The natural gas market currently navigates a period of profound volatility, with prices experiencing a notable surge. This upward trajectory stems primarily from escalating geopolitical tensions in the Middle East, specifically the intensifying conflict between Iran and Israel, and the looming potential for direct US military involvement. These dynamics are fundamentally reshaping global energy supply perceptions and investor sentiment. Iran, despite possessing vast natural gas reserves, operates under significant constraints as an exporter, rendering its existing, albeit limited, export capacity highly susceptible to disruption. A protracted conflict, extending into the crucial winter months, carries substantial implications for global gas prices, particularly for energy-dependent regions like Europe. This report dissects the intricate interplay of these factors, offering a comprehensive analysis of the market’s current state and its potential future trajectory.

The Shifting Sands of Natural Gas Markets

The natural gas market has recently exhibited an aggressive bullish trend, challenging established seasonal patterns and signaling a significant recalibration of risk.

Current Natural Gas Price Trends and Market Sentiment

Natural gas markets are currently testing the critical $4 per MMBtu level, a price point that has historically served as both strong resistance and support. This threshold holds considerable psychological significance for traders and analysts. Recent trading sessions reveal a pronounced upward momentum, with prices surging over 3% in a single day and registering weekly gains exceeding 19%, alongside monthly increases over 24%.1 This robust performance indicates a strong underlying bullish sentiment. The market’s behavior is notably “headline driven,” reacting acutely to unfolding developments in Iran. Thin trading volumes on specific days, such as the Juneteenth holiday in the United States, amplify this sensitivity, allowing news events to exert a disproportionate influence on price movements.3 Analysts observe “bullish momentum” and “persistent buying pressure,” suggesting a fundamental shift in the forces driving the market.3

Seasonal Factors Versus Current Extraordinary Circumstances

Typically, the late June period sees natural gas prices perform poorly due to lower demand associated with milder weather. However, current market conditions are distinct, overriding these historical seasonal trends.3 The market’s unexpected strength, despite conventional seasonality, underscores that broader macroeconomic and geopolitical conditions have fundamentally altered the pricing playbook for natural gas.3

The market’s current behavior, defying the usual seasonal downturn, highlights that an extraordinary, non-seasonal factor now exerts dominant influence. The consistent emphasis on the “war in Iran” and “Middle East turmoil” as primary drivers points directly to geopolitical risk as this overriding element. This implies a significant shift in market dynamics where risk premiums, linked to potential supply disruptions, now outweigh traditional supply-demand fundamentals typically dictated by weather or storage levels. Consequently, investors must now prioritize geopolitical intelligence alongside conventional energy market analysis.

Furthermore, the $4 price level is not merely a technical resistance or support point; it carries considerable psychological weight [User Query]. When combined with a market highly responsive to headlines and characterized by thin trading volumes, any news, particularly concerning conflict, can trigger disproportionate price movements.3 The market’s “aggressive accumulation” into daily closes further suggests that traders are proactively positioning themselves ahead of potential escalations, which can lead to self-fulfilling price movements.3 This creates a highly unstable trading environment where market sentiment, fueled by speculative activity and fear, can rapidly push prices beyond their fundamental valuations. This underscores the critical importance of robust risk management and acknowledges the potential for sharp price reversals if geopolitical tensions unexpectedly de-escalate.

Table 1: Key Natural Gas Price Movements (Recent & Historical)

| Timeframe | Percentage Change | Current Price (USD/MMBTU) | Significance of $4 Level |

| 1 Day | +3.15% | 4.088 | Psychological & Technical Resistance/Support |

| 1 Week | +19.43% | ||

| 1 Month | +24.24% | ||

| 6 Months | +25.29% | ||

| Year-to-Date | +1.89% | ||

| 1 Year | +47.99% | ||

| 5 Years | +154.15% |

Data as of mid-June 2025.1

Geopolitical Catalysts: Iran, Israel, and the US

The escalating conflict in the Middle East, centered on Iran and Israel, with the added dimension of potential US involvement, serves as the primary driver behind the current natural gas market surge.

The Iran-Israel Conflict: A New Energy Flashpoint

The long-standing rivalry between Israel and Iran has intensified into a broader, more perilous regional conflict, posing a direct threat to global energy markets.5 Israel has specifically targeted Iran’s energy infrastructure, including the South Pars gas field – the world’s largest gas field, which Iran shares with Qatar – the Fajr Jam gas plant, and various oil facilities.6 These attacks aim to degrade Iran’s energy production capabilities and exert significant economic pressure. Following the commencement of Israeli attacks, fears of a wider Middle East conflict immediately propelled oil prices higher by nearly 7% in a single day, with prices maintaining these elevated levels.3 Natural gas prices, while initially reacting with some latency, quickly followed suit.3 Iran has retaliated with missile barrages targeting Israeli cities, further escalating the cycle of violence.6 This conflict raises serious concerns about potential disruptions in the Strait of Hormuz, a critical maritime chokepoint for global energy flows.6

The direct targeting of Iran’s gas facilities, particularly the South Pars field, represents a significant shift in the conflict’s energy dimension. Historically, Middle East conflicts primarily impacted oil through risks to transit routes. However, the current actions extend beyond hypothetical transit risks to tangible supply disruption threats at the source of gas production.6 This adds a direct, gas-specific risk premium to the market, distinct from broader oil market concerns. It also signals a willingness to broaden the scope of targets, increasing the perceived risk to all Iranian energy exports.

The US Role and Its Market Reverberations

The potential for direct US military intervention casts a long shadow over energy markets. Statements from President Trump regarding potentially joining Israel’s strikes on Iran, combined with the deployment of assets like the USS Nimitz aircraft carrier, signal a high-risk equilibrium.3 This US involvement, or even the ambiguity surrounding it, significantly intensifies the market’s perception of risk, directly influencing energy prices.3 While US officials have reportedly vetoed plans to target Iran’s Supreme Leader, indicating a complex and potentially restraining role, the administration has also prepared for possible strikes.10 The US role is critical, as direct American participation would almost certainly escalate the conflict to a new level, potentially including attacks on deeply buried enrichment facilities or a blockade of the Strait of Hormuz, which would invite further American response.14

President Trump’s public statements, characterized by uncertainty (“may or may not join,” “target Iran’s leadership”), and the White House’s fluctuating timelines for decision-making, rather than providing clarity, generate significant ambiguity.3 In a market driven by headlines, this ambiguity means that every comment, or even the lack thereof, is subject to intense interpretation, leading to heightened market anxiety and price volatility.3 The visible deployment of military assets further solidifies the potential for intervention. This dynamic ensures that the US posture, even without immediate military action, functions as a constant source of market uncertainty. This uncertainty translates into a sustained geopolitical risk premium, as traders price in the possibility of sudden, drastic changes in the conflict’s scope and intensity based on political rhetoric, rather than solely on confirmed military actions.

Iran’s Pivotal Role in Global Gas Supply

Iran holds a significant, yet often underestimated, position in the global natural gas landscape, though various factors constrain its full influence.

Iran’s Natural Gas Prowess

Iran possesses the world’s second-largest proven natural gas reserves, estimated at 1,200 trillion cubic feet (34 trillion cubic meters), which accounts for 16% of global reserves and 45% of OPEC’s total.9 The nation ranks as the third-highest producer of natural gas globally, trailing only the US and Russia. In 2023, its production reached 9,361 billion cubic feet (265 billion cubic meters), representing at least 6% of global output.9 Iran’s largest gas field, and indeed the largest in the world, is the South Pars field, which it shares with Qatar. This colossal reservoir is the source of the majority of Iran’s gas production.9 Other important gas fields, primarily concentrated in the south along the Gulf, include North Pars, Golshan, Ferdowsi, Kangan, and Nar [User Query].

Sanctions, Production, and Export Realities

Despite its immense hydrocarbon reserves, years of international sanctions and limited foreign investment have prevented Iran’s oil and gas production from reaching its full potential, severely curtailing its natural gas exports.7 Due to these sanctions, Iran relies heavily on domestic companies for development, which also restricts its access to advanced technology.9 In 2023, Iran exported approximately 15.8 billion cubic meters (bcm) of natural gas, a modest figure compared to its substantial domestic consumption of 255.5 bcm.9 Iran also contends with internal energy shortages, declining production, outdated equipment, and insufficient infrastructure investment, despite its abundant resources. The country heavily depends on natural gas for domestic consumption, including electricity generation and household use, often leading to overconsumption dueenced by subsidies and resulting in rolling blackouts.9

Iran’s possession of the world’s second-largest natural gas reserves and its ranking as the third-largest producer presents a striking paradox: despite this immense resource wealth, its export volumes remain remarkably low, and it faces domestic energy shortages.9 This stark contrast highlights a fundamental inefficiency. It signifies that while Iran is a resource superpower, it does not function as an export superpower in natural gas. The primary constraints are not geological but rather political and infrastructural, stemming from international sanctions, a lack of foreign investment, outdated technology, and high domestic consumption. Therefore, even if the current conflict were to ease, Iran’s capacity to significantly boost global gas supply in the short-to-medium term remains severely limited without a fundamental shift in its international relations and investment climate. This makes its existing, albeit limited, export capacity even more sensitive to any disruption.

Furthermore, Iran’s domestic consumption of natural gas, at 255.5 bcm in 2023, vastly surpasses its exports of 15.8 bcm.9 The nation’s heavy reliance on gas for electricity and household heating, even experiencing “rolling power blackouts” due to overconsumption and insufficient investment, underscores this.9 This high domestic demand acts as a structural ceiling on potential export growth. Any disruption to production, even if not directly targeting export infrastructure, could compel Iran to prioritize internal needs over external sales. This inherent domestic demand pressure makes Iran an unreliable swing supplier, even if sanctions were to ease. It also implies that attacks on gas fields could rapidly trigger internal energy crises within Iran, potentially increasing the regime’s desperation or willingness to escalate the conflict.

Table 2: Iran’s Energy Profile at a Glance (Natural Gas & Oil)

| Category | Metric | Value | Global Rank / OPEC Rank | Notes |

| Natural Gas | Proven Reserves | 1,200 Tcf (34 Tcm) | 2nd Globally | 16% of global, 45% of OPEC reserves 9 |

| Production (2023) | 9,361 Bcf (265 Bcm) | 3rd Globally | At least 6% of global production 9 | |

| Exports (2023) | 15.8 Bcm | N/A | Severely curtailed by sanctions 9 | |

| Domestic Consumption (2023) | 255.5 Bcm | N/A | Heavy reliance, leads to shortages 9 | |

| Key Gas Fields | South Pars (World’s Largest), North Pars, Golshan, Ferdowsi, Kangan, Nar | N/A | South Pars shared with Qatar 9 | |

| Oil | Proven Crude Oil Reserves | 157 Billion Barrels | 3rd Globally | 12% of world’s, 24% of Middle East’s [User Query] |

| Production (Crude Oil, 2023) | 3.3 Million Bpd | 9th Globally, 4th in OPEC | Well below full potential due to sanctions 7 | |

| Exports (Crude & Refined Fuel) | ~2 Million Bpd | N/A | $53bn net revenue in 2023 [User Query] | |

| Key Oil Fields | Ahvaz, Gachsaran, Marun, Agha Jari, Bibi Hakimeh, Karanj | N/A | Kharg Island main export terminal [User Query] | |

| Main Refineries | Abadan, Tehran, Isfahan, Bandar Abbas, Arak, Tabriz | N/A | Process various crude types [User Query] |

Data compiled from various sources, primarily User Query and.9

The Strait of Hormuz: A Critical Chokepoint

The Strait of Hormuz represents an indispensable artery for global energy flows, and any disruption to its passage would carry severe implications for natural gas markets.

Strategic Importance of the Strait of Hormuz for Global Energy Flows

The Strait of Hormuz, a narrow maritime chokepoint situated between Iran and Oman, stands as the world’s single most important oil passageway.15 This 39 km strait facilitates the transit of over 20% of the world’s seaborne oil and approximately one-third of the world’s liquefied natural gas (LNG).12 It serves as the sole route to the open ocean for a substantial portion of global oil production and LNG originating from key producers, most notably Qatar.11 Asian markets, including China, India, Japan, and South Korea, demonstrate particular reliance on this waterway, receiving 84% of crude oil and condensate, and 83% of LNG that transited the Strait in 2024.15

Potential Implications of Disruption or Blockade on Natural Gas Supply

A complete closure of the Strait of Hormuz could trigger a surge in oil prices to $120 per barrel, and even partial disruptions have already propelled West Texas Intermediate (WTI) crude to multi-year highs.6 For natural gas, a blockade would prove catastrophic, especially for Europe, which has grown heavily dependent on LNG imports from the Middle East and North America following the significant reduction in Russian pipeline gas supplies since 2022.11 Iran possesses the capability to block the Strait, a wartime measure that could specifically impede LNG shipping from Qatar, the world’s largest LNG exporter.11 Such a disruption, or even the persistent threat of it, embeds significant risk premiums into energy prices.3 While Saudi Arabia and the UAE possess some pipeline infrastructure capable of bypassing the Strait (estimated at 2.6 million barrels per day capacity), this primarily applies to oil and offers only limited relief for LNG flows.15 Furthermore, a blockade would severely damage Iran’s own oil and gas exports, creating considerable tension with foreign partners like China, who rely heavily on Persian Gulf oil.14

The consistent emphasis on the Strait of Hormuz’s criticality for both oil and LNG, with one-third of global LNG passing through it, highlights a particular vulnerability for natural gas. While oil possesses some bypass options, LNG lacks comparable alternative routes.11 This means that a disruption in the Strait of Hormuz would disproportionately impact global LNG supply security compared to oil, given the absence of significant alternative transit infrastructure for gas. Europe, having strategically diversified away from Russian pipeline gas towards LNG, now faces a new, concentrated chokepoint risk. This makes its energy security highly susceptible to instability in the Middle East, establishing a direct causal link between the Iran-Israel conflict and European energy prices.

While Iran has indeed threatened to close the Strait, a complete and prolonged blockade is a highly risky and potentially self-defeating option for the nation.17 Such an action would “strangulate Iran’s own oil exports, further damaging its already very fragile economy,” and would “anger Gulf states” while causing “tension with China”.14 The severe economic blowback and substantial international backlash, particularly from major energy consumers like China, might deter Iran from undertaking such a drastic measure, or at least limit its duration. This implies that while the risk premium associated with a potential closure remains high, the actual likelihood of a complete, long-term blockade might be lower than perceived, though even temporary disruptions would trigger severe market consequences.

Long-Term Implications: Winter Outlook and Global Supply Dynamics

The ongoing conflict in the Middle East casts a long shadow over the future of natural gas prices, particularly as the crucial winter months approach, influencing global supply, demand, and storage dynamics.

Europe’s Vulnerability and US LNG Exports

Europe’s reliance on global liquefied natural gas (LNG) flows has steadily increased, a direct consequence of losing the majority of its Russian pipeline gas supply since the 2022 Russia-Ukraine conflict.11 This structural shift renders European prices highly vulnerable to geopolitical influences and disruptions in critical LNG transportation routes, such as the Strait of Hormuz.11 US LNG exports have become indispensable for Europe, with North America projected to contribute approximately 85% of global incremental LNG supply in 2025, driven by major projects like Plaquemines LNG and the Corpus Christi Stage 3 expansion.19 Furthermore, Ukrainian gas imports have surged by 26% due to Russian attacks on its storage facilities, creating a “stealth demand source for LNG” that indirectly tightens European inventory and escalates pressure on US gas supply.3 The widening arbitrage between Ukrainian and Dutch TTF gas prices incentivizes European exporters to bridge this gap, thereby sustaining pressure on global LNG availability into the third quarter and disproportionately benefiting US natural gas exporters.3

Europe’s energy security for the upcoming winter is not solely dependent on its domestic storage levels; it is deeply intertwined with the tightness of the global LNG market. Europe’s reliance on LNG is a direct consequence of reduced Russian pipeline gas, a shift that means its winter preparedness (storage targets, refill needs) now hinges critically on global LNG availability.11 The surge in Ukrainian import demand further exacerbates this global LNG market tightness, indirectly impacting Europe.3 A prolonged conflict in the Middle East, especially one that affects the Strait of Hormuz, would directly challenge Europe’s ability to meet its storage targets and ensure stable winter supply.

Winter 2025/26 Preparedness and Forecasts

As of April 1, 2025, EU gas stock levels stood at 34%. While lower than the preceding two years (attributable to a colder winter and the expiration of the Ukraine-Russia transit contract), this figure aligns with pre-crisis averages.20 To adequately prepare for the upcoming winter, Europe requires a substantial volume of LNG, approximately 57 bcm, to achieve its 90% storage target by September 30, 2025.20 Global natural gas demand growth is forecast to decelerate to approximately 1.5% in 2025, a significant reduction from 5.5% in 2024, amidst tighter market conditions and heightened macroeconomic uncertainties.19 Conversely, global LNG supply growth is projected to accelerate to 5% (27 bcm) in 2025, primarily driven by new projects, predominantly from North America.19 The World Bank forecasts a more than 50% increase in the US benchmark price in 2025, with European gas prices expected to rise by 6% in 2025 before a projected decline in 2026.22 The primary upside risks to these price forecasts include the imperative to replenish depleted inventories, particularly in Europe, and intensified competition for LNG supplies. Extreme weather events also pose significant upside risks.22 While the International Energy Agency (IEA) projects global oil supply growth to outpace demand, this outlook remains fluid and subject to change given the ongoing Iran-Israel conflict, which has already triggered sharp oil price surges.23

Table 3: European Gas Storage Levels & Targets (2025-2026)

| Metric | Value | Date/Target | Notes |

| EU Gas Stock Level | 34% | April 1, 2025 | Lower than previous two years, in line with pre-crisis average 20 |

| Storage Target | 90% of capacity | September 30, 2025 | EU Gas Storage Regulation objective 20 |

| Volume Needed for Refill | ~57 Bcm (631 TWh) | By Sept 30, 2025 | Requires higher LNG volume than previous summers 20 |

| Winter Preparedness | Critical | Winter 2025/26 | Impacted by global LNG availability and geopolitical events 20 |

| Ukraine-Russia Transit Contract | Expired | December 2024 | Contributed to extensive use of storage facilities 20 |

Data compiled from.20

Risk Premium and Market Speculation

Geopolitical risk has injected a substantial premium into energy markets. Oil analysts and traders estimate that approximately $8-$10 of geopolitical risk premium is currently priced into the market, with expectations for it to rise further if the US directly joins the conflict.12 The heightened risk and volatility observed in European gas prices during conflicts are attributable to speculative strategies that create self-perpetuating dynamics and diminish market transparency.25 Investors are increasingly considering strategic hedging, which may involve taking long positions on energy ETFs and defense stocks, and allocating capital to gold as a geopolitical hedge.6 Hedging strategies, encompassing futures, options, and swaps, are proving critical for managing financial risk and stabilizing revenue flows in these volatile oil and gas markets.26

Geopolitical tensions introduce a “risk premium” into natural gas prices.12 This heightened risk and volatility, in turn, attract speculative strategies and “hot short-term money”.4 These speculative flows, particularly in a market that can be thin, can create self-perpetuating dynamics, pushing prices beyond fundamental supply-demand balances.4 The market’s current bullishness, therefore, is not solely a reflection of physical supply disruption but also a consequence of financial actors betting on further escalation. This creates a dangerous feedback loop: geopolitical headlines drive speculation, which pushes prices higher, which then validates the perception of high risk, attracting more speculation. This makes the market highly susceptible to sharp corrections if geopolitical tensions unexpectedly de-escalate, as speculative positions unwind rapidly.

Conclusion and Strategic Outlook

The natural gas market finds itself at a critical juncture, driven by an unprecedented convergence of factors. Direct military attacks on Iranian energy infrastructure, the ever-present threat of disruption to the Strait of Hormuz, the amplifying effect of potential US intervention, and Europe’s fundamental reliance on global LNG have collectively introduced a significant and sustained risk premium. This premium has overridden traditional seasonal demand patterns, fundamentally altering the market’s behavior. The paradox of Iran’s vast natural gas reserves juxtaposed against its limited export capacity means that any disruption to its existing, vulnerable exports carries disproportionate global impact.

Outlook on Potential Price Trajectories

The trajectory of natural gas prices remains highly sensitive to geopolitical developments. In an escalation scenario, where the conflict prolongs, involves direct US military engagement, or results in a sustained disruption of the Strait of Hormuz, further substantial price increases are highly probable. Prices could well exceed the $4.15 short-term target and move towards new highs, as supply fears intensify and speculative activity surges. Conversely, a de-escalation scenario, marked by a significant diplomatic breakthrough or a reduction in conflict intensity, would likely trigger a sharp reversal. The geopolitical risk premium would unwind, and speculative positions would be liquidated, potentially creating opportunities for shorting the market, as some analysts suggest.4 Even with de-escalation, Europe’s ongoing need to replenish its gas storage for winter and the persistent demand from Ukraine will provide some underlying price support, but the extreme volatility tied to daily headlines would diminis

Strategic Recommendations for Navigating Volatile Markets

For investors, the current environment necessitates strategic hedging to mitigate geopolitical and inflation risks. This may involve considering energy-focused Exchange Traded Funds (ETFs), defense stocks, and gold as a geopolitical hedge.4 Caution against purely momentum-driven trading without robust risk management is paramount. For

businesses and policymakers, the persistent vulnerability of global energy markets to regional conflicts underscores the critical importance of diversifying energy sources and supply routes where feasible, and investing proactively in energy security measures. While short-term volatility is extreme, the long-term outlook for natural gas demand remains robust, with global demand projected to grow annually in 2025 and 2026.22 However, this growth will be profoundly shaped by the evolving geopolitical landscape and the accelerating pace of the global energy transition.

References

- Natural Gas (NG) Price Today, Live Chart & Forecasts | FXEmpire, accessed June 20, 2025, https://www.fxempire.com/commodities/natural-gas

- Natural Gas Futures Chart — NG Futures Quotes – TradingView, accessed June 20, 2025, https://www.tradingview.com/symbols/NYMEX-NG1!/

- Natural Gas Surges Above $4 as War Fears and Imports Drive Price …, accessed June 20, 2025, https://www.tradingnews.com/news/natural-gas-ng-f-breaks-4-usd-as-bullish-momentum-war-risk-and-ukraine-import-align

- Natural Gas Price Outlook – Natural Gas Continues to React to War | FXEmpire, accessed June 20, 2025, https://www.fxempire.com/forecasts/article/natural-gas-price-outlook-natural-gas-continues-to-react-to-war-1527059

- Consumers could start paying more on these items because of the …, accessed June 20, 2025, https://apnews.com/article/israel-iran-economy-trade-energy-inflation-1b7e5bef9c1414cb03cd14e40f4b19e5

- Geopolitical Tensions, Oil Volatility, and the Case for Strategic Hedging in Equity Markets, accessed June 20, 2025, https://www.ainvest.com/news/geopolitical-tensions-oil-volatility-case-strategic-hedging-equity-markets-2506/

- Mapping Iran’s oil and gas sites and those attacked by Israel – Al Jazeera, accessed June 20, 2025, https://www.aljazeera.com/news/2025/6/17/mapping-irans-oil-and-gas-sites-and-those-attacked-by-israel

- Israel targets Iran’s Defense Ministry headquarters as Tehran unleashes deadly missile strike, accessed June 20, 2025, https://apnews.com/article/iran-israel-missile-drone-attacks-nuclear-a8b23f58b502ed77a20a9d843bf30f76

- Why Israel is hitting Iran’s vital energy infrastructure | Hellenic …, accessed June 20, 2025, https://www.hellenicshippingnews.com/why-israel-is-hitting-irans-vital-energy-infrastructure/

- What to know about the conflict between Israel and Iran, accessed June 20, 2025, https://apnews.com/article/israel-attack-iran-strike-nuclear-us-news-5adea3ffa51264e0c7c803d8acfde338

- The conflicts in the Middle East influence LNG Transportation, with the conflict in Iraq threatening to push European Henry Hub Natural Gas prices higher. – Moomoo, accessed June 20, 2025, https://www.moomoo.com/news/post/54328221/the-conflicts-in-the-middle-east-influence-lng-transportation-with

- Navigating Geopolitical Storms: How Energy Resilience Plays Offer Shelter in Volatile Markets – AInvest, accessed June 20, 2025, https://www.ainvest.com/news/navigating-geopolitical-storms-energy-resilience-plays-offer-shelter-volatile-markets-2506/

- Geopolitical Premium Keeps Oil Elevated – Rigzone, accessed June 20, 2025, https://www.rigzone.com/news/wire/geopolitical_premium_keeps_oil_elevated-19-jun-2025-180890-article/

- Iran–Israel conflict: Iran has run out of good options | Chatham House, accessed June 20, 2025, https://www.chathamhouse.org/2025/06/iran-israel-conflict-iran-has-run-out-good-options

- Amid regional conflict, the Strait of Hormuz remains critical oil chokepoint – U.S. Energy Information Administration (EIA), accessed June 20, 2025, https://www.eia.gov/todayinenergy/detail.php?id=65504

- www.deccanherald.com, accessed June 20, 2025, https://www.deccanherald.com/world/explained-the-strategic-importance-of-strait-of-hormuz-3591946#:~:text=Explained%20%7C%20The%20strategic%20importance%20of,the%20world’s%20liquified%20natural%20gas.&text=Oil%20tankers%20pass%20through%20the%20Strait%20of%20Hormuz.

- Geo Focus: Why the Strait of Hormuz Matters for Global Oil Supply – Deccan Herald, accessed June 20, 2025, https://www.deccanherald.com/world/explained-the-strategic-importance-of-strait-of-hormuz-3591946

- Natural Gas Prices Continue to Climb: What’s Driving the Surge in 2025? – Trading News, accessed June 20, 2025, https://www.tradingnews.com/news/natural-gas-price-continue-to-climb-whats-driving-the-surge-in-25

- Gas Market Report, Q2-2025 – NET, accessed June 20, 2025, https://iea.blob.core.windows.net/assets/91739d87-1613-4840-927a-79448067f067/GasMarketReport,Q2-2025.pdf

- ENTSOG SUMMER SUPPLY OUTLOOK 2025 WITH WINTER 2025 /26 OVERVIEW, accessed June 20, 2025, https://www.entsog.eu/sites/default/files/2025-04/SO0067-25_Report_Summer%20Supply%20Outlook%202025.pdf

- Commission welcomes new ENTSOG report confirming the importance of storage last winter and need to start refilling as soon as possible, accessed June 20, 2025, https://energy.ec.europa.eu/news/commission-welcomes-new-entsog-report-confirming-importance-storage-last-winter-and-need-start-2025-04-10_en

- Natural gas markets: Price swings amid a shifting global landscape – World Bank Blogs, accessed June 20, 2025, https://blogs.worldbank.org/en/opendata/natural-gas-markets–price-swings-amid-a-shifting-global-landsca

- Oil Supply Growth to Outpace Demand Amid Iran-Israel Tensions: IEA | Egypt Oil & Gas, accessed June 20, 2025, https://egyptoil-gas.com/news/oil-supply-growth-to-outpace-demand-amid-iran-israel-tensions-iea/

- Surging supply, faltering demand reshape global oil market: IEA, accessed June 20, 2025, https://www.downtoearth.org.in/energy/surging-supply-faltering-demand-reshape-global-oil-market-iea

- www.researchgate.net, accessed June 20, 2025, https://www.researchgate.net/publication/385022958_Dynamic_speculation_and_efficiency_in_European_natural_gas_markets_during_the_COVID-19_and_Russia-Ukraine_crises#:~:text=The%20heightened%20risk%20and%20volatility,%5B7%5D%20.%20…

- Oil and Gas Hedging Strategies: Essential Techniques for Market Stability – Fieldvest, accessed June 20, 2025, https://www.energyfieldinvest.com/post/oil-and-gas-hedging-strategies

Annual Gas Market Report (AGMR) – Gas Exporting Countries Forum, accessed June 20, 2025, https://gecf.org/_resources/files/events/gecf-unveils-the-annual-gas-market-report-2025/gecf-agmr-2025.pdf

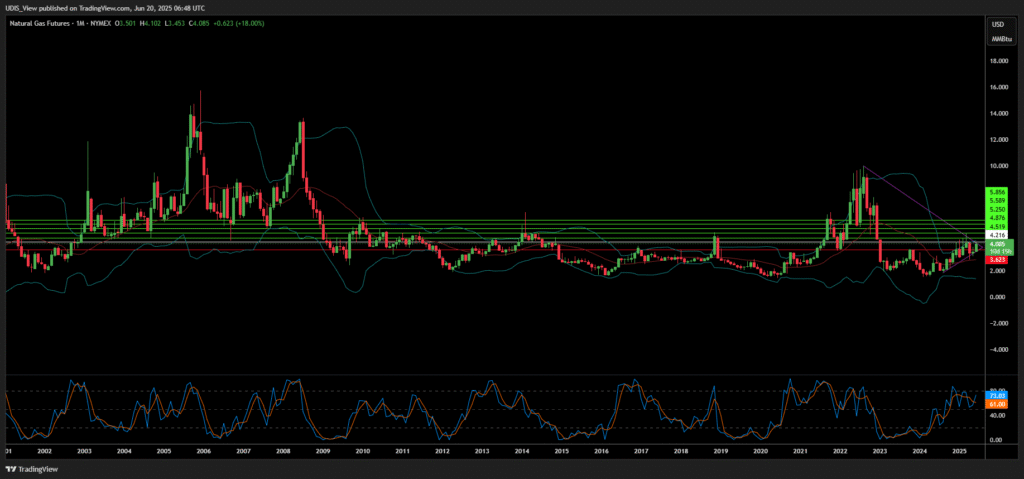

Natural Gas Long (Buy)

Ebter At: 4.216

T.P_1: 4.519

T.P_2: 4.876

T.P_3: 5.250

T.P_4: 5.589

T.P_5: 5.856

S.L: 3.623