20.5 billion in 2024, it is projected to reach $128.8 billion by 2035.11 This represents an impressive Compound Annual Growth Rate (CAGR) of 18.2% between 2025 and 2035.11 In the short term, the CGT market is expected to nearly quadruple from $5.3 billion in 2022 to $19.9 billion by 2027.6

This explosive growth is fueled by several factors. These include the rising prevalence of chronic and rare diseases. Increased investment from pharmaceutical companies and advancements in gene-editing technologies, such as CRISPR and CAR-T cell therapies, are also key drivers.11 Strong government funding and regulatory support worldwide further accelerate development pipelines.11

The following table illustrates the projected growth of the global Cell & Gene Therapy Market:

| Year | Market Value (USD Billion) | CAGR (2025-2035) |

| 2022 | $5.3 | N/A |

| 2024 | $20.5 | N/A |

| 2027 | $19.9 | N/A |

| 2035 | $128.8 | 18.2% |

Note: The 2027 projection of $19.9B 6 and 2024 valuation of $20.5B 11 reflect different reporting periods and methodologies, indicating robust growth across the sector.

Key Industry Trends Shaping the Future

Several dominant trends are shaping the future of the CGT market. A primary shift is towards personalized medicine. Therapies are increasingly tailored to individual genetic profiles. This enables more targeted and effective treatments, exemplified by CAR-T cell therapies where a patient’s own immune cells fight cancer.11

Innovation in delivery systems is also significant. While viral vectors like AAV and lentivirus remain common, non-viral vectors are gaining traction due to their safety and efficacy.11 Digital technologies and Artificial Intelligence are increasingly integrated into therapy development. They optimize patient selection and outcome tracking, enhancing precision medicine.11

Crucially, the decentralization of care is gaining momentum. CGTs are becoming safer to administer, allowing for treatment in more locations.6 This includes community settings outside traditional academic centers. This represents a significant evolution from just five years ago, when such a shift was deemed impossible.6 This trend strongly validates Orgenesis’ core decentralized model. It suggests that Orgenesis is not merely an innovator, but a company whose fundamental business model aligns perfectly with the future operational requirements of the CGT industry. As the market matures, the ability to deliver therapies closer to the patient, more efficiently, and at lower cost will become a competitive necessity. This positions Orgenesis as a potential infrastructure provider for the broader CGT ecosystem.

Overcoming Barriers: A Collaborative Imperative

Despite the immense potential, the CGT market faces significant hurdles. These therapies are among the world’s most expensive treatments, often costing hundreds of thousands to millions of dollars per dose.6 Improving patient access is a critical challenge. Barriers include rapid disease progression due to long manufacturing times, treatment shortages, and logistical issues for patients.5 Manufacturing problems also hinder widespread access.5

While safety has improved, concerns about side effects persist among patients and doctors.5 Regulatory hurdles and ethical concerns surrounding gene editing also pose challenges to broader adoption.11 Proposed solutions include early patient referrals, managed entry agreements, and robust real-world data collection to demonstrate long-term performance.5 A holistic approach involving collaboration among various stakeholders is crucial to optimizing patient access while ensuring payer affordability.15 Orgenesis’ value proposition extends beyond its specific therapeutic pipeline. It offers a systemic solution to the industry’s most pressing commercialization challenges. By tackling cost, speed, and accessibility, Orgenesis could unlock a larger patient population and accelerate market adoption for CGTs overall. This makes Orgenesis a potentially attractive investment not just for its products, but for its enabling technology that could facilitate the entire industry’s growth.

Orgenesis’ Strategic Position in an Evolving Industry

Orgenesis Inc. is strategically positioned within the rapidly evolving cell and gene therapy landscape. Its decentralized POCare Platform directly addresses the critical barriers to CGT adoption. These include high costs, limited accessibility, and logistical complexities.1 The company’s model aligns seamlessly with the industry’s inevitable shift towards personalized and localized treatment delivery.6

The company exhibits diversified growth vectors. Its therapeutic pipeline, exemplified by ORG-101, demonstrates compelling clinical success.8 The recent Neurocords acquisition further expands its reach into the growing regenerative medicine market for spinal cord injuries.10 This diversification reduces reliance on a single therapeutic area, enhancing the company’s overall resilience.

Orgenesis’ model is scalable and reproducible. The OMPUL technology and closed-loop systems facilitate GMP-compliant, scalable, and harmonized production.1 This is crucial for ensuring consistent quality and enabling global deployment of advanced therapies.13 This focus on infrastructure positions Orgenesis as a “pick-and-shovel” play in the CGT “gold rush.” While individual therapy developers face high clinical trial risks, Orgenesis’ platform aims to facilitate

any CGT. This potentially offers a more stable and broadly applicable revenue stream as the entire market expands. If their decentralized model becomes an industry standard for efficient production, Orgenesis could benefit from the success of many therapies, not just its own.

While the Nasdaq delisting presents a challenge, the company’s stated commitment to re-listing and continued business development signals resilience.2 Its extensive strategic partnerships further de-risk its ambitious growth plans by leveraging external resources and shared investments.2 Achieving significant cost reduction in CGTs could be a game-changer. It could expand the patient population eligible for these therapies by making them more palatable to payers and health systems. It could also increase adoption rates and potentially disrupt the pricing models of existing centralized manufacturers. This positions Orgenesis not just as an innovator, but as a potential cost leader, a powerful competitive advantage in a high-value, high-cost market.

Conclusion: Unlocking Potential, Driving Value

Orgenesis Inc. stands at the forefront of a paradigm shift. It is fundamentally transforming the delivery of advanced cell and gene therapies. Its innovative decentralized model directly addresses the industry’s most pressing challenges: high costs, limited accessibility, and complex logistics. By bringing production closer to the patient, Orgenesis aims to democratize access to life-saving treatments.

The company’s robust POCare Platform, promising therapeutic pipeline, and strategic partnerships are strong growth catalysts. Its demonstrated ability to reduce costs and enhance accessibility positions it favorably within a rapidly expanding market. Despite recent financial hurdles, Orgenesis’ fundamental business model remains compelling. It offers a unique value proposition within a high-impact sector poised for significant expansion. Investors should consider its long-term potential as it endeavors to unlock the full promise of cell and gene therapies while driving substantial shareholder value.

References

- Orgenesis Inc, accessed July 8, 2025, https://orgenesis.com/

- News & Events – Orgenesis, accessed July 8, 2025, https://ir.orgenesis.com/press-release-details?newsId=2966164

- Orgenesis Inc. – AnnualReports.com, accessed July 8, 2025, https://www.annualreports.com/Company/orgenesis-inc

- POCare Platform – Orgenesis, accessed July 8, 2025, https://orgenesis.com/platform

- Understanding Barriers to CAR T-Cell Therapy for Blood Cancer Patients – HealthTree, accessed July 8, 2025, https://healthtree.org/cll/community/articles/ash-24-barriers-for-receiving-car-t-cell-therapy

- The Evolution and Future of Cell & Gene Therapy | Deloitte US, accessed July 8, 2025, https://www.deloitte.com/us/en/Industries/health-care/blogs/the-evolution-and-future-of-cell-and-gene-therapy.html

- Partnerships – MIDA Biotech, accessed July 8, 2025, https://midabiotech.com/partnerships

- Orgenesis’ CAR-T ORG-101 Demonstrates Efficacy and Safety in Acute Lymphoblastic Leukemia in Real-World Study in China – CGTLive®, accessed July 8, 2025, https://www.cgtlive.com/view/orgenesis-car-t-org-101-demonstrates-efficacy-safety-acute-lymphoblastic-leukemia-real-world-study-china

- Orgenesis Announces Positive Results From a Real-World Study of ORG-101 CAR-T Therapy in Patients with CD19+ Acute Lymphoblastic Leukemia – GlobeNewswire, accessed July 8, 2025, https://www.globenewswire.com/news-release/2024/08/29/2937765/24226/en/Orgenesis-Announces-Positive-Results-From-a-Real-World-Study-of-ORG-101-CAR-T-Therapy-in-Patients-with-CD19-Acute-Lymphoblastic-Leukemia.html

- Orgenesis Inc. Announces Acquisition of Certain Neurocords LLC Assets, Strengthening its Regenerative Medicine Portfolio with Spinal Cord Injury Therapies – Stock Titan, accessed July 8, 2025, https://www.stocktitan.net/news/ORGS/orgenesis-inc-announces-acquisition-of-certain-neurocords-llc-assets-vohznl7tj0e8.html

- The Increasing Value Of The Cell And Gene Therapy Industry By 2035 – PharmiWeb.com, accessed July 8, 2025, https://www.pharmiweb.com/press-release/2025-04-24/the-increasing-value-of-the-cell-and-gene-therapy-industry-by-2035

- Lentiviral Vectors for T Cell Engineering: Clinical Applications, Bioprocessing and Future Perspectives – PubMed Central, accessed July 8, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8402758/

- From decentralized manufacturing to allogeneic therapy: an interview with Greg Roumeliotis, VP Global Business Development, Orgenesis, Inc. – RegMedNet, accessed July 8, 2025, https://www.regmednet.com/from-decentralized-manufacturing-to-allogeneic-therapy-an-interview-with-greg-roumeliotis-vp-global-business-development-orgenesis-inc/

- Orgenesis Inc. (via Public) / Material Agreement, Asset Transaction (Form 8-K), accessed July 8, 2025, https://www.publicnow.com/view/D43B787846D0D6F5DA100688FCD606012836840B

- CAR-T cell therapies: patient access and affordability solutions – PMC – PubMed Central, accessed July 8, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC11959894/

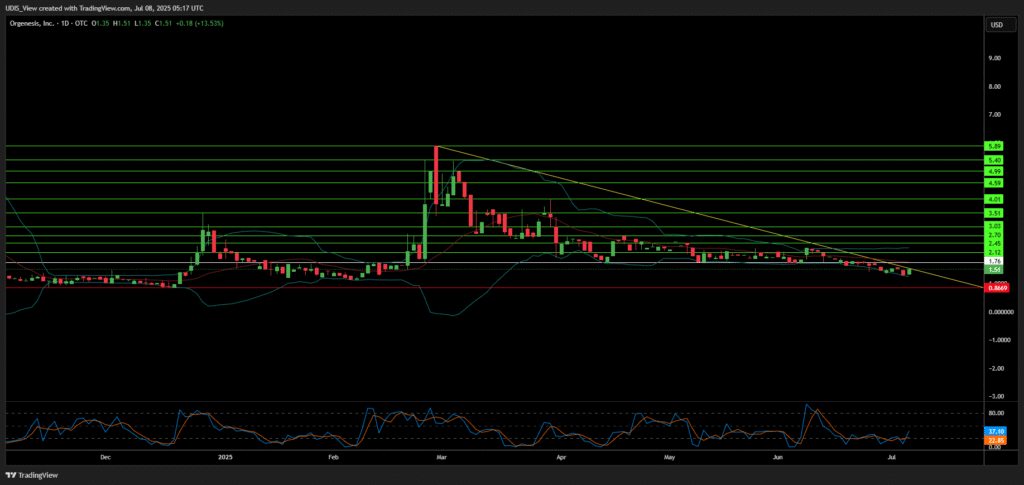

Orgenesis Long (Buy)

Enter At: 1.76

T.P_1: 2.12

T.P_2: 2.45

T.P_3: 2.70

T.P_4: 3.03

T.P_5: 3.51

T.P_6: 4.01

T.P_7: 4.59

T.P_8: 4.99

T.P_9: 5.40

T.P_10: 5.89

S.L: 0.8669