A New Chapter in US-Mexico Financial Tensions

The recent US Treasury Department sanctions on three Mexican financial institutions – CIBanco, Intercam Banco, and Vector Casa de Bolsa – mark a significant escalation in Washington’s anti-narcotics campaign. This action introduces a new layer of complexity to the already intricate US-Mexico relationship. Specifically targeting alleged fentanyl money laundering, these measures reverberate across financial markets, casting a spotlight on the Mexican peso (USD/MXN) and its future trajectory. This report delves into the multifaceted outlook for the peso, examining the economic fundamentals, geopolitical crosscurrents, and the strategic implications of these unprecedented financial measures.

These sanctions explicitly target financial flows associated with fentanyl trafficking, signaling a notable shift in US enforcement priorities. The focus extends beyond traditional drug money laundering to encompass the entire supply chain of synthetic opioids. This aggressive posture, directed at a key trading partner, represents a novel application of financial leverage. Historically, sanctions have typically targeted geopolitical adversaries or nations with severe human rights abuses. Applying such robust financial tools to a close economic partner over a security issue like fentanyl establishes a significant precedent. It suggests a more assertive, and potentially unilateral, approach from the United States, blurring the lines between economic policy and national security objectives.

The Sanctions Hammer: Washington’s Escalated Anti-Fentanyl Campaign

On June 25, the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) issued historic orders designating CIBanco, Intercam Banco, and Vector Casa de Bolsa as “primary money laundering concerns”.1 These actions represent the first implementation of authorities granted under the Fentanyl Sanctions Act and the FEND Off Fentanyl Act, underscoring a heightened US resolve to disrupt the financial infrastructure supporting illicit opioid trafficking.2

The targeted institutions include CIBanco, a commercial bank with approximately $7 billion in assets, Intercam Banco, with $4 billion in assets, and Vector Casa de Bolsa, a brokerage firm managing nearly $11 billion in assets and ranking among Mexico’s top 10 securities brokers.3 FinCEN alleges these institutions played a “longstanding and vital role” in laundering millions of dollars for Mexico-based cartels, including the Beltran-Leyva Cartel, Jalisco New Generation Cartel (CJNG), Gulf Cartel, and Sinaloa Cartel.3 They also reportedly facilitated payments for fentanyl precursor chemicals originating from China.2 Specific accusations highlight direct involvement: a CIBanco employee allegedly facilitated a $10 million account for a Gulf Cartel member in 2023, while Intercam executives reportedly met with suspected CJNG members to discuss money laundering schemes. Vector, for its part, stands accused of processing over $2 million in laundered proceeds for the Sinaloa Cartel and facilitating bribes to former Mexican security chief Genaro García Luna.4

The immediate impact of these sanctions is severe. They prohibit certain US transactions with the three Mexican firms, effectively severing their access to the American financial system. Experts describe this as a “death blow” for the targeted firms, given its “enormously impactful” nature [User Query]. These prohibitions will become effective 21 days after their publication in the Federal Register.1 While CIBanco and Intercam are relatively small within the broader Mexican banking landscape, and their combined assets constitute less than 3% of total banking assets 6, the assessment of these sanctions as a “death blow” is telling. This severity stems not from the size of the sanctioned entity within its domestic market, but from the indispensable nature of US dollar access for international financial operations. The United States leverages its dollar dominance, and its control over the global payment infrastructure 8, to exert significant extraterritorial pressure. This means even smaller institutions become vulnerable if they rely on dollar transactions, imposing a substantial compliance burden on all financial institutions with a US nexus, regardless of their size.

Furthermore, the explicit mention of Chinese companies facilitating payments for precursor chemicals 5 indicates the US’s comprehensive approach to disrupting the fentanyl supply chain. Fentanyl production in Mexico heavily relies on precursors from China.10 By sanctioning Mexican financial intermediaries involved in these Chinese precursor payments, the US demonstrates its willingness to target any node in the fentanyl supply chain, irrespective of jurisdiction. This could lead to increased scrutiny and potential future sanctions on Chinese entities or financial institutions facilitating such trade. Such actions would further complicate already strained US-China relations and potentially disrupt global supply chains for legitimate chemicals, signaling a holistic and aggressive strategy to combat the fentanyl trade.

Mexico’s Resolute Response: Sovereignty, Scrutiny, and Stability

Mexico’s immediate response to the sanctions has been a calculated mix of diplomatic rejection, domestic investigation, and proactive measures to ensure financial stability. President Claudia Sheinbaum responded sharply, rejecting the allegations and demanding “concrete evidence” from Washington. She asserted Mexico’s sovereignty, stating, “We’re no one’s piñata,” and emphasizing that “Mexico must be respected”.11

Mexico’s Finance Ministry confirmed its notification of the FinCEN investigation but stated it received no “conclusive information” to substantiate the claims [User Query]. President Sheinbaum downplayed the significance of the alleged transfers, emphasizing that they involved “legally constituted Chinese companies” and were part of $139 billion in bilateral trade, characterizing them as routine transactions.11 The sanctioned institutions themselves have also “categorically denied” the allegations.11

Despite this public rejection of the US evidence, Mexico’s National Banking and Securities Commission (CNBV) and Financial Intelligence Unit (UIF) promptly launched their own investigations into the three institutions [User Query]. President Sheinbaum reported finding “administrative infractions” but maintained these were “nothing close to the accusations” from the US Treasury.11 Crucially, on June 26, the CNBV declared temporary management intervention of CIBanco and Intercam Banco. This decisive action aimed “to prevent a possible run on deposits” and protect creditors and depositors.7 This swift temporary takeover of CIBanco and Intercam demonstrates a proactive stance by Mexico to contain potential contagion and protect domestic financial stability, even while publicly disputing the US’s evidence. This dual approach – diplomatic pushback combined with pragmatic domestic risk mitigation – reveals a strategic maneuver. If Mexico genuinely found no evidence of money laundering, the temporary takeover to prevent a “run on deposits” implies a recognition of the

impact of the US sanctions, even if the basis for those sanctions is disputed. Mexico is balancing national sovereignty and political messaging with practical financial stability concerns, indicating a nuanced and complex diplomatic game.

The Mexican banks association quickly asserted that these interventions “don’t represent a systemic risk or affect the stability of the Mexican financial system, which remains solid and well capitalized”.7 Analysts generally concur, noting that the targeted banks account for less than 3% of total banking assets, and the Mexican central bank’s proactive liquidity measures and capital buffers further mitigate systemic collapse.6 The Mexican government’s emphasis on “legally constituted Chinese companies” and “thousands of transfers” [User Query] also highlights a potential friction point in US-Mexico-China trade relations. Mexico implicitly pushes back on the US’s characterization of its trade with China, suggesting that it perceives the US actions as potentially overreaching into its legitimate trade relationships, rather than solely targeting illicit activities. This could strain US-Mexico trade relations beyond the fentanyl issue, particularly if the US continues to scrutinize Mexico’s trade with China for dual-use goods or financial flows. This underscores the complexity of disentangling legitimate commerce from illicit finance in global supply chains.

The Peso’s Economic Compass: Interest Rates, Trade, and Capital Flows

The Mexican peso’s performance hinges on a combination of domestic economic policy, bilateral trade dynamics, and global risk sentiment. While the recent sanctions introduce a new variable, the peso’s underlying drivers remain critical for its outlook.

Mexico’s central bank (Banxico) recently maintained interest rates at 11%, significantly above US rates (5.25% for the Federal Reserve), creating a “powerful positive carry” for those shorting USD and going long MXN.13 This substantial interest rate differential has been a primary factor in the peso’s recent strength. As of June 25, 2025, the USD/MXN traded around 18.99, reflecting a nearly 10% year-to-date appreciation for the peso.13

However, Banxico cut its policy rate by 50 basis points to 8.5% in May 2025, with expectations of further cuts to approximately 8% by year-end, signaling a prioritization of economic stability over inflation control.14 The Federal Reserve, conversely, has maintained a steady rate around 4.5%.15 This growing divergence in monetary policy between Banxico’s dovish stance and the Fed’s hawkish consistency poses a significant long-term risk to the peso’s carry trade attractiveness. While Mexico’s rate remains higher, a trend of cuts erodes the perceived attractiveness and stability of that higher yield, making US fixed-income instruments more appealing due to policy stability.15 Sustained Banxico easing could therefore lead to a gradual but persistent weakening of the peso, as investors seek more stable, albeit lower, returns in the US. This erosion of investor confidence could ultimately outweigh the current carry trade benefits.

Mexico’s close trade ties with the US mean shifts in trade policy and tariffs significantly impact the peso.17 Former US President Donald Trump’s threat of 25% punitive tariffs on Mexican imports, aimed at spurring action on fentanyl flows, highlights ongoing trade tensions.18 Such tariffs could slash Mexico’s GDP by 16%, with the automotive industry particularly vulnerable.18 However, the peso’s depreciation can offset a portion of tariff impacts, making Mexican goods cheaper for US buyers.18 The interplay between potential US tariffs and peso depreciation creates a complex hedging mechanism, but it does not fully neutralize the economic damage. While a 23% peso depreciation might effectively neutralize 23 percentage points of a 25% tariff for US buyers 19, this is an effective cost reduction, not a complete elimination of economic impact for Mexico. Peso depreciation also increases imported input costs for Mexican industries 19, and tariffs can still significantly reduce GDP.18 Mexico thus faces a challenging scenario: either the peso strengthens, making exports more expensive and tariffs more impactful, or the peso depreciates, partially mitigating tariffs but increasing import costs and potentially fueling inflation. This highlights the deep vulnerability of Mexico’s trade-dependent economy to US policy.

Mexico also benefits from nearshoring trends, gaining US market share from China, though uncertainty around USMCA renegotiations tempers this optimism.14 Remittances are Mexico’s largest single source of foreign income, totaling $63.3 billion in 2023 and accounting for 4.5% of its GDP. This inflow, driven by the strong US labor market, provides a stable and significant source of foreign currency, supporting the peso.21 Mexico’s status as a leading oil exporter means oil price recovery strengthens fiscal and trade accounts, further benefiting the MXN.13

Key Economic Indicators & Interest Rate Differentials (US vs. Mexico)

This comparative table provides a concise overview of the fundamental economic conditions influencing the USD/MXN exchange rate. Finance professionals can quickly grasp the prevailing interest rate differential, a primary driver of the carry trade, and contextualize central bank decisions within the broader inflation and unemployment landscape. This side-by-side analysis highlights the divergence in monetary policy and economic health between the two nations, directly informing assessments of capital flows and currency attractiveness.

| Indicator | United States (as of June 2025) | Mexico (as of June 2025) | Differential (Mexico – US) |

| Policy Interest Rate | 4.50% (Fed Funds) 15 | 8.00% (Banxico) 15 | +3.50% |

| Inflation Rate (May 2025) | 2.40% 22 | 4.42% 22 | +2.02% |

| Unemployment Rate (May 2025) | 4.20% 22 | 2.70% 22 | -1.50% |

| GDP Growth Forecast (2025) | (Implicitly positive, strong consumer spending 19) | <1% 14 | (Mexico lower) |

Geopolitical Crosscurrents: Beyond Economics

The US sanctions on Mexican banks are not isolated financial measures; they represent a significant geopolitical maneuver within the broader context of US-Mexico relations and the global “weaponization of the dollar.”

These sanctions constitute the “latest phase” in Washington’s intensified campaign against fentanyl, a synthetic opioid responsible for tens of thousands of American deaths annually [User Query]. The US Treasury has also frozen assets of major cartel leaders and designated cartels as Foreign Terrorist Organizations (FTOs) and Specially Designated Global Terrorists (SDGTs).4 This campaign coincides with broader US-Mexico trade tensions, including the threat of 25% punitive tariffs on Mexican imports.18 Experts note the fentanyl context is “significant,” signaling the US will “attack it from all fronts” [User Query]. This demonstrates a “whole-of-government” approach by the US, combining financial sanctions, trade threats, and law enforcement actions to combat fentanyl, rather than solely relying on traditional security cooperation.

The US-Mexico security relationship is “intertwined geographically, economically, and politically,” with over $800 billion in goods flowing across the border annually.23 Cooperation has evolved from counter-narcotics efforts to counter-terrorism post-9/11, now returning to focus on Transnational Criminal Organizations (TCOs) due to the opioid crisis.23 Despite existing frameworks like the 2021 Bicentennial Framework, “deficiencies in intelligence cooperation stem from structural issues,” including Mexican mistrust of US operations and US concerns about corruption and cartel infiltration.10 Mexico has taken steps such as extraditing alleged drug kingpin Ovidio Guzmán, launching a system to track diversion of dual-use chemicals, and enacting a constitutional reform banning fentanyl production.10 However, the US’s unilateral application of sanctions and Mexico’s strong pushback on sovereignty expose a fundamental tension in their security cooperation. The US imposes sanctions citing “reasonable grounds” without publicly presenting clear evidence.11 Mexico, in turn, demands evidence and asserts its sovereignty, stating “We’re no one’s piñata”.11 This diplomatic friction can erode the trust necessary for effective intelligence sharing and joint operations, potentially leading to a more strained and less collaborative security relationship. Mexico may prioritize national sovereignty over deeper integration with US anti-narcotics efforts, potentially manifesting as increased reluctance to share sensitive intelligence or to allow US agencies greater operational scope within its territory.

The dollar’s “outsized role” in the global financial system grants the US “significant leverage” to apply financial sanctions.8 Such sanctions can prohibit trade, cause economic hardship, and effectively “shut a whole country out of the global economy” due to US control over the SWIFT payment infrastructure and the US banking system.8 The number of US sanctions has “increased drastically” in recent years.8 As a response, sanctioned entities increasingly utilize digital assets like cryptocurrencies to evade controls.5 The “weaponization of the dollar” through sanctions, exemplified by this case and historical precedents, encourages de-dollarization efforts and the search for alternative financial systems, potentially undermining the dollar’s long-term global dominance. When countries perceive their dollar reserves or access to the US financial system as vulnerable to unilateral political action, they seek alternatives.25 This includes diversifying currency reserves and exploring non-dollar payment systems.9 While the dollar’s dominance remains robust, repeated and expansive use of financial sanctions, particularly against trading partners or for issues perceived as domestic security rather than international threats, creates incentives for other nations to reduce their reliance on the dollar. This could lead to a gradual “fractionalization of the global financial system” 25, with more regional currency blocs or alternative payment infrastructures emerging. For the MXN, this might mean less direct exposure to future US financial leverage, but also potentially reduced liquidity and integration with global markets. This poses a long-term challenge to the US’s financial hegemony.

Historical parallels illustrate the varied impacts of US sanctions on currencies:

- Russia (Ruble): Following sanctions in 2022, the ruble initially lost nearly half its value but later appreciated due to capital controls and trade flow adjustments.26 However, recent US sanctions on Russian lenders caused another sharp drop, highlighting structural limitations and leading to increased inflation risk.27

- Iran (Rial): The US “maximum pressure” campaign, including sanctions on Iran’s oil exports, caused the rial to collapse to a record low, losing over half its value in eight months. This signaled a profound loss of faith in the regime’s economic management.28

USD/MXN Outlook: Navigating Volatility and Future Trajectories

The Mexican peso’s outlook remains a complex interplay of its robust economic fundamentals, the evolving geopolitical landscape with the US, and global market sentiment. Recent sanctions introduce a new layer of uncertainty, but analysts offer clear trajectories.

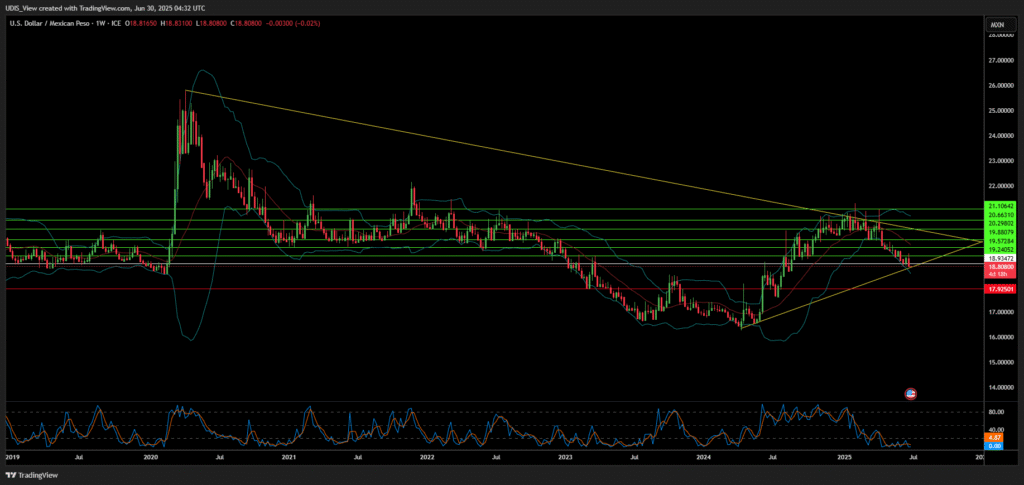

As of June 25, 2025, the USD/MXN traded around 18.99, marking a nearly 10% year-to-date appreciation for the peso.13 Technical analysis suggests a bearish bias for USD/MXN (peso strengthening), with key support levels identified at 18.83-19.00.15 However, the current downtrend shows signs of exhaustion, with bullish divergence in the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) hovering around the zero line. This indicates a potential technical transition or sideways movement in the near term.15 Key resistance levels for the pair are 19.40-19.42, with a critical psychological level at 20.00.15 The current technical indicators, which suggest a loss of bearish momentum for USD/MXN, align with the fundamental expectation of peso weakening due to monetary policy divergence. These technical signals are not merely random market noise; they reflect the underlying shift in fundamental drivers. As the interest rate differential narrows and investor confidence in the peso’s yield erodes, the selling pressure on USD/MXN (peso strengthening) naturally diminishes. This confluence of technical and fundamental signals suggests a high probability of a shift in the USD/MXN trend, making the current levels potentially unsustainable for the peso. Investors should prepare for a period of dollar strength.

Analysts generally expect the USD/MXN rate to rise in the short term (2025), reaching approximately 20.42 in two months (July 2025) and 20.52 by Q3 2025.17 This indicates a bullish outlook for the USD against the MXN in the immediate future, aligning with anticipated increases in US yields from Federal Reserve actions, which typically bolster the USD and strain the MXN.13 Looking further ahead, forecasts anticipate modest peso depreciation to 20.8/USD by 2026 under a base-case scenario of stable global conditions and responsive central banks.13 Long-term projections to 2030 suggest a gradual but steady appreciation of the dollar against the peso, with the USD/MXN rate reaching around 20.36.17

Several factors will continue to influence future movements:

- Monetary Policy Divergence: Continued Banxico rate cuts against a steady Fed stance will likely weaken the peso’s carry trade appeal.15

- Trade Shifts: The threat of US tariffs 18 and the pace of nearshoring 14 will remain critical determinants.

- Geopolitical Developments: Escalations in the anti-fentanyl campaign, particularly if they involve broader trade measures or impact more significant financial institutions, could trigger increased volatility and capital flight.2 Global risk aversion typically strengthens the safe-haven dollar against the “risk-on” peso.13

- Oil Prices & Remittances: Sustained high oil prices and robust remittance inflows would provide underlying support for the peso.13

The repeated mention of US President Donald Trump’s past and threatened future actions, including tariffs and Foreign Terrorist Organization designations 4, highlights a critical, unquantifiable variable for the peso’s outlook: the upcoming US election cycle. Trump’s previous policies, such as trade tariffs and an aggressive stance on Mexico, demonstrably impacted the peso.13 His potential return to office could re-ignite these pressures or introduce new, unpredictable policies. The current sanctions were, in fact, implemented under the “Trump administration”.11 The political uncertainty surrounding the US presidency thus introduces a significant, unquantifiable risk factor for the Mexican peso. Investors must monitor US election developments closely, as a shift in administration could dramatically alter the US-Mexico relationship and, consequently, the peso’s trajectory. This makes long-term forecasts particularly susceptible to political shifts.

USD/MXN Forecasts (Short-term, Medium-term, Long-term)

This table offers concrete forecasts across different time horizons, providing finance magazine readers with essential data for investment and business planning. Presenting these projections alongside their key influencing factors allows for a comprehensive understanding of expected currency movements, aiding strategic decision-making for businesses and investors.

| Time Horizon | Forecast (USD/MXN) | Key Influencing Factors |

| Current (June 25, 2025) | ~18.99 13 | Strong carry trade, recent appreciation |

| Short-term (July 2025) | ~20.42 17 | Anticipated US yield increases, Banxico easing |

| Short-term (Q3 2025) | ~20.52 17 | Continued monetary policy divergence, global risk sentiment |

| Medium-term (2026) | ~20.80 13 | Base-case scenario, stable global conditions, responsive central banks |

| Long-term (2030) | ~20.36 17 | Gradual dollar appreciation, economic fundamentals, interest rate trends |

Conclusion

The US sanctions on Mexican banks represent a significant escalation in the anti-fentanyl campaign, employing financial tools against a key trading partner in an unprecedented manner. While the targeted Mexican institutions are relatively small, the “death blow” assessment underscores the critical reliance of Mexican financial entities on access to the US dollar system, highlighting the potent extraterritorial reach of US financial power. Mexico’s response has carefully balanced diplomatic defiance with pragmatic measures to ensure domestic financial stability, revealing a complex strategy to assert sovereignty while mitigating economic fallout. The Mexican government’s defense of its trade ties with China, despite US allegations, also points to potential future friction in the broader US-Mexico-China trade relationship.

The Mexican peso’s outlook remains fundamentally driven by interest rate differentials, trade dynamics, and global risk sentiment. While the peso has demonstrated recent strength due to attractive carry trade opportunities, the growing divergence in monetary policy between a dovish Banxico and a hawkish Fed poses a significant risk to this appeal, suggesting a likely depreciation of the peso in the short to medium term. The specter of US tariffs, particularly under a potential future Trump administration, introduces further volatility and economic vulnerability for Mexico, despite the peso’s capacity for depreciation to offer a partial offset. This underscores Mexico’s deep economic reliance on its northern neighbor.

Geopolitically, the US’s unilateral application of sanctions and Mexico’s strong pushback on sovereignty expose underlying tensions that could hinder future security cooperation, even with shared objectives. This assertive use of financial leverage by the US also contributes to a global trend encouraging de-dollarization efforts and the exploration of alternative financial systems, potentially challenging the dollar’s long-term global dominance. Investors and policymakers must closely monitor these intertwined economic and geopolitical currents, particularly the unpredictable influence of the upcoming US election cycle, as they will define the Mexican peso’s trajectory and the broader contours of the US-Mexico relationship.

References

- FinCEN Sanctions Three Mexican Financial Institutions – Unwary Transactions May Trigger Prohibited Conduct with Broad Legal Implications – Duane Morris, accessed June 30, 2025, https://www.duanemorris.com/alerts/fincen_sanctions_three_mexican_financial_institutions_unwary_transactions_may_trigger_0625.html

- Sanctions on Mexican Banks Signal a New Era of Regulatory Risk for Cross-Border Financial Flows – AInvest, accessed June 30, 2025, https://www.ainvest.com/news/sanctions-mexican-banks-signal-era-regulatory-risk-cross-border-financial-flows-2506/

- Treasury Issues Historic Orders under Powerful New Authority to Counter Fentanyl, accessed June 30, 2025, https://home.treasury.gov/news/press-releases/sb0179

- US blocks money transfers by 3 Mexico-based financial institutions accused of aiding cartels, accessed June 30, 2025, https://apnews.com/article/cartels-fentanyl-treasury-department-cibanco-vector-intercam-banks-59bddc26a923e0849e438cbaf35ad5b7

- FinCEN Targets Three Mexico-Based Financial Institutions for Laundering Opioid Proceeds, accessed June 30, 2025, https://www.trmlabs.com/resources/blog/fincen-targets-three-mexico-based-financial-institutions-for-laundering-opioid-proceeds

- The Sanctioned Crossroads: Navigating Risk and Reward in Latin American Banking Stocks, accessed June 30, 2025, https://www.ainvest.com/news/sanctioned-crossroads-navigating-risk-reward-latin-american-banking-stocks-2506/

- Mexico Assumes Control of Two Small Banks Following U.S. Treasury Sanctions, accessed June 30, 2025, https://www.morningstar.com/news/dow-jones/202506267549/mexico-assumes-control-of-two-small-banks-following-us-treasury-sanctions

- Weaponisation of the dollar: Explained – Positive Money, accessed June 30, 2025, https://positivemoney.org/uk-global/update/weaponisation-of-the-dollar-explained/

- To Infinity and Beyond: US Dollar-Based Jurisdiction in the US Sanctions Context – Susan Emmenegger, accessed June 30, 2025, https://www.ziv.unibe.ch/unibe/portal/fak_rechtwis/c_dep_private/ziv/content/e7688/e50302/e150986/e196606/e1215672/Emmenegger_Zuber_SZW2022_DollarBasedJurisdiction_ger.pdf

- Illicit Fentanyl and Mexico’s Role – Congress.gov, accessed June 30, 2025, https://www.congress.gov/crs-product/IF10400

- Mexico’s president slams sanctions on Mexican banks by Trump administration | AP News, accessed June 30, 2025, https://apnews.com/article/vector-intercam-cibanco-cartels-money-laundering-sheinbaum-mexico-banks-c2ed5a2aadf277a2d13e3b577c3faa54

- Mexico’s president pushes back against U.S. sanctions on Mexican banks accused of money laundering – KJZZ, accessed June 30, 2025, https://www.kjzz.org/fronteras-desk/2025-06-26/mexicos-president-pushes-back-against-u-s-sanctions-on-mexican-banks-accused-of-money-laundering

- How Much Is the Dollar in Mexico? Rates, History, Outlook | EBC Financial Group, accessed June 30, 2025, https://www.ebc.com/forex/how-much-is-the-dollar-in-mexico-rates-history-outlook

- Our economic outlook for Mexico – Vanguard, accessed June 30, 2025, https://corporate.vanguard.com/content/corporatesite/us/en/corp/vemo/vemo-mexico.html

- USD/MXN Analysis: Mexican Peso Strengthens Ahead of Banxico Rate Decision, accessed June 30, 2025, https://www.forex.com/ie/news-and-analysis/usd-mxn-analysis-mexican-peso-strengthens-ahead-of-banxico-rate-/

- USD/MXN Outlook: Mexican Peso Shows Weakness Following Fed Decision – FOREX.com, accessed June 30, 2025, https://www.forex.com/en-us/news-and-analysis/usdmxn-outlook-mexican-peso-shows-weakness-following-fed-decision/

- Dollar to Peso Forecast: What to Expect Through 2030 | EBC Financial Group, accessed June 30, 2025, https://www.ebc.com/forex/dollar-to-peso-forecast-what-to-expect-through

- Analysis: The potential economic effects of Trump’s tariffs and trade war, in 9 charts – PBS, accessed June 30, 2025, https://www.pbs.org/newshour/economy/analysis-the-potential-economic-effects-of-trumps-tariffs-and-trade-war-in-9-charts

- Economic Impact Analysis of US Tariffs on Mexico and Mitigating Factors | Wilson Center, accessed June 30, 2025, https://www.wilsoncenter.org/article/economic-impact-analysis-us-tariffs-mexico-and-mitigating-factors

- Economic Impact Analysis of US Tariffs on Mexico and Mitigating Factors | Wilson Center, accessed June 30, 2025, https://plasticpipeline.wilsoncenter.org/article/economic-impact-analysis-us-tariffs-mexico-and-mitigating-factors

- Understanding the Impact of Remittances on Mexico’s Economy and Safeguarding Their Future Impact – CSIS, accessed June 30, 2025, https://www.csis.org/analysis/understanding-impact-remittances-mexicos-economy-and-safeguarding-their-future-impact

- Mexican Peso – Quote – Chart – Historical Data – News – Trading Economics, accessed June 30, 2025, https://tradingeconomics.com/mexico/currency?&ei=g91eva3nfqr6ywpc1yiw&ved=0cekqfjajobq&usg=afqjcne1wieiwdwt7grz4npzdrar4sbw0q/survey

- Uncertain Times Ahead for U.S.-Mexico Intelligence Cooperation | Lawfare, accessed June 30, 2025, https://www.lawfaremedia.org/article/uncertain-times-ahead-for-u.s.-mexico-intelligence-cooperation

- The Effectiveness of Economic Sanctions At Risk from Digital Asset Growth | U.S. GAO, accessed June 30, 2025, https://www.gao.gov/blog/effectiveness-economic-sanctions-risk-digital-asset-growth

- Financial sanctions and the US-dollar – EconStor, accessed June 30, 2025, https://www.econstor.eu/bitstream/10419/317913/1/vaw-2025-1457704.pdf

- Sanctions and the Exchange Rate – Intereconomics, accessed June 30, 2025, https://www.intereconomics.eu/contents/year/2022/number/3/article/sanctions-and-the-exchange-rate.html

- The Kremlin Has Limited Options to Shore Up the Ruble, accessed June 30, 2025, https://carnegieendowment.org/russia-eurasia/politika/2024/12/russia-economy-ruble-trouble?lang=en

- ‘Maximum Pressure’: Iran’s Rial Hits Record Low Due to U.S. Sanctions – FDD, accessed June 30, 2025, https://www.fdd.org/analysis/2025/03/26/maximum-pressure-irans-rial-hits-record-low-due-to-u-s-sanctions/

- Treasury Sanctions Iranian Network Laundering Billions for Regime Through Shadow Banking Scheme, accessed June 30, 2025, https://home.treasury.gov/news/press-releases/sb0159

- Sanctions on Mexican Banks: A Catalyst for Strategic Shifts in Financial Services Investing, accessed June 30, 2025, https://www.ainvest.com/news/sanctions-mexican-banks-catalyst-strategic-shifts-financial-services-investing-2506/

USD/MXN Long (Buy)

Enter At: 18.93472

T.P_1: 19.24052

T.P_2: 19.57284

T.P_3: 19.88079

T.P_4: 20.29802

T.P_5: 20.66310

T.P_6: 21.10642

S.L: 17.92501