The financial markets recently observed a pivotal development as Datadog (DDOG), a leading provider of cloud observability solutions, secured its inclusion in the esteemed S&P 500 index. This significant announcement, made on July 2, 2025, confirmed that Datadog would replace Juniper Networks (JNPR) prior to the opening of trading on Wednesday, July 9, 2025.1 This unscheduled index alteration was necessitated by Hewlett Packard Enterprise Co.’s (HPE) completion of its acquisition of Juniper Networks on the same day, requiring a prompt replacement to maintain the index’s 500-company composition.1

The market’s reaction to this news was immediate and pronounced. Datadog shares surged by 10% to 11% in extended trading following the announcement, reaching a five-month high.2 Investing.com also reported an over 8% rise in trading.4 This robust initial response underscored the market’s positive anticipation of the “index effect,” a well-documented phenomenon where inclusion in a major index drives significant stock appreciation due to mandated passive fund inflows. The swift and substantial price jump signaled strong investor confidence and the expected influx of capital from passive funds.

The unscheduled nature of this inclusion carries particular weight. While S&P 500 changes typically occur during routine quarterly rebalancings, this adjustment was a direct consequence of Juniper’s acquisition by HPE.2 The S&P committee had previously opted against making changes at the usual rebalancing time in early June. Their prompt action to elevate Datadog when a slot opened, rather than delaying or choosing another candidate, highlights Datadog’s immediate readiness and strategic importance.2 Such an unscheduled addition, driven by necessity, serves as an even stronger affirmation of Datadog’s robust financial health and market position, signifying a powerful seal of approval from the index committee. The immediate selection of Datadog suggests that it was not merely an eligible candidate, but rather the unequivocal and readily apparent choice for the index committee, indicating a high level of pre-existing validation of its market standing. This rapid entry provides a more potent signal of institutional endorsement than a routine inclusion, potentially fostering sustained positive sentiment and investor confidence beyond the initial mechanical effects.

A New Era for Datadog

Datadog’s entry into the S&P 500 marks a significant milestone for the cloud observability leader. The announcement, made by S&P Dow Jones Indices on July 2, 2025, set the effective date for inclusion as prior to the opening of trading on Wednesday, July 9, 2025.1 This change saw Datadog (DDOG) stepping in to replace Juniper Networks (JNPR), following Hewlett Packard Enterprise Co.’s (HPE) completion of its acquisition of Juniper Networks on July 2, 2025.1

The market’s reaction was swift and decisive. Datadog shares experienced an immediate and robust surge, rising by 10% to 11% in extended trading following the July 2 announcement, reaching a five-month high.2 This immediate price appreciation is a clear manifestation of the “index effect,” a well-understood market dynamic. Investing.com corroborated this, reporting an over 8% rise in trading for Datadog shares.4 The rapid and substantial price jump confirmed the predictable market phenomenon where inclusion in a major index triggers significant stock appreciation. This consistency across various S&P 500 additions suggests a highly predictable market dynamic, which sophisticated investors can anticipate and leverage. For market participants, this consistent reaction reinforces the importance of monitoring index changes and understanding the mechanical impact of passive investing, highlighting that even in complex markets, certain fundamental forces, like index rebalancing, create predictable short-term opportunities and risks.

The Road to Inclusion: Why Datadog, Why Now?

Inclusion in the S&P 500 is not solely determined by market capitalization; it involves a sophisticated selection process orchestrated by the S&P Dow Jones Global Indices committee. This committee exercises considerable discretion in choosing new components, aiming to ensure the index accurately reflects a balanced cross-section of the U.S. economy, rather than merely compiling the largest companies by market value.2 While companies must satisfy various criteria, including profitability and market capitalization, meeting these quantitative thresholds does not guarantee a spot. The process involves careful qualitative deliberation beyond strict numerical benchmarks.2

Datadog unequivocally met these stringent criteria, positioning itself as an ideal candidate for inclusion. Its market capitalization, approximately $46.6 billion as of July 2, 2025 2 (with another source indicating around $39.26 billion 7), substantially surpassed the S&P 500’s minimum threshold, which was updated to $22.7 billion or more effective July 1, 2025 (an increase from $20.5 billion).8 Furthermore, Datadog’s valuation is notably higher than the median for the S&P 500 itself, firmly establishing its status as a large-cap company, a fundamental requirement for the index.2

Beyond its size, Datadog’s robust financial health and consistent profitability were crucial factors. The company reported a GAAP net income of $24.6 million on $761.6 million in revenue for the first quarter of 2025.2 For the full fiscal year 2024, Datadog generated $2.68 billion in revenue.2 This consistent profitability demonstrates operational maturity and stability, a key criterion for the index committee, which explicitly favors companies with reliable earnings.2

Perhaps most significantly, Datadog’s strategic sector alignment played a decisive role. Both Datadog and Juniper Networks are classified as information-technology providers.1 Datadog’s leadership in cloud observability—a critical tool for managing modern infrastructure—effectively fills the gap left by Juniper’s removal, thereby maintaining the desired sector balance within the index.2 This highlights the committee’s focus on ensuring the index accurately reflects the broader economy and its evolving technological landscape. The S&P committee’s selection of Datadog over companies with considerably larger market capitalizations, such as AppLovin, which had a market cap of approximately $114.16 billion to $114.65 billion as of July 2, 2025 2, underscores a strategic preference for foundational enterprise technology that addresses critical infrastructure needs.2 This decision is not simply about size; it reflects a deliberate choice to prioritize stable, indispensable enterprise solutions over potentially more volatile segments like consumer-facing ad-tech or fintech. The committee’s aim is to maintain balance across industries, and Datadog’s role in cloud observability aligns perfectly with this objective, representing a vital and growing segment of the economy.2

This selection process demonstrates that the S&P 500 is not a passive reflection of market capitalization alone. The committee actively curates the index to ensure it reflects the strategic evolution and foundational pillars of the U.S. economy. The shift from hardware (Juniper) to software-defined infrastructure management (Datadog) within the IT sector signals a deliberate recognition of new economic drivers. This proactive approach makes the S&P 500 a more dynamic and forward-looking benchmark. For investors, this implies that S&P 500 inclusion is a robust signal of a company’s long-term strategic importance and alignment with future economic trends, encouraging a deeper look into a company’s business model and sector relevance.

Beyond Market Cap: The S&P 500 Committee’s Nuanced Calculus

The selection of Datadog for the S&P 500, particularly when other highly anticipated candidates like Robinhood Markets Inc. and AppLovin Corp. were bypassed, reveals the S&P committee’s sophisticated selection philosophy, which extends far beyond mere market capitalization.2 Both Robinhood and AppLovin were popular predictions for S&P 500 inclusion and significantly exceeded the market cap threshold, with Robinhood estimated at $63.8 billion 2 and AppLovin at approximately $114.16 billion to $114.65 billion as of July 2, 2025 14 (with the article also citing $140.9 billion 2). However, the index committee opted against their inclusion, underscoring its discretionary power and the paramount importance of qualitative factors.2

The committee’s emphasis on consistent profitability and operational stability stands out as a primary differentiator. Datadog’s consistent net income of $24.6 million in Q1 2025 2 and its established position as a provider of monitoring software for businesses demonstrate a stable, profitable business model. The S&P 500 committee explicitly favors companies with consistent earnings.2 In contrast, Robinhood’s path to sustained profitability remains uncertain, and the company faces ongoing regulatory headwinds.2 AppLovin’s massive valuation, while impressive, is influenced by volatile gaming markets, and the company was the subject of critical short-seller reports earlier in the year. The committee likely deemed AppLovin’s business model too speculative for the index.2 This comparison clearly illustrates the qualitative criteria underpinning S&P 500 selection, prioritizing stability and predictability over speculative growth potential.

Furthermore, the committee demonstrated a clear preference for foundational enterprise technology. Datadog’s focus on cloud observability and its tools for monitoring and analytics for developers represent a critical and foundational layer of modern enterprise IT infrastructure.2 This contrasts sharply with AppLovin’s ad-tech and gaming focus, which already competes with existing constituents like Meta and Alphabet, and Robinhood’s fintech niche.2 The committee seeks to ensure balanced sector representation and a focus on industries fundamental to economic growth and stability.2

The explicit rejection of larger companies like AppLovin, despite their superior market capitalization, transforms the S&P 500 inclusion from a simple market cap ranking into a powerful qualitative endorsement.2 This indicates that the index functions as a rigorous quality filter, prioritizing companies with robust business models, consistent profitability, and strategic relevance, even if their recent stock performance has been subdued (Datadog was down 5.5% year-to-date as of July 2, 2025 2, while the Nasdaq Composite was up approximately 5.6% 2 with other sources showing +3.07% 5 or +0.94% 16). The qualitative deficiencies in AppLovin (volatile gaming markets, short-seller reports) and Robinhood (uncertain profitability, regulatory headwinds) outweighed their size advantage.2 This reveals a clear preference for business model stability, predictable earnings, and essential industry function over speculative growth or consumer-facing volatility. For investors, this signifies that S&P 500 inclusion is a strong signal of a company’s fundamental health and long-term viability, not merely a reflection of recent market hype. It reinforces the index’s reputation for representing the most stable and influential U.S. companies.

This analysis demonstrates that the S&P committee’s due diligence extends far beyond superficial metrics like market capitalization or recent stock performance. It delves into the underlying business model’s sustainability, predictability of earnings, and systemic importance to the economy. The committee is willing to select a company that might be temporarily out of favor with the market (like Datadog’s year-to-date underperformance) if its fundamental quality and long-term trajectory align with the index’s mandate for stability and representation of the most influential U.S. companies. This reinforces that S&P 500 inclusion is a powerful signal of a company’s fundamental health and long-term viability, suggesting a deeper level of institutional vetting than mere market hype.

To illustrate these comparative factors, the following table provides a concise overview:

Comparative Factors: Datadog vs. Other S&P 500 Candidates

| Criteria | Datadog (DDOG) | Robinhood (HOOD) | AppLovin (APP) |

| Current Market Cap | ~$46.6 Billion 2 (also ~$39.26 Billion 7) | ~$63.8 Billion 2 | ~$114.16 Billion – $114.65 Billion 14 (also ~$140.9 Billion 2) |

| Profitability | Consistent ($24.6M Q1 2025 net income) 2 | Uncertain path to sustained profitability 2 | Volatile, subject to short-seller reports 2 |

| Sector Representation | Cloud Observability (foundational enterprise tech) 2 | Fintech (niche, growing) 2 | Ad-tech/Gaming (competes with existing constituents) 2 |

| Stability/Consistency | High (consistent earnings, critical infrastructure) 2 | Moderate (regulatory headwinds, speculative growth) 2 | Low (volatile markets, speculative valuation) 2 |

The “Index Effect”: Unpacking the Stock Boost Mechanism

Inclusion in the S&P 500 triggers a powerful market dynamic known as the “index effect,” which significantly boosts a company’s stock value.2 This phenomenon is primarily driven by the mandatory rebalancing of trillions of dollars in passive index-tracking funds.2 These funds, designed to mirror the index’s composition precisely, are compelled to acquire shares of any new constituent. For Datadog, this translated into immediate and substantial demand as these funds moved to mirror the index’s updated composition.

Historically, such inclusions have consistently caused short-term price surges. Datadog’s shares rising over 10% in after-hours trading immediately following the July 2 announcement serves as a clear, real-time example of this effect.2 Investing.com also noted an over 8% rise.4 Datadog’s closing price on July 2, 2025, was $135.01 6, a significant jump from its price near $100 before the announcement.2

This initial surge is not merely a fleeting event; the initial inflows often stabilize into sustained institutional ownership, as evidenced by prior S&P 500 additions like CrowdStrike and Palantir.2 This transition from immediate demand to long-term institutional holding contributes to greater stock stability and broader market acceptance. Strategic positioning by fund managers further amplifies this dynamic. Many funds begin accumulating shares in the days leading up to the official inclusion date (July 9 in Datadog’s case) to avoid buying at inflated prices once the news is widely digested.2 This pre-positioning process itself generates upward momentum in the stock price during the run-up to the effective date.2 Technical traders closely monitor resistance levels, such as Datadog’s price near $100 before the announcement, aiming for a breakout toward $110, which would mirror similar post-inclusion rallies observed in other stocks.2

The “index effect” extends beyond simple passive fund inflows; it initiates a powerful, self-reinforcing cycle of increased liquidity, enhanced visibility, and a lower cost of capital, fundamentally improving the company’s long-term market standing and attractiveness to a broader investor base.2 When passive funds are compelled to purchase Datadog shares, it creates immediate demand, leading to higher stock prices. This initial price increase then triggers a cascade of secondary and tertiary effects. Firstly, increased trading volume translates into greater liquidity, making it easier for large institutional investors to enter and exit positions without significantly impacting the price. This enhanced liquidity, in turn, attracts more institutional investors. Secondly, being part of the S&P 500 automatically includes Datadog in countless financial analyses, news reports, and investment screens, significantly raising its profile among both active fund managers and retail investors. Thirdly, a more liquid and visible stock, backed by sustained institutional ownership, typically trades at a higher multiple and can raise capital more cheaply in the future, as investors perceive lower risk and greater stability. Finally, the S&P 500 inclusion itself acts as a powerful marketing tool and a validation of the company’s quality, attracting even more discretionary capital.2 Thus, the index effect is far more than a short-term price bump; it fundamentally alters a company’s market structure, investor base, and long-term financial flexibility, providing a significant competitive advantage. This powerful mechanism drives a company’s market maturation, fundamentally improving its long-term financial flexibility and competitive advantage, signaling a transition from a “growth story” to an “established growth story” in the eyes of the market.

Datadog’s Long-Term Trajectory: A Cloud Observability Powerhouse

Datadog’s inclusion in the S&P 500 is not merely a liquidity event; it serves as a powerful validation of its leadership in the rapidly expanding cloud observability market.2 This market, valued at over $10 billion 2, has varying growth projections from different sources, indicating its dynamic nature. The global observability tools and platforms market was valued at USD 2.4 billion in 2023 and is projected to reach USD 4.1 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 11.7%.18 A more specific focus on the Cloud Observability Tools Market projects a higher CAGR of 17.67% by 2028.19 Meanwhile, the broader observability platform market size reached USD 2.9 billion in 2025 and is forecast to attain USD 6.1 billion by 2030, expanding at a 15.9% CAGR.20 As enterprises increasingly transition to complex hybrid and multi-cloud environments, tools like Datadog’s, which provide comprehensive monitoring and analytics, become indispensable for managing performance, security, and cost.2 This highlights the strong secular tailwinds supporting Datadog’s core business.

The company’s financial performance indicators underscore its ability to capitalize on this market growth. Datadog reported Q1 2025 revenue of $761.6 million (or $762 million), representing a 25% year-over-year increase.10 This robust growth trajectory outpaces some overall market growth forecasts, demonstrating Datadog’s effectiveness in capturing market share and executing its strategy within its high-growth segment.2 For the full fiscal year 2024, Datadog generated $2.68 billion in revenue.12

Datadog operates within a competitive landscape, facing rivals such as Cisco (which acquired Splunk on March 18, 2024 21), Elastic, and even cloud infrastructure giants like Amazon and Microsoft, who offer their own monitoring tools.2 However, Datadog distinguishes itself through its agility in integrating observability with critical functions like security and AI analytics, offering a more unified and comprehensive platform that sets it apart from competitors.2

A broader macro trend suggests that S&P 500 additions often signal secular winners. Workday’s inclusion in the S&P 500, for instance, occurred on December 23, 2024 23, preceding a period of significant growth in the enterprise SaaS sector. This historical precedent suggests that Datadog’s entry into the index could mark the beginning of a sustained period of outperformance, driven by its foundational role in enterprise digital transformation.2

Despite its strong market position and S&P 500 validation, Datadog has underperformed the broader tech sector year-to-date. As of July 2, 2025, its stock was down 5.5% 2, while the Nasdaq Composite was up approximately 5.6% 2 (with other sources showing +3.07% 5 or +0.94% 16). This relative underperformance, coupled with its median Nasdaq valuation, suggests that Datadog might still represent a compelling value proposition ahead of its “prime-time moment”.2

Datadog’s S&P 500 inclusion, driven by its leadership in cloud observability, signifies a deeper maturation of the enterprise cloud market.2 It indicates that businesses are moving beyond mere cloud adoption to a critical phase of optimizing, securing, and understanding their complex multi-cloud environments, making observability solutions indispensable and therefore a core component of the broader economy.2 The S&P committee’s choice of Datadog, a tool for managing cloud infrastructure, over more direct cloud providers or other tech companies, implies that the management and optimization of cloud infrastructure are now considered as foundational and critical as the infrastructure itself. This represents a shift from a focus on “cloud adoption” to “cloud optimization and resilience” as a core economic driver.2 Datadog’s inclusion is not just about its individual success but about the broader recognition that the observability layer of the cloud stack is now a mature, essential, and high-growth segment, reflecting a fundamental shift in enterprise IT spending priorities.2 This establishes observability as the indispensable “control plane” of the modern digital economy, elevating it from a specialized IT function to a strategic imperative.

The situation where Datadog has underperformed the broader tech sector year-to-date despite its strong market position and S&P 500 validation creates a unique investment narrative. The market’s prior underpricing of Datadog’s fundamental strength, coupled with its recent S&P 500 inclusion, suggests that the institutional “seal of approval” acts as a powerful re-rating catalyst. It implies that the stock’s valuation has not yet fully caught up to its intrinsic value or its newly validated status as a “secular winner.” This offers an entry point for investors seeking quality growth at a more reasonable price, leveraging the S&P 500 inclusion as a validation point rather than just a short-term trading event. This scenario is particularly attractive for long-term, value-oriented technology investors who missed earlier tech rallies, presenting an opportunity to invest in a company that has now received a stamp of institutional approval, suggesting a more stable and predictable growth trajectory going forward.

The following table summarizes Datadog’s recent financial performance and market context:

Datadog’s Recent Financial Performance and Market Context

| Metric | Value |

| Q1 2025 Revenue | $761.6 Million 2 |

| Q1 2025 Net Income | $24.6 Million 2 |

| Full Year 2024 Revenue | $2.68 Billion 2 |

| Market Capitalization (July 2) | ~$46.6 Billion 2 (also ~$39.26 Billion 7) |

| YTD Stock Performance (DDOG) | -5.5% 2 |

| YTD Nasdaq Performance | +5.6% 2 (also +3.07% 5 or +0.94% 16) |

Investment Implications and Outlook

Datadog’s S&P 500 inclusion presents distinct considerations for both short-term traders and long-term investors. For short-term trading, positioning ahead of rebalance-driven inflows is key. Investors may consider acquiring DDOG shares, particularly at entry points below $100, which was the approximate price before the announcement.2 The mandatory inflows from passive funds are expected to lift shares through the July 9 effective date.2 However, short-term traders should also be mindful of the potential for a post-announcement pullback as some funds may lock in gains, suggesting a nuanced approach to capturing immediate momentum.2

From a long-term strategic perspective, Datadog warrants consideration as a core holding in diversified technology portfolios. Beyond the immediate liquidity event, the company’s fundamental business strength in the cloud monitoring space positions it for significant sustained growth, projected at 15% annually through 2028.2 Datadog’s strategic ecosystem partnerships, such as those with Microsoft Azure, are expected to amplify its competitive moat and ensure continued relevance in an increasingly multi-cloud world.2 This emphasizes the robust fundamental business strength and long-term growth drivers that underpin the investment thesis.

Looking ahead, Datadog faces both opportunities and risks. Opportunities include continued expansion into new observability areas, such as security and AI analytics, deepening enterprise adoption, and leveraging its enhanced profile and credibility stemming from S&P 500 inclusion.2 Potential risks involve intense competition from large, established players like Cisco/Splunk (Splunk was acquired by Cisco on March 18, 2024 21), Amazon, and Microsoft, potential market saturation in certain segments, and broader macroeconomic slowdowns that could impact enterprise IT spending.2 A balanced view acknowledges both the upside potential and downside risks inherent in the rapidly evolving technology sector.

Datadog’s S&P 500 inclusion, coupled with its year-to-date underperformance relative to the Nasdaq, presents a unique opportunity for value-oriented technology investors.2 This situation suggests an opportunity to acquire a fundamentally strong, S&P 500-validated company at a potentially discounted rate before its full growth potential is reflected in its stock price.2 The underperformance indicates that the market had not fully priced in Datadog’s fundamental strength or its impending S&P 500 inclusion. The inclusion now acts as a powerful re-rating catalyst.2 For investors who may have missed earlier tech rallies, Datadog offers a chance to invest in a “secular winner” that has now received an institutional seal of approval, but whose stock price has not yet fully caught up to its intrinsic value or peer performance.2 This creates a compelling narrative for investors seeking quality growth at a reasonable price, leveraging the S&P 500 inclusion as a validation point rather than just a short-term trading event.

Conclusion: A Seal of Approval for the Future of Enterprise Tech

Datadog’s inclusion in the S&P 500 is far more than a mere liquidity event; it represents a powerful endorsement of its pivotal role in the future of enterprise technology.2 The decision reflects the S&P committee’s discerning eye for companies demonstrating consistent profitability, operational stability, and critical sector relevance.2 This move underscores the index’s commitment to reflecting the evolving landscape of the U.S. economy, particularly the increasing importance of foundational software and cloud infrastructure management.2

Datadog stands as a recognized leader in the indispensable cloud observability market, positioned for sustained growth amidst the ongoing digital transformation of enterprises.2 Its agility in integrating new technologies like AI and security further solidifies its competitive advantage, ensuring its continued relevance and demand in complex multi-cloud environments.2 While other companies, such as Robinhood and AppLovin, may eventually achieve similar milestones, Datadog’s blend of financial strength, strategic market positioning, and validated growth trajectory makes it a compelling consideration for both short-term momentum and long-term wealth creation.2 The July 9 rebalance date marks a starting line for Datadog’s enhanced market presence, rather than a finish line for its growth story.2

Datadog’s inclusion suggests that the S&P 500 index is evolving to become a more dynamic reflection of foundational, high-growth enterprise technology trends.2 It moves beyond traditional hardware or consumer-facing software to encompass critical infrastructure management layers like observability.2 The S&P 500 has been continuously increasing its exposure to technology, and Datadog’s specific role in monitoring and analytics for developers and managing modern infrastructure is distinct from consumer social media, e-commerce, or gaming companies.2 Its inclusion, replacing a hardware company like Juniper, signals a shift towards software-defined infrastructure management and analytics as a core economic driver.2 This implies that future S&P additions might increasingly signal the next wave of essential business-to-business technology rather than just consumer-facing giants.2 For investors and industry observers, the S&P 500’s composition can thus serve as a powerful signal of which technological segments are achieving critical mass and institutional validation, guiding future investment and strategic planning in the enterprise technology landscape.2

References

- Datadog Set to Join S&P 500 – Jul 2, 2025 – Press Releases, accessed July 3, 2025, https://press.spglobal.com/2025-07-02-Datadog-Set-to-Join-S-P-500

- Datadog’s S&P 500 Ascension_ A Catalyst for Growth and Institutional Validation.docx

- Datadog Stock Surges On S&P 500 Inclusion – Moomoo, accessed July 3, 2025, https://www.moomoo.com/news/post/54984332/datadog-stock-surges-on-s-p-500-inclusion

- Datadog to join S&P 500, replacing Juniper Networks – Investing.com, accessed July 3, 2025, https://in.investing.com/news/stock-market-news/datadog-to-join-sp-500-replacing-juniper-networks-4899436

- 2 Glorious Growth Stocks Down 36% and 57% You’ll Wish You’d Bought on the Dip, According to Wall Street | The Motley Fool, accessed July 3, 2025, https://www.fool.com/investing/2025/06/19/2-growth-stocks-down-36-and-57-bought-wall-street/

- Better Growth Stock: Rocket Lab USA vs. Datadog | The Motley Fool, accessed July 3, 2025, https://www.fool.com/investing/2025/06/19/better-growth-stock-rocket-lab-usa-vs-datadog/

- Datadog, Inc. (DDOG) Investor Outlook: A 19% Potential Upside With Robust Revenue Growth – DirectorsTalk Interviews, accessed July 3, 2025, https://www.directorstalkinterviews.com/datadog-inc-ddog-investor-outlook-a-19-potential-upside-with-robust-revenue-growth/4121197951

- S&P Dow Jones Indices Announces Update to S&P Composite 1500 Market Cap Guidelines, accessed July 3, 2025, https://press.spglobal.com/2025-07-01-S-P-Dow-Jones-Indices-Announces-Update-to-S-P-Composite-1500-Market-Cap-Guidelines

- S&P Dow Jones Indices Announces Update to S&P Composite 1500 Market Cap Guidelines, accessed July 3, 2025, https://www.stocktitan.net/news/SPGI/s-p-dow-jones-indices-announces-update-to-s-p-composite-1500-market-tt10ngtjfn66.html

- Datadog Announces First Quarter 2025 Financial Results | Datadog, accessed July 3, 2025, https://investors.datadoghq.com/news-releases/news-release-details/datadog-announces-first-quarter-2025-financial-results/

- Datadog Announces First Quarter 2025 Financial Results – GlobeNewswire, accessed July 3, 2025, https://www.globenewswire.com/news-release/2025/05/06/3074862/0/en/Datadog-Announces-First-Quarter-2025-Financial-Results.html

- Datadog Announces Fourth Quarter and Fiscal Year 2024 Financial …, accessed July 3, 2025, https://investors.datadoghq.com/news-releases/news-release-details/datadog-announces-fourth-quarter-and-fiscal-year-2024-financial/

- Datadog Announces Fourth Quarter and Fiscal Year 2024 Financial Results, accessed July 3, 2025, https://investors.datadoghq.com/static-files/79f50d82-d309-45f2-8fa0-a094c5317173

- AppLovin to Announce Second Quarter 2025 Results – Stock Titan, accessed July 3, 2025, https://www.stocktitan.net/news/APP/app-lovin-to-announce-second-quarter-2025-n9a9k9w0ytpj.html

- AppLovin Corporation (APP) Stock Price & Latest News – June 2025 – InsideArbitrage, accessed July 3, 2025, https://www.insidearbitrage.com/symbol-metrics/APP

- Datadog Inc (DDOG) Stock Price & News – Google Finance, accessed July 3, 2025, https://www.google.com/finance/quote/DDOG:NASDAQ

- Datadog, Inc. Class A Common Stock (DDOG) Historical Quotes – Nasdaq, accessed July 3, 2025, https://www.nasdaq.com/market-activity/stocks/ddog/historical

- Observability Tools and Platforms Market Size, Share | Industry Report, 2032 – MarketsandMarkets, accessed July 3, 2025, https://www.marketsandmarkets.com/Market-Reports/observability-tools-and-platforms-market-69804486.html

- Market Share and Forecast: Cloud Observability solutions, 2023-2028, Worldwide (Bundle of Two Reports) – GII Research, accessed July 3, 2025, https://www.giiresearch.com/report/qks1637477-market-share-forecast-cloud-observability.html

- Observability Market Size, Report, Share & Competitive Landscape 2030, accessed July 3, 2025, https://www.mordorintelligence.com/industry-reports/observability-market

- hurricanelabs.com, accessed July 3, 2025, https://hurricanelabs.com/blog/cisco-acquired-splunk-cybersecurity/#:~:text=In%20a%20major%20step%20to,shift%20towards%20software%20and%20services.

- Investor Relations – Cisco Completes Acquisition of Splunk, accessed July 3, 2025, https://investor.cisco.com/news/news-details/2024/Cisco-Completes-Acquisition-of-Splunk/default.aspx

- Why Apollo Global and Workday are being added to the S&P 500 – YouTube, accessed July 3, 2025, https://www.youtube.com/watch?v=Zfn-oktxme4

- Apollo Global Management Stock Pulls Back After Hitting All-Time High – Investopedia, accessed July 3, 2025, https://www.investopedia.com/apollo-global-management-workday-stocks-jump-on-s-and-p-500-inclusion-8758086

- Takeaways from the S&P 500 December 2024 rebalancing | Northern Trust Asset Management, accessed July 3, 2025, https://ntam.northerntrust.com/united-states/all-investor/insights/point-of-view/2025/december-sp-500-index-rebalance-market-sentiment-high-tech-trends-continue

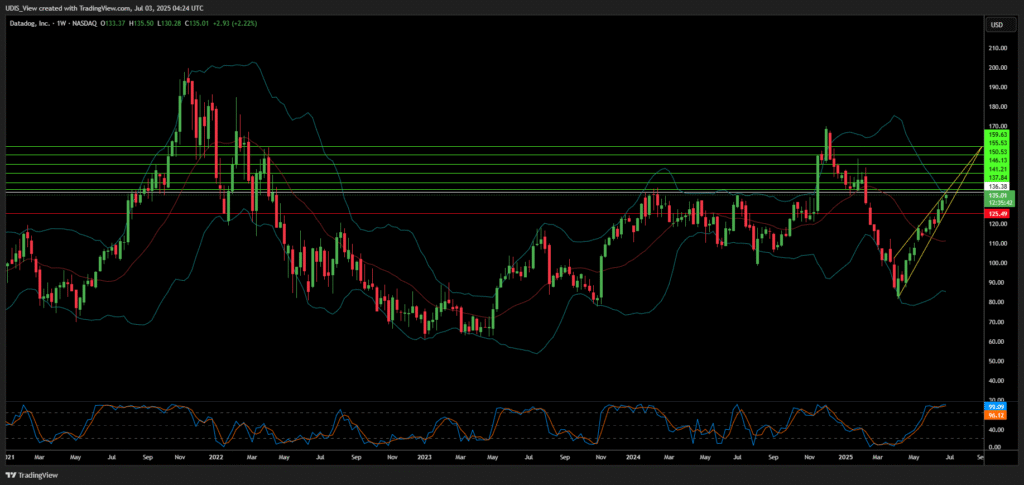

Datadog Long (Buy)

Enter At: 136.38

T.P_1: 137.84

T.P_2: 141.21

T.P_3: 146.13

T.P_4: 150.53

T.P_5: 155.53

T.P_6: 159.63

S.L: 125.49